ZestyAI, a provider of climate and property risk analytics solutions, has partnered with CSAA Insurance Group for wildfire risk assessment.

ZestyAI offers insurance and real estate companies access to precise intelligence about every property in North America.

The company uses AI, including computer vision, to build a digital twin for every building across the country. This amounts to 200 billion property insights accounting for all details that could impact a property’s value and associated risks, including the potential impact of natural disasters.

To help gauge property-level wildfire risk, CSAA plans to integrate ZestyAI’s Z-FIRE solution into underwriting and rating processes for homeowners’ insurance.

The company partners with about half of the top 50 property & casualty insurance carriers in the US to underwrite and rate homeowners and business insurance.

Many of the company’s climate risk products, such as its predictive AI wildfire risk model Z-FIRE, have seen widespread regulatory approval and commercial adoption across all states in the US by the likes of Amica, Aon, Berkshire Hathaway, Cincinnati Insurance and Farmers Insurance. Moreover, the California FAIR Plan and many others are making Zesty.ai’s models an important part of their risk management strategies.

This partnership with CSAA Insurance Group comes as wildfires continue to cause destruction in multiple states across the country.

According to Zesty.AI, Z-Fire provides wildfire risk scores for all properties in the 48 contiguous US states. In addition, a joint study by the Insurance Institute for Business & Home Safety (IBHS) and ZestyAI, which studied more than 71,100 wildfire-exposed properties, found that property owners who clear vegetation from the perimeter of their home or building can nearly double their structure’s likelihood of surviving a wildfire.

Rick Lanter, senior vice president of product strategy and development for CSAA Insurance Group, said, “Our goal is to continuously find better ways to serve our policyholders,” said. “By broadening our understanding and application of AI, we expect to more accurately estimate wildfire risks in support of our customers.”

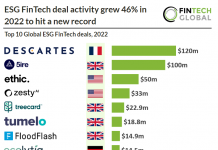

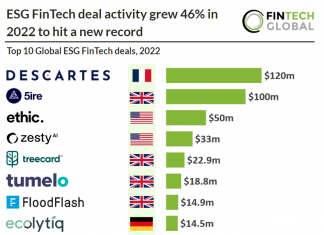

In July last year, Zesty.AI raised $33m in conjunction with their Series B led by Centana Growth Partners.

Copyright © 2023 FinTech Global