US FinTechs recorded another red-letter week this week with companies based in the country making up 20 of the 38 deals reported on by FinTech Global.

Over $1.6bn was raised in total across the FinTech sector this week, with the US market leading the way in the most companies. Trailing them in a far second was the UK with 7 deals, while Brazil and France pulled in two new deals. Canada, Taiwan, Sweden, Spain and Norway were also represented.

Of the investments recorded, CyberTech companies made up the majority – bringing in 10 deals in total. WealthTech and FinTech slugged it out to a draw in second with 7 each, RegTech came behind them with 5, while the Crypto space made up 4 of the deals. There were 3 InsurTech deals this week, with one PayTech and one PropTech raise each rounding off the deals.

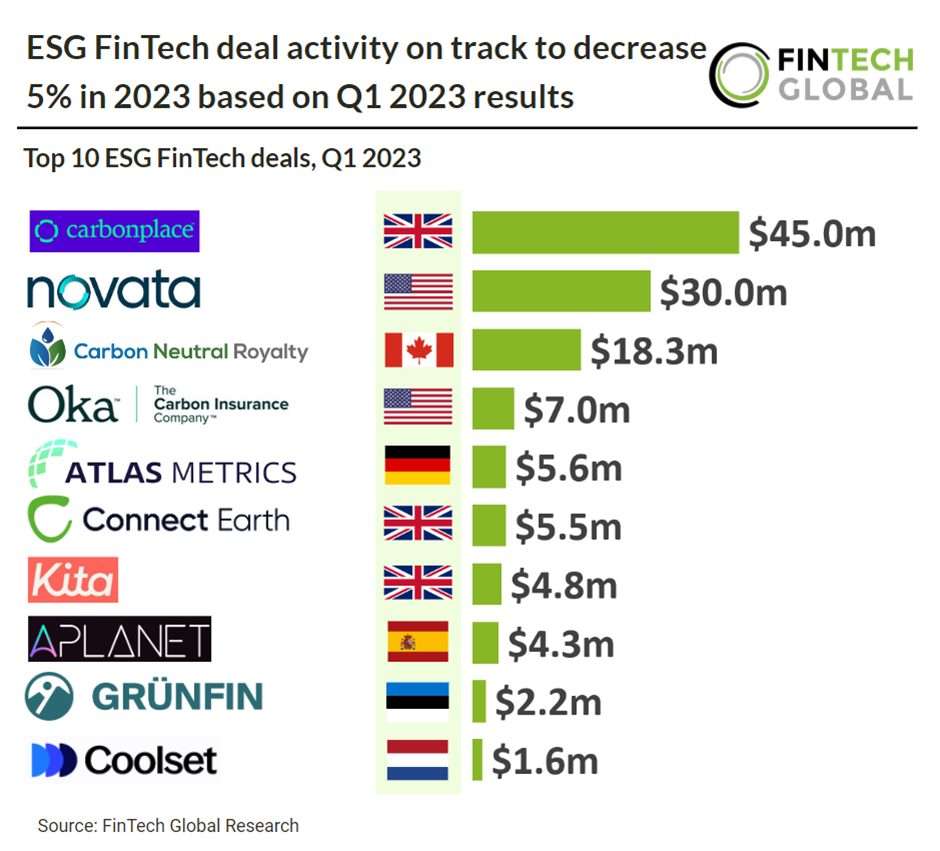

Research by FinTech Global this week found that the ESG FinTech deal activity is set to fall 5% this year based on the results from the first quarter.

Total investment raised by ESG FinTech companies in 2022 was $878m which indicates that 2023 investment is on track for another consecutive decline from 2021’s peak of $1.17bn.

