Following a fairly mediocre week for FinTech deals last week, the sector came roaring back this week with a total of 37 deals reported by FinTech Global.

One of the biggest funding rounds this week was in the InsurTech sector, with insurance brokerage firm PCF Insurance Services securing an eye-watering $500m in preferred equity investment.

Other big investments recorded included $175m for B2B FinTech Demandbase, who help organisations hit their revenue goals.

2022 proved to be a rocky year across the globe, and despite some green shoots of optimism in the FinTech sector, there was notable declines in funding in the industry last year.

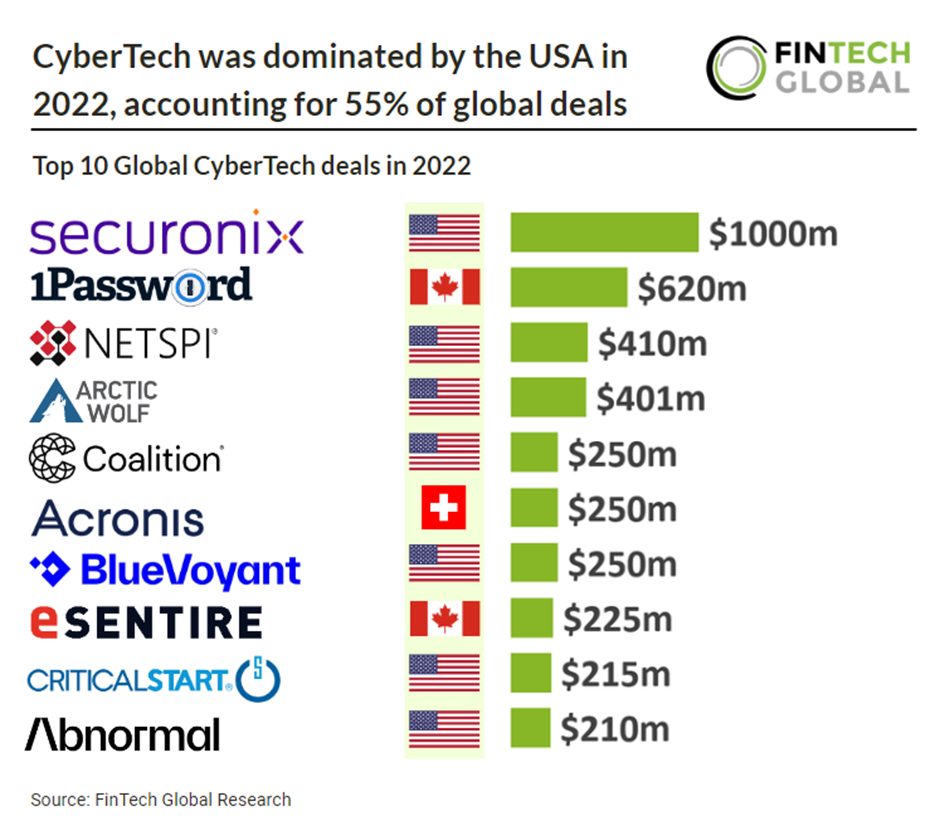

Recent research by FinTech Global found that the CyberTech sector saw a 27% decline in funding compared to 2021. Despite this, investment in the sector is 88% higher than it was in 2020.

Securonix, a threat detection platform, was the Largest CyberTech deal in 2022 raising $1bn in its latest private equity funding round. The funding round was led by Vista Equity Partners, with support also coming from Volition Capital and Eight Roads Ventures.

