The FinTech sector has recorded its second uneventful week in a row after FinTech Global recorded only 17 funding rounds in the industry.

Of the 17 funding rounds recorded, US and UK-based companies made up the majority of the list, with eight and six recorded respectively. Other countries represented in the raises were the Netherlands, Switzerland and Germany.

Sector-wise, CyberTech and PayTech firms led the way for representation with four a piece, while WealthTech, FinTech and RegTech came in with two each and ESG and InsurTech having one company represent them.

The total raised across the 17 rounds this week was $616.4m.

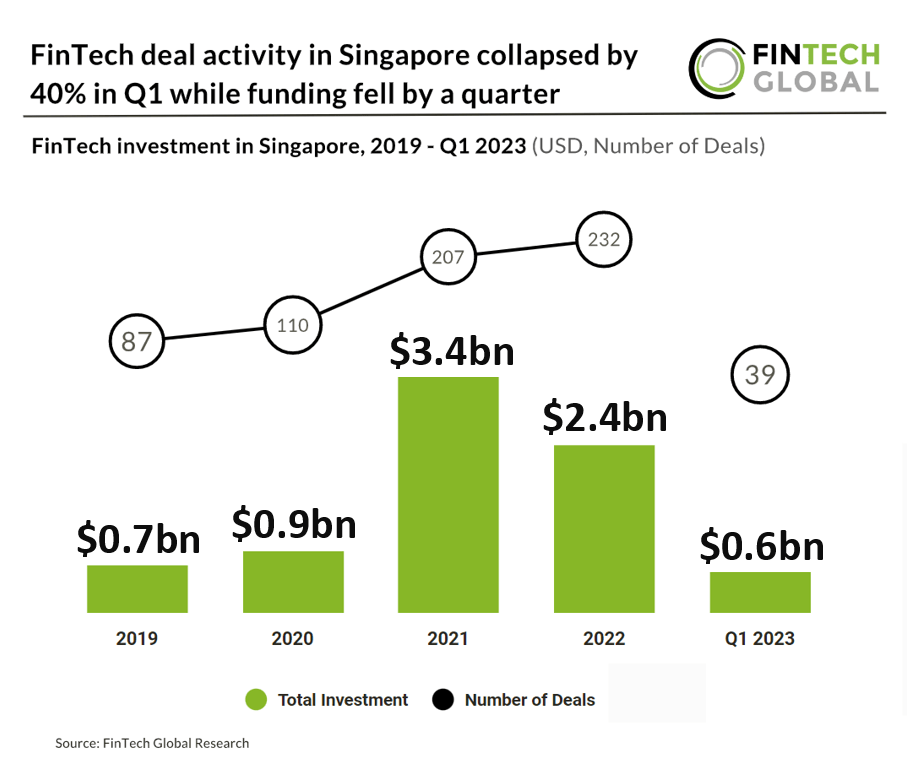

Research by FinTech Global this week found that FinTech deal activity in the Singaporean market fell by 40% in the first quarter, while funding fell by a quarter.

Investment in Singaporean FinTech reached $642m in Q1, which represents a 25% decrease compared to Q1 2022.

