Key European FinTech seed investment stats in H1 2023:

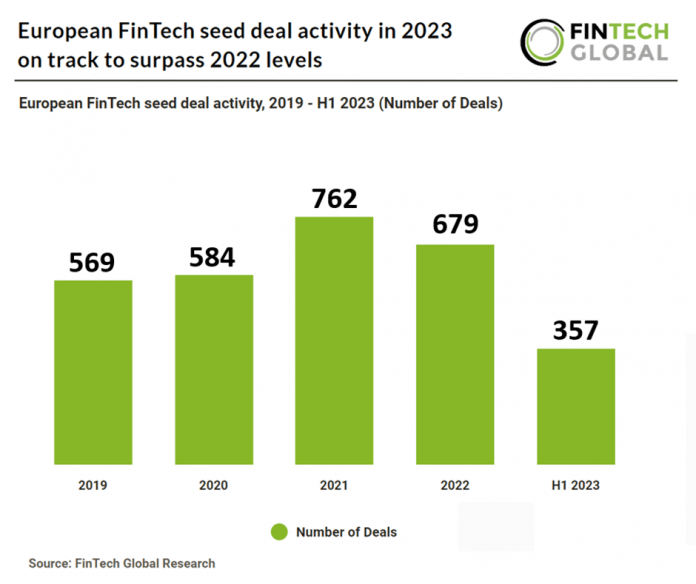

• European FinTech seed deal activity is on track to reach 714 deals in 2023, a 5.1% increase YoY

• European FinTech seed deal activity reached 184 deals in Q2 2023, a 6.3% rise from Q1 2023

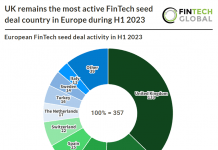

• The UK was the most active seed deal country in Europe during H1 2023

European FinTech seed deal activity is on track to bounce back this year with the first half of 2023 recording 357 transactions. Based on the number of European FinTech seed deals in the first six months, deal activity is projected to hit 714 in 2023, marking a YoY growth of 5.1%. In Q2 2023, European FinTech seed deal activity increased to 184 deals, indicating a 6.3% upswing compared to Q1 2023. Although this deal activity may seem like a minor increase, European FinTech deal activity in H1 2023 decreased 45% YoY. This indicates that European FinTech is continuing to disrupt and innovate but later stage funding rounds are seeing a decline.

Carbonplace, a global carbon credit transaction network, was the largest European FinTech seed deal in H1 2023, raising $45m from nine investors. The company plans to utilise the funds to increase the size of its platform and team, broaden its range of services to reach a more extensive customer base of financial institutions, and hasten collaborations with more carbon market participants across the globe, such as registries and marketplaces. Carbonplace aims to facilitate the trade of certified carbon credits by connecting buyers and sellers through their banks. The platform, which is set to be launched later this year, will enable immediate transfer of ownership upon payment, ensuring secure and traceable reporting throughout the carbon credit transfer process. This system will be available to financial institution clients who wish to provide their customers with a secure and transparent way to access carbon markets.

The UK was the most active country for FinTech seed deals in Europe with 133 transactions, a 31.6% share of total deals. Germany was second with 48 funding rounds, a 13.4% share and France was third with 32 deals.

In June 2023, The European Commission proposed new regulations to modernise digital payments and the broader financial sector, aiming to enhance consumer protection, competition, and data sharing security. These rules intend to enable consumers to access a wider range of affordable financial products and services by securely sharing their data. The proposals prioritize consumers’ interests, competition, security, and trust. The electronic payment market has evolved significantly, with EU electronic payments growing to €240 trillion in 2021 from €184.2 trillion in 2017, driven further by the COVID-19 pandemic. The rise of digital technologies has ushered in new providers, including those offering ‘open banking’ services that facilitate secure financial data sharing between banks and fintech firms. However, this digital shift has also introduced more complex fraud risks. This package of reforms aims to make the EU’s financial sector adaptable to the ongoing digital transformation, considering both the opportunities and risks, particularly from a consumer perspective.