A handful of large deals prop up a slow week for the FinTech sector. A total of $789m was raised across 22 funding rounds, with the ten biggest deals pulling in $729m of that.

The biggest deal of the week was an impressive $245m, which was secured by Teamshares, a US-based employee ownership company. This funding round included a $124m Series D round that was led by QED Investors. Teamshares buys small enterprises from retiring proprietors, ensuring that these businesses become 80% employee-owned within a span of two decades.

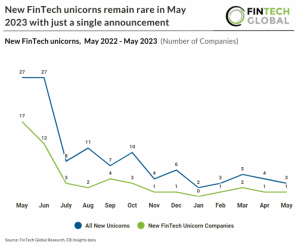

There were two other deals to exceed $100m this week. These were payroll lender OneBlinc and crypto wallet Bitgo. The latter of these reached an impressive $1.75bn valuation following the close of the funding round. Unicorns in the FinTech sector have become rare. In fact, between January and May 2023 there were just five new FinTech unicorns, according to research from FinTech Global. This is in stark contrast to previous years. For example, in May 2022 there were 17 new FinTech unicorns. This was then followed by a sharp decline as the world entered a difficult financial market.

A common trend each week is the US’ domination of the FinTech funding rounds and it was no different this week. The country was home to 12 funding rounds, including seven of the ten biggest deals (Teamshares, OneBlinc, BitGo, ClassWallet, Persefoni, ProjectDiscovery and Symmetry Systems).

The remaining US-based companies to secure capital were Caden, Dinari, Tausight, Demex and Metabase Q.

Other countries represented this week were Australia (Stockspot), Canada (Finofo), France (ZetaChain), Hong Kong (Xverse), India (Vegapay), Ireland (Fineos), Israel (OX Security), Singapore (ZTX), Tanzania (d.light) and UK (Communion).

In terms of sectors, the most popular of the week were CyberTech, and cryptocurrency and blockchain with six deals apiece. The CyberTech companies were ProjectDiscovery, Symmetry Systems, Tausight, Metabase Q and OX Security. The cryptocurrency and blockchain companies were BitGo, ZetaChain, Dinari, Xverse and ZTX.

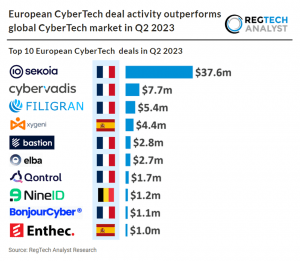

On the topic of CyberTech, a report from FinTech Global this week found that the European CyberTech deal market outperformed the global market during Q2 2023. There were 49 funding rounds in the second quarter in Europe, a 9% drop from Q2 2022. Global CyberTech deal activity dropped 16 percentage points more than European CyberTech deal activity in Q2 2023. While European deal activity was relatively stable with last year, the funding volume took a huge hit. European CyberTech companies raised a combined $83m in Q2 2023, a 73% drop YoY.

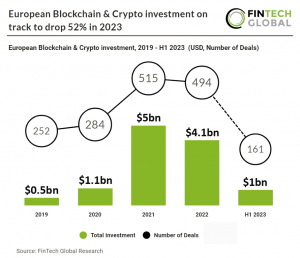

As for cryptocurrency and blockchain, European Blockchain & Crypto investment is on track to drop 52% in 2023, according to research from FinTech Global. European Blockchain & Crypto investment from 2019 – 2022 has increased at a CAGR of 52%. However, deal activity is on track to reach 322 deals in 2023, which would represent a 35% drop YoY. There were 161 deals in H1 2023, a 49% drop from H1 2022.

The next most popular sectors were PayTech and WealthTech, which recorded three deals each. The PayTechs were ClassWallet, Finofo and Vegapay. The three WealthTechs were Teamshares, Communion and Stockspot.

There were also two marketplace lending companies (OneBlinc and d.light), two InsurTechs (Fineos and Demex), one RegTech (Caden) and an ESG FinTech business (Persefoni).

Here are this week’s 22 FinTech funding rounds.

Teamshares attains a staggering $245m from top VC firms

Teamshares, the pioneering market leader for small business employee ownership, has made headlines with its latest funding announcement.

The firm has secured a remarkable $245m in venture capital. This recent influx includes a notable $124m Series D funding round. The driving force behind this Series D round was Frank Rotman at QED Investors. The investment saw substantial involvement from prior investors such as Inspired Capital, Khosla Ventures, Slow Ventures, Spark Capital, and Union Square Ventures.

At its core, Teamshares is a beacon for employee ownership in small businesses, powered by bespoke software, comprehensive education, and innovative financial tools. They aim to cultivate an impressive $10bn in new wealth via employee stock ownership.

The firm purchases conventional small enterprises from retiring proprietors, ensuring that these businesses become 80% employee-owned within a span of two decades. Furthermore, they equip these businesses with rejuvenated leadership, essential financial literacy, equity management systems, and an array of financial instruments. Remarkably, these enterprises will perpetually be owned by their employee shareholders and Teamshares, eliminating the need for another sale.

The recent Series D funds are poised to facilitate Teamshares in its mission to expand its unique model nationally and expedite its product development phase. This includes their nascent neobank, charge cards, and insurance solutions crafted exclusively for Teamshares’ network of employee-dominated businesses.

From its humble beginnings with just four companies generating $10m in revenue in January 2021, Teamshares has seen exponential growth. The firm now boasts collaborations with 84 companies, pulling in revenues surpassing $400m as of July 2023. This success story translates to the creation of 2,100 new employee owners spread across 29 states and 42 distinct sectors.

Teamshares CEO Michael Sutherland Brown said, “We founded Teamshares after a decade of hard-won experience running small businesses, delivering education at scale, and executing M&A transactions. Teamshares provides retiring owners with a financial exit and a legacy of employee ownership, while also preserving jobs and creating stock wealth for hard-working small business employees.”

QED Investors’ Chief Investment Officer Frank Rotman commented, “Teamshares is a unique company with a huge addressable market. Employee ownership aligns the interests of all stakeholders and makes companies and people better off financially.”