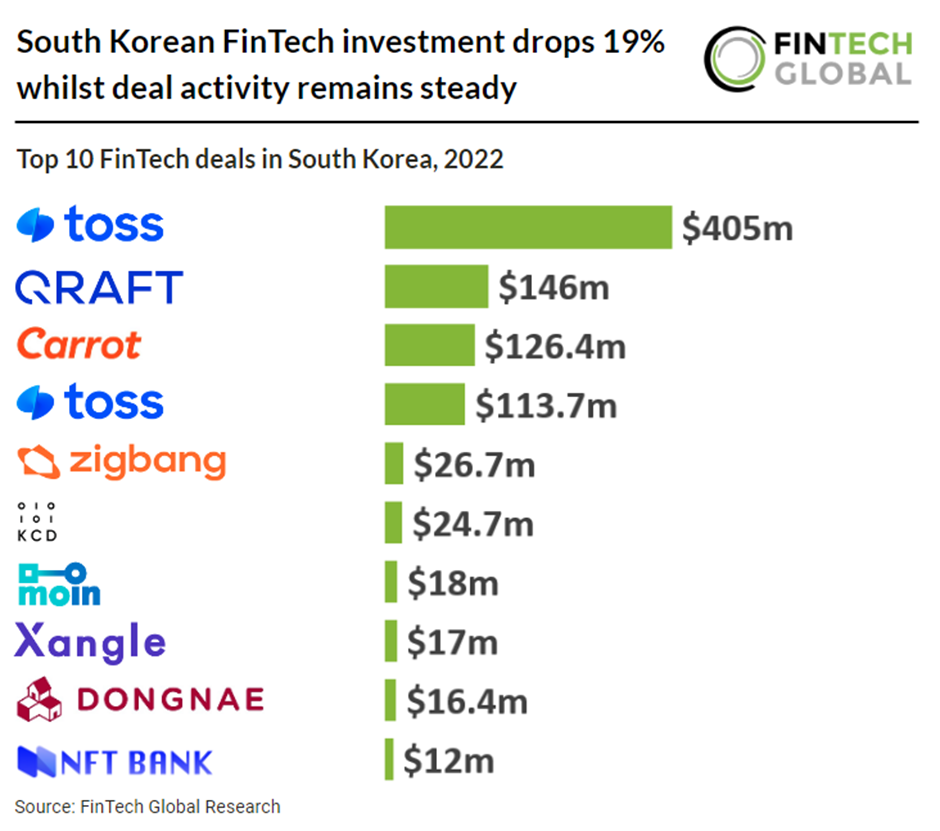

Elsewhere, FinTech Global research found that despite a strong year for FinTech in South Korea, deal activity fell 19% year-on-year.

FinTech deal activity in South Korea during 2022 saw almost no change from 2021, despite the drop in funding. In total 43 FinTech deals were raised by South Korean companies in 2022.

Meanwhile, Kenya’s FinTech sector recorded a solid 2022, with both investment and deal activity setting a new record for the country.

Kenyan FinTech investment saw a more than three-fold increase to $158m and deal activity reached 48 deals in total, a 14% increase from the previous year.

Here are this week’s deals.

PCF Insurance secures $500m

PCF Insurance Services, a US-based insurance brokerage firm, has secured a $500m preferred equity investment in a transaction co-led by Carlyle’s Global Credit platform and private equity firm HGGC.

PCF Insurance Services is a leading full-service consultant and insurance brokerage firm offering a broad array of commercial, life and health, employee benefits, and workers’ compensation solutions.

Since executing its management-led buyout in November 2021, PCF Insurance completed more than 100 partner transactions and increased its revenue to $700m.

Demandbase snares $175m

Demandbase, a company that helps B2B organisations hit their revenue goals, has scored $175m in financing from Vista Credit Partners.

The investment will be used strategically to support Demandbase’s next wave of platform innovation. This comes on the heels of a successful fourth quarter and full year 2022, including strong revenue growth and record Q4 bookings.

The past year marked a number of important innovations and company milestones for Demandbase, including delivering what it claims is the first 100% free account identification solution and becoming the first to unify sales intelligence and account engagement insights for sellers.

The company also enhanced B2B ad-tech with the addition of people-based advertising, launched Demandbase Data (D2) Labs, and broadened and evolved product offerings by more than doubling its mobile phone and company data in Demandbase One and releasing Demandbase Intent, making its intent data available for use outside the Demandbase One platform.

Car finance startup Carmoola nets over £100m

UK car finance FinTech Carmoola has raised £8.5m in its Series A round, alongside a new £95m debt facility.

With the capital, Carmoola plans to grow its team to 20 people to help meet the market demand. Funds will also be used to scale the company and support its rapid customer adoption.

The company’s mission is to revolutionise how people pay for cars. Carmoola launched ten months ago with a “neo car finance” product that removes complexity of car purchases.

Its technology offers a streamlined process that provides buyers with a budget, generates a free history check on the car and allows a payment to be made instantly online and at the showroom within 60 seconds through the Carmoola virtual card.

