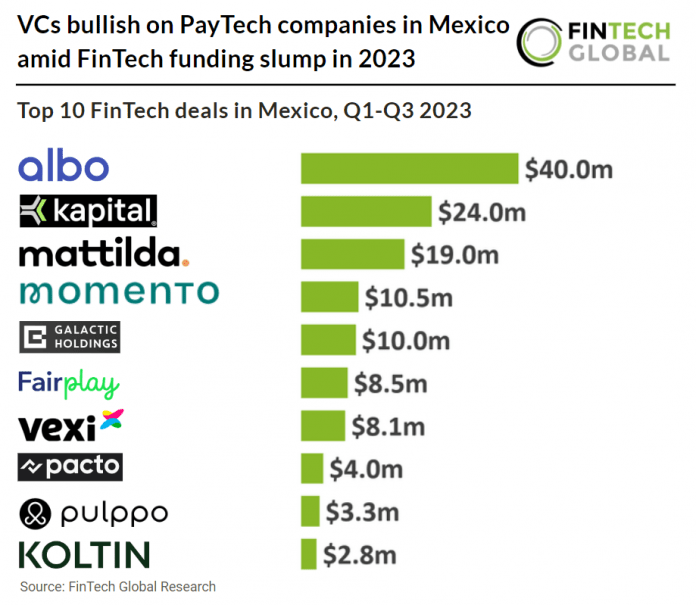

Key Mexican FinTech investment stats in Q1-Q3 2023:

• Mexican FinTech companies raised a combined $141m in the first three quarters of 2023, a sizable 73% drop from Q1-Q3 2022

• Mexican FinTech deal activity totalled at 40 transactions during the period, down 53% YoY

• PayTech was the most active FinTech subsector in Mexico during Q1-Q3 2023 with nine deals

Mexican FinTech has seen reduction in both deal activity and investment in 2023. Mexican FinTech firms collectively secured $141M in funding during the first three quarters of 2023, marking a substantial 73% decline compared to the same period in 2022. Mexican FinTech deal volume amounted to 40 transactions during the first three quarters of 2023, representing a 53% YoY decrease. Based on deal activity in the first three quarters of 2023, deal activity is on track to reach 53 transactions, a 53% drop compared to 2022.

albo, a challenger bank, had the largest FinTech deal in Mexico during Q1-Q3 2023 after raising $40m in their latest Series C extension funding round from Morpheus Ventures. The company plans to utilize the capital to broaden its operations and extend its market presence. Led by CEO and Founder Ángel Sahagún, albo provides personal debit accounts, business accounts for businesses, and credit options for individuals and businesses, all without any fees or commissions. Its mission is to empower people worldwide with financial freedom. In August 2023, albo acquired delt.ai, a fintech company affiliated with Y-Combinator, with a strong presence and expertise in the Mexican market. delt.ai specializes in offering financial services and management tools tailored to small and medium-sized businesses (SMBs). Their product lineup includes business loans, credit cards, and a comprehensive financial platform for SMBs. To date, delt.ai has facilitated over 130,000 transactions through its platform, extending more than $90 million in business loans and credit lines. This acquisition aligns perfectly with albo’s strategic vision to deliver top-notch financial products and services, fostering responsible financial habits.

PayTech was the most active FinTech subsector in Mexico during Q1-Q3 2023 with nine deals, a 22.5% share of total deals. The Mexican payments market is projected to expand from $103bn in 2023 to $167bn by 2028, with a compound annual growth rate (CAGR) of 10.18% (2023-2028). This growth is primarily attributed to the increasing trend of digitalization. InsurTech was the second most active Mexican FinTech subsector with eight deals, a 20% share of deals.