The historical narrative of Teamshares’ funding journey reveals that USV has consistently backed Teamshares. Rebecca Kaden, Managing Partner at USV, shared that USV took the decision to invest in every Teamshares round since spearheading their Series A, commending the firm’s potential to play a transformative role for both small businesses and the wider American economy.

FinTech firm OneBlinc secures monumental $100m credit boost

OneBlinc, a prominent FinTech entity renowned for offering payroll loans to Federal employees, has proudly declared that it has landed a remarkable credit facility worth $100m with the esteemed Clear Haven.

This remarkable achievement has been orchestrated with the primary intent of propelling future portfolio expansion, coupled with refinancing the existing credit facility held by OneBlinc.

In a climate where credit markets are exhibiting increasing volatility, transactions of this magnitude are an unusual sight. Accentuating the significance of this deal is its close succession to OneBlinc’s prior attainment of a $20m Series A funding round, which was prominently spearheaded by Banco Bradesco, a banking titan ranking third in Latin America and ninth globally.

OneBlinc’s CEO, Fabio Torelli, expressed his sentiments regarding the new alliance, “Our partnership with Clear Haven reinforces the trust and credibility OneBlinc has cultivated. This collaboration underscores our unwavering commitment to our clients and mission.”

Clear Haven’s Managing Partner, Mark Simmer, reciprocated the appreciation, lauding OneBlinc: “Fabio has assembled an exceptional team at OneBlinc; we’re extremely excited to work with them as they build on their commitment to expand access to banking and financial services in underserved communities.”

The freshly inked credit agreement mirrors a significant leap in OneBlinc’s strategy for expansive growth. George Ermel, CFO at OneBlinc, voiced his contentment with the arrangement, emphasizing, “This deal not only strengthens our financial position but aligns perfectly with our ongoing mission to serve those who need it most. We’re committed to delivering on our promise to our clients, and this partnership with Clear Haven puts us in an excellent position to continue that important work.”

This fiscal year has witnessed OneBlinc’s financial foundation being bolstered, both through the credit facility and the earlier Series A equity round. This robust backing will empower the firm to persevere in their mission to aid underserved clients, even amidst adverse market dynamics. With their recent collaboration with Mintech, a frontrunner in big data collection and processing, OneBlinc is set to intensify its focus on alternative credit paradigms to sustain large-scale fair funding access.

BitGo consolidates position with $100m Series C funding, valuation soars to $1.75bn

BitGo, the “leading regulated custodian in over 50 countries” and responsible for processing “20% of all on-chain Bitcoin transactions by value”, has announced today a considerable achievement. The company successfully raised $100m in their Series C financing round.

The new capital comes from strategic investors outside of BitGo’s existing network and pushes the company’s valuation to an impressive $1.75bn. With this fresh influx of funds, BitGo is poised to make strategic acquisitions, further strengthening their offering of secure and regulated custody, wallet, and infrastructure solutions across the globe.

BitGo’s services, which encompass the most secure and scalable wallet solutions for the digital asset economy, are evidently in high demand. In 2023 alone, the company witnessed a 60% increase in newly acquired clients and a staggering 40x growth in staked assets. Their offerings have gained trust from Fortune 100 clients like Nike, leading Bitcoin businesses such as Swan, and new-age Web3 projects including Mysten.

Furthermore, the company aims to utilise the new funding to “provide institutions, brands, coin foundations, and others with secure and seamless participation in the digital asset ecosystem.” BitGo’s announcement today follows its recent unveiling of the Go Network, a service that facilitates institutions in trading and settling both digital assets and fiat currencies around the clock from secure custody.

BitGo CEO Mike Belshe shared his optimism, “Not only are we seeing growing demand for regulated custody solutions in the US, but we’re also seeing the demand on a global scale. We are very pleased to announce our $100m Series C for the purpose of meeting this growing need.”

On a historical note, BitGo has been at the forefront of the FinTech industry since its inception in 2013. Over the years, the company has introduced numerous innovative solutions and has managed to secure backing from prominent investment firms including Goldman Sachs, Craft Ventures, and Galaxy Digital Ventures.

Digital wallet ClassWallet secures $95m to innovate public fund management

ClassWallet has disclosed the successful closure of a significant institutional growth capital round totalling $95m.

This sizeable fundraise was spearheaded by Guidepost Growth Equity, and saw participation from noteworthy investors such as Education Growth Partners (EGP) and Lazard Family Office Partners. The commitment these investors have shown will undoubtedly bolster ClassWallet’s ongoing endeavours to revolutionise how government agencies transact.

Delving deeper into its workings, ClassWallet is not merely a digital wallet. With its patented technology, it serves as an avenue for its clients to distribute funds both swiftly and compliantly on a grand scale. It manages to automate the entirety of the purchasing and reimbursement process.

The compelling need to enhance workflows, guarantee compliance, guard against fraud, and monitor expenditure is why ClassWallet finds itself utilised for a myriad of purposes. From education and early childcare to scholarships and emergency assistance, it’s making waves in 32 US states.

Jamie Rosenberg, ClassWallet Founder and CEO, commented on the pressing challenges in the sector, “There are significant complexities to ensuring public funds reach the right people and are used for the right purpose. The truth is, compliance is frequently the stumbling block for government initiatives. It’s disheartening to see eager governors and policy creators bankroll programmes based on perceived needs, only to later witness funds lying idle due to compliance-related red tape. That’s the issue ClassWallet addresses.”

Guidepost General Partner, Gene Nogi, remarked on the transformational prowess of ClassWallet, “ClassWallet has fundamentally transformed the way state agencies and school districts disburse funds. With ClassWallet’s adoption, these agencies can finally bid adieu to the outdated, laborious procedures that hindered public fund distribution. Our excitement to collaborate with ClassWallet, given their dominant market position, knows no bounds.”

Further support comes from Andy Kaplan, Managing General Partner at EGP, “We are eager to back ClassWallet’s progressive trajectory. Their innovative approach to fund disbursement in education and the subsequent positive academic impacts for learners align perfectly with what we seek in edtech investments.”