Cloud optimisation company ProsperOps nets $72m

ProsperOps, an autonomous cloud cost optimisation platform, has collected $72m in a funding round led by H.I.G. Growth Partners.

This capital will allow ProsperOps to scale its platform capabilities, engineering and go-to-market teams. It will also expand from Amazon Web Services (AWS) to additional cloud providers.

ProsperOps claims to offer best-in-class return on investment on cloud spend, helping teams unlock maximum value and savings outcomes for companies building in the cloud. It claims administrators save around $800m of compute usage.

Liquidity Group joins unicorn club after $40m investment

Israel-headquartered Liquidity Group has reportedly joined the unicorn club after a $40m funding round brings its valuation to $1.4bn.

The investment was led by Japanese banking giant MUFG Bank, according to a report from Invest Club.

Founded in 2018, Liquidity Group is a credit-oriented FinTech platform that invests, syndicates and automates growth and middle market lending for businesses around the world, providing capital mainly to later-stage technology companies.

Its platform leverages integrated machine learning and real-time data and performance monitoring across its platform to enhance, automate and expedite processes across the full credit investment lifecycle.

Finch raises $40m

Finch, an API-powered employment system, has collected $40m for its Series B funding round, which was co-led by General Catalyst and Menlo Ventures.

This fresh equity burst will help Finch accelerate connectivity across the employment data ecosystem by investing into its existing products as well as new ones. It is also looking to expand its team across the HR, FinTech and benefits teams.

Finch’s mission is to build a future where employment is connected and programmable. Its applications are instantly compatible with over 200 employment systems to offer products and services to employers.

DataMesh secures $30m from NAB Ventures-led Series A

DataMesh, a payments software and data analytics firm, has scored $30m from a Series A funding round led by NAB Ventures.

The two companies will also partner post-funding round to help transform the point-of-sale user experience for NAB business customers.

Also taking part in the round were Deutsche Bank and 1835i Ventures, the investment arm of ANZ.

DataMesh’s technology provides merchants with customised payment solutions and data analytics to help streamline in-store and online customer experiences.

GrainChain raises $29m

GrainChain, which is digitising the agricultural supply chain, has closed an investment round on $29m.

GrainChain integrated FinTech tools into its smart contract solution to enable new liquidity options to farmers and offer prompt payment upon delivery of commodities. This includes the ability to create lien instruments, deploy and manage capital, add insurance products, monitor and track farming operations, and facilitate repayment of funds.

Through this tool, users can reduce risk through real-time, accurate data as commodities move through the supply chain.

Since 2020, the company has grown its user base at a compounded rate of around 125% and revenue by around 400%.

Credit card FinTech Pliant snares $28m

Pliant, a German B2B credit card FinTech, has raised $28m in a Series A round headed by investor SBI Investment.

Founded in 2020, Pliant offers companies the digital credit card solution for maximum flexibility and savings fully digital card and receipt management.

The company also offers a Pliant app as well as physical and virtual cards including cashback – and claims seamless integration into existing finance and accounting software is guaranteed.

The firm also offers a Pliant Earth feature, which gives its customers the opportunity to offset travel-related CO2 emissions automatically and through certified providers.

India-based SaaS provider Mintoak scores $20m

Mintoak, an India-based SaaS platform aimed at merchant services, has scored $20m in its Series A funding round.

Funds from the round will be used to enhance Mintoak’s technology and bolster its existing product portfolio. The FinTech company also plans to bolster its presence in India and expand into West Asia, Africa and Southeast Asia.

Mintoak offers a SaaS platform that helps banks and merchant acquirers connect with small and medium enterprise customers and drive higher cross-sell of financial products. Its platform powers omnichannel payments, real-time analytics for business owners, SME commerce enablement solutions and access to capital.

It currently supports over 1.5 million merchants, including banks in India as well as those in Africa and the Middle East.

Crypto protocol security firm Chaos Labs nets $20m

Chaos Labs, an automated economic security system for crypto protocols, has raised $20m in a seed funding round.

The company is the first automated risk management platform for crypto, operating best-in-class security practices including robust agent- and scenario-based simulations.

Working with Chaos Labs, the firm claims teams can optimise user capital efficiency and more quickly adapt to ever-changing crypto markets – helping them stay competitive without compromising on the security of their protocol.

