As 2023 enters its second month, funding in FinTechs are once again on the up – with FinTech Global reporting on 34 funding rounds this week.

Leading the way this week with Egyptian FinTech MNT-Halan, who scored $400m in a round of funding.

In other areas, RegTech firm Saviynt scored $205m in growth financing to meet the company’s growing demand.

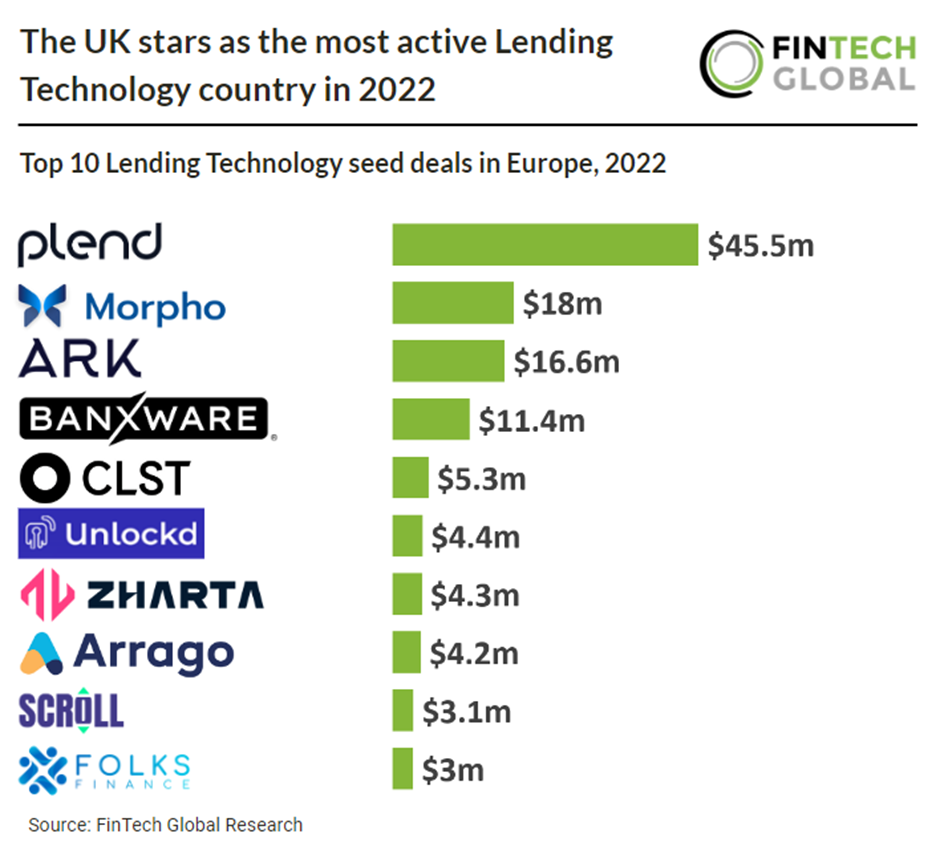

Coming out of 2022, the UK market proved to be the most active lending technology country in the full year.

Research by FinTech Global found that the UK was the most active with 22 deals, a 33% share of total deals. France was the second most active country with nine deals and joint third were The Netherlands, Germany and Switzerland with four deals each.

European Lending Technology seed deals in 2022 raised a total of $199m over 66 deals hence a $3m average deal size.

