Key Baltic FinTech investment stats in H1 2023:

• Baltic FinTech deal activity reached 26 transactions in H1 2023, 54% lower than the previous year

• Baltic FinTech deal activity dropped 18 percentage points more than general deal activity in the region in H1 2023 YoY

• Baltic FinTech companies raised a combined $72m in H1 2023, a 87% drop from H1 2022

The Baltic FinTech sector has seen a significant drop in both investment and deal activity during H1 2023. In the first half of 2023, there were 26 transactions in the Baltic FinTech sector, marking a 54% decrease compared to the previous year’s H1 activity. The Baltic’s general market also saw a drop in deal activity during H1 2023 YoY although FinTech has dropped 18 percentage points more. In the first half of 2023, Baltic FinTech firms secured a total of $72 million in funding, reflecting an 87% decrease compared to the funding raised in the same period in 2022.

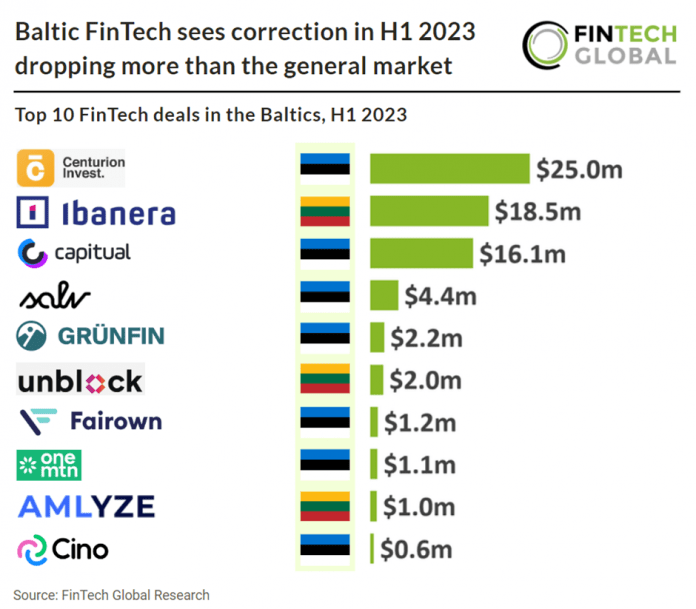

Centurion Invest, a digital asset trading platform, had the largest FinTech deal in the Baltics during H1 2023 after raising $25m in their latest Venture funding round, led by GEM Digital. This funding round empowers Centurion Invest to realize its ambitious worldwide expansion strategies, bolstering its products and services, and investing in the advancement of additional Web3 platforms. Aligned with its objective of expanding the use of digital assets among both B2C and B2B users globally, the company has set aside a substantial portion of the funds to onboard industry professionals and skilled professionals across Europe, North America, as well as key regions in Southeast Asia and Africa. Centurion Invest’s utility token – $CIX is an ERC20 deflationary token, which powers the overall CI ecosystem, with utilities and benefits across Payments, Financial Services, Rewards, Referral Bonuses, Staking income source, Trading Fees discounts, priority access to services like Launchpad & IEOs, various Cashbacks & Merchant Rebates, and the flagship Visa digital asset Debit Card, to name just a few.

Estonia was the most active FinTech country by far in the Baltics during H1 2023 with 16 deals, a 62% share of deals. This was followed by Lithuania which had eight deals, a 31% share of deals and Latvia was the third most active with one deal during H1 2023.

The latest Baltic regulatory development comes from Lithuania’s Ministry of Finance, the Bank of Lithuania, Go Vilnius (city development agency), and various business associations including ROCKIT, FinTech Hub LT, Infobalt, and BCCS have signed a Memorandum of Understanding (MoU). In June 2023 the MoU outlined five distinct directions, aiming to enhance business conditions and establish a transparent and secure regulatory framework. These guidelines were developed under the Ministry of Finance’s supervision and are strategically significant for Lithuania’s economy. The directions cover areas like supporting FinTech sector growth, attracting innovative solutions, establishing Lithuania as a FinTech competency centre, ensuring safety and reliability, and elevating Lithuania’s standing as a European Fintech hub. The country’s finance minister emphasized the rapid growth of Lithuania’s FinTech sector and the goal of becoming a recognized global FinTech centre with the help of these guidelines.