Chaos Labs will use the funding to expand its offerings and build out its suite of risk and security products.

Data security solution Metomic locks in $20m Series A

Metomic, a data security solution for protecting sensitive data, has scored $20m in a Series A round led by Evolution Equity Partners.

Security, privacy and compliance teams use Metomic’s no-code workflows to automate data policies across their SaaS applications. This includes the ability to deliver real-time notifications directly to employees when they have uploaded sensitive data into the wrong environment, essentially enabling a human firewall across the organization.

Over the last 18 months, Metomic claims its automated platform has prevented over two million data leak threats lurking in SaaS ecosystems.

It has also detected hundreds of millions of sensitive data points within SaaS apps and found that 99% of the sensitive data does not need to be there or is accessible to people who shouldn’t have access.

Entitle launches with $15m seed

Entitle, the founder of a cloud permissions management platform, has exited a period of stealth with $15m in seed financing.

Founded in 2021, Entitle applies its teams’ expertise in deep learning, security operations and vulnerability research to deliver a cloud permissions management platform that fuses a security-first approach with a commitment to business enablement.

According to Entitle, its cloud permission management platform transforms how employees access cloud-based resources. It also automates access requests to prevent entitlement sprawl and save IT and DevOps teams a substantial amount of effort.

Entitle also eliminates provisioning-related bottlenecks so security leaders can easily enforce the Principle of Least Privilege while maintaining a seamless user experience.

General Catalyst leads $15m Series A for Puzzle

Puzzle, a company developing smart accounting software with a real-time financial data platform, has scored $15m in a Series A raise.

Puzzle claims the combination of smart accounting software with a real-time financial data platform, brings capabilities beyond legacy accounting software, making it simpler for founders to build a scalable foundation for fundraising, taxes and improving business health.

The company said it believes accounting and finance are the underrated superpowers that set apart the next great businesses, but leaders are held back by legacy software that lacks the speed, collaboration, and intelligence needed for today’s fast-changing economy.

By combining smart accounting software and a real-time financial data platform in a single solution, Puzzle said it can enable a new set of capabilities for startups immediately, including a design that makes finances real-time and explorable to anyone.

Cybersecurity platform for SMEs CyberSmart raises $15m

Cybersecurity platform for SMEs CyberSmart has reportedly collected $15m for its Series B funding round.

With the capital, CyberSmart plans to develop its product and explore potential acquisitions. Additionally, the CyberTech company plans to expand its channel partners and customers in Europe, Australia and New Zealand.

UK-based CyberSmart is a cybersecurity platform aimed at SMEs. Users can instantly check their organisation’s security status and see where there is room for improvement. Its platform also boasts 24/7 cyber risk management, with the solution identifying risks and offering simple instructions to avoid them.

The solution also provides visibility into every device used by the company and offers training to educate staff on online safety.

Irish cybersecurity insights startup Siren collects €12m

Cybersecurity insights platform Siren has raised €12m in a funding round from the European Investment Bank.

This investment comes after a strong growth year for Siren, which reported a 162% revenue growth. Other notable milestones include a new patent, with four more pending, and a new headquarters and new partnerships.

Based in Ireland, the company offers an advanced intelligence platform that allows investigators to make complex searches, organise the results visually and create advanced reports to share their findings with their teams. Additionally, companies leverage the technology to protect their assets and networks against fraud and cyber threats.

The platform enables organisations to close cases faster by accelerating investigations with easier access to unconnected data. Organisations can visualise, analyse and disseminate a more precise set of data relationships at machine speed and scale.

Email-focused CyberTech Sublime raises $9.8m

Sublime, which claims to be the first open email security platform that lets anyone write, run and share rules to detect and block email-originated threats, has raised $9.8m.

Kamdjou started working with DoD in high school and over eight years he worked and led numerous offensive security efforts. Whilst also working as a red teamer in the private sector, Kamdjou found that phishing was always his easiest entry point.

Kamdjou set out to create a product that could stop someone like him and realised the key was empowering email security professionals to collaborate and have more control. Through the community, users can share detections, receive new rules and updates, automatically and build their own rules to block threats.

Sublime claims to be the first open, free and self-hostable email security platform. With one line of code and a Docker instance, anyone can set up Sublime for free in their own environments and start running behavioural rules to block phishing attacks and other email-borne threats.

