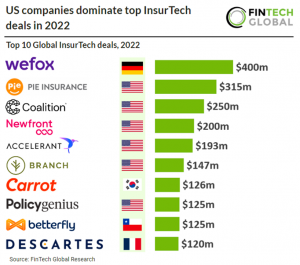

Despite a tough fundraising climate and a cool-off in investment since 2021 levels, InsurTech is still a thriving sector. Many companies closed significant deals last year.

According to a report from CB Insights, InsurTech funding dropped 4% quarter-over-quarter in Q3 2022 to hit $2.3bn, the lowest it’s been since the second quarter of 2020.

What’s more, is there were no new InsurTech unicorns in Q3 2022, for the first time since Q2 2018.

This may paint a bleak picture for the industry. However, it is very much still a thriving sector. For example, according to Dealroom, although late stage funding is cooling off, funding at early and medium stages is still going strong, indicating innovative new entrants in the sector.

Moreover, InsurTech startups are still heavily underinvested compared to industries such as FinTech, health and mobility. This represents an opportunity. An eye-watering $6trn worth of opportunity according to Dealroom.

So what were the biggest deals in InsurTech last year?

German-based wefox bags $400m

Berlin-based InsurTech company wefox has closed its Series D funding round on $400m, bringing its valuation to $4.5bn.

This is a notable increase from its previous valuation of $3bn, which it reached in June 2021 after the close of its Series C on $650m.

Mubadala Investment Company led the Series D round, with participation also coming from Eurazeo, LGT, Horizons Ventures, OMERS Ventures and Target Global.

With the funds, the InsurTech company plans to bolster its product development efforts and expand across Europe and into Asia and the US.

The company is a fully licensed digital insurance company that sells insurance through intermediaries and not directly to customers.

It currently offers household, motor and personal liability insurance, but is planning to launch 20 new services this year, including property and casualty, pet, health and life insurance

Pie Insurance raises $315m

Pie Insurance, a leading tech-enabled provider of workers’ compensation insurance to small businesses, raised $315m in Series D funding.

The round was led by Centerbridge Partners and Allianz X, the digital investments arm of Allianz Group.

White Mountains Insurance Group also joined as a new investor. Previous investors Gallatin Point Capital, Greycroft, Acrew Capital and others also participated in the round.

Pie aims to leverage technology to transform how small businesses buy and experience commercial insurance, with the goal of making it affordable and “as easy as pie”.

The InsurTech said its intense focus on granular, sophisticated pricing, and data-driven customer segmentation enables it to match price with risk accurately across a broad spectrum of small business types, which allows the company to offer more affordable insurance to small business owners.

The funding sees Pie’s total capital raised double to over $615m and follows an “incredible period of growth” for the company. Pie has more than doubled its gross written premiums and its number of policyholders and partners.

The InsurTech said the raise will allow it to continue providing simple and affordable commercial insurance to America’s 32.5 million small businesses.

Coalition soars to $5bn valuation with $250m raise

Coalition, a cyber insurance provider, raised $250m in Series F funding, propelling it to a $5bn valuation.

The round saw participation from Allianz X, Valor Equity Partners, Kinetic Partners and other existing investors.

Coalition’s Active Insurance combines cybersecurity tools, access to around-the-clock digital forensics and incident response, and broad insurance coverage to help organisations identify, mitigate, and insure digital risk.

The company has reported that is experiencing a “wave of growth”, exceeding $775m in run rate GWP (gross written premium) and a nearly 200% increase in revenue growth over the prior year.

The funding will accelerate this growth, power its international expansion, and broaden the services it provides to manage digital risk, Coalition said.

Newfront lands $200m

Newfront, a modern insurance brokerage platform, has raised $200m at a $2.2bn valuation.

The round was led by the Growth Equity business within Goldman Sachs Asset Management and B Capital with participation from existing investors including Founders Fund and Meritech Capital.

Newfront said it is transforming the delivery of risk management, employee experience, insurance, and retirement solutions by building the modern insurance platform.

The company plans to grow its technology teams and focus in particular on harnessing data-driven insights for clients. It also plans to invest in specialised client resources and experts across a wide variety of industries and expand across the US.

Accelerant bags $190m

Accelerant, an InsurTech empowering underwriters with superior risk exchange and data analytics coupled with long-term capacity commitments, raised in excess of $190m at a $2bn pre-money valuation.

The round was led by Eldridge, with participation from Deer Park, Marshall Wace, MS&AD Ventures, and others. Existing majority investor Altamont Capital Partners also participated in the round.

Accelerant is a data-driven, technology-fuelled insurance platform that strives to empower underwriters to more effectively serve their insureds. The company uses data intelligence tools to rebuild the way that underwriters share and exchange risk.

Accelerant will deploy the capital to continue to rebuild the way that underwriters share and exchange risk to improve outcomes for programme managers, primary issuing carriers, and ultimate risk-bearers.

Branch raises $147m

Branch, a home and auto insurance technology company, has raised $147m in Series C funding and joined the unicorn club.

The round was led by Weatherford Capital, with participation from new and existing investors including Acrew, AmFam Ventures, Anthemis, Gaingels, Greycroft, HSCM Ventures, Narya, SignalFire, and Tower IV.