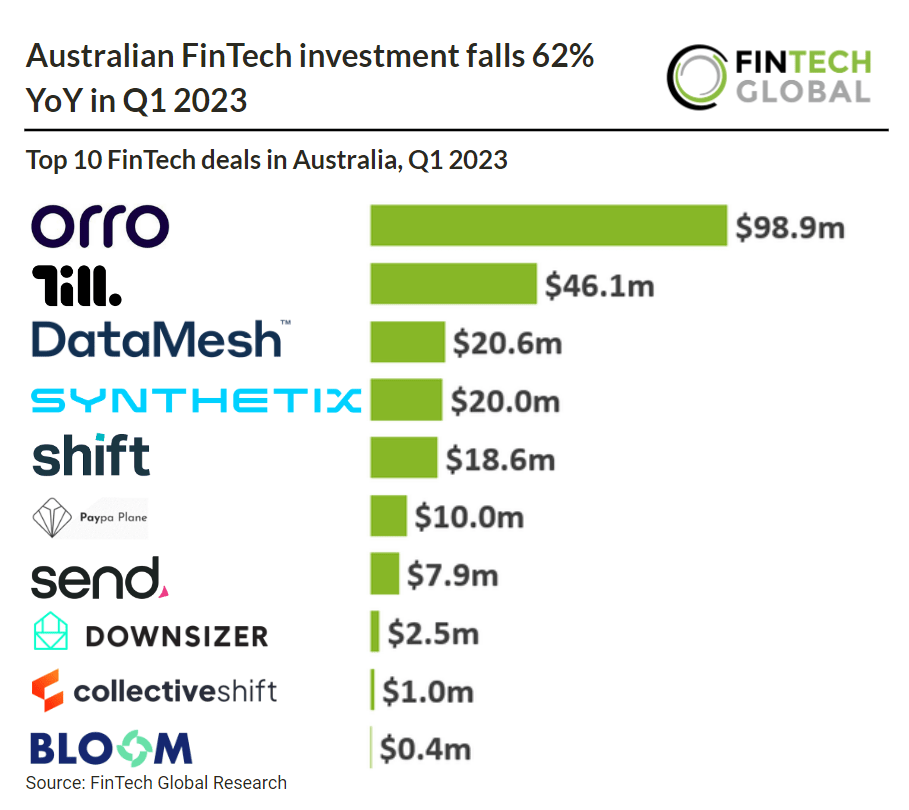

The Australian FinTech sector recorded a rough first quarter compared to last year, with research by FinTech Global finding investment in the sector fell 62% in Q1 2023.

Based on Q1 2023 deal activity, Australian FinTech deal activity is expected to drop 22%. Average FinTech deal size decreased to $10.2m, which is a 15% drop.

Here are this week’s deals.

Insurance broker Howden secures $1.1bn in debt and equity

Insurance broker Howden Group Holdings has raised over $1.1bn in debt and equity, which it intends to use towards M&A initiatives.

Founded in 1994, Howden Group Holdings comprises Howden Broking and underwriting business DUAL. Howden Group Holdings’ businesses operate in 50 countries across Europe, Africa, Asia, the Middle East, Latin America, the USA, Australia and New Zealand, employing 14,500 people and handling $30bn of premium on behalf of clients.

According to a report from the Insurance Journal, Howden finalized a $500m seven-year term loan earlier in March, with more than 60 lenders providing capital, including more than 10 new lenders to the group.

The group also increased its revolving credit facility from $230.2m to $447.9m across a range of banking relationships.

Savings app Super.com locks in $85m in Series C

Super.com, a ‘super’ savings app, has revealed that it has raised $85m in a Series C fundraising round headed by Inovia Capital.

In October last year, Super.com (formerly Snapcommerce) rebranded its suite of products and launched SuperCash, a unique cashback card that provides users the opportunity to build credit without the barriers within the traditional financial industry. Since its launch, the SuperCash product has grown triple digits in customers and transactions every month.

The Super.com app provides discounts and savings across multiple categories. The firm said its model follows in the footsteps of so-called “super apps” widely used internationally, such as WeChat, which has user numbers in the billions. To date, Super.com customers have saved over $150m in direct savings across the ecosystem.

Latin American FinTech Clara nets $60m equity financing

End-to-end spend management solution for LatAm firms Clara has scored $60m in a recent round of equity financing.

Today, about 10,000 companies in Latin America are using Clara’s product suite to automate and simplify their daily operations, while taking advantage of its spend management software that provides real-time reports for better financial decision-making.

Clara claims it exists to empower customers by simplifying an otherwise complex topic – spend management – such that it becomes one less thing to think about. So that companies can focus all their energy on unlocking their true value and unleashing their competitiveness.

