The intersection of artificial intelligence (AI) and financial compliance is reshaping how firms handle regulatory reviews.

RegTech firm Saifr remarked that in an industry as tightly regulated as financial services, the stakes couldn’t be higher. Non-compliance doesn’t just attract fines; it damages reputations.

According to Saifr, compliance teams, the guardians of regulatory adherence, find themselves under immense pressure. They are now dealing with an unprecedented volume and variety of content—videos, GIFs, podcasts, infographics, all disseminated across numerous channels. The task is daunting, made even more so by the evolving complexity of regulations.

Looking back, compliance reviews were a paper-heavy process up until the mid-1990s. Financial firms would shuffle paper copies between departments, annotating them with handwritten notes, suggestions, and required disclosures. It was an inefficient system, prone to delays and confusion.

In the view of Saifr, the shift towards digital and web-based methods in the early 2000s was a significant pivot, making content approval quicker and more manageable. However, many of these systems haven’t kept pace with technological advancements, leaving today’s teams in a similar state of inefficiency.

The manual nature of traditional compliance reviews presents numerous challenges. Coordinating complex reviews across different teams without specialized technology is fraught with potential for oversight and miscommunication, the RegTech firm claimed.

The reliance on lengthy email chains and multiple document versions complicates feedback consolidation and can obscure regulatory risks amid the chaos. This inefficiency not only prolongs the review process but also diverts resources from more strategic tasks, all the while heightening regulatory risk.

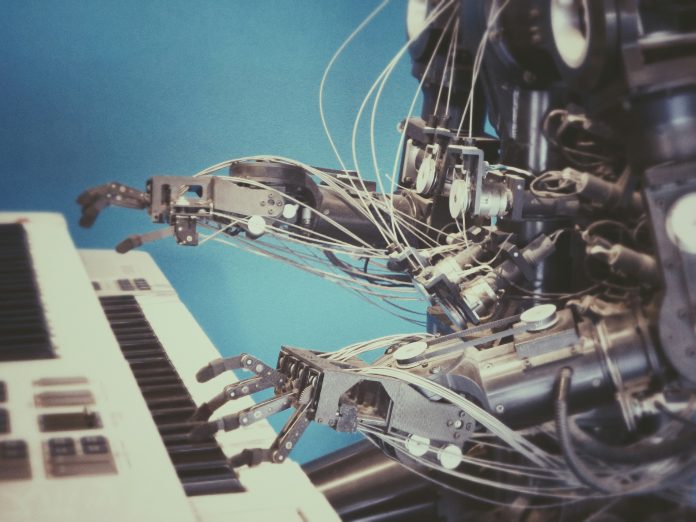

The limitations of manual reviews highlight a pressing need for a new approach. Enter RegTech solutions, which offer a promising path forward. Workflow tools centralize feedback, control versions, and facilitate easier coordination. Moreover, the introduction of AI and large language models into compliance reviews marks a significant leap. AI’s ability to understand and analyze language can swiftly identify potential risks, suggest remedies, and recommend necessary disclosures, thereby streamlining the review process.

This technological advancement not only enhances efficiency but also enables compliance teams to concentrate on areas that demand their expertise. Digitization offers another crucial advantage: data. Analytics can uncover review bottlenecks, reveal patterns, and identify opportunities for improvement, informing strategic decisions and future improvements.

The evolution from paper-based processes to AI-enhanced reviews underscores a transformative period in financial compliance. With regulations becoming more complex, manual reviews are increasingly untenable. Financial institutions now have at their disposal AI-driven solutions that offer insight, efficiency, and the agility to meet regulatory demands head-on.

The journey from pen and paper to AI signifies more than just technological progress—it heralds a new era of compliance review, one where efficiency and intelligence lead the way in safeguarding the financial ecosystem’s integrity.

Read the full post here.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global