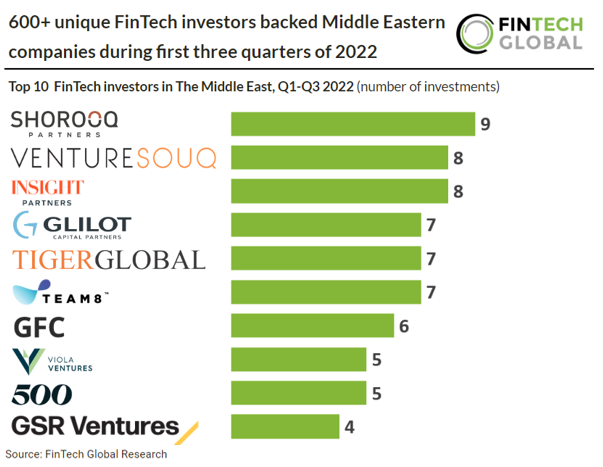

- In total there were 632 investors participating in Middle Eastern FinTech funding rounds during Q1-Q3 2022. The total number of FinTech investors in the region increased 7.5% from the same period in 2021. The top 10 investors listed has drastically changed from 2021 with six new entrants. Key venture firms in the Middle East such as FJ Labs which raised seven deals in Q1-Q3 2021 announced only two in 2022 during the same period.

- Shorooq Partners, a United Arab Emirates based tech investor, took part in the most FinTech funding rounds in the Middle East during Q1-Q3 2022. Shorooq Partners announced their latest fund in March 2022, The Bedaya Fund II, targeting a fund size of $150 million. The Bedaya Fund II will primarily focus on early stage start-ups and has recently been making strides as the first mover in the MENAP region through its Web 3.0 thesis. The company said “We have always been early movers, be that robo-advisory, crowdfunding, SME lending, open banking, card issuer processing, and so forth. We believe Web 3.0 models like DeFi, NFT, Metaverse are going to be the key players in the next iteration of online business,” said Shane Shin, a founding partner at Shorooq Partners.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global