Climate tech leader Persefoni bags $50m in Series C-1

Climate tech platform Persefoni has recently made headlines with its announcement of securing $50m in its Series C-1 investment round.

Spearheading this substantial funding were notable names such as TPG Rise, with considerable support from Clearvision Ventures, ENEOS Innovation Partners, NGP Energy Technology Partners, Prelude Ventures, Parkway Ventures, Rice Investment Group, Bain and Co., EDF, and Alumni Ventures.

Diving deeper into Persefoni’s offerings, it stands out as a Climate Management & Accounting Platform that serves a vital role for businesses and financial institutions. It provides a consolidated platform for carbon accounting and management, effectively utilising its advanced AI co-pilot product, aptly named PersefoniGPT.

With the new influx of funds, Persefoni has ambitious plans for its future. It aims to enhance its AI developments, solidify its support to the global clientele, and uphold its dedication to providing top-tier climate software solutions.

Moreover, a fascinating detail regarding Persefoni is its foundational ethos. Since its inception in January 2020, the company has integrated AI technology at its core, evident in its formal incorporation name – ‘Persefoni AI Inc.’ The recent strides in GPT and LLM models are set to usher in a new era in the Climate Tech domain, with Persefoni aiming to lead the charge, especially with the imminent launch of PersefoniGPT.

Persefoni isn’t just making waves with customer-centric products scheduled for Q4 2023. It’s also ensuring internal efficiency. By focusing on generative AI, the firm expects to see substantial reductions in operational costs. This isn’t the first taste of AI innovation for Persefoni. It has seamlessly incorporated several AI features into its core platform, greatly assisting in enterprise data management.

Persefoni CEO and Co-Founder Kentaro Kawamori remarked, “This Series C round represents a significant vote of confidence in our strategic vision, our product and sales execution, and our commitment to bringing best-in-class climate software solutions to our customers.”

Kim Stroh, Co-founder and Head of AI, Persefoni, added, “Our early shift to invest in the transformative power of AI and machine learning technologies continues to pay dividends. This innovation drives sustainability and efficiency simultaneously, and it’s a key reason why Persefoni is trusted by partners leading in their respective markets, like Workiva, Deloitte, ERM, and Bain & Co.”

To date, this latest funding round brings Persefoni’s total raised investments to an impressive figure, exceeding $150m.

Irish FinTech powerhouse Fineos secures $40m in latest funding round

Irish FinTech company, Fineos, primarily known for its prowess in the insurance software segment, has impressively clinched a $40m investment to fortify its financial foundation.

The substantial amount is broken down into two main components: a full $35m institutional placement and a conditional $5m placement exclusively from Fineos’ founder and CEO, Michael Kelly, according to a report from Silicon Republic. However, the approval for the $5m chunk rests on the forthcoming securityholder consensus at the annual general meeting, slated for the close of this year.

Digging deeper into the Fineos story, the company, established in 1993 by the vision of Michael Kelly, focuses its efforts on devising software solutions tailored for life, accident, and health insurance carriers. Their influence is undeniable, with over 50 global clients, counting industry heavyweights like Aviva, APL, Amica, FBD, and New Ireland amongst their clientele.

Intentions for the freshly acquired funds are clear: to relentlessly drive the growth trajectory of Fineos and ensure a smooth regulation of cash flow timelines. This comes at a time when acquisitions form the backbone of Fineos’ expansion plans.

Notably, the company acquired Limelight Health in 2020 for $75m, a firm recognised for its innovative approaches in redefining sales and underwriting functions for group benefits insurance. The subsequent year saw the addition of Spraoi to the Fineos family, enhancing the company’s machine learning capabilities for group life and employee benefits sectors.

Echoing the company’s ambitious road ahead, Fineos CEO Michael Kelly said, “The placement proceeds significantly strengthen our capital position and provide Fineos with the financial flexibility to deliver on our growth strategy. We thank our security holders for their unwavering support of Fineos.”

Lastly, it’s worth noting that 2021 wasn’t the maiden funding endeavour for Fineos. The company previously amassed €44m through an institutional placement in Sydney. These funds were efficiently channelled towards research & development, and unlocking fresh avenues of growth.

d.light harnesses $30m to boost off-grid solar solutions in Tanzania

ZetaChain clinches $27m funding for its chain-agnostic platform

Layer-1 blockchain network, ZetaChain, has recently garnered a remarkable $27m in its latest equity round.

This injection of capital will further bolster its chain-agnostic platform, which promises to be a game-changer in the blockchain sphere.

Leading this round were notable names in the tech and financial sector: Blockchain.com, Human Capital, Vy Capital, Sky9 Capital, Jane Street Capital, VistaLabs, CMT Digital, Foundation Capital, Lingfeng Capital, GSR, Kudasai, Krust, among several other significant investors.

So, what exactly does ZetaChain offer Established in 2021, this innovative protocol delivers standardised interoperability across diverse networks. This means non-smart contract chains can now smoothly integrate with the expansive decentralised finance (DeFi) ecosystem. For developers, this translates to the ability to introduce smart contracts on networks that previously didn’t support this technology, such as Bitcoin and Dogecoin.

To get a bit more technical, a smart contract functions as a digital agreement stored on a blockchain, which auto-executes when specific conditions are met. One of the enduring challenges within the crypto realm has been enabling these contracts to interact across different blockchains. ZetaChain offers a robust solution by letting developers craft omnichain decentralised applications (DApps). These DApps ensure assets and data can be accessed from any platform, irrespective of their originating blockchain, and without the need to bridge or wrap tokens.

ZetaChain’s traction in the market is evident. The company reports the deployment of over 27,000 DApp contracts on its platform, catering to a diverse array of third-party applications – from cross-chain DeFi and nonfungible tokens to Web3 identity and gaming protocols. Furthermore, the platform boasts of over 13 million transactions conducted on its testnet, involving more than 1.7 million users.