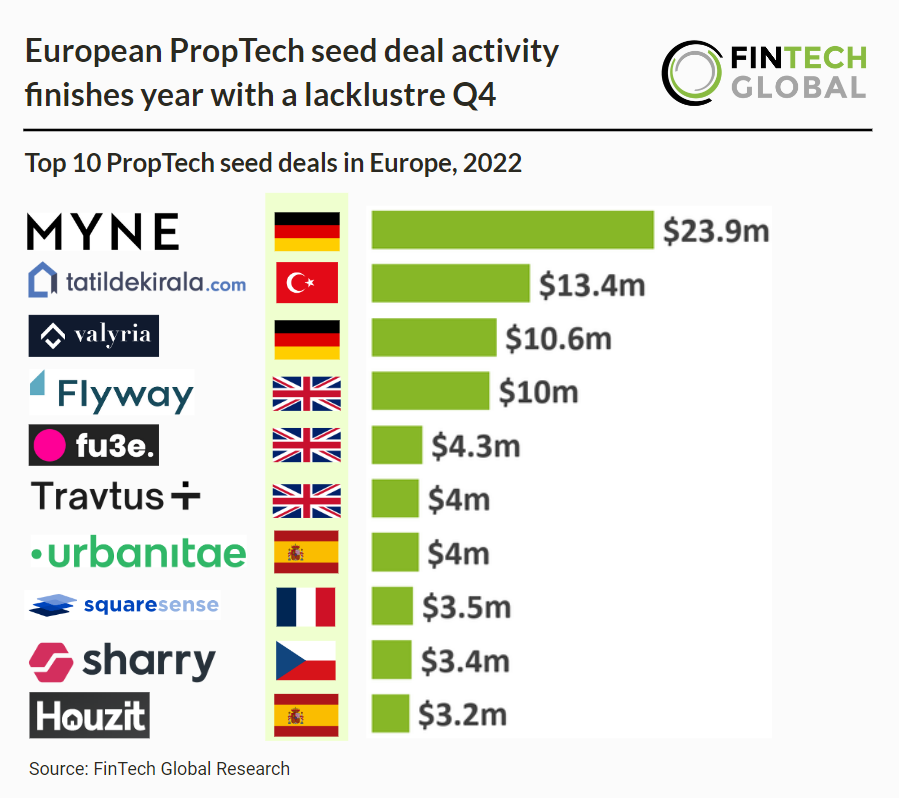

Elsewhere, a fairly strong year for the European PropTech industry ended with a whimper, with the sector slowing down considerably in Q4 2022 reaching 13 deals in total, a 40% drop from Q1 levels.

The PropTech sector accounted for a 11.8% share of all FinTech seed deals in Europe which was 0.8% higher than the Lending Technology sector for comparison.

