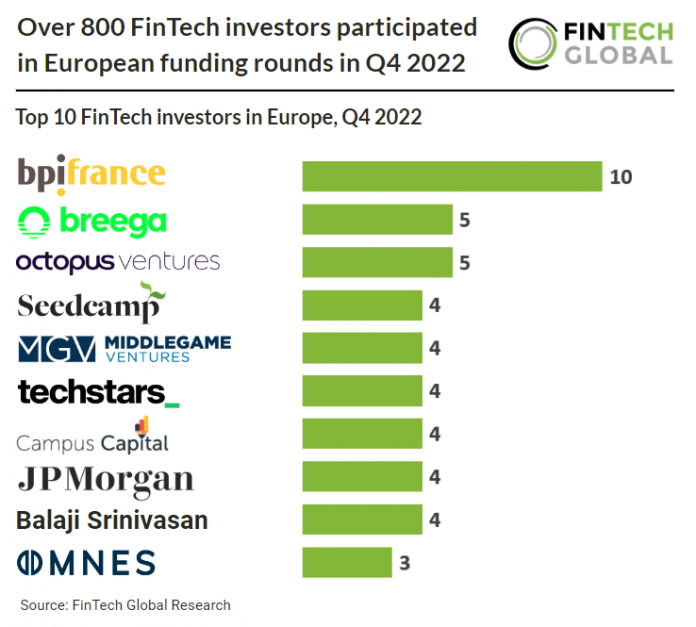

Key Highlights from European FinTech investor activity during Q4 2022:

• There were 863 unique FinTech investors in European companies

• They backed a total of 371 FinTech deals, a 2.7% increase from Q3

• Total funding hit $2.8bn, a 33% from the previous quarter

In total 863 unique investors participated in European FinTech funding rounds during the fourth quarter of 2022. Total capital invested in European FinTech companies reached $2.8bn in Q4 2022, a 33% drop from the previous quarter. European FinTech deal activity in Q4 2022 increased a modest 2.7% from Q3 levels reaching 371 deals in total during Q4. The UK was the most active FinTech country in Europe during Q4 2022 with a 31% share of total FinTech deals. France was the second most active with 15% and Switzerland was third with 8%.

Bpifrance, which provides investment and loans to companies of all sizes, was the most active FinTech investor in Q4 2022 participating in ten FinTech funding rounds during the quarter. Bpifrance’s goal is to favour the growth of the French economy by helping entrepreneurs thrive. As of 25 January 2023, Bpifrance has committed €20.5bn in direct funding, €7.1bn of guaranteed bank loans and €4bn of investment. Bpifrance’s 2022-2025 strategic plan covers the priorities of the France 2030 Investment Plan. With a budget of €54 billion, France 2030 is an Investment Plan from the French government, aiming to sustainably transform the key sectors of the French economy through research, innovation and industrial investment. It seeks to position France as a leader of tomorrow’s economy.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global