The additional capital will be used to boost the technological development of its spend management and payment platform and consolidate its market leadership throughout Latin America. Clara is also deepening its leadership bench with new executive hires across its engineering, product, and risk functions.

France-based Mooncard secures €37m in funding

France-based Mooncard, which automates corporate spend management, has raised €37m in a fresh funding round.

Mooncard automates corporate spend and expense reporting. Its Visa payment card can be configured for each employee or user profile, with the ability to establish daily spend limits and activate spend categories, such as restaurants, service stations and taxis. Companies can even deactivate certain features for specific employees, including cash withdrawals, foreign purchases, online spend and more.

In the event of an exceptional request, a manager or administrator can receive an SMS so they can react in real-time. All transactions are stored in a cloud server and can be consulted in real time.

Mooncard supports over 6,000 companies, including Air France, Cora, Cityscoot, Mirakl and many others. It also has 400 customers outside of France and its solution is leveraged by 500 public institutions.

TheGuarantors snares $35m in growth financing

TheGuarantors, a firm building smart financial and insurance solutions for renters and landlords, has scored $35m in growth funding.

Founded in 2015, The Guarantors is working to improve renting affordability and access for renters across the U.S.

The company estimates that five million households will struggle to get approved for rental housing each year based on their finances, and that renters have a collective $65bn locked away in security deposits. TheGuarantors offers a suite of tools that help renters more affordably overcome these traditional barriers and qualify for the home of their dreams.

TheGuarantors claims it has protected over $2bn in rent and deposits, nearly $1bn covered in 2022 alone.

Corporate accounting FinTech Trullion secures $30m

Corporate accounting software developer Trullion has secured $30m in its latest funding round as it looks to accelerate its growth and product development.

This capital has been earmarked to accelerate the growth of its AI-based applications and develop two new modules that support audit and revenue recognition.

Trullion’s AI-powered accounting platform connects corporate controllers, CFOs and external auditors on one platform. This gives a single source of truth for financial leaders.

The platform leverages AI and machine learning to automate accounting and compliance workflows, including lease accounting revenue recognition and audit automation.

Biometric wearable provider Token snares $30m

Token, a company that has developed a next-generation authentication wearable, has raised $30m in a new funding round.

According to Biometric Update, Token’s wearable is a next-generation multi-factor authentication solution which is easy to implement, and stops phishing attack and data breaches.

Launched in 2017, the Token ring is activated with fingerprint biometrics, and provides proximity security through NFC connectivity and secure credentials with an EAL5+ certified secure element.

The company remarked that its wearable technology avoids the vulnerabilities of bring-your-own-device authentication approaches and legacy MFA products.

The investment will be used for inventory and working capital to support overall growth and future product development.

Staking service provider P2P.org raises $23m

P2P.org, a staking service provider, has secured $23m in a funding round to support the development of a new infrastructure platform for intermediaries. The company’s existing infrastructure is focused on direct holders.

The investment was supported by crypto investor Jump Crypto, crypto exchange Bybit and digital asset bank Sygnum, according to a report from CoinDesk.

This capital injection will enable the company to develop blockchain infrastructure that enhances the user experience in staking, as well as researching and developing expansion initiatives.

P2P claims to help crypto businesses growth through an institutional-grade staking solution. It supports token holders, custodians, exchanges and wallets, and funds, with features including staking, insurance, white label nodes, referral programs, APIs, RPC nodes, free rebate and more.

Sales tax compliance platform TaxCloud nets $20m

TaxCloud, a sales tax compliance platform for ecommerce companies, has raised $20m in a growth equity funding round.

Camber Partners, a growth equity firm focused on product-led growth (PLG) software companies, led the investment round. Camber’s investment in TaxCloud marks its first in the ecommerce sales tax and use space.

The investment will enable TaxCloud to continue providing exceptional service to its customers, while expanding its product offerings, marketing efforts, and sales operations, ultimately driving growth in the ecommerce sales and use tax market.

TaxCloud’s platform helps merchants calculate, collect, and file sales and use tax for transactions in all 50 U.S. states and the District of Columbia. The platform is trusted by more than 4,000 ecommerce businesses, and is a recognized leader in customer service and support in the sales tax management space.