German FinTech finway lands €9.2m

German finance operating system for SMBs finway has raised €9.2m in a Series A financing raise led by Capital 49.

finway claims it replaces the inefficient, fragmented SMB finance tool market with one centralized platform covering invoicing and accounting workflows, spend and travel expense management.

The firm said it helps SMBs to eliminate a variety of time-intensive, error-prone manual tasks. By enabling intelligent and digital workflows, finway streamlines the entire accounts payable function.

The finway team will use the investment to advance the development of its software solution.

Credit risk FinTech DirectID receives €9m minority investment

UK-based DirectID, which offers credit risk, risk analytics and predictive modelling services, has received a €9m minority investment from Ingka Investments.

With this equity, DirectID is planning to accelerate the launch of advanced predictive models for credit and risk, built from open banking. The company is also looking to expand its credit risk offering into new markets and accelerate the development of models for each stage of the credit life cycle, from originations through portfolio management to collections.

DirectID’s mission is to promote financial inclusion through its global risk score. Its platform, which leverages open banking data, offers advanced data to optimise credit and risk decisions in a growing number of countries.

Risk managers are supplied with a real-time dataset to drive efficiencies, optimise decisions and drive lifetime value across the credit lifecycle. The insights cover how much a customer can afford to repay, verify the customers income across all streams, details of where customers spend their money, highlight emerging financial distress before a customer defaults and more.

SendOwl scores $9m in seed financing haul

San Fransciso-based tech firm SendOwl has bagged $9m from a seed funding round headed by TheGP.

Founded in 2010, SendOwl claims it has helped thousands of creators around the world become financially profitable creatorpreneurs.

SendOwl powers the digital economy with checkout and delivery tools like on-site checkout, unique payment links, subscriptions, drip campaigns, PDF stamping, download restrictions, and so much more.

The SendOwl app connects with Stripe or Shopify store to automatically and securely deliver digital goods.

Income-backed DeFi protocol Huma Finance bags $8.3M

Huma Finance, an income-backed DeFi procotol, has scored $8.3m in a seed funding round led by Race Capital and Distributed Capital.

Also taking part in the funding round was ParaFi Capital, Folius Ventures, Robot Ventures and Circle Ventures.

The company’s first product launch is an on-chain factoring market, and they plan to use the funds to continue developing the platform and expanding its reach into new markets.

Huma’s initial launch partners include global financial technology firm Circle, and blockchain payment networks Request Network and Superfluid that are enabling borrowing against invoices and users’ incomes.

Carbon credit insurer Oka pulls in over $7m

Oka, a provider of insurance solutions for companies in the carbon credit market, has raised over $7m in funding.

According to Oka, the voluntary carbon market (VCM) is experiencing significant growth and is projected to reach $1trn by 2037, highlighting the scale of the opportunity.

Oka is on a mission to provide insurance that will replace credits if destroyed or invalid, providing security and confidence to the VCM market.

The carbon insurance company provides insurance with the goal of providing security, confidence and protection in an unregulated and opaque market.

The capital will be used to scale Oka’s innovative carbon credit insurance offerings, addressing the risks that large US corporations face when buying carbon credits to offset their emissions and meet net-zero targets.

Green Check Verified nabs $6m to further bridge cannabis and finance

Green Check Verified, a FinTech platform for the legal cannabis sector, has closed its Series A funding round on $6m.

This funding round comes after a strong period of growth for Green Check, which culminated in 87% growth in revenue. Other notable stats from the past year include a 55% growth in financial institution clients and a 261% growth in cannabis businesses served.

Green Check was founded in 2017 by a team of technology, banking and regulatory experts. Its goal is to transform how financial institutions and cannabis businesses interact.

The company empowers financial institutions to build and scale a cannabis banking program. As for businesses, it helps them build relationships with financial institutions and maintain compliance.

Stelo Labs bags $6m from Andreessen Horwitz-backed funding round

Stelo Labs, a startup seeking to protect wallets from scams and phishing and securely navigate Web3, has raised $6m.

Stelo Labs’ mission is to make web3 more secure and usable. The firm claims its extension interprets and enriches transactions to keep users safe from crypto phishing, fraud and scams.

