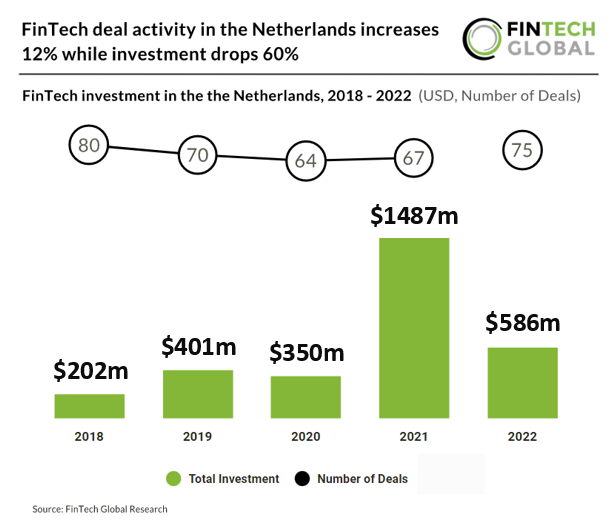

Key Dutch Highlights in 2022:

• FinTech Deal activity increases to 75 deals, a 12% increase from 2021

• FinTech Investment drops to $586m, a 60% drop from 2021

• RegTech starts as the most active FinTech subsector with 13 deals

FinTech investment in the Netherlands dropped significantly to $586m in 2022, a 60% drop from 2021 levels. Investment levels in 2022 were still above 2018 – 2020 levels with a 23.7% CAGR growth from 2018 – 2022. Deal activity in the country increased 12% in 2022 to 75 deals in total. Deal activity also saw no change in Q4 2022 from Q3 with both quarters reaching 16 deals each. RegTech companies raised the most amount of deals in 2022 with 13 in total. Blockchain & Crypto companies raised the second most deals with 12 in total and WealthTech was third with 11.

Back base, a banking infrastructure provider, was the largest FinTech deal in the Netherlands during 2022. The company raised $129m in their latest Private Equity funding round which was led by Motive Partners. The fresh funding propelled Back base to unicorn status and will allow it to double down on its vision for engagement banking and accelerate its mission of re-architecting banking around the customer.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global