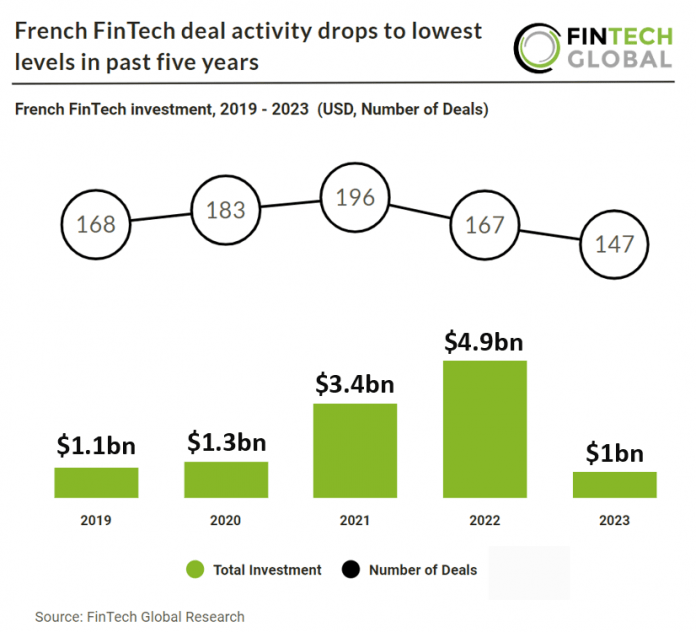

Key French FinTech investment stats in 2023:

• French FinTech deal activity totalled at 147 transactions in 2023, a 12% reduction from 2022

• French FinTech companies raised a combined $1bn in 2023, a 79% drop from the previous year

• The average FinTech deal size in France was $6.8m during 2023

In 2023, the French FinTech sector experienced a notable shift in its deal activity and funding landscape. The year saw a total of 147 deals completed, marking a 12% decrease compared to 2022. This is much better than the European average which saw a 43% drop over the same period. French FinTech companies collectively secured $1bn in funding throughout the year, reflecting a significant 79% decline compared to the previous year’s figures. Despite the decrease in overall funding, the average deal size in the French FinTech space remained relatively substantial at $6.8m, a 77% reduction which indicates a major drop in large deals.

Ledger, which provides security and infrastructure solutions to critical digital assets, was the largest French FinTech deal in 2023 raising $108m to extend their Series C funding round. The extension round maintained the company’s valuation at €1.3 Billion. The company intends to use the funds to further its global ambitions and accelerate its drive to support blockchain innovation. Led by Pascal Gauthier, Chairman and CEO, Ledger is a global platform for digital assets and Web3. With more than 6M devices sold to consumers in 200 countries and 10+ languages, 100+ financial institutions and brands as customers, 20 % of the world’s crypto assets are secured, plus services supporting trading, buying, spending, earning, and NFTs.

In 2019, France implemented significant regulatory changes for digital assets and initial coin offerings (ICOs). These changes include defining tokens as digital representations of securities, allowing token issuers to obtain optional visas from the Autorité des marchés financiers (AMF) for ICOs, and introducing a framework for a secondary market for digital assets with digital asset service providers. These providers can opt for an optional license but none have done so yet, and registration with the AMF is mandatory for all digital asset service providers. From 2024, registration will entail additional requirements such as internal controls, conflict of interest rules, and client communication. Entities acting as intermediaries for cryptocurrency exchanges against legal tender must also be approved as payment service providers, reflecting France’s commitment to establishing a comprehensive regulatory framework to promote responsible practices and investor protection in the digital asset and ICO space.