Financial market infrastructure firm Axoni lands $20m

Axoni, a provider of data synchronisation technology and financial market infrastructure, has closed a $20m equity financing round.

The round was led by EJF Ventures, with participation from Laurion Capital Management, Communitas Capital, and existing investors. Axoni has raised more than $110m since inception.

Axoni’s AxCore software synchronizes data across enterprises, solving decades-old coordination problems between large companies. By guaranteeing data is continually and automatically replicated in real time, with guaranteed accuracy and completeness, Axoni technology reduces cost, risk, and errors when moving trade data and other critical information between financial institutions.

With AxCore now deployed across various asset classes and markets, the company claims it is also standardising the internalization of data, further reducing costs for institutions who can leverage existing familiarity with Axoni software.

Thetanuts Finance collects $17m for its buy-side altcoin options

Thetanuts Finance has closed an institutional funding round on $17m, as it looks to create a buy-side altcoins options market.

This capital will help Thetanuts push the boundaries for structured products and derivatives in decentralised finance. Funds will also help Thetanuts to build partnerships with L1/L2 projects and founders, liquidity providers, foundations, market makers and major exchanges.

Thetanuts prides itself as an early pioneer of the Decentralised Options Vaults (DOVs) model, which serves as a foundational building block in the decentralised cryptocurrency option market. It stated that to drive meaningful progress in the space, DOVs need to evolve to facilitate two-way markets and offer more diverse asset offerings.

Existing DOC-based protocols are currently exclusively focused on the sell-side market for large cap tokens. Combined with the lack of decentralised options exchanges and liquidity sources, users have little ability to buy options, particularly for altcoins, Thetanuts explained.

Through the support of the $17m investment, Thetanuts hopes to build a buy-side altcoin options market through DOVs. It also hopes to deliver a novel design that combines a DOV layer with an AMM and money market that will enable users to access leverage using altcoin options.

Pricing operations platform m3ter secured $14m in Series A

Pricing operations platform m3ter has secured $14m in its Series A funding round, which will help it launch new analytics features.

This new analytics tool includes a cost allocator, which will leverage data science techniques to identify gross margin performance on a per-customer basis. This allows businesses to take action on low-margin performance on a per-customer basis, meaning businesses can take action on low-margin clients via pricing adjustments or cost optimisations.

Other tools currently being developers are Pricing Experimenter and Usage Forecaster products. The former allows customers to explore different pricing models in real-time with historic or simulated data to better understand their impact on revenue before implementing them.

m3ter, which launched from stealth in 2022, was founded with the mission of helping software companies go beyond simple recurring subscription models to implement hybrid and usage-based pricing models.

Quickpass Cybersecurity bags $12m

Quickpass Cybersecurity, a provider of privileged access management and helpdesk security automation for managed service providers (MSPs), has collected $12m in funding.

With the support of the fresh capital, CyberQP hopes to bolster its offering and expand its reach to more MSPs around the world.

CyberQP helps MSPs and their customers protect their critical assets. Its privileged access management and helpdesk security automation offers comprehensive security solutions that protect businesses from cyber threats.

One of the features offered by CyberQP is just-in-time account creation. This is where accounts and passwords are created on-demand when technicians need them. Other features include privileged admin account management, zero trust help desk, Azure active directory password sharing, privileged identity management and privileged account discovery.

FinTech investor 42Markets Group gets $10m from Convergence Partners

42Markets Group, a financial and capital markets FinTech investment group, has received a $10m growth investment from private equity firm Convergence Partners.

This capital injection will help 42Markets accelerate the development and expansion of its portfolio companies. Its portfolio includes digital trading platform Mesh, financial service software developer Andile and foreign currency risk management platform FX Flow.

Gradual homeownership provider Wayhome nets £8m Series A

Wayhome, a gradual homeownership provider, has scored £8m in a Series A funding round headed by Allianz X.

Wayhome claims it offers a completely new way for people to get on the housing ladder without needing to take out a mortgage. Homeowners are able to get capital to buy a home worth up to eight times their income with only a 5% deposit.

The funding raised will provide cash runway to break-even point as Wayhome continues to disrupt the conventional home buying space with their unique Gradual Homeownership model.