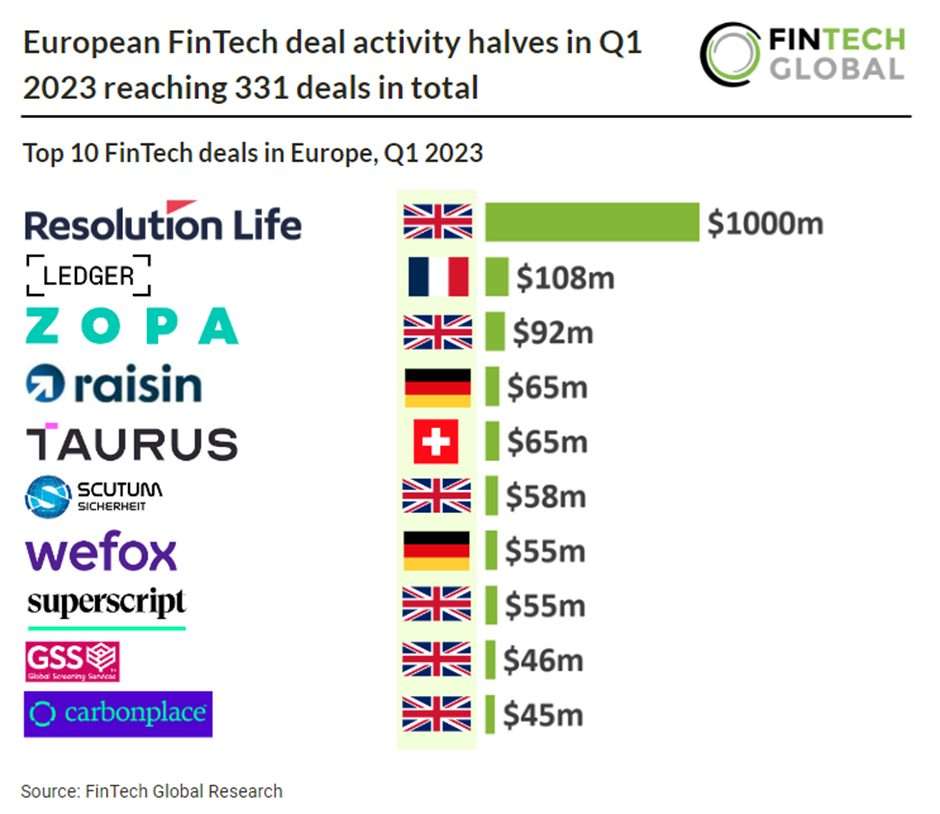

In other disappointing news for the FinTech sector, FinTech Global found that European FinTech deal activity halved in Q1, reaching 331 deals in total.

European FinTech investment also witnessed a substantial drop to $3bn in Q1 2023, a 77% reduction from Q1 2022 levels.

Here are this week’s deals.

Quantexa achieves unicorn status following £103.9m Series E raise

Quantexa, data analytics firm, has scored £103.9m in a Series E funding round, lifting its valuation to $1.8bn and becoming a unicorn.

The rise to becoming a unicorn follows a $153m Series D funding round in 2021, where the company saw its valuation climb to between $800m and $900m.

This recent funding round comes off the back of Quanteca’s acquisition of Aylien, a Dublin-based AI-focused company.

According to UKTN, Quantexa will use its new funding to develop new tools for its patented decision intelligence platform.

Cybereason nets $100m in SoftBank-led investment

Cybereason, a company that focuses on XDR, has scored $100m in an investment headed by SoftBank to support its global growth and advance.

Alongside the funding, Cybereason said that Eric Gan will serve as the company’s new CEO, subject to confirmation by the firm’s board and pending customary regulatory approvals.

Eric Gan has a long history with Cybereason, starting with SoftBank Corp.’s initial investment in Cybereason in 2015.

Prior to SoftBank, Gan co-founded eAccess, a telecommunications company. Gan later became an Executive Vice President of SoftBank, where he led its Business Development Unit, which formed alliances with overseas companies. Before eAccess, Gan was an analyst and managing director for Goldman Sachs.

Kin Insurance closes $100m catastrophe bond

Kin Insurance, a direct-to-consumer home insurance company, has closed a $100m private placement catastrophe bond transaction.

The company strives to make home insurance more convenient and affordable by cutting out administrative and agent-related expenses.

Kin’s technology platform draws on thousands of data points to evaluate the risk profile of each home and price policies accurately. Kin said this is particularly important for homes that are hard to insure, including those that are impacted by severe weather events caused by climate change.

The latest catastrophe bond brings Hestia Re’s total outstanding limit to $275m. The new multi-year reinsurance arrangement with Hestia Re provides the Kin Interinsurance Network with indemnity-based coverage for large hurricanes and other named storms affecting the State of Florida.

Payments infrastructure firm TerraPay nets over $100m

TerraPay, a global payments infrastructure business, has scored over $100m in its Series B equity financing round.

TerraPay is committed to driving financial inclusion and specializes in enabling the delivery of cross-border remittances and instant money transfers, securely, and at a low cost. With the new funding, the company is well-positioned to capitalize on the growing demand for its remittance and payments solutions and continue its mission of making cross-border payments more accessible, secure, and affordable for all.

With the funding, TerraPay plans to further its global expansion plans, especially across the LATAM and MENA regions, strengthen its existing pay-out network to 150 countries by 2024, support and accelerate its growth and invest in the marketing and adoption of alternative payment methods for mobile wallets.

TerraPay also aims to expand its regulatory and compliance infrastructure including key license applications across the world.

Everstream Analytics bags $50m

Everstream Analytics, a global supply chain insights and risk analytics firm, has raised $50m in a Series B funding round.

