Key FinTech investment stats in Latin America during Q3 2023

• Latin American FinTech deal activity reached 35 deals in Q3 2023, a 69% drop YoY

• Latin American FinTech companies raised a combined $186m in the third quarter, a 66% drop from Q3 2023

• Brazil was the most active FinTech country in Latin America during Q3 with 16 deals, a 48% share of all transactions.

Latin America’s FinTech sector in Q3 2023 has dropped significantly from 2022’s levels although the region is doing well compared to others. Globally, all regions saw a drop in deal activity during Q3. Latin America recorded the third smallest drop in deal activity with only North America and Africa seeing smaller reductions. In the third quarter of 2023, Latin American FinTech deal volume plummeted by 69% compared to the previous year, with only 35 deals recorded. In the third quarter of 2023, Latin American FinTech firms collectively secured $186m in funding, marking a substantial 66% decrease from the same quarter in the previous year.

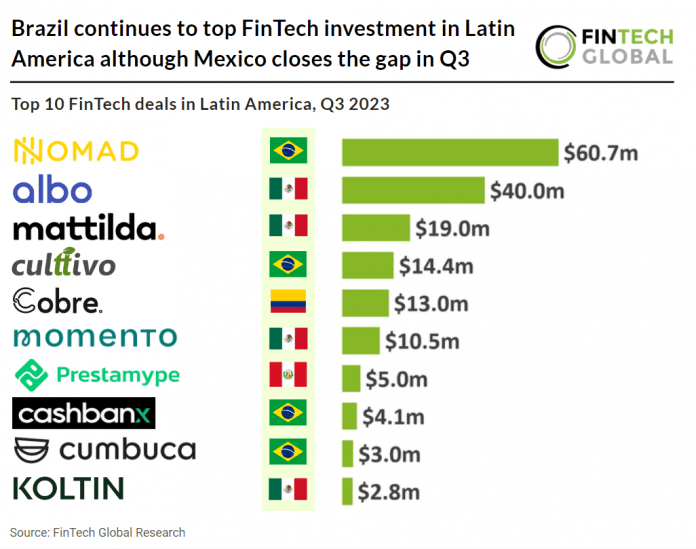

Nomad, a Brazilian financial services app including bank accounts and investing, had the largest FinTech deal during Q3 2023 after raising $60.7m in their latest Seies B funding round, led by Tiger Global Management. The company plans to utilize the capital to bolster its worldwide investment platform and introduce new offerings, such as credit cards. With this investment, Nomad’s valuation is now 1.8 billion reais ($365 million). Lucas Vargas, CEO of Nomad said “It was a challenging process [building Nomad]. There are fewer rounds taking place, so the approach is already more skeptical in general in the market. It’s natural that, with this skepticism, in this process of presenting the company, there is greater scrutiny and a need for a deeper understanding of everything behind it,”

Brazil was the most active FinTech country in Latin America during Q3 with 16 deals, a 48% share of deals. This was closely followed by Mexico with nine deals, a 27% share of deals and Colombia was third with three deals, a 9% share of all transactions. Notably the deal gap between Mexico and Brazil’s deal activity has shrunk 16 percentage points in Q3.

In May 2023, FinTech associations in Mexico, Colombia, Peru, and Chile joined forces to propose unified standards for Open FinTech, potentially paving the way for the establishment of cohesive regulatory bodies across Latin America. This initiative aims to improve cross-border transactions and establish a common framework for sharing financial data among FinTech companies, banks, and other participants in the financial market. The objective is to reduce information disparities, stimulate competition, and lower costs for end-users. This collaborative endeavour represents a significant milestone in Latin America, where regulatory advancements have traditionally occurred independently in various nations. It holds the potential to expedite financial inclusion and provide advantages to the growing FinTech landscape in the region.