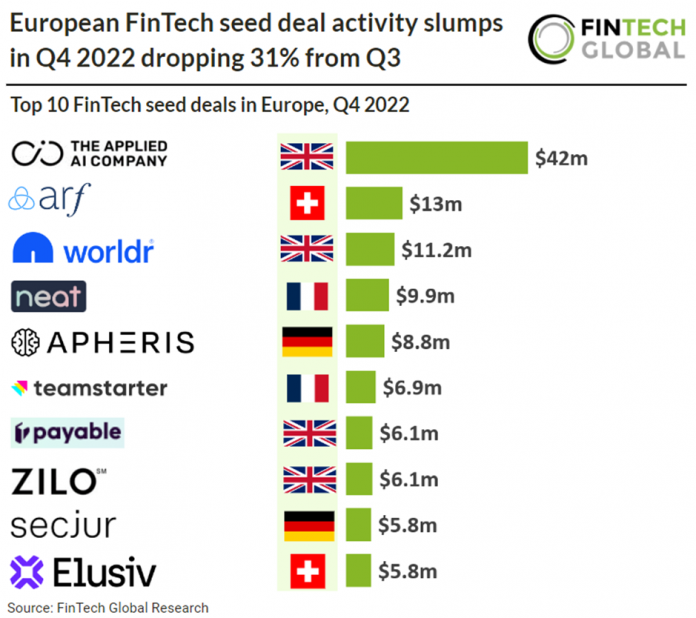

· European FinTech seed deal activity reached 119 deals in total for Q4 2022, a 31% drop from Q3 2022 levels. A continued drop in FinTech seed deals is likely to happen in 2023 as the Euro area increases their interest rates to 2.5% in December 2022. This increases the cost of borrowing, which directly affects FinTech funding.

· The UK was the most active FinTech seed deal country in Q4, with UK-based companies raising 27 deals in total – a 23% share of total deals. The UK had one more FinTech deal in Q4, compared to the previous quarter. France was the second most active with 17 deals and Germany was third with 11 deals.

· The Applied AI Company, which is automating tasks in regulated industries, was the largest FinTech seed deal in Europe during Q4 2022. The UK based company raised $42m in their seed round led by G42. AAICO’s mission is to develop targeted machine learning driven products that automate mission critical business processes involving manual or repetitive work.” said Mr. Bolurfrushan, founder and CEO of AAICO. “We are humbled by the support of our investors in current market conditions. We take this responsibility seriously and are clear-eyed that a capital raise is not an indicator of success. We continue to keep our heads down, building great products for our US and UK based customers’.’

· In December 2022 The European Commission is planning to put forward a proposal for regulation to establish a digital euro in the second quarter of 2023.The European Central Bank (ECB), which revealed the plans in a new report, said that the Commission has already started legislative preparations. The move comes after the ECB and euro area national central banks launched the investigation phase of the digital euro project in October 2021.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global