With a vast database and advanced data science and meteorological expertise, Everstream claims it offers deeper predictive capabilities in areas like climate that other providers cannot.

The company was recently named one of the World’s Most Innovative Companies for its application of AI and predictive analytics to anticipate and mitigate the entire spectrum of global supply chain risk.

Everstream said it continues to outpace and out-innovate its competitors while delivering unmatched value to clients. It has a proven track record of significantly reducing the time and effort required to map a supply chain at the n-tier level.

RegTech firm Fourthline lands €50m in funding

Fourthline, a RegTech firm that provides AI-powered and compliant KYC and AML solutions, has bagged €50m from new and existing investors.

The Fourthline platform provides banks and financial services providers with a complete suite of proprietary tech products that adhere to local KYC, AML and GDPR requirements in Europe and beyond.

Fourthline’s AI-driven solutions unlock compliance for the entirety of the lifecycle, from onboarding, the verification and analysis, through to investigations and continuous KYC, in all stages of business development.

Since it launched five years ago, the firm has grown more than 80% yearly. Fourthline now employs over 270 people across The Netherlands, France, Spain and The UK; and works with European fintech leaders including N26, Trade Republic, Qonto and Scalable Capital; and other regulated financial institutions such as NN, Solaris and Western Union.

Strivacity lands $20m in SignalFire-led funding

Strivacity, a firm aiming to make customer sign-in experiences simple and secure, has scored $20m in new funding.

Strivacity is a cloud-native customer identity and access management vendor for the Fortune 1000 that creates simple, speedy and secure sign-in journeys. This enables customers to engage sooner and allows companies to convert more customer visits into revenue.

The company will use the new funding to grow its investment in product development, accelerate its go-to-market initiatives and continue to deliver high-quality service to its customers.

London FinTech Paytrix lands $18.3m for its payments ecosystem

Paytrix, a London-based FinTech building a payments ecosystem to help businesses grow, has raised $18.3m in Series A funding to drive product development and international expansion.

Through one platform, one contract and one API, Paytrix’ payments curation solution provides access to the “best payments ecosystem around the world.”

The infrastructure is designed to reduce the inefficiency, cost and complexity of international payments. In contrast, existing international payments solutions typically require businesses to source, negotiate and maintain a minimum of 10 to 15 partners, contracts and APIs.

Unusual Ventures, Motive Partners and Bain Capital Ventures co-led the Series A investment. Bain Capital Ventures participated in an earlier funding round in May 2022 with Fin Capital, Better Tomorrow Ventures, Hambro Perks, ClockTower Ventures, The Fintech Fund, D4 Ventures and a number of notable angel investors all also participating in both rounds.

UK CyberTech Push Security nets $15m Series A

Push Security, a CyberTech firm focused on SaaS security for modern IT and cybersecurity teams, has bagged $15m in a Series A raise.

The road was headed by Google Ventures and saw participation from Decibel and a range of angel investors.

These angels included co-founder of Duo Security Dug Song, Tray.io co-founder and CEO Rich Waldron.

Many employees today are moving fast and adopting SaaS platforms to get things done. While SaaS makes productivity gains and innovation accessible for companies of all sizes, it also introduces risk to the business unless its properly managed.

PayPal Ventures backs German FinTech Finanzguru in €13m raise

Finanzguru, a Frankfurt-based open banking financial advisor, has scored €13m in a funding round headed by SCOR Ventures and PayPal Ventures.

Launched in 2018 as a multi-banking app, in recent years Finanzguru has expanded into an independent platform that allows its customers to manage all of their banking accounts and contracts.

Since mid-2021, the company has also offered its customers independent advice on insurance and financial products based on a digital analysis of their banking data, which can be accessed in a state-of-the-art setting by phone or video chat.

Finanzguru has grown to more than 1.5 million registered users and is Germany’s fastest growing financial startup in terms of downloads. More than 100,000 of the app’s users are already utilizing Finanzguru’s brokerage services and buying financial and insurance products.

The company will use the funding to speed up profitable growth in Germany, as well as to further expand its product platform. The firm will also seek to strengthen its current team of 70 employees.

SpendFlo bags $11m for its SaaS platform

SpendFlo, an all-in-one platform to buy, manage and secures SaaS, has raised $11m in Series A funding.

The round, which takes the total raised by the company to $15.4m, was led by Prosus.

