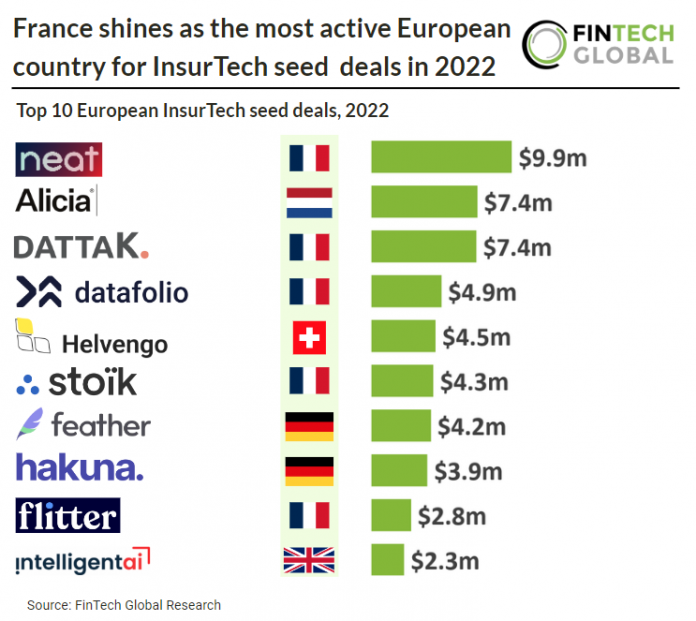

Key European InsurTech seed investment stats in 2022:

• French companies announced 11 InsurTech seed deals in 2022, a 24% share of total European InsurTech seed deals.

• Overall, there were 46 European InsurTech seed deals in 2022

• Q4 was the least active quarter in 2022 with only nine seed deals raised by European InsurTech companies

Early stage European InsurTech investment saw an eventful year with 46 seed deals raised in total with France accounting for the most at 11 transactions. The UK, Germany and Spain were the joint second most active InsurTech seed countries with six deals each. The InsurTech sector accounted for 6.9% of all European FinTech seed deals in 2022. Q4 was the least active quarter in 2022 raising only nine deals, a 31% drop from Q1 levels. The average European InsurTech deal size was $3.5m in 2022 which is lower compared to other active FinTech subsectors such as PayTech ($6.5m).

Neat, an embedded insurance solution, was the largest European InsurTech seed deal in 2022, raising $9.9m in their seed round, led by Octopus Ventures. The fresh capital will be used by the company in its international expansion efforts as well as tripling the headcount as it seeks to hire more than 40 individuals within the next 10 months. Neat has already attracted over 100 customers including Floa Bank, Casino, Maeva, Ecox and grew more than 350% in the number of transactions during October 2022.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global