Stelo also announced three new products, including Stelo v2, which has redesigned the Stelo extension from scratch to make it simpler, faster and easier to use.

The company has also introduced Stelo for developers, which is a developer API to aid every dApp and wallet to use the Stelo Transaction Engine, which powers the Stelo extension. The firm also launched Approvals.xyz, a token approvals experience to understand a wallet health and keep it safe.

Vietnamese FinTech Gimo lands $5.1m Series A

Gimo, a FinTech startup from Vietnam, has closed its Series A funding round with an investment led by TNB Aura.

Founded in 2019, Gimo claims it strives to better the financial lives of the Vietnamese financially underserved, first with on-demand pay.

Currently, nearly 500,000 workers from approximately 100 businesses are getting on-demand access to their earned wages with Gimo, the firm claims.

GIMO’s latest financing follows a year of remarkable growth. With a solid 24x year-on-year revenue growth and an 11x year-on-year transaction volume increase, the company claims it has delivered one of the favourite financial apps for Vietnamese financially underserved workers.

Zylo raises additional $5m

Zylo, a company positioning itself as an enterprise leader in SaaS Management, has raised an additional $5m in Series C funding.

Zylo announced the first tranche of its $31.5m Series C raise in November. Baird Capital’s Venture Team led the initial Series C round, which also included Spring Lake Equity Partners and existing investors Bessemer Venture Partners, Menlo Ventures and High Alpha, as well as strategic partner and investor Coupa Ventures.

Companies such as Adobe, Atlassian, Coupa, Doordash, Intuit, Slack, Salesforce, and Yahoo leverage Zylo’s technology and SaaS Management expertise to control the rising costs and risks of SaaS while improving software adoption by employees and driving innovation.

According to Zylo, this additional funding comes in the wake of an exceptionally strong year of growth.

Web3 technology platform Nefta rakes in $5m seed

Nefta, a company focused on the Web3 space, has scored $5m in a seed funding round headed by Play Ventures.

Founded in 2022, Nefta has rapidly expanded in the Web3 space, offering a complete end-to-end solution for companies looking to build, launch and grow high-quality Web3 games.

Nefta claims its team has a wealth of industry experience, providing the skills and knowledge to handle the complexities of Web3, leaving its partners free to focus on building great products.

Nefta has gained attention in the blockchain gaming space for its one-stop-shop Web3 toolbox and white-label solution and will be launching its Web3 advertising network in Q1 2023.

Nefta will use the new financing to expand its business and team, grow its market presence and realise its vision of being the go-to platform for Web3 solutions.

Blockchain firm Gateway.fm lands $4.6m in seed raise

Gateway.fm, a decentralised blockchain infrastructure node provider, has scored $4.6m in a seed funding round led by Lemniscap.

The company’s Gateway Grow solution is built for institutional staking validators across several Proof-of-Stake chains like Ethereum, Gnosis and IXO. Gateway Access is the company’s dedicated, cost-effective RPC node service built for scale, which currently supports ETH, Fantom, NEAR and Gnosis.

Gateway.fm claims that the funding will be used to expedite product development and the provision of advanced staking services while driving user acquisition and recruitment efforts, with a particular emphasis on scaling the company’s engineering department.

Fabacus secures £4.5m from WealthClub-led investment

Fabacus, a software-as-a-service platform for the licensing industry, has raised £4.5m from an investment round led by WealthClub.

Fabacus’ platform, Xelacore, bridges the flow of licensed product sales reporting information and the data flow between licensor, licensee and end-user. This unlocks new capabilities assisting with consumer engagement initiatives, as well as provides robust data capture and structuring to meet increasingly stringent ESG reporting requirements.

Fabacus has spent the last three years aligning the licensing industry on better practice and smarter collaboration, with an architecture built to enable all stakeholders to benefit from economies of scale.

With significant growth and revenues expected in the next 12 months, the capital from this latest round will bolster the balance sheet and team, allowing the Company to accelerate faster.

Eko lands $3.6m to support micro-entrepreneurs

Eko India Financial Services (Eko), a technology-based platform for financial transactions for micro-entrepreneurs, has raised $3.6m in Series B funding.

Founded in 2007, Eko enables digital product brands to tap the next-billion-customer through a platform of embedded-in-the-community micro-entrepreneurs as influencers, facilitators and resellers.