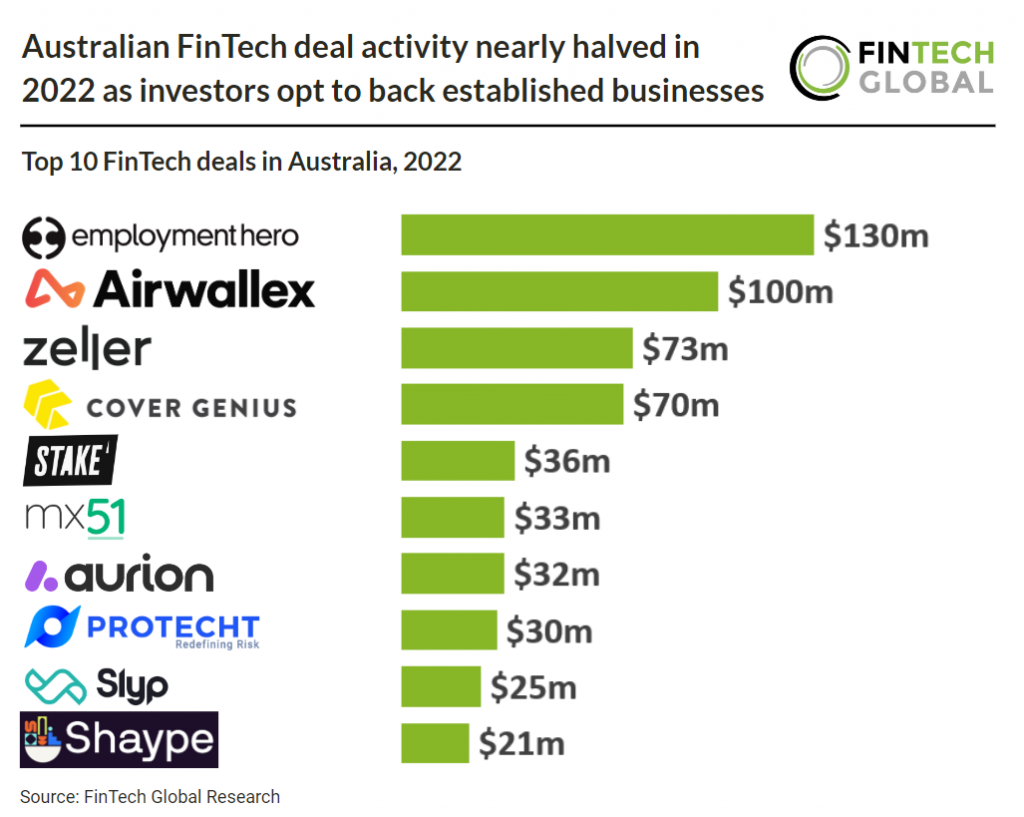

The Australian FinTech sector nearly halved in 2022 as investors opt to back established businesses.

Overall 112 deals were announced in the country during 2022, a 45% drop from the previous year and a clear signal of a downturn in the sector.

Here are this week’s deals.

Egyptian FinTech MNT-Halan lands $400m

Egyptian FinTech platform MNT-Halan has secured $400m in funding, making it the largest investment in Egypt and the Middle East over the past 12 months.

Investment firm Chimera Abu Dhabi deployed $200m in equity into MNT-Halan in exchange for a 20% stake. MNT-Halan is also in advanced stages to raise $60m of primary capital from international investors. With the close of the round, MNT-Halan’s valuation exceeds $1bn.

MNT-Halan also secured $140m through two securitisations through subsidiaries Tasaheel Microfinance Company and Halan Consumer Finance with Commercial International Bank.

Identity and access governance solutions provider Saviynt scores $205m

Saviynt, an identity and access governance firm, has raised $205m in growth financing from AB Private Credit Investors’ Tech Capital Solutions group.

Saviynt will use this funding to meet the market’s growing demand for its converged identity platform and accelerate innovation.

Alongside the funding, Sachin Nayyar has been appointed as the company CEO. Nayyar previously led Saviynt from inception in 2011 to leadership in the identity governance market in 2018.

Nayyar rejoins Saviynt after serving as founder and CEO of cyber company Securonix, which he led to a $1bn plus growth investment led by Vista Equity Partners in 2022.

Small business lender iwoca ups funding round to £170m

Small business lender iwoca has increased its funding line from Pollen Street Capital to £170m, up from £125m.

The small business lender experienced a surge in demand last year, with it issuing loans to 15,429 businesses, an increase of 54% from 2021.

It also doubled the maximum size of its Flexi-Loan, last year, rising from £200,000 to £500,000 to meet the demand from medium sized businesses.

Iwoca reaches nearly three million businesses across the UK and Germany through its embedded lending technology. Its platform allows businesses to access loans directly through a range of platforms, including accountancy software apps and digital neobanks.

Another of its core products is iwocaPay, which is an omni-channel B2B payment solution. Last year, it released the Revenue Based Loan service in partnership with eBay, which sees repayments made as a percentage of a business’s monthly sales.

Tech subscription platform Raylo nets £110m

Raylo, which provides UK consumers with access to tech products through subscription, has received £110m in debt financing from NatWest bank and Quilam Capital.

The funds will allow the company to expand its platform and extend the reach of its services to more customers. It hopes to expand its direct-to-consumer channel and its checkout integration for merchants, Raylo Pay.

Rayo offers access to high-value tech products on monthly subscriptions.

This funding comes after a strong period of growth for Raylo. The FinTech has experienced over 100% year-on-year growth. It hopes to continue this growth rate during the cost-of-living crisis as it believes consumers will seek products at low monthly subscription costs.

Digital bank Zopa nets £75m

Digital bank Zopa has raised £75m from existing investors to support the next stage of its growth, which includes M&A activity.