The funding brings Branch’s valuation to $1.05bn.

Branch launched in 2019 with a focus on leveraging the power of community to make insurance more affordable and has already helped members save an annual average of $548.

Now, with inflation at a 40-year high, Branch remains committed to bringing its instant bundled savings to consumers in every state. Branch said the equity financing round positions to accelerate its national rollout while scaling its differentiated distribution strategy which includes direct, agency, and embedded channels.

The announcement comes on the heels of an expansion into nine new states already in 2022, making Branch’s frictionless insurance available in 28 states.

Carrot eyes unicorn status after $250m

South Korean digital insurance carrier Carrot has raised $250m in a round led by Affirma Capital.

Established in 2019, Carrot is on a mission to advance outdated insurance and deliver coverage that is fair and reliable through the use of technology.

Carrot said the capital will be raised across two connected rounds with wide participation of existing investors. The initial round of $145m was closed in the past week and the remaining $105m will be raised through the extended round during the fourth quarter of this year.

Upon completing its extended round of financing next quarter, Carrot’s valuation will reach 1 trillion won (US $850 million), taking it one step closer to becoming the nation’s first unicorn digital insurer. With the fresh capital, Carrot intends to strengthen its position as a pioneer in the existing market, accelerate its advancement of tech capacity and expansion of in-house pipelines, as well as external open innovation activities. The company anticipates faster rate of growth in coming years and plans to reach break-even by 2024 and go public by 2025.

Carrot claims to be the nation’s first fully-licensed 100% digital insurance carrier. The company said it has been disrupting the insurance market and outpaced its global peers in terms of the speed of acquiring customers to its usage-based insurance programme.

Policygenius collects $125m

Policygenius, a digital insurance platform, has collected $125m in funding, as it capitalises on two years of strong growth.

All of Policygenius’ existing major investors joined the round, including KKR, Norwest Venture Partners, Revolution Ventures, AXA Venture Partners and MassMutual Ventures. The investment was also backed by first-time investors, including Brighthouse Financial, Global Atlantic Financial Group, iA Financial Group, Lincoln Financial and Pacific Life.

This fresh funding round will be used to bolster the growth of its life, disability, home and auto insurance.

In addition to the equity funding, Policygenius received a credit facility from ORIX Corporation to finance its growth. The InsurTech company also refinanced its existing senior loan facility with JPMorgan Chase.

Founded in 2014, Policygenius is a one-stop digital platform that lets consumers compare and buy insurance. It has integrations with numerous insurance carriers and has a proprietary technology for quoting, underwriting and fulfilment.

It recently released Policygenius Pro, which is a turnkey partnerships platform that helps independent agents and financial advisors accelerate and streamline life insurance sales.

Since Policygenius closed its Series D in 2019, which raised $100m, it has increased its investment into integrated no-exam life insurance offerings to address Covid-related impacts on life insurance medical exams and improve customer experience.

Betterfly secures $125m

Betterfly, which claims to have become the first Latin American “social” unicorn, has raised $125m in its Series C funding round.

Glade Brook Capital led the round, with commitments also coming from Greycroft, Mundi Ventures and Lightrock. QED Investors and DST Global Partners, which led Betterfly’s Series A and B rounds, respectively, also joined the fresh investment.

Following the close of the round, the FinTech company was valued at $1bn and comes just six months after it raised $60m for its Series B. Over the past 12 months, it has raised more than $200m in funding.

With the capital, the company plans to launch in Mexico, Colombia, Argentina, Peru, Ecuador, Panama and Costa Rica. Next year, Betterfly is eyeing the US, Portugal and Spain markets.

In addition to international expansion, the company is planning to release new products, including insurance, lifestyle and financial services. It also plans to establish new partnerships with insurance carriers and financial services companies.

Finally, Betterfly is hoping to continue its mission for helping social conscious businesses.

The company was founded in 2018, but the idea for the platform came in 2017 when Eduardo della Maggiora was riding a bike. Maggiora wondered if it was possible to convert calories burned through exercise into calories of food for children in need.

Descartes Underwriting secures $120m Series B

Descartes Underwriting, which is helping insurers address climate and emerging risks, has secured $120m in its Series B.

The investment was led by growth equity firm Highland Europe, with commitments also coming from Serena, Cathay Innovation and Blackfin Capital Partners. Seaya Ventures and Mundi Ventures also joined the round as new investors to Descartes.

With the capital injection Descartes plans to scale its approach to corporate and public entity risk exposures. Funds will also help grow its technology platform, expand into new lines of business and further its global expansion efforts.

Descartes’ mission is to combat climate change risks. Its parametric insurance solutions leverage new data sources combined with AI to boost transformation within an evolving risk landscape and challenge traditional insurance models.

The InsurTech company works with corporate brokers to offer affordable insurance solutions to help their clients to manage their climate-related and emerging risks.

Its technology supports cover for natural disasters, including cyclone, flooding, earthquake, hail, wildfire, tsunami, tornado and more. It also supports policies customised against yield, drought, excess rain, frost, crop production, hail, forestry storm damage, wildfire, smoke taint and more.

Copyright © 2023 FinTech Global