Wayhome currently boast an annual rate of £100m deployed in customer property purchases and intend that the raise will assist the leadership team in doubling this to £200m per year within 12 months.

IoT security enterprise NetRise locks in $8m

NetRise, a company providing visibility into IoT security problems, has raised $8m in a recent funding round.

The company enables device manufacturers and enterprise customers to detect, respond to, and prevent threats throughout their supply chains.

The NetRise platform enables continuous monitoring and analysis, compliance assessment and recommendations, real-time-risk tracking, and the generation, storage and management of Software Bills of Materials (SBOMs).

The firm reduces the time and cost of firmware and software supply chain security programs, allowing organizations to quickly find and remediate previously undetected issues.

Contractor FinTech Constrafor raises $7.5m through SAFE note

Constrafor, which provides embedded financing and payment software for contractors and subcontractors, has reportedly raised $7.5m through a SAFE note.

The capital injection was led by Motive Partners, according to a report from TechCrunch. Fifth Wall also joined the round, making its first investment into Constrafor.

Existing Constrafor backers FinTech Collective, Clocktower Technology Ventures, Commerce Ventures, FJ Labs and NotreVis, also joined the round.

A SAFE note allows an investor to buy a specific number of shares for an agreed-upon price at some point in the future.

Third-party data observability platform Riscosity raises $7m

Riscosity, a maker of a third-party data observability platform, has raised $7m in a funding round headed by S3 Ventures.

Riscosity’s software—trusted by multiple large public enterprises—manages and mitigates data supply chain risk for security, compliance, and engineering teams.With the financing, Riscosity will accelerate its product roadmap and expand its team to serve its growing user base.

According to the firm, this investment accelerates the company’s ability to grow its team, expand its Third-Party Data Observability (TPDO) platform, and serve its growing base of large enterprise customers.

Security firm Sonet.io comes out of stealth with $6m

Sonet.io, a company that looks to enhance security and observability for remote workers, has landed $6m after arising from stealth.

Sonet.io claims its air-gapped solution greatly simplifies IT operations and streamlines remote workforce management while reducing costs by up to 10 times compared to traditional solutions.

The firm safeguards applications and servers with zero-trust access control using no-code policies and a user-friendly admin console that reduces the demand for costly IT expertise.

Sonet.io’s cloud service allows businesses to control access to applications and servers, prevent sensitive data theft and monitor user activity from any device, with no agents or additional devices required.

Through the new funding, Sonet.io plans to accelerate customer acquisition and continue to invest in the SaaS platform to provide a seamless user experience, protect applications, servers, and data, and provide visibility into remote workforce activities.

Physical security outfit Hakimo bags $6m

Hakimo, a tech firm that claims it is dedicated to modernising physical security through AI, has raised $6m in new funding led by Rocketship.vc.

The Hakimo platform uses computer vision and machine learning to automate the monitoring of physical security sensors such as cameras and badge readers. The platform also provides an option to communicate warnings through speakers when it detects unwanted activity such as a person entering an area where they do not belong.

In addition, Hakimo natively integrates with most enterprise video and access control systems to provide a unified solution that responds to alarms automatically, exposes potential insider threats and detects faulty cameras and door hardware.

The company will use the new funding to accelerate product development and expand into new markets.

Summer bags $6m to grow student debt and education assistance offering

Summer, a firm committed to addressing the US student debt crisis, has raised $6m in new funding.

Founded in 2017, Summer works with leading financial institutions, employers, and unions to provide a high impact, comprehensive digital solution that helps individuals plan for college costs, reduce the burden of student loan debt, and optimize retirement savings.

To date, the company has delivered more than $1bn in total projected savings for borrowers across the United States, offering assistance on every leg of the personal finance journey.

By ensuring that an employee’s student loan payments count toward the retirement match provided by their employer, Summer’s workplace solution can relieve student loan borrowers from having to make an impossible decision between paying down their debt or saving for retirement.

Digital mortgage platform Tembo bags £5m

Digital mortgage platform Tembo has raised £5m in a funding round, as it looks to bolster its instant comparison technology.