This burst of equity will allow Zopa to grow its balance sheet and support M&A dealmaking, which could commence later this quarter.

Zopa stated that despite the economic uncertainty, the firm managed to grow its revenue by over 100% year-over-year. It attributes this growth to the continued expansion of its suite of digital-first financial products.

Since it launched in 2020, the bank has attracted over £3bn in deposits, over £2bn in loans on balance sheet and issued more than 400,000 credit cards.

Visa backs Moov Financial in $45m Series B

FinTech firm Moov Financial has scored $45m in a Series B funding round led by Commerce Ventures.

Founded in 2018, Iowa-based Moov provides a platform for developers looking to embed payment functionality into their software.

The firm claims it takes the complexity out of the process so developers and product teams can focus on their customers and deliver exceptional user experiences—not worrying about banking protocols, security, or compliance.

This investment comes after a significant milestone for Moov which became a net new US-licensed acquiring processor, issuer and program manager.

Treasury Prime scores $40m

Treasury Prime, an embedded banking software platform, has collected $40m in its Series C funding round, which was led by BAM Elevate.

The embedded banking software platform will use the fresh capital to enhance its multi-bank network solution. It will also develop new products and services, including lending options and an integrated partner marketplace solution.

Finally, funds will be put towards enhancing its strategy, broadening its offerings to provide services to a variety of enterprise and bank partners.

Hnry nets $35m to simplify admin for sole traders

Hnry, a New Zealand-based accounting FinTech platform, has raised $35m in Series B funding on its mission to simplify financial admin for sole traders.

Hnry was found to help sole traders spend less time on financial admin and more time “doing the important stuff”.

The company has reportedly had five years of solid growth, which prompted its CEO and co-founder James Fuller to approach investors and investment firms for a Series B funding round.

Not only does Hnry want to simplify financial and tax admin, the company is also on a mission to become advocates for its community and help create useful resources that help build business and sustain families.

Following the funding, Hnry will be looking to grow and invest in its team, develop new products, and support more sole traders.

Digital lender Lulalend lands $35m Series B

Lulalend, a South African digital lender catering to SMEs, has finalised a $35 million Series B funding round.

The company’s digital-first approach, paired with its credit scoring algorithm, has enabled it to offer a faster, simpler, and more transparent service for SMEs to access business funding.

By leveraging data from a diverse set of alternative sources, which support quicker and more accurate assessments of business health, Lulalend can review applications and distribute funds in hours as opposed to the weeks or months it takes traditional lenders.

Founded in 2014, Lulalend’s customer offering has recently grown to encompass a neo-banking proposition named Lula, built in partnership with Access Bank. Offering a bank account specifically tailored for SMEs, an AI-driven cash flow management tool and real-time access to funding via the existing Lulalend funding solutions, Lula promises to simplify money management for the more than 2 million formal and informal SMEs that exist in South Africa.

Lulalend will use the funding to scale its business and address South Africa’s enduring SME credit gap, which is estimated to be valued at more than $20bn per year.

FINBOURNE collects £30m debt facility

FINBOURNE Technology, which is on a mission to reduce the cost of investing and increase transparency, has collected £30m in a debt facility.

This equity will allow FINBOURNE to strengthen its capital structure so it can respond to market opportunities and expand its international footprint. It plans to extend its products beyond investment management and into banking and capital markets.

The company is also looking to release new SaaS capabilities across portfolio and fund accounting to support asset servicers in their digital transformation.

One of the planned product launches is FINBOURNE Horizon, a global community of mutually beneficial integration partnerships across the wider ecosystem. The goal of the tool is to remove the barriers to external innovation by supplying clients with technology to future-proof operations, augment processes, and outsource non-differentiating activities.

Founded in 2016, FINBOURNE’s mission is to reduce the cost of investing and improve efficiency, transparency and trust in capital markets.

