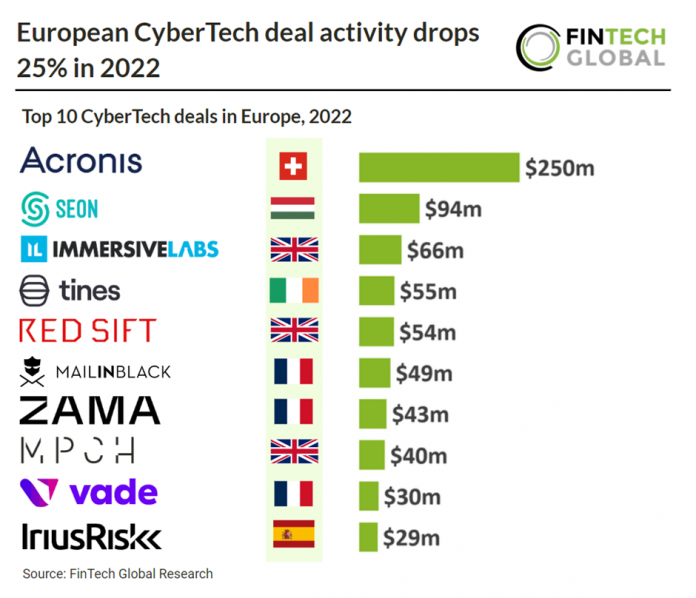

Key European CyberTech investment stats in 2022:

• European CyberTech deal activity reached 122 deals in total during 2022, a 25% drop from 2021 levels

• European CyberTech investment dropped 35% from the previous year to $1.1bn in 2022

• France was the most active CyberTech European country in 2022 with a 19.6% share of all deals

European CyberTech deal activity saw a 25% decline in 2022 reaching 122 deals in total. Global CyberTech deal activity reduced 13% in 2022 from 2021 activity indicating that VCs are seeing more innovation in other regions compared to Europe or there is more potential for growth in other regions and Europe is more mature. European CyberTech investment also dropped in 2022 to $1.1bn, a 35% reduction from 2021.

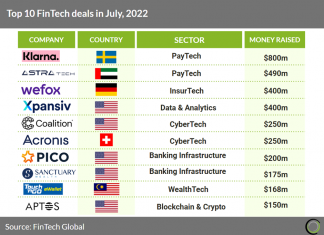

Acronis, a data protection software vendor, was the largest European CyberTech deal in 2022 raising $250m in their latest Private Equity funding round led by BlackRock. The latest funding brings Acronis’ valuation to $3.5bn. The funding will be invested in growing its sales and market teams, making acquisitions, and supporting ecosystem partners, the firm claims. The cybersecurity firm offers Cyber Protect Cloud that gives features to detect malware in corporate networks and tools for protecting data from outages. Its software is used by 750,000 businesses and 5.5 million consumers globally.

France was the most active CyberTech European country in 2022 with a 19.6% share of all deals. On 18 February 2021, the French government launched the national cyber-security strategy for the period 2021-2025. The strategy has EUR 720 million (USD 870 million) of public support allocated to, among others, develop self-sufficient cyber-security solutions in France. Given the strategy will be implemented by the Public Investment Bank and Export Credit Agency of France, Bpifrance, the support will take the form of, among others, state loans or reimbursable payments.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global