This capital injection will help Tembo further the development of its technology, providing users with an instant comparison of affordability and costs for all the available options and buying schemes to help them buy or remortage their home. This includes family mortgages, which leverage income, property equity or savings to boost affordability. Other options are specialist part buy, part rent and shared ownership schemes for those without family or friend support.

Funds will also be used to bolster its strategic partnerships with wealth managers, house builders and lenders, including Barratt Homes and Aviva.

Tembo is a UK-based digital mortgage platform that offers a one-stop-shop for available mortgage schemes open to customers. Its platform searches over 100 lenders and schemes to find the best options for customers, detailing metrics such as max borrowing, live interest rates and monthly repayments.

Brazilian auto InsurTech Justos bags $5.5m

Justos, a Brazil-based auto InsurTech startup, has raised $5.5m in a funding round led by a major reinsurer.

Justos says that its differential is to offer auto insurance with a more driver-friendly pricing. The startup uses machine learning to create models that can predict claims and, as a result, charges an individualized value for each driver.

The startup sells its insurance on a monthly payment basis. According to how the driver drove during the month, they can get a discount on the next monthly payment.

Since it began operations in January 2022, Justos has gained “thousands of customers” and its claims ratio is slightly above the average of the top 10 incumbents, partly because the startup’s premium is more competitive.

Bixby secures $5.5m to expand credit information platform

Bixby Research and Analytics, a provider of credit information on private syndicated loan issuers, has scored $5.5m in a Series A.

Bixby said it will use the funding to expand into new product lines, enhance platform functionality and extend its reach in international markets, in the coming year. The strategic partnership with Fitch Solutions will leverage complementary platforms to enhance data, research and news offerings for its clients.

Bixby currently counts among its clients many of the world’s leading asset managers and hedge funds. It has experienced significant growth since inception, as loan managers have looked to Bixby’s innovative technology to increase trading velocity, optimize their portfolios and find new trading opportunities to gain a competitive advantage.

Since its product launch, Bixby has used a client-centric approach to build its platform from the ground up, continuously gathering feedback and improving upon user experience. Bixby’s proprietary software puts news in the hands of its clients ahead of their competitors, and its standardized approach to data allows clients to look at more opportunities, faster.

Ansa raises $5.4m for its digital wallet infrastructure for merchants

Ansa is a first-of-its-kind digital wallet infrastructure platform for merchants, and it has closed its first round of funding on $5.4m.

The FinTech company stated that credit and debit cards account for 57% of consumer payments in the US, but the true cost to merchants is hidden to the average consumer. Card fees can represent well over 12.5% of the transaction.

High payment costs are felt by merchants across categories: from coffee, quick serve, and transportation to vertical platforms, marketplaces, and creator platforms wanting to support micro-transactions. This is even more so for those with unique needs, which Ansa calls HULT merchants (habitual use, low value).

These merchants need to patch together vendors, invest in a cross-team complex engineering project and spend large sums on compliance to get a closed-loop program live. Ansa lets a merchant create a wallet within weeks.

Through Ansa, merchants can quickly and compliantly launch smooth, digitally native customer balances to increase revenue and decrease cost of payments. It added that customers who keep a merchant balance tend to visit more often and have higher transaction sizes, and cost savings can be funnelled into loyalty programs or marketing to further strengthen that customer relationship.

Decentralised asset management platform Teahouse bags $5m

Teahouse Finance, a decentralised asset management and strategy platform provider, has raised a total of $5m in funding.

Founded in 2021, Teahouse Finance was started to solve what it claims is the ‘concentrated liquidity provision’ problem.

With the use of dynamic algorithms, Teahouse smart contracts manage users’ funds on their behalf, similar to an investment portfolio with the added benefit that users can enter/exit on a weekly basis.

Strategies take various inputs including market volatility to dynamically adjust the liquidity pool ranges and hedge positions to maximize trading fees made while keeping impermanent loss contained.

The new funding will be used to develop new products and strategies as well as improving the security of the asset management platform.

US-based CyberTech platform AaDya Security secures $5m

US-based CyberTech platform AaDya Security has raised $5m for its Series A round, which was led by New York-based Left Lane Capital.

This capital injection will help AaDya fill a key leadership position in finance, as well as expand its sales team to help it accelerate the growth of its channel program for managed service providers, resellers and referral partners serving SMEs.