ShopUp lands $30m to streamline B2B commerce

ShopUp, a Bangladeshi B2B commerce platform, has netted $30m in debt financing to build supply chain infrastructure and expand services to SMBs.

The company’s $30m financing round included $20m from UK-based lending platform Lendable.

ShopUp is Bangladesh’s leading full-stack B2B commerce platform for small businesses. The company provides easy access to B2B sourcing, last-mile logistics, digital credit and business management solutions to small businesses.

Mokam, ShopUp’s platform, is designed to serve the small stores that distribute the vast majority of the food and household items consumed in Bangladesh.

Cloud data security firm Sentra nets $30m

Sentra, a cloud data-focused security company, has scored $30m in a Series A funding round led by Standard Investments.

The company also announced that Standard Investments’ Peter Marturano, technology sector head, and MRV’s Oshri Kaplan, managing director, will be joining its board of directors.

Sentra enables security teams to gain full visibility and control of cloud data, as well as protect against sensitive data breaches across the entire public cloud stack.

This funding will enable Sentra to increase its market presence, invest in its technology and partner ecosystem and, grow its team to meet the accelerating demand of Sentra’s cloud-native data security solution around the globe.

Mexican FinTech Minu raises $30m

Mexican FinTech startup Minu, which offers an employee wellness service, has raised $30m in funding to support the development of gamified features.

With the fresh funds, Minu plans to bolster its distribution among customers, as well as further the development of its platform to include more modules for human resources and chief financial officers.

Minu provides businesses with a platform to manage all their employee benefits. Some of the core features include training plans and videos for fitness and meditation, virtual personal finance courses, donations to social causes and communication tools.

Clients can also pick from additional modules to implement. This includes salary on demand, which allows employees to get early access to their earned wages. It also offers savings, loans, discounts, payments and payroll dispersion.

Finally, through the platform, employees can get free online health consultations as well as access to insurance services.

Sunstone Credit lands $20m to help businesses go solar

Sunstone Credit, a technology-enabled clean energy financing platform that helps businesses go solar, has raised $20m in an oversubscribed Series A funding round.

Launched in 2021, Sunstone is on a mission to help more businesses go solar by providing simple and cost-effective loan financing.

According to Sunstone, most companies have not had access to loan financing for solar installations. This is despite the rising business demand for clean energy, customer preferences for sustainability, and a need for resilient power access.

Available through a national network of solar installer partners, Sunstone’s solar finance offering allows businesses to reap the substantial benefits of going solar and owning their own solar system.

Finley nags $17m

Debt capital raise and management solution Finley has raised $17m in Series A funding led by CRV to transform the debt ecosystem.

According to Finley, with so many players in the private credit space, and no centralised standards, raising and managing debt capital is now more complex, fragmented, and opaque than ever before.

This leads to inaccurate transactions, limited views of risk, and frequent lender-borrower disagreements. Finley’s tools aim to bring speed, transparency, and simplicity to debt capital.

The company also works with customers like TripActions, Ramp, and Parafin, to prove that tech-enabled debt capital management is not only possible, but an essential part of the modern financial tech stack.

The Finley team is made up of talent from across companies in Silicon Valley and traditional finance. They have experience from businesses such as Goldman Sachs, Ironclad, Nova Credit, Blend, Twilio and many others.

Coverflex scores €15m Series A

Coverflex, an employee benefits platform, has landed €15m in a Series A funding round led by SCOR Ventures.

Coverflex claims it is on a mission to improve the way companies compensate their people, making it more transparent, flexible and easier for everyone to make the most of what they get.

This funding round, Coverflex claims, will allow it to continue growing its team to more than 150 by the end of 2023, mainly in its product, sales and engineering teams.

In addition, the funding will support its launch in Italy and consolidate its position in the employee benefits management space in Portugal.

BOXX Insurance scores $14.4m Series B

BOXX Insurance, an InsurTech that combines cyber insurance and security, has landed $14.4m in Series B funding round.

The latest investment was led by Zurich Insurance. The company revealed that it has also met its combined goal to grow 10x in the last two years whilst continuing to outperform its underwriting targets.

