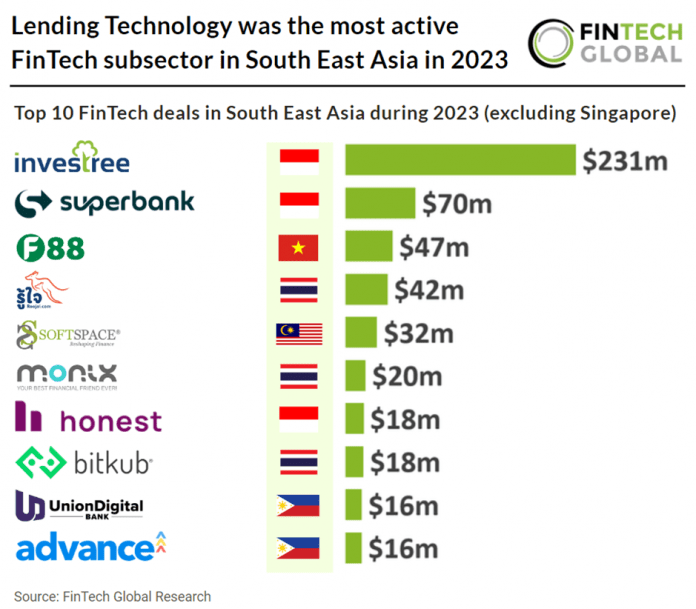

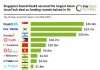

Key Southeast Asia FinTech investment stats in 2023 (excluding Singapore):

· Southeast Asia FinTech deal activity totalled at 111 deals in 2023, a 47% drop from 2022

· Southeast Asia FinTech companies raised a combined $617m in 2023, a 74% reduction from the previous year

· Lending Technology was the most active Southeast Asia FinTech subsector in 2023 with a 22% share of total deals

In 2023, the FinTech landscape in Southeast Asia witnessed a significant decline in deal activity, registering a sharp 47% drop compared to the previous year. The region’s FinTech companies also faced a substantial reduction in funding, with a collective fundraising total of $617m in 2023, reflecting a substantial 74% decrease compared to 2022.

Investree, which provides a B2B marketplace lending platform for SMEs, had the largest Southeast Asia FinTech deal in 2023 after raising $231m in their latest Series D funding round, led by JTA International Investment Holding. Investree President Director & Co-Founder/CEO Adrian Gunadi said that the fresh funds would be used to expand its products and services, as well as increase collaboration with various partners to provide more innovative digital solutions for MSME players. Founded in 2015, Investree provides four loan products for MSMEs, namely Invoice Financing for MSMEs which provides services/products to large companies with payment sources from invoices; Working Capital Term Loan (WCTL) for MSMEs with unique business models; Buyer Financing for MSMEs as retail buyers at large retailers/wholesalers; and Micro Productive Loans for ultra-micro entrepreneurs from the Investree partner ecosystem.

Lending Technology was the most active Southeast Asia FinTech subsector in 2023 with 22 deals, a 22% share of total deals. WealthTech was the second most active subsector with 15 deals, a 14% share of deals. Blockchain and digital assets were the third most active subsector with 14 deals, a 13% share of total deals.

Credit bureaus are essential components of credit ecosystems, promoting competition and affordability in lending markets. Mel Carvill, a non-executive director of Home Credit Group says expanding the use of credit bureaus in Southeast Asia can alleviate credit invisibility, streamline lending processes, and lead to lower interest rates for consumers, as evident in research by the U.N. Capital Development Fund. To achieve this, the private and public sectors must collaborate to adopt successful models from countries like India and China, where initiatives like Aadhaar and Pradhan Mantri Jan-Dhan Yojana have significantly improved financial access and inclusion, offering valuable lessons for Southeast Asian emerging markets.