Since its inception, ZetaChain has rallied an impressive line-up of contributors from the crypto universe, including Ankur Nandwani (formerly with Coinbase, Brave, and 0x), Panruo Wu (an early contributor to THORchain), and Brandon Truong (previously at BuzzFeed, Udacity, and Yada). The core team also features ex-stalwarts from Cosmos, Ignite, ConsenSys, and other reputed blockchain initiatives.

ZetaChain’s Ankur Nandwani, commenting on the venture’s vision, said, “Our Ethereum Virtual Machine EVM-compatible cross-chain smart contracts alleviate these issues by allowing decentralised app developers to build services that are faster, more secure, and easy to use.”

Cybersecurity firm ProjectDiscovery secures $25m Series A funding

ProjectDiscovery, the open-source-driven cybersecurity specialist, has made headlines with the announcement of a significant $25m Series A financing.

The round witnessed contributions from leading names like CRV, Point72, SignalFire, Rain Capital, Mango Capital, Accel, Lightspeed, Guillermo Rauch, Caleb Sima, and Talha Tariq, among others. Adding to the momentous occasion, the company unveiled its brand-new ProjectDiscovery Cloud Platform, an enterprise-grade SaaS solution anchored on its acclaimed open-source tools.

This platform is tailored to empower businesses to pinpoint and rectify vulnerabilities on an expansive scale.

Diving into the essence of ProjectDiscovery, its inception was based on the collaborative efforts of four cybersecurity engineers. They identified a pronounced gap in the market for contemporary security instruments capable of automated asset identification and vulnerability scans. These tools were meant to detect evolving components that posed potential risks to an organisation’s ever-changing attack scope.

Partnering with an enthusiastic open-source community, they crafted a suite that included ProjectDiscovery’s flagship product, the Nuclei vulnerability scanner. This scanner is adept at identifying emerging vulnerabilities in various domains, such as web applications, APIs, cloud ecosystems, and third-party software.

Regarding the utilisation of the newly-acquired funds, Andy Cao, chief operating officer of ProjectDiscovery, stated that the capital would be instrumental in consolidating a top-tier team, launching a dominant enterprise product, and persistently backing their vast open-source user base. He attributed the company’s present triumphs to the unwavering dedication of its community and expressed confidence in their sustainable growth prospects.

Adding depth to the utility of the ProjectDiscovery Cloud Platform, it’s a culmination of the best open-source tools by ProjectDiscovery, packaged for the enterprise sector. The platform facilitates businesses in effectively managing assets, uncovering, and addressing vulnerabilities at large, and rectifying cloud security misalignments.

Reid Christian, general partner of CRV, lauded ProjectDiscovery’s pioneering approach, which fosters real-time global collaboration to quickly identify and neutralise security threats.

Previously, the firm gained notable traction, as evident from over 3,000 organisations and engineers registering for the beta version of the ProjectDiscovery Cloud Platform. Their rapid growth rate in the open-source domain of the cybersecurity sector is truly commendable.

Dr. Chenxi Wang, a foundational investor in ProjectDiscovery and managing general partner at Rain Capital, encapsulated the excitement around the company’s unique positioning in merging open-source innovation with enterprise requirements.

AI-driven data security platform Symmetry Systems lands $17.7m funding

Symmetry Systems, a prominent data security firm, has announced the closure of its latest funding round on $17.7m.

Notable investors included ForgePoint Capital, Prefix Capital, W11 Capital Management, and TSG (The Syndicate Group).

Symmetry Systems has developed an advanced Data Security Posture Management (DSPM) platform. This AI-powered solution empowers organisations to vigilantly monitor sensitive data, mitigate exposure risks, streamline security and privacy compliance audits, address both insider and third-party risks, and adopt a robust zero-trust data security model.

The fresh capital will be channelled to enhance the capabilities of its DSPM platform, with a key focus on AI integration. The firm is ambitiously working on introducing an LLM-based natural language interface, designed to simplify the process for less technical users, aiding them in comprehending data-related threats and their potential countermeasures.

Setting Symmetry Systems apart in the crowded data access governance domain is its flagship product, Symmetry DataGuard. It boasts a unique capability to scrutinise data objects and identities, often overlooked by mainstream solutions, enabling security personnel to effectively gauge and contextualise data-associated risks in their operational environment.

Trace3 VP of innovation Katherine Walther said, “In the data access governance space, Symmetry DataGuard differentiates itself with its ability to analyse data objects and identities previously missed by traditional solutions so security teams can accurately contextualise the risk of the data in their environment.”

Symmetry Systems isn’t new to the investment scene. They had previously secured $3m in 2020, followed by an impressive $15m in 2021.

Consumer data leader Caden attracts $15m Series A investment

Caden, a dynamic data intelligence firm, has proudly announced its latest fundraising success, bagging $15m.

This investment was spearheaded by Nava Ventures, with key contributions from Jerry Yang’s AME Cloud Ventures, Streamlined Ventures, Montage Ventures, Industry Ventures, 1707 Capital, AAF Management, among others.

At its core, Caden champions the ethical use of first-party data, enabling both businesses and end users to gain actionable insights from their data. Their mobile app, released earlier this summer, not only presents users with intriguing analytics about their consumer habits but also offers them the opportunity to monetise their personal data in safe, privacy-focused ways. This approach has seen them amass billions of shared data points, revolutionising the manner in which consumer data is harnessed.

With this fresh injection of funds, Caden aims to expedite product development, fortify market activation strategies, and enrich their team with industry-leading professionals.

Beyond the mobile app, Caden has further enriched its service portfolio with the introduction of Caden AI. This personal assistant, the first of its kind, can automatically adapt based on a user’s media habits, purchases, travels, and more. For businesses, CadenOS, an intelligence suite, provides an unparalleled hyper-panel of consumer behaviours. This suite serves multiple sectors, ensuring that consumer data usage remains transparent and accountable, especially amidst rising concerns over data practices.

Caden CEO and Founder, John Roa said, “We are thrilled to have secured this milestone investment round, validating our value and potential. With the support of our new and existing investors, we intend to transform the consumer data market by building the most ethical, actionable and valuable data intelligence company in the world.”