Back in October, BOXX acquired Templarbit, a cybersecurity platform. The company has also begun the integration of its threat intelligence software into its product suite and underwriting framework.

Over the course of 2022, BOXX launched its Hackbusters Incident Response, virtual CISO service for businesses, a new mobile app solution for consumers, in addition to testing a number of new security-based initiatives.

Floodbase launches parametric flood solution and bags $12m

Floodbase, a climate adaptation technology company, has released a flood solution for parametric hurricane policies and raised $12m in Series A funding.

Floodbase is a climate adaptation technology company that provides precise, near real-time data and analysis on flooding and flood risk.

Powered by 15 satellites, machine learning, and on-the-ground data, Floodbase’s technology provides better data to insurance companies and governments to inform better flood preparedness and recovery decisions.

As climate change makes storms stronger and wetter, Floodbase said its flood data makes it possible for insurers to offer residential and commercial policyholders protection against hurricane flood damage.

Gem Security rakes in $11m following stealth period

Gem Security has emerged from a period of stealth, launching its Cloud TDIR platform and landing $11m in seed funding from Team8.

The company launched its Threat Detection, Investigation and Response platform enables organisations to optimise coverage through a continuous incident readiness dashboard and combines real-time cloud-native threat detection based on behavioural analytics and tactics, techniques and procedures.

The platform also enriches context across the entirety of cloud infrastructure for instant root cause analysis and isolates risks swiftly using cloud-native entity quarantine capabilities.

Gem Security helps organisations implement a continuous, risk-based program to manage their threat exposure.

The firm offers a platform that leverages existing infrastructure and solutions while offering unique automated detection, investigation and response capabilities purposely-built for cloud environments.

Investor workflow automation platform Passthrough bags $10m

Passthrough, a leader in fund workflow automation for investors, fund managers and other FinTechs has scored $10m in a Series A.

With Passthrough, investors are able to speed through the fundraising process on subsequent funds with just a few clicks, allowing fund managers to close capital commitments in minutes instead of weeks.

Their mission is to become the default fund closing platform for fund managers, fintechs, and other large asset managers by combining seamless fund workflows with structured, interoperable investor identity information.

Later this year, a new API integration offering from Passthrough will provide an embeddable fund closing option for enterprises and other FinTechs, with improved customization for a seamless experience in meeting fund workflow needs.

CyberTech Guardz secures $10m in seed funding

Guardz, a cybersecurity firm aiming to create a safer world for SMEs, has launched from stealth and landed $10m in seed financing.

The Guardz platform is purpose-built to provide real-time cybersecurity protection and insurance for small companies, many of whom sit in high-risk industries possessing sensitive data, such as law, healthcare, financial services, retail, and more.

Guardz claim the solution propels businesses from zero or low cyber protection to comprehensive security, defending against the top attack vectors including: cloud applications, web browsing, cyber awareness, devices, emails, and compromised data.

The funding will allow the company to expand its product, develop its cyber insurance line of business, and scale its go-to-market distribution channels.

Stubben Edge bags £5.6m to help brokers and IFAs digitise

UK-based FinTech Stubben Edge Group has raised £5.6m in an oversubscribed funding round on its mission to help brokers and Independent Financial Advisors (IFAs) digitise their businesses.

Stubben Edge Group is a UK FinTech company specialising in creating innovative products and technology for the financial services and insurance industries.

The company has developed a distribution portal that is the only single, networked system for Independent Financial Advisers (IFAs), brokers and Appointed Representatives (ARs) looking to really grow their businesses.

With a private client heritage and backed by Lloyd’s Names, the group is continuing to expand to building systems, technologies, and cutting-edge analytics.

NFT-powered lending and borrowing marketplace Archimedes raises $4.9m

Archimedes, which claims to be a one-of-a-kind lending and borrowing marketplace that utilises NFTs, has raised $4.9m in its seed round.

With the close of this seed round, Archimedes has raised a total of $7.3m in pre-launch funding.

