Silicon Valley Bank (SVB) has announced a shake-up of its leadership team, with the appointment of a new Head of Global Payments, and a new Head of Global Digital Solutions.

The move will see Martin Murrell take up the reins as Head of Global Payments, while Milton Santiago has been named Head of Global Digital Solutions.

The new leaders will be tasked with furthering SVB’s commitment to innovative products, client solutions and exceptional client experience.

Gagan Kanjila, Chief Product Officer for SVB, said: “In a period of dramatic change in the payments and digital banking landscape, Martin and Milton bring the vision and execution needed to enhance SVB’s product suite, bringing inventive and bespoke solutions to our innovation economy clients.”

As Head of Global Payments, Murrell will lead the teams responsible for SVB’s core payments products, including commercial card, merchant services and embedded payments.

He will oversee key product enhancements, product-related risk management efforts and critical client experience initiatives to create a differentiated payments platform for SVB.

With over 25 years of experience in the banking sector, Murrell is considered a veteran of the space, having been part of the team that took Amalgamated Bank public, and successfully executed the company’s first acquisition in its 100-year history.

As Head of Global Digital Solutions, Santiago who joined SVB back in 2018, is set to be responsible for defining the British organisation’s digital strategy and aligning technology investments in support of the strategy.

With 30 years of experience across the digital transformation sector, he will lead the Digital Solutions team in the creation of innovative digital client experiences.

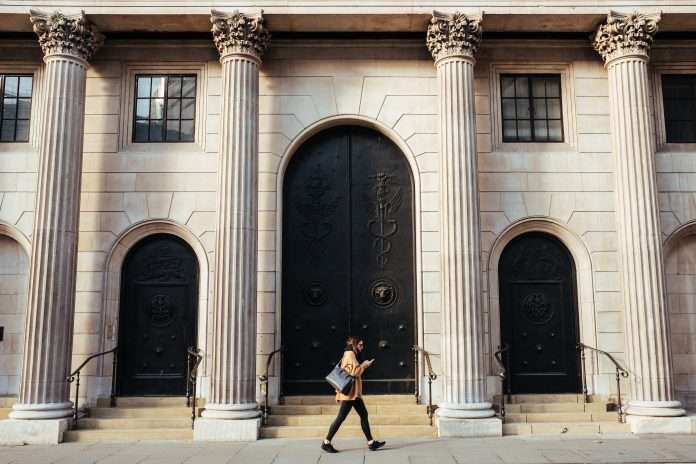

Earlier this year, HSBC acquired Silicon Valley Bank UK (SVB UK) for £1, in a move designed to help protect deposits of thousands of startups in the UK, according to a report from UKTN.

The transaction was facilitated by the Bank of England in consultation with the Treasury. No taxpayer funds were used.

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global