Founded in 2021 by Siddharth Sridharan, Ajay Vardhan, and Rajiv Ramanan, SpendFlo aims to simplify buying, managing and renewing SaaS solutions for companies.

This is because businesses don’t have a simple way to centralise their intake and approval workflows, access benchmark pricing data to negotiate effectively, automate third-party risk assessment, understand real-time spend, usage and sentiment.

Salt Labs bags $10m

Salt Labs, a new loyalty and payments technology company, has raised $10m in a pre-seed funding round to reinvent the way hourly workers earn.

Salt Labs founding team includes Jason Lee and Rob Law who previously co-founded unicorn company DailyPay which created the on-demand pay industry to address income inequality for hourly workers.

The mission of Salt Labs is to enable hourly workers to own the long-term value of their work. Unlike white collar workers who are afforded several opportunities to build long-term wealth through company stock plans, partnership interests, or even a 401k plan, it is often the case that frontline workers aren’t afforded those same opportunities for a variety of technology or cost reasons. This has resulted in the growing wealth gap disparity.

Salt Labs’ technology changes how a worker earns and enables them to capture the value of their work, on top of their regular paycheck.

Mortgage intermediaries platform Acre bags £6.5m

Acre, a mortgage intermediaries platform, has secured £6.5m in funding to grow its tech platform and change the home buying process.

Following this investment, Acre claims it will seek to continue its rapid customer growth and pursue its vision of changing the way people buy homes.

Acre plans to roll out new partnerships with lenders and insurers that help its brokers recommend and apply for the right financial products and services as efficiently as possible. Acre believes that in order to deliver on this vision, client data and identity need to be entered and verified once, and shared across the whole home buying process.

The firm’s ongoing evolution comes at a time when lending is increasingly complex due to the difficult economic climate, and brokers’ increased responsibility for outcomes for their customers.

Premium digital finance services firm Kashet bags CHF6.2m

Kashet, a Swiss-UK premium digital finance services firm, has recently raised CHF 6.2m in Series A funding.

According to Kashet, it has been operating in stealth mode, building an FCA-licensed business, joining MasterCard, and receiving strategic investment including that from Trifork Labs, a Copenhagen technology accelerator.

The company claims it is focused on delivering a membership-based financial solution app for customers and private bank clients.

Kashet has already obtained FCA licenses in the UK, including E-Money, AISP, and PISP licenses. The company intends to submit applications for UK FCA 5MLD registration and a Swiss Fintech License with Switzerland’s Regulatory Authority FINMA

Trustle secures $6m seed

Trustle, a provider of cloud access management solutions, has raised $6m from a seed funding round headed by Glasswing Ventures.

Founded in 2019, Trustle claims its mission is to revolutionise the management of access-at-risk.

Trustle enables deep integration into a company’s critical cloud resources, including Azure, Okta, and Google Workspaces, and makes it simple for citizen developers to automate secure access control and compliance reviews across systems. Most recently, Trustle added support for Tableau and expanded support for GitHub.

Through its platform, Trustle claims teams can automatically grant and rescind access to multiple resources on a user-by-user basis while offering a holistic overview of all connected systems.

Blockchain PropTech Coadjute lands £4m financing

Coadjute, a London-based PropTech firm that uses a blockchain network to record property transactions, has bagged £4m in a funding round.

According to UKTN, Coadjuste’s core service is its blockchain-based digital ledger that estate agents can use to track transactions. The Coadjute platform is designed to connect with existing real estate software, rather than replace it.

Coadjute CEO Dan Salmons said, “Industry leaders are increasingly talking about a truly digitised property market but can’t imagine how that gets delivered.

“Coadjute has been investing in the technology that enables that future, everything from upfront information to smart contracts, digital identity to synchronised settlement. Customers are routinely astonished how far ahead we are – we can do what many think is still science fiction.”

Paytrix, a FinTech building a payments ecosystem to help businesses grow, has raised $18.3m in Series A funding to drive product development and international expansion.

Trading and investing platform Sarna rakes in $2.5m

Sarna Finance, a trading and investment platform, has secured over $2.5m in seed investments from a range of venture capital firms.

Participating in the round were investors such as Simplex Ventures, Wedbush and Motivate Ventures.

The infusion of capital will help the firm bring its mobile investing app, currently in beta, to market in the United States this summer and in Europe at the end of 2023.

The company will also continue building its best-in-class risk management engine for real-time customer buying power calculations that enables T+0 settlement.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global