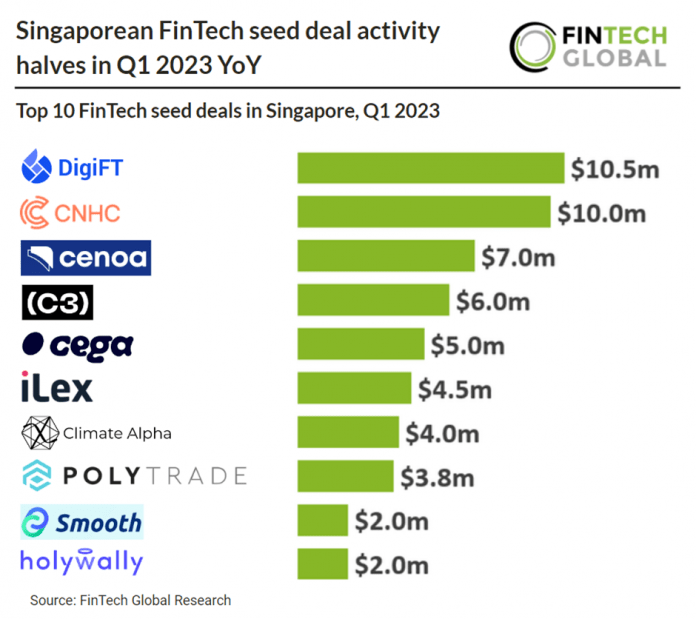

Key Singaporean FinTech seed investment stats in Q1 2023:

• Singaporean FinTech seed deal activity dropped 52% to 19 transactions in Q1 2023 YoY

• Singapore’s combined investment from FinTech seed deals reached $56m in Q1 2023, a 21% drop from Q1 2022

• Blockchain & Crypto was the most active FinTech subsector in Singapore during Q1 2023 with a 53% share of deals

Singapore’s FinTech sector saw a lack of innovation compared to the previous year with seed deal activity and investment dropping in Q1 2023. Singaporean FinTech seed deal activity dropped by more than half to 19 deals over the same period compared to Q1 2022. Singapore’s combined investment from FinTech seed deals totalled at $56m in Q1 2023, a 21% drop YoY.

DigiFT, a crypto trading platform, was the largest Singaporean FinTech seed deal in Q1 2023, raising $10.5m in their seed round, led by Shanda Group. DigiFT said that the new funds will be used to support its license applications in Asia, the Middle East and Europe, go-to-market plans, and technology development. The firm added that plans for its team’s expansion is also in the pipeline. Founded in 2020, DigiFT is a DEX in the Monetary Authority of Singapore (MAS) Fintech Regulatory Sandbox. Its objective is to offer regulated decentralized finance solutions on the Ethereum public blockchain by implementing an Automatic Market Making (AMM) mechanism. This mechanism enables the provision of secondary trading liquidity for security tokens, which are backed by financial assets like bonds and equities. “We are encouraged by investors’ confidence in our vision to be a regulated DeFi exchange. The industry has been through a tough time in the past year. This fundraise is a testament that this industry has huge potential if the gap between traditional finance and Web3 can be bridged. We look forward to further working with regulatory bodies to steer our industry in the right direction,” said Henry Zhang, Founder and CEO of DigiFT.

Blockchain & Crypto was the most active Singaporean FinTech subsector in Q1 2023 for seed deals, with ten companies raising seed funding in the sector. This represented a 52% share of total FinTech seed deals announced in the quarter. The Monetary Authority of Singapore (MAS) published a consultation paper in October 2022 suggesting several regulatory measures for digital payment token service providers (DPTSPs) to decrease the possibility of consumer harm from cryptocurrency trading. The proposals target licensed and exempt payment service providers that offer a digital payment token service under the Payment Service Act 2019. Despite recognizing that prohibiting retail access is unlikely to be effective, the MAS’s proposals do not go so far as to impose such a ban.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global