Partner at Nava Ventures, Freddie Martignetti, shared, “Caden has showcased exceptional traction in acquiring and activating ethical consumer data, and we are excited to partner with them on their ambitious mission. We hope that our collaboration can enable individuals to have greater control over their data and lay the groundwork for a new relationship between individuals and enterprises.”

Leading Web3 platform ZTX nabs $13m in investment push

ZTX, a Web3 virtual world and creator platform, is now in a stronger position in the digital finance realm.

The company has successfully bagged a $13m seed round. This significant financial boost was led by Jump Crypto. The round also saw investments from other notable parties such as Collab+Currency, Parataxis, MZ Web3 Fund, and Everest Ventures Group, to name a few.

ZTX isn’t just another name in the digital world. They have managed to harness the power of their legacy Web2 business ZEPETO, which boasts an impressive count of over 400 million lifetime users. For those in the know, ZEPETO stands as the fourth largest metaverse platform worldwide, only surpassed by giants like Roblox, Fortnite, and Minecraft.

The partnerships they’ve established span from high-end brands like Gucci to renowned music sensations like K-Pop’s BLACKPINK. With such a vast user base and partnership spectrum, ZTX is all set to leverage its resources to further the adoption of Web3 globally.

But what is their grand vision It’s nothing short of advancing the Web3 infrastructure for creators in immersive, 3D environments. Their team comprises seasoned experts from big names like Apple, Roblox, and even Web3 ecosystems like Cosmos and Solana.

ZTX Co-CEO Chris Jang voiced his excitement, “We’re excited to share news about our fundraising round. We have been building steadily and discreetly for well over a year, and with our token launch happening in the coming months we want to emphasize the commitment that our investors, just like our team, have toward our vision to provide an infrastructure layer to creators.”

MZ Web3 Fund’s General Partner, Yuki Kanayama, expressed confidence in ZTX’s vision, stating: “We believe that ZTX has the potential to create a unique world. The seamless integration of digital asset creation and trading in the metaverse with Web3 technology is truly exciting. Moreover, the ZTX team’s expertise in both the metaverse and Web3 is exceptional, and we have high expectations for their future endeavors.”

Sharing a similar sentiment, Stephen McKeon, Partner at Collab+Currency, remarked: “As a crypto-focused venture fund, we back visionary teams who are using decentralized technology to shape the next wave of consumer products. We are thrilled to be part of this round, supporting ZTX’s exceptional team and their unique advantages. ZTX can provide a distinct infrastructure layer for diverse NFT projects and Web3 builders with its creator-focused tooling, and we look forward to helping ZTX succeed in its ambitious mission.”

Delving into ZTX’s past, it was founded in 2022 as a joint initiative between Jump Crypto and ZEPETO. ZTX has consistently been at the forefront of innovation. Just last month, the company unveiled its first Playtest – an invite-only beta test for its forthcoming 3D open-world platform. Collaborations like the one with Dust Labs to launch the ZTX Partner Wearables initiative further emphasize their commitment to evolving the digital metaverse landscape.

Dinari secures $7.5m for its decentralised stock trading innovation

Dinari, a firm dedicated to offering real-world asset-backed tokens, has recently publicised its successful $7.5m seed investment.

Prominent investors in this round featured the likes of SPEILLLP, part of the Susquehanna International Group of companies, along with 500 Global and Balaji Srinivasan, previously the chief technology officer at Coinbase. Other notable supporters were Third Kind Venture Capital, Sancus Ventures, and Version One VC.

Increasingly gaining traction, the tokenisation of real-world assets (RWA) is catching the eye of both crypto enthusiasts and traditional financial experts keen on tapping into the potential of blockchain technology. One such innovator in this domain, Dinari, established in 2021, aspires to revolutionise access to corporate equity using blockchain.

Through its dShare platform, the company provides a unique opportunity to invest in renowned securities such as Apple or Tesla stocks. All of this is made possible by leveraging a wallet on the Arbitrum network, specially curated for international users due to specific regulatory constraints.

While the announcement highlighted the fresh influx of capital, Jake Timothy, Dinari’s co-founder and chief technology officer, further elaborated on their goals via an email to CoinDesk. He emphasised that the funds would be channelled to bolster the dShare platform’s capabilities. This platform uniquely offers tokens – each dShare token, to be precise – that enjoy a 1-1 backing, reminiscent of stablecoins like USDC or Tether.

Hamilton Lane, an investment-management powerhouse with a staggering $824bn under its stewardship, has recently expanded its portfolio to include two of its funds via Securitize on the much-talked-about Polygon blockchain.

Commenting on their strides in transparency and regulatory adherence, Dinari co-founder and chief legal officer Chas Rampenthal stated, “Our transparency page is accessible for anyone to view, and we also provide a live feed of our brokerage accounts so that our users can have every confidence in our 1-1 backing. Furthermore, we are working with regulators from all around the world to ensure that our offering complies with rigorous regulatory compliance requirements.”

Tausight secures $6m for its AI-driven healthcare data security platform

Tausight, an AI-powered data security company, has raised an additional $6m with the financing round led by Polaris Capital.

Joining this investment venture were Flare Capital Partners and .406 Ventures.

This innovative company is at the forefront of leveraging AI technology to guard some of healthcare’s most vulnerable data from cyber threats. Their main product, the AI-powered PHI Security Intelligence platform, streamlines the process of identifying and classifying electronic protected health information (ePHI).

This not only enhances the safety of patients’ confidential data but the recent expansion of the Tausight platform now covers an even wider array of sensitive healthcare data categories. This expansion enables the company to address pivotal customer requirements and cater to emerging healthcare market segments.

The newly acquired funds have a defined purpose. Tausight plans to use this capital to amplify its market presence and bolster its customer growth. A portion of this investment will also be channelled to further enhance their patented AI technology.

Highlighting the growing significance of cybersecurity, earlier this year, President Biden unveiled his National Cybersecurity Strategy. This move underscores the increasing awareness of rampant ransomware attacks and cyber threats that major industries, especially healthcare, are contending with. Each security breach not only tarnishes a company’s reputation but also levies hefty business costs. Hence, fortifying against these cyber vulnerabilities and safeguarding against ransomware attacks have ascended to the top of business agendas.