AaDya’s flagship product Judy is an all-in-one cybersecurity solution that was designed for the needs of small and midsize business customers and the service providers that support them. The easy-to-use platform helps SME customers protect themselves from threats and comply with regulations related to data privacy and access.

It also helps managed service providers and managed security service providers looking to scale or streamline their security offerings by automating and streamlining security tasks and monitoring.

Boston InsurTech MGA Ledgebrook secures $4.6m

Ledgebrook, a Boston-based InsurTech MGA startup focussing on middle market E&S, has raised $4.6m in funding to scale its flagship products and support future offerings.

Founded in 2022, Ledgebrook is a tech-enabled E&S MGA looking to provide the fastest, easiest quoting experience to wholesale brokers while delivering best-in-class pricing and risk selection via their innovative next-gen tech stack.

Led by insurance industry veterans, Ledgebrook said it offers the best of both worlds: deep insurance expertise empowered by the best of modern technology.

Buoyed by the positive reception to the launch of its first product, Ledgebrook will look to move quickly in staffing up to accommodate demand and recruiting the next set of underwriting leaders to launch additional LOB on the back of the same core tech stack.

By leveraging a combination of both the best of modern technology and underwriting expertise, the InsurTech MGA aims to differentiate itself by offering the fastest, smoothest quoting experience to its wholesale broker partners.

Cata Labs secures $4.2m seed

Cata Labs, a company building an open-source protocol to provide liquidity between modular blockchains, has secured $4.2m in seed funding.

The name of this company’s product is Catalyst. With Catalyst, any new modular chain can automatically connect liquidity and swap with any chain – including liquidity hubs like Ethereum and Cosmos.

Modular blockchains – a new concept in crypto – are made up of different modules that can be added as needed. Each module performs a specific function, making the blockchain more flexible and adaptable. Modular blockchains can help increase the scalability and customisation of blockchain networks.

Catalyst claims it is changing this, offering an automatic cross-chain connection for modular chains at launch – dissolving the barriers between chains as the global liquidity layer.

CyberTech enterprise Stack Identity lands $4m in seed financing

Stack Identity, a startup automating identity and access management governance, has come out of stealth mode and raised $4m.

Businesses of all sizes can now benefit from Stack Identity’s automated breach detection leveraging advanced heuristics that continuously detects and removes bad actors from cloud environments.

Through its patent-pending Breach Prediction Index (BPI) algorithm, the firm reduces the risk of cloud vulnerabilities and improves IAM audits, compliance and governance.

The newly raised capital will allow the company to further invest in solving the challenge of automating cloud security as enterprises accelerate the development of data-centric and AI-powered applications.

It will use the funds to scale product development, strengthen go-to-market strategies and expand customer reach, including SMBs, mid-market and enterprises.

Customer identity RegTech startup Bits Technology secures €4m

Stockholm-based Bits Technology, which offers business and customer identity, has raised €4m in its seed funding round.

The RegTech will use this seed capital to accelerate its product development and go-to-market strategy to help more organisations bolster their identity and AML processes.

Bits Technology’s goal for 2023 is to launch a suite of products for the European market, including a no-code solution and API offering. Its platform allows customers to create dynamic onboarding flows that can be scaled across multiple markets without needing to worry about local compliance regulations or integrating with new service providers.

Additionally, the platform will allow teams to build a tailored onboarding experience and customer reporting solution for AML and user management. It boasts collaborative tools so teams can access actionable data, customise rules, assess risk, prevent fraud and maintain compliance.

Online identity verification firm IDPartner picks up $3.1m

IDPartner, a company that optimises online identity verification through a network of financial institutions, has bagged $3.1m in a seed round.

IDPartner addresses a problem that confronts all 5 billion Internet users — how to verify their identities and build trust online.

Founded by former Santander identity and payments leaders, IDPartner collaborates with OneID UK, Akoya and others to create a product that allows individuals to control their digital identities and choose a preferred identity verification partner from a network of trusted providers, including banks and other financial service firms.

IDPartner benefits businesses by providing a high assurance, low friction reusable method for customers to securely access their online services, wherever they are. The company also helps banks and other partners become indispensable to their customers by providing safer, faster, and easier onboarding and login across the entire internet.

