Japanese early and growth-stage investment firm GMO VenturePartners has reportedly generated $240m in capital gains from three of its portfolio companies.

The majority of the returns came from FinTech companies Coda Payments and GMO PaymentGateway, with 2C2P also earning the firm capital gains, according to a report from Tech In Asia.

Coda Payments, which offers payment services for mobile and online games, was GMO VenturePartners’ first investment via its $15.1m Global Payment Fund. The investment resulted in a 300-times return, with Coda’s valuation estimated to be around $2.5bn, the report said.

Last year, the firm announced it had hit the first close for its seventh FinTech fund. It had pulled in JPY 11.3bn ($85m), but it is unclear whether the firm is nearing its final close.

GMO Fintech Fund 7 invests into FinTech and Decarbon Tech related startups in the Indo-Pacific region to help solve social issues and support growth. It typically invests around Series A and B rounds, but also backs seed and growth stages.

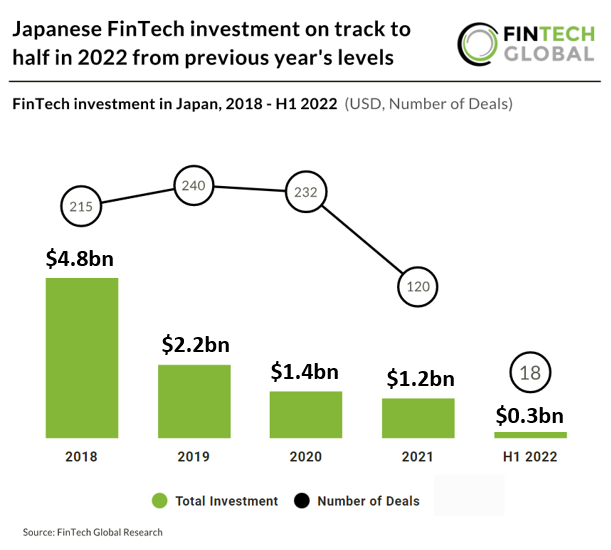

Like many markets around the world, 2022 was a tough year for Japan’s FinTech sector. In the first six months, just $300m was invested through 18 deals. This drop put the sector on track to half the total annual investment volume.

While 2022 was difficult for many countries, Japan’s FinTech sector has seen funding drop for the past three years. It has dropped from $4.8bn in 2018 to just $1.2bn in 2021.

Copyright © 2023 FinTech Global