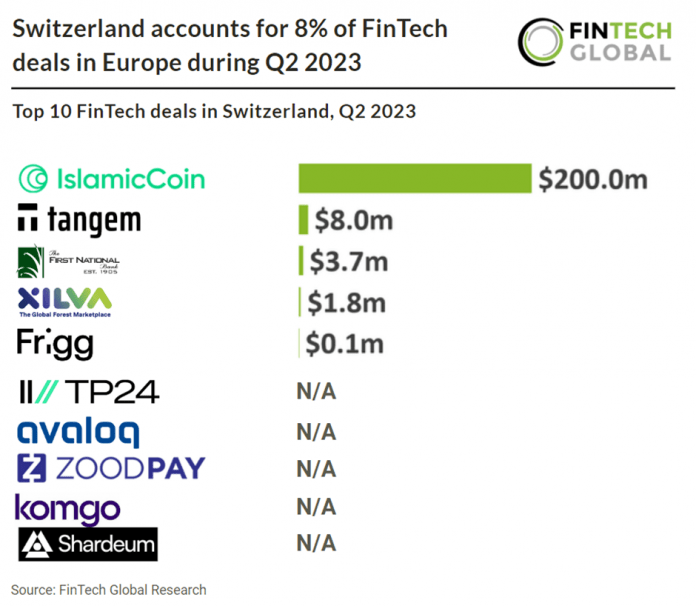

Switzerland accounts for 8% of FinTech deals in Europe during Q2 2023

Key Swiss FinTech investment stats in Q2 2023:

• Swiss FinTech deal activity reached 33 deals in Q2 2023, a 34% drop YoY

• Swiss FinTech companies raised a combined $213m in Q2 2023, a 13% drop from Q2 2022

• Switzerland accounted for 8% of European FinTech deals in Europe during the second quarter

In the second quarter of 2023, the number of FinTech deals in Switzerland recorded a significant decline of 34% compared to the same period last year, amounting to a total of 33 deals. Swiss FinTech companies collectively raised $213m during Q2 2023. This figure represents a decrease of 13% compared to the funding raised in Q2 2022. In the second quarter of 2023, Switzerland contributed to 8% of the total FinTech deals taking place in Europe.

IslamicCoin, a native currency of Haqq that focuses on empowering the Muslim community with a financial instrument for the digital age, had the largest FinTech deal in Q2 2023, raising $200m in their latest private equity round, led by ABO Digital. Islamic Coin, a digital money platform catering to the global Muslim community, has secured a significant funding round of $400 million. This funding surpasses prominent players in the crypto industry such as Circle, BlockFi, and Solana, making it one of the largest funding rounds in crypto history. Islamic Coin has garnered international recognition, including accolades like the Most Promising ESG Crypto at the Abu Dhabi Blockchain Awards. The partnership with ABO Digital will enable Islamic Coin to introduce its Shariah-compliant financial products to the ABO network of investors and access up to $200 million for future growth. ABO Digital CEO Amine Nedjai expressed excitement about collaborating with Islamic Coin and praised their ambitious project as a revolutionary force in the Shariah-compliant market.

In the InsurTech sector, a preliminary bill of the Federal Council for the amendment of the Swiss ISA (Insurance Supervision Act) foresees the competence of FINMA to exempt small insurance undertakings with innovative business models under certain conditions from insurance supervision if this serves the sustainability of the Swiss financial market and the interests of the insured are safeguarded. The amended ISA is expected to enter into force by mid 2023 at the earliest.