Operant nets $3m to help protect cloud native applications

Operant, a CyberTech company looking to protect cloud native applications, has reportedly raised $3m in its seed funding round.

Its platform empowers security teams to create guardrails for runtime applications as they are developed.

Operant offers a runtime application protection platform that shields applications with fine-grained enforcements across every interaction and cloud.

Clients can identify and prioritise risks across all application layers, get insights and view the entire application stack across any cloud of cluster in dev. Other features include runtime enforcement, vulnerability scanning for APIs, dynamic microsegmentation, policy-as-code, and more.

Security firm Shield picks up $2.1m in pre-seed funding

Shield, a security company focused on protecting users from online scams, has landed $2.1m in a pre-seed investment raise.

Shield claims its mission is to revolutionise internet security by developing products that encourage growth and innovation while maintaining the highest security standards.

Surveying the crypto security landscape, smart contracts have been the primary focus; however, 1 in 3 crypto attacks aren’t related to contracts and instead are triggered by compromised private keys or front-end spoofing.

Therefore, auditing and monitoring your smart contract alone is not enough. To fill the gap, Shield is developing automated protections against frequently neglected attack vectors.

Norway-based compliance platform ComplAI scores $1.7m

Norway-based compliance platform ComplAI has reportedly secured $1.7m in a funding round, which was led by RunwayFBU.

With the funds, ComplAI hopes to deepen its cloud-based tool, establish an online marketplace and grow its marketing presence to scale its footprint to the cosmetics industry.

The RegTech company offers secure, efficient and transparent end-to-end management of compliance. Its solution allows all involved parties in compliance processes across value chains to cooperate in a secure environment where all tiers can collect, structure, store, audit and distribute standards, documentation, evidence and audit results.

ComplAI fosters collaboration between asset owners, auditors, stakeholders and standard owners. It also empowers automation by structuring evidence to gradually automate compliance checks.

Banking alternative for Web3 Nebeus beats crowdfunding goal

Nebeus, a FinTech banking alternative for Web3 that integrates traditional banking and cryptocurrencies, has reached its crowdfunding target of €1.1m.

Nebeus is an IBAN account for crypto holders. Users can either spend directly from their Nebeus Euro IBAN or a GBP Sort Code account without needing to withdraw crypto gains to another bank.

In addition to this, the platform allows users to buy, sell and exchange cryptos and stablecoins at low fees. Users can also rent their cryptos to earn monthly reward payments, stake cryptos, borrow up to 80% of the value of held crypto and buy an insurance policy for bitcoin and Ethereum.

According to the crowdfunding page, the company has over 130,000 users and the number of transactions on its platform has grown by ten-times. Additionally, it highlights a handful of new products in the pipeline, trading, DeFi and credit.

The company also makes money through its cards. While the first card is free for users, any additional card comes at a cost. Other income lines come through loans and credit, and transaction fees.

UK-based CyberTech Melius Cyber secured £500,000

UK-based cybersecurity platform Melius Cyber has raised £500,000 from the North East Venture Fund to support

Melius recently bolstered its management team through several senior appointments, including Matt Little as its chair.

Commenting on the deal, Melius CEO Richard Brown said, “We had a great 2022 in terms of moving the product forward, building our team and putting the foundations in place for growth. Our focus now is to grow our customer base and to continue to improve the product. This investment gives us the working capital we need to build our brand and market position.”

Melius aims to make cybersecurity easy, simple and affordable for SMEs. Its Cyber Safe product provides an end-to-end cybersecurity solution that helps organisations protect their valuable assets and sensitive data from cyber threats, including malware, ransomware and phishing attacks.

French FinTech startup Nalo completes new funding deal

French FinTech startup Nalo has secured a new funding deal, which was led by Mandalore Partners, an asset manager focused on insurance and savings.

This investment sees Groupe APICIL, which is the third biggest social insurance group in France, become the majority shareholder in Nalo. The size of the deal was not disclosed.

The investment aims to bolster FinTech Nalo’s business activities and the growth of its assets under management, while also preserving the startup’s independence and full structural and operational autonomy.

Mandalore Partners served as the counsel to the deal and will continue to consult the two firms.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global