Tausight founder and Chief Technology Officer David Ting commented, “This additional funding reflects our continued momentum as we expand Tausight’s AI-based data security platform to more segments of the healthcare ecosystem so the industry can take proactive steps to protect its data from cyber threats.”

Further adding to the discussion on Tausight’s capabilities, Dave Barrett, partner with Polaris Partners, said, “Tausight is uniquely approaching the healthcare cybersecurity crisis by reinventing traditional data security through transformative AI. This new funding shows our confidence that Tausight can help the entire ecosystem – including healthcare providers, payors and 3rd party security solutions – to better identify, detect and protect their most sensitive data.”

Earlier in the year, Tausight announced the launch of its expanded AI-powered PHI Security Intelligence platform, marking another significant milestone for the company.

Climate-focused Demex bags $5m to transform the reinsurance market

The Demex Group, described as the innovators behind unprecedented reinsurance solutions tackling accumulating losses from secondary perils, has successfully garnered an investment of $5m.

This recent funding round drew the attention of both returning and fresh investors, with Blue Bear Capital taking the lead. A notable venture and growth equity firm centred on global climate challenges, Blue Bear Capital has been collaborating closely with Demex since 2021.

Delving deeper into the Demex Group’s offerings, they’ve constructed unparalleled reinsurance mechanisms specifically targeting the escalating losses attributed to secondary perils. These secondary perils, encompassing winter storms, heatwaves, cold spells, droughts, and floods, have historically been the cause of tremendous global insured losses. Such losses, in some cases, even surpass the damages caused by more commonly recognised ‘primary’ catastrophe perils, such as hurricanes and earthquakes.

The newly acquired funds are earmarked for launching revolutionary weather risk transfer capabilities. Bill Clark, Demex CEO, elucidated the urgency of this venture, emphasising the mounting losses from frequent non-catastrophic weather events.

He highlighted, “Severe convective storms (SCS) induce losses in the midwestern states surpassing even the hurricane-inflicted damages in coastal regions. This rising trend of SCS loss is contributing to unpredictable earnings, credit downgrades, and potential bankruptcy for many insurance firms.” Demex’s RCR Re solution, tailor-made for severe thunderstorms, is poised to become an indispensable facet of insurers’ reinsurance strategies in the forthcoming year.

Since 2000, secondary peril losses have amounted to an overwhelming $1.1trn, overtaking the $880bn losses caused by primary perils within the same timeframe. Traditional reinsurance practices have often overlooked or gravely restricted secondary peril coverage, compelling insurers to self-insure against disproportionately larger losses than ever before.

Blue Bear Capital’s COO, Hank Hattemer, conveyed his enthusiasm about spearheading the funding round for Demex, acknowledging the invaluable potential of Demex’s groundbreaking tech solutions. He asserted, “Demex’s RCR Reinsurance mechanism stands out as the market’s sole approach to reinsuring against SCS and other Secondary Peril damages.”

Inaugurated in 2020, Demex bridges the realms of climate, insurance, and technology. Last year, they unveiled the Retained Climate Risk Reinsurance, a distinctive product relying on Demex’s exclusive Proxy Claims Index. This initiative permits insurers to economically purchase reinsurance covering secondary peril risks accumulating over periods.

Demex CEO Bill Clark said, “This additional investment empowers us to deliver new weather risk transfer capabilities to insurance companies that are facing escalating losses due to the increased frequency of non-catastrophic weather events.”

Hank Hattemer, COO of Blue Bear Capital, commented, “Blue Bear is excited to lead this round for Demex given the unequivocal opportunity for Demex’s team and technology to provide a risk transfer solution that is calibrated to the weather-driven loss experience of insurers.”

Previously, Demex has made noteworthy strides in the FinTech realm, leveraging their pioneering ethos and cutting-edge technology.

Hong Kong’s Bitcoin Web3 wallet Xverse pulls in $5m raise

Xverse, a Bitcoin Web3 wallet, including NFTs through a method called Ordinals, has secured significant backing in its latest seed round.

The company raised $5m in a seed round that was led by prominent industry investor Jump Crypto.

Other participants in the round included RockawayX, Sfermion, Alliance, NGC Ventures, V3ntures, Old Fashion Research, 2140 Bitcoin Ecosystem Fund, Bitcoin Frontier Fund, Newman Capital, Franklin Templeton, New Layer Capital, Miton C, Gossamer Capital, Daxos Capital, Sora Ventures, Tyhke Block Ventures, IOBC Capital and Despread, among others.

Xverse offers a unique Bitcoin Web3 wallet, providing users with an extensive range of advanced features related to decentralized finance (DeFi), Stacks, Lightning, and other Bitcoin scaling solutions. The company also supports Ordinals, a cutting-edge method of generating NFTs on the Bitcoin blockchain, which has been making headlines in recent months.

The new funding will enable Xverse to accelerate the development of its advanced features, particularly in areas related to DeFi and Bitcoin scaling solutions such as Stacks and Lightning.

Last month, Ordinals, the method of generating NFTs supported by Xverse, received considerable attention after daily new inscriptions reached a staggering 350,000. The Xverse wallet is available on iOS, Android, and also through a Chrome extension.

Communion’s new savings app for millennials attracts £2.5m ($3.1m) in pre-seed funding

Communion, the new FinTech brainchild of ex-Habito CEO Daniel Hegarty, is stepping into the spotlight, armed with a mission to revolutionise how millennials approach savings.

The company recently celebrated securing £2.5m in a pre-seed funding round, according to a report from Sifted.

Key contributors to this impressive haul included Revolut backers Target Global and a selection of esteemed angel investors: Max Rofagha, the founder of Finimize; Greg Marsh, founder of the personal finance app Nous; and Erin Lantz from Softbank-supported InsurTech, Ethos.

Diving deeper into what Communion offers, it stands out as a blend between an easy-access savings account and a financial education app. At its core, it promises a straightforward savings account boasting an impressive 3.66% AER, accessible primarily for iPhone users, with Android users soon to be included.