Archimedes is a lending and borrowing marketplace that utilises NFTs and industry best practices. Leverage takers that use the platform are sent an NFT, which represents a yield-generating stablecoin position that has been leveraged at up to 10 times the principal collateral amount.

Its mission is to make capital efficient DeFi opportunities more accessible. Archimedes, which is open source, also hopes to become the go-to place for technical and non-technical users seeking high quality lending, borrowing and leverage solutions.

Wink widens seed round with further $3m

Wink, a US-based biometric identity and payments platform, has received an additional $3m of seed investment.

Wink’s biometric identity and payments platform is bringing forth a unique patent pending approach to passwordless authentication and handsfree payments, by converting any camera on any device into a secure authenticator and a payments acceptance point.

This means that with Wink’s technology, institutions will be able to authenticate and accept payments from their consumers across the billions of computers, smartphones, connected cars, SmartTVs, POS terminals and any IOT device that is camera and internet enabled.

Greenlight Re backs Vertical Insure in additional $2m raise

Vertical Insure, an embedded insurance platform for platforms, has raised $2m in additional funding, bringing its total seed round to $6m.

Vertical Insure provides vertical SaaS platforms with embedded, white label insurance products that can be deployed to their current customer base.

The company offers customised insurance options that are 100% built around each business and its customers, resulting in added value and new revenue without any extra overhead.

Vertical Insure operates in an emerging wave of business known as SaaS+. In addition to their core software product, SaaS+ platforms employ embedded products as a secondary revenue model. Vertical Insure is the “plus” that SaaS platforms can integrate and monetize to become SaaS+ platforms.

Vertical Insure said it will use the funding to accelerate product development, hiring and GTM. The company has also recently finalised its partnership with with battleface, an award-winning provider of travel, registration and event insurance.

WealthTech startup beatvest closes €1.3m round

WealthTech startup beatvest, a mobile app designed to help people get involved with investing, has reportedly collected €1.3m in seed financing.

beatvest aims to establish an investing platform that can be used by beginners and seasoned investors. It will launch a do-it-yourself portfolio building tool, which is complemented by educational tools.

Through the mobile app, users are taught investing step-by-step through modules. These modules are personalised to the experience of the user and helps the user use their new knowledge in the real world. Finally, the platform offers a section where users can keep up with trends, insights and book summaries.

Since 2022, its app has been tested with over 100 users. While the launch date is not clear, people can join the waiting list. Those on the waitlist will be able to get the app for free when it is released.

Greenspark lands £1m to aid firms measure climate action

Greenspark, a firm that encourages businesses to take climate-friendly actions, has scored £1m in a seed funding round.

Greenspark incentivises and inspires companies to take action on environmental and social issues around the world.

At a time when consumer and employee demand for action on climate change and social injustice is at an all-time high, the firm claims it is giving businesses the tools they need to do something about it.

The firm’s Impact-as-a-Service Platform allows companies to create positive impact at key business touchpoints, track it in an easily digestible way, and then communicate it effectively with their customer base, site visitors and key stakeholders.

The company will use the funding to launch its Climate API, which it says can “integrate impact into any business use case”.

Thai InsurTech startup Eazy Digital lands $850k

Eazy Digital, a Thai InsurTech startup that provides digital platforms for insurance companies, has raised $850,000 in an oversubscribed seed funding round.

The round was led by Wavemaker Partners, with participation from Seedstars International Ventures, Wing Vasiksiri, and Sasin Bangkok Venture Club.

Founded by insurance industry veterans Harprem Doowa and Maethavee Sukul, Eazy Digital is a platform that aims to help insurance companies manage their agents, operations, user referrals, and engagement.

Eazy Digital’s platform is designed to provide a SaaS solution to small and medium-sized insurance companies that lack the resources to digitise their processes and distribution.

Maryland-based CyberTech Foretrace bags $500,000

Maryland-based CyberTech Foretrace has received $500,000 in seed funding from TEDCO, an investor focused on technology companies in Maryland.

