Key European InsurTech investment stats in Q2 2023:

• European InsurTech deal activity reached 17 deals in Q2 2023, a 21% increase from Q1 2023

• European InsurTech companies raised a combined $99.5m in Q2 2023, down 28% from the previous quarter

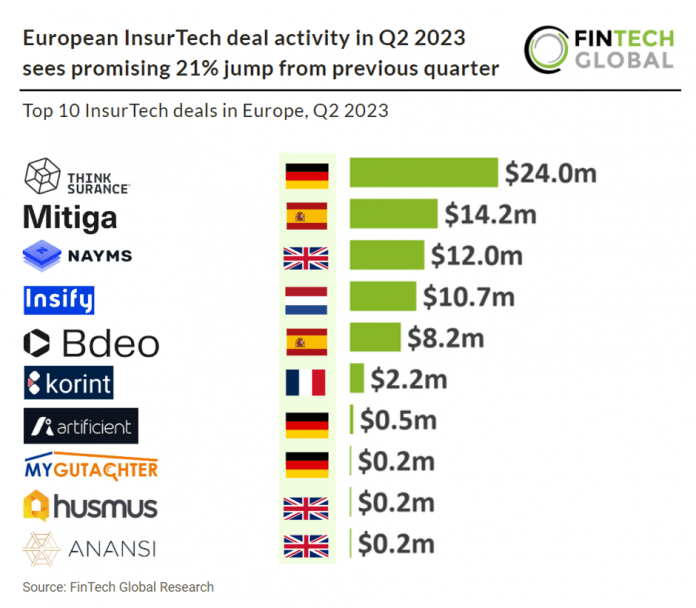

• Germany and the UK were the joint most active European InsurTech countries in Q2 2023 with four deals each.

In Q2 2023, the number of InsurTech deals in Europe rose by 21% compared to Q1 2023, reaching a total of 17 deals. European InsurTech deal activity in Q2 2023 dropped 33% YoY. In Q2 2023, European InsurTech companies experienced a 28% decrease in funding from the previous quarter, raising a combined total of $99.5m.

Thinksurance, an advisory suite that connects insurers and broker agents, had the largest InsurTech deal in Europe during Q2 2023, raising $24m in their latest Series B funding round, led by MTech Capital, Segenia Capital and Viewpoint Ventures. Thinksurance will use the capital to expand its position in the market. The funding will also enable Thinksurance to continue to expand its platform to cover further aspects of the consultation and distribution of commercial insurance.

“With this funding, we plan to continue to broaden the scope of our offering and value add to our partners,” said Florian Brokamp, CEO and co-founder of Thinksurance, in the release. “Our vision comes down to enabling brokers and insurers to really be able to focus on what they do best as opposed to getting bogged down with time-consuming busy work – ultimately to the benefit of the entire industry and its clients.” Thinksurance offers a platform that enables insurance distributors to fully digitalize consultations and policy processes, allowing them to provide insurance solutions for their clients. With its key platform, Advisory Suite, the company provides an omni-channel software for insurance consultations. The technology modularly digitizes the entire consultation process, from needs analysis to binding. In addition, Thinksurance offers insurers and brokers the digitalization of their products and comprehensive data and analysis tools for market-oriented and product and pricing strategies.

The UK and Germany were the joint most active InsurTech countries in Europe during Q2 2023 with four deals each, a combined 47% share of deals. Spain was the second most active European InsurTech country with three deals, a 18% share of deals.

The European Insurance and Occupational Pensions Authority (EIOPA) has outlined its strategy for 2023-2026, focusing on strengthening the insurance and pensions sectors and safeguarding consumer interests. Key priorities include sustainable finance, digital transformation, supervision, policy, financial stability, and internal governance. EIOPA plans to integrate ESG risks, conduct climate change stress tests, implement digital operational resilience measures, regulate the use of artificial intelligence, address consumer issues, and provide advice on the review of the IORP II Directive. Additionally, EIOPA will chair the Network of EU Agencies.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global