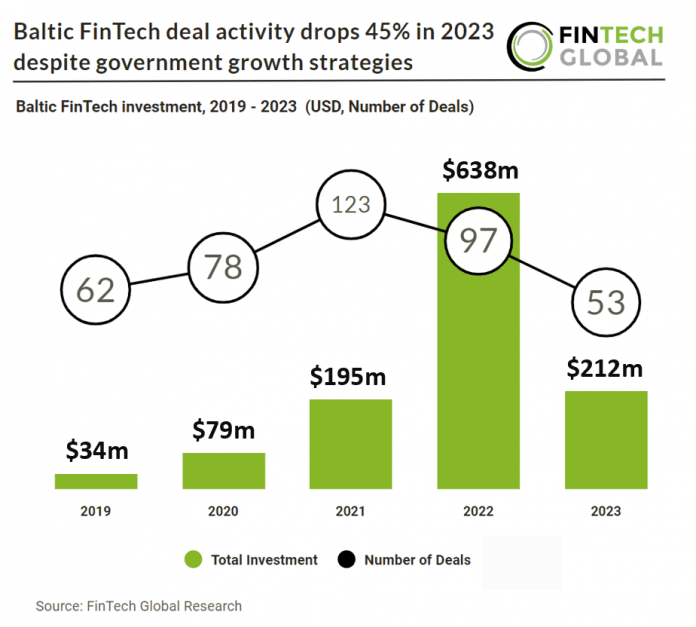

Key Baltic FinTech investment stats in 2023

• Baltic FinTech investment totalled at $212m in 2023, a 67% drop YoY

• Baltic FinTech deal activity reached 53 deals in 2023, a 45% reduction from 2022

• Estonia was the most active FinTech country with 31 deals

In 2023, the Baltic FinTech sector experienced a significant decline in investment, plummeting to $212m, marking a stark 67% drop compared to the previous year. This downturn was mirrored in the deal activity within the region, which saw a notable decrease with only 53 deals recorded, representing a 45% reduction from the figures reported in 2022.

Nord Security, a global leader in internet privacy and security solutions, raised the largest FinTech deal in the Baltics in 2023 after their $100m investment, led by Warburg Pincus, a premier global growth investor. With this fresh injection of capital, the company intends to diversify its product lineup and accelerate its growth through strategic partnerships and acquisitions. This strategic move is expected to enhance security measures for both individual and business customers. Nord Security offers a wide range of products, including the renowned NordVPN service, NordPass password manager, NordLayer business network access security software, and NordLocker encrypted cloud storage. Before securing external funding, Nord Security operated independently for more than a decade, demonstrating a resilient and diverse revenue model. In 2022, the company expanded its product portfolio by partnering with Surfshark, a prominent player in consumer cybersecurity. Surfshark offers a comprehensive suite of products, including a consumer VPN, Antivirus, Alert online data leak detection system, Alternative ID online identity protection tool, Search private search tool, and Incogni automated personal data removal system.

Estonia was the most active country in the Baltics with 31 deals, a 58% share of total deals. This was followed by Lithuania with 20 deals, a 38% share of total deals. Finally Latvia had 2 deals in 2023.

Lithuania’s government is aiming for a 30% average revenue increase for FinTechs by 2028 through its new five-year strategy. Notable incentives including tax breaks for R&D, direct funding, and initiatives like the Green Finance Action Plan. Additionally, Lithuania prioritizes talent development through programs like the AML Centre of Competence and Knowledge Hub Programs, aiming to establish itself as a FinTech Centre of Excellence.

Baltic FinTech deal activity drops 45% in 2023 even with government growth strategies