Foretrace is an external attack surface management platform that provides footprinting and information gathering to protect companies from cyberattacks.

By integrating known attacker techniques, Foretrace gives clients a clearer image of what information illicit players can find.

Pet care app Fluffy raises $450k

Pet care app Fluffy, which helps owners find insurance for their furry friends, has reportedly raised $450,000 in its pre-seed round.

This funding comes ahead of the launch of Fluffy’s pet insurance. Being released later this month, the product will be backed by an unnamed insurer.

Fluffy is a membership platform aimed at dog owners. It claims to be a service that covers ‘all you need’ to raise a healthy and happy pet.

Its full membership includes dog training from experts, 24/7 vet support and insurance coverage. The app also offers reward points to users, which can be exchanged for dog food, smart collars, dog toys and flea treatment. Alternatively, the points can be redeemed for the owner, such as Amazon Prime membership, cinema tickets, Netflix subscriptions and coffee.

German InsurTech Baobab lands €3m investment

Berlin-based cyber insurance platform Baobab has scored €3m from UK-listed FinTech fund Augmentum.

According to Finextra, this is Augmentum’s first investment in the InsurTech space and its second in Germany following an investment in Gover.

Baobab helps small and medium businesses manage cyber risks by combining cyber insurance and security measures.

Augmentum’s FinTech portfolio now comprises 25 private companies and includes the likes of Tide, Zopa and Anyfin.

Cybersecurity startup Peris.ai backed by East Ventures

Peris.ai, Indonesian-based cybersecurity as a service startup, has raised funding in a round led by East Ventures.

Through providing services such as a bounty platform powered by ethical hackers, ongoing monitoring and protection of networks, systems, and data, as well as incident response and recovery services, Peris.ai helps businesses and individuals strengthen their cybersecurity.

The company has also created a robust innovation in its product by integrating artificial intelligence and machine learning capabilities to augment human efforts in securing IT infrastructures.

Peris.ai said this allows more efficient and effective protection against attacks, as the system can continuously learn and adapt to new threats. T

The usage of AI and machine learning enables the analysis and interpretation of a large amount of data, providing insights and recommendations that would not be possible through manual efforts alone.

Peris.ai said it will allocate the capital mainly to further build and enhance its cybersecurity platform, train machine learning and AI capabilities, and nurture the ethical hacker community.

European lending platform TP24 secures funding

European lending platform TP24 has received a mezzanine funding facility from Channel Capital Advisors.

With the funds, TP24 hopes to free up equity capital to fuel its business growth and drive global expansion plans.

Mezzanine funding includes a mixture of debt and equity financing, which gives the lender the right to convert the debt to an equity interest in the company in case of default.

Based in Switzerland, European lending platform TP24 is a data-driven working capital provider for SMEs. It offers quick and flexible credit lines between £250,000 and £5m. Loans are based on accounts receivables so they can better match a company’s specific requirements and capabilities.

To alleviate manual oversight, TP24 helps set up the credit facility and automatically renews the contract after a standard yearly revision. All the borrower needs to do is provide TP24 with a weekly update about the account receivables, either through a link or manually through the dashboard.

TransUnion backs Bud’s open banking platform

Bud, an open banking and data intelligence leader, has secured funding from TransUnion to drive innovation and growth in open banking.

Headquartered in the UK, Bud helps its clients to turn complicated financial data into services that accelerate growth.

Clients use Bud’s platform to enhance their customer onboarding experience and personal financial management services, in order to boost engagement and increase loyalty. Bud’s aggregation and categorisation capabilities power lending through income and employment verification, affordability assessments and ongoing transaction monitoring – connecting people to financial products and services that improve their lives.

Following the investment, TransUnion’s Satty Saha will join the Bud board of directors and work closely with the Bud executive team to support future growth objectives.

Last week saw a total of $887m raised over 30 deals, with the PayTech sector performing particularly well.

Copyright © 2023 FinTech Global