However, it’s not just about the savings. New users undergo an “initiation phase,” which involves committing £1 a day for 10 days. Successful completion grants them access to a collection of concise educational videos from Hegarty, focusing on prudent savings techniques. Additionally, a live chat feature connects users to a dedicated team of ‘Money Guides’, offering tailored savings advice.

The purpose behind the recently raised funds is evident. Communion aims to pull ahead in a saturated market with an enticing customer acquisition strategy. By introducing a ‘top up’ feature, members can earn an extra 2% on their already promising 3.66% AER by inviting friends to the app. Successfully enlisted friends receive a 0.2% bonus, and the cycle continues. This technique could potentially catapult the savings rate to a market-leading 5.66% AER.

Previously, Hegarty’s influence in the FinTech space was evident with his role at digital mortgage broker Habito. This isn’t the first time he has attracted significant investment; his tenure at Habito had several successful funding rounds.

Metabase Q bags $3m funding to bolster cybersecurity in Latin America

Metabase Q, a trailblazing all-encompassing cybersecurity solution catering primarily to multi-national corporations within Latin America, shared news of its recent financial achievements.

The company has successfully secured $3m in its Series A funding round. This funding event was led by its existing investor, SYN Ventures, and saw participation from other existing backers such as GBM and John Watters, who previously held positions as President and COO at Mandiant.

Specialising in safeguarding multi-national corporations operating within Latin America, Metabase Q has rolled out its Batuta platform (translated as ‘Baton’ in English and inspired by the conductor’s tool in orchestras). This platform offers a range of modules that streamline the entire cybersecurity workflow. These range from swift deployment initiatives to real-time inventory management, extensive vulnerability assessments, AI-powered insights, and prompt incident responses.

Metabase Q, through the recently raised funds, aims to strengthen and expand its capital-efficient operations. Their objective is to redefine the methodologies modern enterprises adopt to manage, gauge, and advance their cybersecurity endeavours.

The company’s traction is evident, with an impressive 403% quarter-over-quarter surge in new bookings, underscoring Metabase Q’s innovative approach as the cybersecurity industry’s future trajectory.

Metabase Q CEO Mauricio Benavides remarked, “The demand for Metabase Q’s platform is evident in customer validation and an impressive 403% quarter-over-quarter growth in new bookings, demonstrating that Metabase Q’s approach to cybersecurity is the future of the industry. This is particularly true for businesses in the Latin American market—an underserved area given the influx of digital transformation and thus cyber risks present.”

Further, Jay Leek, General Partner at SYN Ventures, commented, “In a world inundated with cybersecurity technologies, Metabase Q stands apart. Their mission isn’t just about creating another tool; it’s about enabling every company globally to build a modern cybersecurity program.

“Their approach has been transformative to the Latin American market to date and is exactly the forward-thinking approach we believe will redefine industry standards.”

Before this Series A round, Metabase Q had garnered funds bringing their total capital raised to $8m. This total is notably efficient, considering the firm’s size and its robust growth metrics.

Canadian FinTech Finofo attracts $1.25m for its unique FX automation tool

Finofo, a Canadian-based financial technology start-up, has emerged with a vision to streamline the often complex world of foreign exchange (FX).

Today, the company, co-founded by Charles Maranda, Prateek Sodhi, and Malav Shah, has announced a groundbreaking platform that aims to provide businesses with a more transparent, efficient, and cost-effective method for handling cross-border transactions.

The company has secured an impressive $1.25m in pre-seed funding, with Motivate Venture Capital leading the round, according to a report from TechCrunch. Notably, other participants include SaaS Venture Capital, Sweet Spot Capital, and Desjardins, a major player in the Canadian financial arena.

Delving deeper into Finofo’s offerings, their platform serves as a bridge for businesses to effortlessly manage multi-currency accounts, easing the process of sending and receiving money on a global scale. Beyond mere currency conversion, the company stands out with its automation feature for accounts payables. Such capabilities are aimed at replacing the traditional “black box” nature of the FX world, which has left many businesses in the dark.

Finofo’s fresh injection of funds is earmarked to further enhance its platform, aiming to introduce a proprietary algorithm. This new feature will enable the company to offer financial planning advice, by analysing clients’ financial data. By assessing accounting details, such as invoices and budgeting spreadsheets, Finofo hopes to guide businesses in determining the best times and methods for currency conversions.

In a discussion about the company’s direction, Finofo CFO Charles Maranda explained that the goal of the financial planning product is to help businesses understand the risk from currency fluctuation and manage it effectively. “This stands in stark contrast to traditional financial institutions that rely on a one-size-fits-all approach and aggressive sales tactics.”

The company’s ambitions don’t stop there. Maranda emphasises a vision wherein Finofo evolves into a comprehensive “super app” for business financial operations, creating a seamless environment for planning, strategising, and executing financial decisions.

It’s noteworthy to mention that Finofo, despite being founded by first-time entrepreneurs, has already attracted attention from prominent investment firms. While they narrowly missed an investment from a16z due to being “too early-stage”, the founders’ tenacity led to introductions to other investors who expressed keen interest.

As they look to the future, Finofo is setting its sights on the Canadian market, partnering with local banks and registering with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). With a commitment to exceptional customer service and education, Finofo hopes to rapidly gain the trust of businesses, ensuring that they have a reliable partner in their cross-border financial endeavours.

Vegapay’s fintech platform nabs $1.1m in pre-seed round

Vegapay, a digital lending and card management platform, has successfully secured $1.1m in a pre-seed funding round.

This round saw participation from a consortium of investors, including Eximius Ventures, DSP HMK, Capri Global, Upsparks Capital, MGA Ventures, Climber Capital, and individuals such as Arun Venkatachalam from Murugappa Group and Pratekk Agarwaal, a General Partner at GrowthCap Ventures.

Specialising in lending technology, Vegapay has engineered a system allowing both regulated entities and fintechs to further their issuance of cards and enhance lending penetration across India. The platform’s chief aim is to establish a micro-service-driven card and lending issuance stack. This innovation will empower issuers to effortlessly integrate and roll out lending products tailored to the distinct needs of various consumer segments.

