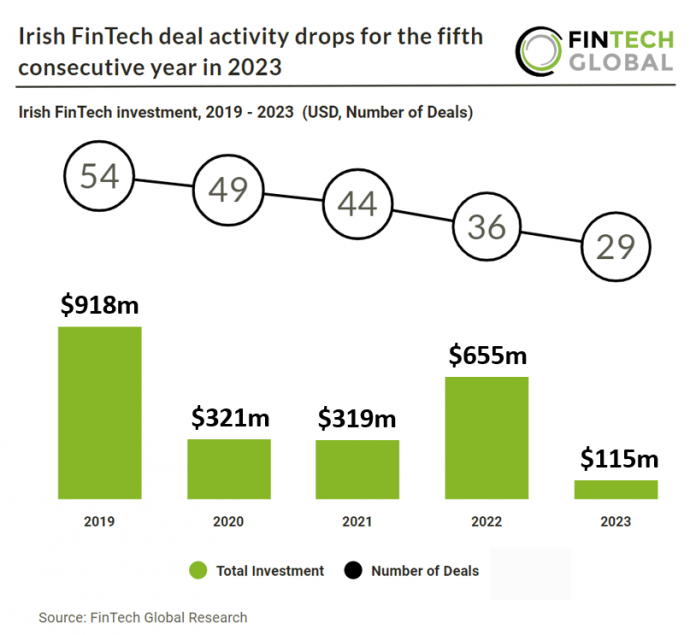

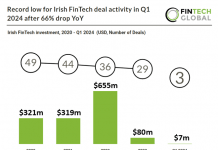

Key Irish FinTech investment stats in 2023:

• Irish FinTech companies raised a combined $115m in 2023, a 83% drop from 2022

• Irish FinTech deal activity reached 29 transactions in 2023, a 19% drop YoY

• PayTech was the most active FinTech subsector with four deals in 2023

In 2023, Irish FinTech companies experienced a significant downturn, raising a total of $115m, marking an 83% decrease from the previous year. This decline was mirrored in deal activity, with only 29 funding rounds recorded, representing a 19% drop year-on-year. According to the Irish Venture Capital Association Investment in Irish SMEs reached a record €1.35bn in 2023, but fell by 16% in the last quarter compared to the previous year. This indicates that FinTech is performing worse than the general market in Ireland during 2023 for funding.

NomuPay, a unified payment platform, had the largest Irish FinTech deal in 2023 after raising $53.6m in their latest Series A funding round, led by Finch Capital and Outpost Ventures. NomuPay’s growth journey is experiencing a remarkable boost due to this substantial investment. The company has made significant strides, successfully onboarding new clients since Q4 2022, and is actively expanding its presence in key markets. Moreover, NomuPay continuously extends its uP Platform to include new markets while allocating resources to product development, aiming to further enhance its offerings. Peter Burridge, former head of operations payouts at PayPal and CEO of NomuPay, says “Every growing international enterprise knows the problem of ‘multiples’, when it comes to payments. There are multiple countries, multiple payment types, different payment use cases in each nation, a variety of channels, and an endless list of changing regulations. As a result, expansion slows down. Companies have to maintain countless technical integrations and vendor relationships, while reconciling global payments. “In the face of continued technological, market, method and data fragmentation, we provide companies with an ‘all access pass’ to global payments’, enabling enterprises to continue to expand globally, and to future-proof payment strategies.”

PayTech was the most active Irish FinTech subsector in 2023 with four deals, a 14% share of all transactions. Online payments continue to grow in popularity in Ireland. Total transaction value is expected to show an annual growth rate (CAGR 2023-2027) of 12.8% resulting in $29.06bn by 2027. Total transaction value in the Digital Payments market is projected to reach US$17.95bn in 2023.