Singaporean venture capital firm Northstar Group has reportedly hit the $90m first close for its fund with a brand-new investment strategy.

Northstar Ventures I is seeking a total of $150m for its new fund and expects to hold a second close on $120m later this quarter, according to a report from Tech In Asia. The firm anticipates it will hold its third close in mid-2023, hitting either $150m or more.

This new fund will target early-stage startups in Indonesia and other countries in Southeast Asia.

As for the sectors it is aimed at consumer internet, FinTech and enterprise software sectors. Its portfolio includes food and beverage enabler Wahyoo, fashion community MAKA and more.

With the close of the latest fund, Northstar manages $2.6bn in committed capital. Since it was founded in 2003, the company has invested in over 50 companies.

Last year, Northstar backed the $113m Series B funding round of Indonesian crypto asset trading and investment app PINTU.

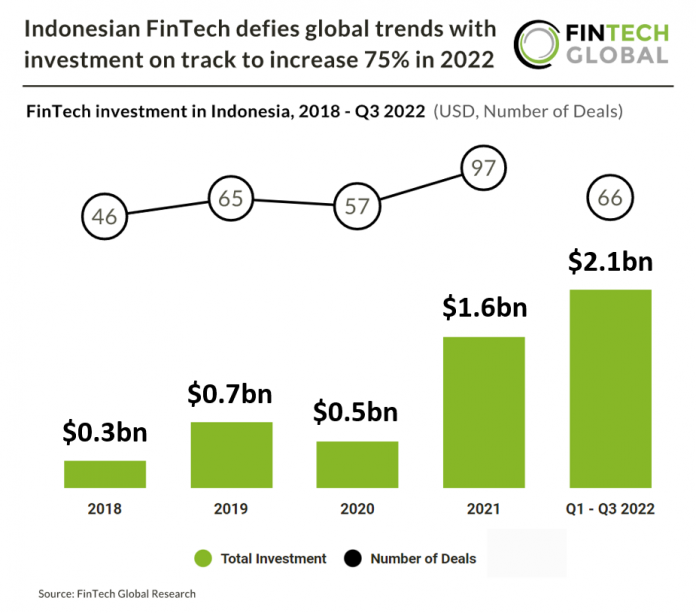

Indonesia had a strong 2022 for FinTech investment. In the first three quarters of the year, the firm experienced $2.1bn invested across 66 deals, putting it on track to increase annual funding by 75%.

In 2021, $1.6bn was invested across 97 transactions in the country.

Copyright © 2023 FinTech Global