With this capital, Eko plans to expand its network of engaged micro-entrepreneurs and product development.

On its mission of taking banking and financial services to all, Eko has built over 100 services on its platform to cater to all needs a customer has from a bank, and even offered open APIs to truly democratise them.

Eko has served over 50 million customers till date, is available over a merchant network of 1,50,000 customers and enables over 7 million banking transactions a month.

Data security firm CommandK nets $3m in seed raise

CommandK, an early-stage cybersecurity firm, has raised $3m in a seed funding raise led by Lightspeed.

Established in 2022, the California-based firm has developed infrastructure to protect sensitive data. The company also offers built-in solutions to prevent data-leaks and simplify governance.

The company’s solution scans the tools organisations use to identify and help remediate any data leaks, helping organizations remain compliant with existing policies and regulations.

CommandK provides support for various cloud solutions and provides organizations with an overview of any identified issues from a single dashboard.

Curio snares $2.9m in seed financing

Curio Research, a provider of an on-chain gaming lab building crypto Web3 games, has scored $2.9m in seed funding.

Its on-chain games are powered entirely by smart contracts, which create a multiplayer computation that enables all participants to contribute to a shared universe of code and data. This allows for maximum transparency and leads to games built entirely by players’ creativity and content.

The firm’s first game – Treaty – launched last month and allows players to write and deploy smart contracts to draft rules around how they interact with other players in the game.

Curio intends to use the funds to build new games that will unite web3 capabilities, design and create seamless experiences, onboard players, and expand its development and design team in San Francisco and remotely.

Multi-signature wallet provider Den scores $2.8m seed funding

Den, a multi-signature wallet provider for teams, has concluded a seed round led by IDEO CoLab Ventures on $2.8m.

Den claims that it has helped over 200 on-chain teams secure more than $130 million in assets and transact over $15 million in value.

With the new funding, Den aims to tackle chellenges surrounding on-chain teams, such as user experience issues related to blockchain transaction fees and making it simpler for on-chain teams to trafe assets, generate financial and accounting statements and customise permissions for secure on-chain transactions.

The capital will also contribute to its growing team and expanding its product development to continue solving the problems that hamper on-chain teams.

Bulgarian RegTech Evrotrust bags €2.5m in funding

Evrotrust Technologies, a Bulgarian RegTech identity verification and qualified trust services provider, has raised €2.5m in funding.

Founded in 2015, Evrotrust claims it offers unique and revolutionary technology for identification, strong authentication and signing. The technology is specifically developed with many of the current regulatory changes in mind, that take place within the services industry.

The key focus of the solution is to offer much higher legal and security protection for the enterprise during interactions with their clients, while providing the clients with easy-to-use and fast tools to make their experience as seamless as possible.

Payments startup HedgeFlows launches following £2m

HedgeFlows, a FinTech platform for small and medium-sized enterprises, has launched following a funding raise of £2m.

The HedgeFlows platform enables SMEs to seamlessly manage foreign payments, cashflows and invoices, giving ambitious companies access to services which are often denied by the big banks. The company is fully licensed by the FCA.

HedgeFlows aims to empower businesses to better plan and manage their financial needs in any currency.

The Hedgeflows platform helps businesses grow and improve their international trade capabilities to sell across borders.

Investment platform Sprout scores $1m pre-seed

Sprout, a UK-based platform for underserved private investors to access a selection of venture capital funds, has raised $1m in pre-seed financing.

Sprout has developed a platform to support underserved investors with access to venture capital funds.

Users can manage their portfolio online and browse through Sprout’s curated selection of high-quality VC funds, invest through Sprout’s platform and monitor portfolio performance through the company’s regular updates.

Karambit.AI collects $75k grant

Karambit.AI, which helps companies secure their software supply chains, has received a $75,000 grant from the Virginia Innovation Partnership Corporation (VIPC).

This funding will be used to work with organisations in its pilot programme to see how effective its solution is at defending software supply chains.

Capital will also be used to help management engage with a broader set of potential customers to fine-tune the Karmbit.AI product development roadmap.

The FinTech stops software supply chain attacks by automatically finding unauthorised code modifications and keeping malicious software updates from being installed. Its technology can automatically detect malicious modifications and reduce manual analysis backlogs, as well as flag malicious code injections.