Colombian FinTech company KLYM, which is on a mission to build a scalable credit system for companies, has reportedly raised $27m in funding.

The capital injection was led by JP Morgan and the International Finance Corporation, according to a report from Contxto.

This fresh capital will enable KLYM to expand its operations. A key part of this will be boosting its presence in Brazil, where it opened an office last year.

With the round closed, KLYM is already looking to raise more funds this year. The FinTech also expects it will reach profitability having quadrupled its revenues last year.

KLYM is a data-driven solution that enables it to offer real-time financial services. Its data capabilities allow it to offer solutions such as working capital.

The platform can provide supply chain finance locally in over 25 currencies through a partnership with JPMorgan. It can also provide suppliers financing to guarantee the delivery of goods on quality and time as required.

Additionally, KLYM offers capital to vendors so they can buy more products and pay for them sooner. Finally, the Colombian FinTech company offers an on-the-fly working capital solution that will deliver a higher advance rate, in multiple currencies and from multiple banks.

With the close of the round, KLYM has raised a total of $200m in financing, with around half of this being through equity injections.

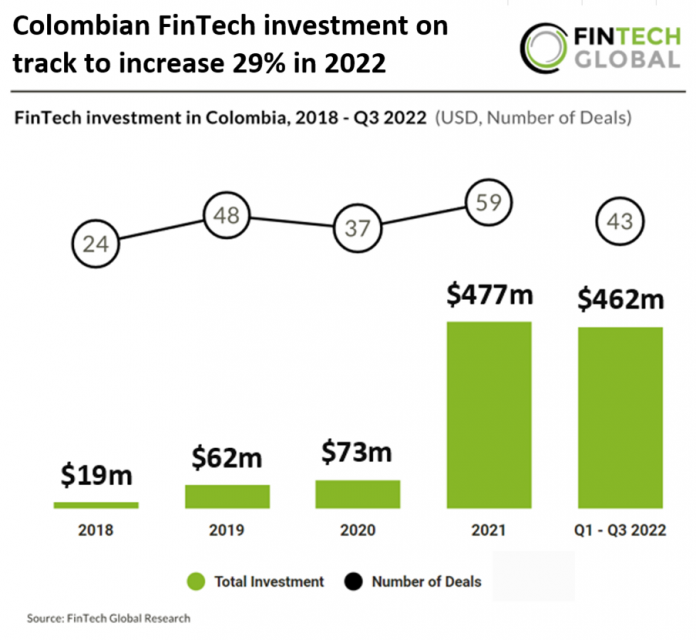

Colombia’s FinTech sector has a strong 2022. In the first nine months of the year, $462m was raised across 43 deals. This is just $15m short of the total capital raised in the whole of 2021.

One Colombian FinTech company to raise funds last year was Finaktiva, which raised $25m in a mix of debt and equity. The platform helps companies quickly access credit lines, early bill payments, payment management and credit insurance.

Copyright © 2023 FinTech Global