Key Decentralised Finance investment stats in Q1 2023

• Decentralised Finance companies raised 23 deals in Q1 2023, a 69% drop YoY

• There have been 625 DeFi deals raised as of Q1 2023

• The USA has been the most active DeFi country with a 31% share of deals as of Q1 2023

Decentralised Finance (Defi) deal activity continues it’s free fall from its peak in 2021 when 235 deals were completed during the year. This was followed by 206 deals in 2022 and based on Q1 results only 91 deals are expected to be raised in 2023. In total there have been 625 DeFi deals raised as of Q1 2023. Q1 2023 saw 23 DeFi deals raised, a 69% drop from Q1 2022.

In June 2023, Binance.US, the U.S. affiliate of cryptocurrency giant Binance, has reportedly conducted layoffs following recent regulatory charges and asset freeze attempts by regulators. Although the exact number of affected employees remains unverified, approximately 50 individuals were said to have been laid off according to sources. The dismissals primarily impacted personnel in the legal, compliance, and risk departments. Binance.US has yet to comment on the matter, and employees have resorted to social media to announce their departure, with some citing the layoffs as the reason for leaving. The Securities and Exchange Commission (SEC) accused Binance and its CEO of evading securities laws, while also filing a lawsuit against Binance.US’ operating company, BAM Trading, over alleged misleading investor information. In response, Binance has pledged to vigorously defend itself against the charges, dismissing the SEC’s allegations as unwarranted.

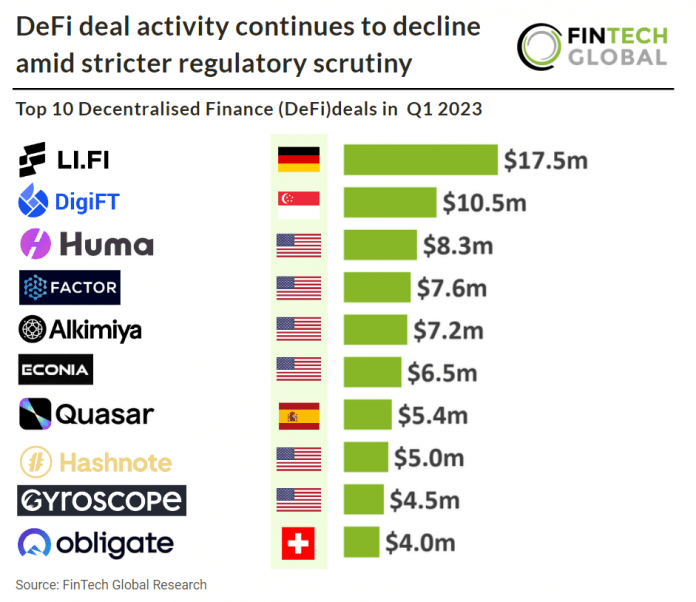

LI.FI, which builds a DeFi middleware for the application layer, was the largest DeFi deal in Q1 2023, raising $17.5m in their latest Series A funding round, led by CoinFund and Superscrypt. The proceeds from the funding round will be used to accelerate the development of LI.FI’s offering across more blockchains, decentralized exchanges (DEXs), cross-chain bridges, etc. And it will also be used to bolster sales, business development, and marketing, and help better bridge the gap between traditional finance (TradFi) and DeFi in ways that would help onboard these institutions to the financial markets of the future. LI.FI simplifies the essential financial infrastructure necessary to navigate through various chains, serving as the primary gateway to access decentralized finance (DeFi). By doing so, it enables traditional finance (TradFi) to save precious time and resources in terms of market entry, research, integration, and ongoing maintenance. This eliminates the risk of incurring unnecessary expenses in the rapidly evolving infrastructure landscape, benefiting developers engaged in diverse projects such as dApps, Web3, and other protocols. LI.FI rapidly emerged as a prominent player in cross-chain liquidity aggregation, swiftly capturing over 96% of cross-chain swap activity on MetaMask within a mere six months, as indicated by Dune’s data. Furthermore, LI.FI introduced Jumper.Exchange, a versatile multi-chain exchange interface that empowers eligible users to effortlessly swap between virtually any pair of assets with a single click.

Of the 625 DeFi deals raised as of Q1 2023, the USA has been the most active with a 31% share of total deals. In Q1 2023 The USA was also the most active with five deals, a 22% share of deals. Singapore was a close second for the most active DeFi country in Q1 2023, raising four deals, a 17% share of deals. Switzerland and the United Kingdom were the third most active with three deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global