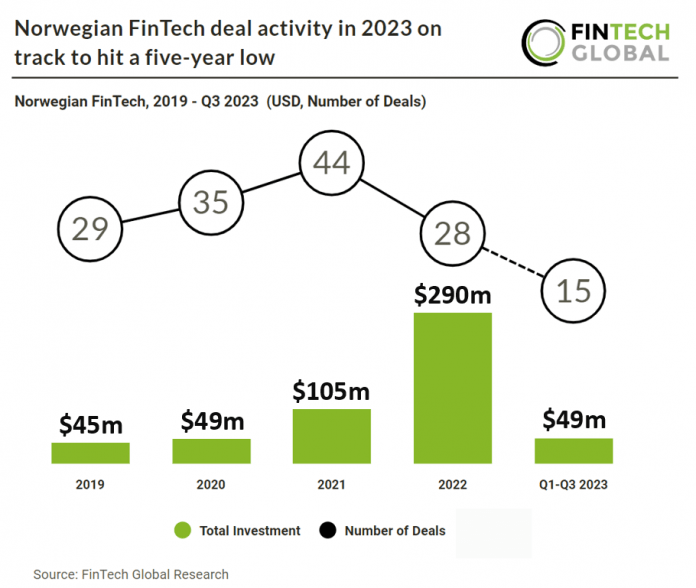

• Norwegian FinTech deal activity on track to reach 20 deals in 2023, a 29% drop compared to 2022

• Norwegian FinTech companies are expected to raise a combined $65.3m in funding in 2023, a 78% drop from the previous year

• Norway’s most active FinTech subsector in Q1-Q3 2023 was RegTech with four transactions

Norway’s FinTech sector has fallen below pre-covid deal activity in 2023 indicating a negative outlook for the sector. Norwegian FinTech deal volume is projected to hit 20 deals in 2023, marking a 29% decline compared to the previous year. In 2023, it is anticipated that Norwegian FinTech firms will secure a total of $65.3m in funding, reflecting a substantial 78% decrease compared to the preceding year.

Two, a B2B payments company, had the largest Norwegian FinTech deal in Q1-Q3 2023 after raising $19.3m in their latest Series A funding round, led by Antler and Shine Capital. The company simplifies B2B payments to the level of ease seen in B2C transactions. It asserts its ability to enhance order acceptance by employing multiple credit underwriters to evaluate each order. One of the potential underwriters is their proprietary credit engine. Notably, the company successfully facilitated a transaction of €450,000, which was seamlessly processed from start to finish within just 45 seconds at the checkout. Shine Capita CEO and founder Mo Koyfman said, “Global business-to-business payments remain woefully analogue, significantly lagging the innovation we’ve seen in consumer payments over the last decades. “The world-class Two team is building an end-to-end global solution for B2B transactions across all sales channels. This has already led to explosive growth with businesses in the U.K. and the Nordics, and, with their recently announced banking partnerships, Two can now offer a truly global B2B solution for large multinational corporations.” Two recently teamed up with Allianz and Santander allowing it to support large and multinational merchants across all Europe and North America.

Norway’s most active FinTech subsector in Q1-Q3 2023 was RegTech with four deals, a 27% share of total deals. This was followed by PayTech and PropTech which had three deals each, a 20% share of all transactions.