With these new funds, Vegapay has set its sights on refining their technology to simplify frontline adoption for both institutions and non-institutions. This technological evolution is geared towards drastically reducing the time required for banks and fintech firms to launch new financial offerings.

Vegapay CEO Gaurav Mittal highlighted the company’s aspirations, saying, “The banks and the fintech players take months to launch new financial products like credit cards and lending offerings. However, we can help them reduce the time taken to bring products to the market by 90%. This would enable our partners to launch their products in just one week. Our mission is to assist our partners in achieving the $1.5 trillion AUM by providing customised digital lending solutions at an unprecedented speed.”

Complementing their lending solutions, Vegapay aims to develop an omni-channel lending solution to offer a broad range of products, including co-lending, secured credit, and unsecured credit. Elaborating on the market dynamics, Pearl Agarwal, founder and managing director of Eximius Ventures, said, “As per an RBI report, 65% of the credit card penetration is present in tier I cities. However, the penetration in Tier II and III cities has been significantly lower. To service this growing audience, Vegapay has devised an ingenious plan.”

Founded in October 2022, Vegapay is the brainchild of seasoned fintech professionals and banking stalwarts such as Gaurav Mittal (Ex-Zeta), Himanshu Agrawal (Ex-Amazon), Puneet Sharma (Ex- BharatPe), and Abhinav Garg (Ex-Podeum).

Israeli firm OX Security bags strategic backing from IBM Ventures

OX Security, an Israeli CyberTech startup established in 2021, has secured a notable investment from IBM Ventures.

The company, known for its leadership in software supply chain security and its foundational role in the Open Software Supply Chain Attack Reference (OSC&R), has taken this step to further consolidate its position in the industry.

The exact amount invested by IBM, a leading hybrid cloud and AI enterprise and the parent company of Red Hat, the premier provider of enterprise open source solutions globally, hasn’t been disclosed. Nevertheless, this move signifies the intent of both parties to join forces and push the boundaries of software supply chain security, aiming to deliver unmatched value for developers specialising in cloud-native solutions.

Taking a step beyond the conventional CI/CD or SDLC, OX Security offers an integrative approach to software supply chain security. It provides holistic visibility, automation, and risk insights spanning from Code-to-Cloud-to-Code. By blending the best practices from risk management and cybersecurity with an intuitive user experience, OX ensures that the software supply chain security processes are seamless for security teams and easily embraced by developers. OX’s alignment with the OSC&R framework further guarantees the consistency and integration often missing in many security strategies.

Neatsun Ziv, Co-founder and CEO of OX Security, expressed his enthusiasm about the collaboration, “This investment from IBM is proof that OX’s holistic security solution for today’s modern software supply chains is the right solution at the right time. We look forward to working closely with IBM and the team at Red Hat, helping their enterprise customers bake security into product development – ensuring the integrity of every software build, remediating critical risks quickly and releasing secure products with confidence.”

Speaking about IBM’s history and the importance of this partnership, Professor Yaron Wolfsthal, Head of IBM’s Security Center of Excellence in Israel, commented, “IBM has been contributing to open source ecosystems for over 20 years.

“With over 75% of applications consisting of open source code, it is critical that organisations be able to determine the trustworthiness of the dependencies, tools and infrastructure used in every project. OX’s holistic approach and its thought leadership in standardising software supply chain risks represents our commitment to help organisations improve the security of the open source ecosystem.”

Ben Daniels, Partner at IBM Ventures, also highlighted the significance of the investment, “With IBM’s investment in OX, we continue to emphasise the importance of software supply chain security as a key part of cloud-era application development.”

On a side note, OX Security had showcased their solution, running as a Red Hat OpenShift operator, in August at Black Hat 2023 in Las Vegas. There’s an evident eagerness between OX Security and IBM to cooperate, furthering the successful adoption of DevSecOps practices. Alongside this strategic collaboration, it’s worth noting that IBM joins the cohort of investors who previously funded OX Security’s $34m seed round in September 2022.

Australia’s robo-advisory pioneer Stockspot receives funding boost

Australia’s leading robo-adviser, Stockspot, is gearing up for a transformative phase in its journey, especially within the country’s digital investment sector.

While the exact amount of the investment was not disclosed, it is known that the major strategic backing comes from Mirae Asset Global Investments, a prominent global asset manager.

Established as Australia’s foremost robo-adviser, Stockspot has championed the cause of digital investment in the nation. The firm expertly integrates technological advancements with industry insights, delivering personalised investment strategies and premium client interactions. They’ve notably disrupted the traditional realm of wealth management, introducing transparent, low-cost portfolio management solutions powered by avant-garde technology.

The new influx of capital from Mirae Asset will propel Stockspot’s ambitions further, enhancing its state-of-the-art technology, broadening its expert team, and facilitating the creation of innovative products and services tailored for modern client needs.

Stockspot boasts an impressive record, currently managing over $650m for 13,000 clients. This achievement marks a staggering fivefold growth since its last capital raise in 2019.

Stockspot CEO Chris Brycki expressed his enthusiasm, saying, “We are thrilled to partner with Mirae Asset Global Investments, a renowned leader in the global financial services industry.

“This investment is a resounding validation of Stockspot’s vision to make investment advice accessible to all Australians and enable individuals to achieve their financial dreams. With Mirae Asset Global Investments’ support, we are poised to reshape the investment landscape and redefine how Australians approach wealth management.”

Mirae Asset’s Chairman and Global Strategy Officer, Hyeon-Joo Park, also shared his thoughts on the collaboration, noting, “We firmly believe in and continue to embrace digital transformation and technology as a means to provide investors with leading and highly accessible solutions.

“Stockspot’s commitment to transparency, technological excellence, and its investors aligns perfectly with Mirae Asset’s business philosophy to embrace the future with an open mind. Our investment supports Stockspot’s continued growth and ability to deliver quality investment and portfolio management outcomes for all investors.”

This recent funding follows Stockspot’s notable growth trajectory, having amplified its business five times since its previous capital acquisition in 2019.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global