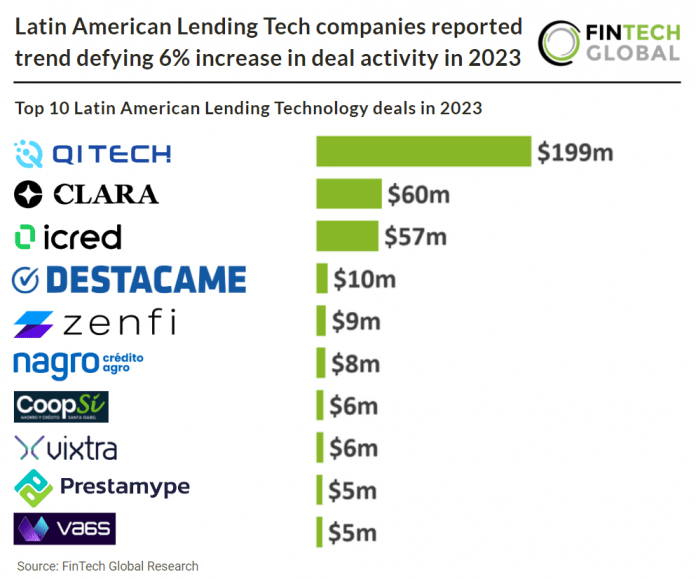

Key Latin American Lending Technology stats in 2023:

• Latin American Lending Technology deal activity reached 76 deals in 2023, a 6% increase from 2022

• Latin American Lending Technology companies raised a combined $491m in 2023, a 57% reduction from the previous year

• Brazil was the most active Latin American Lending Technology country with 20 funding rounds, a 26% share of all deals in the region

In 2023, the Latin American lending technology sector saw a notable surge in deal activity, totalling 76 deals, marking a 6% increase compared to 2022. However, despite this heightened activity, there was a significant decrease in the total funds raised by Latin American lending technology companies which reached $491m, resulting in a notable 57% reduction from the previous year.

QI TECH, which provide a range financial services products such as Lending as a service, had the largest Latin American lending technology deal in 2023 after raising $199m in their Series B funding round from General Atlantic. Essentially, QI Tech allows any company to act like a bank and offer financial products to its customers, employees or suppliers. For example, if a telecom company decides to offer payroll loans to its employees, “the telecom could partner with QI and act like a bank,” Mac Dowell said. Specifically, QI Tech’s offering provides digital registration tools, data validation, credit scoring, digital account opening, wire transfers, Pix, bank slips and credit underwriting for various sectors of the economy. It also powers a variety of use cases, including buy-now pay-later by e-commerce clients or the issuance of home equity and student loans by asset managers and FinTechs.

Brazil was the most active Latin American Lending Technology country with 20 deals, a 26% share of total deals. This was followed closely by Mexico with 16 deals, a 21% share of total deals and Colombia with 15 deals, a 20% share of total deals.

Brazil’s National Monetary Council has implemented tighter regulations on the issuance of private debt securities associated with real estate and agribusiness financing. These securities, including CRAs, CRIs, LCAs, LCIs, and LIGs, have witnessed substantial growth in Brazil recently and offer tax exemptions to investors. However, only a fraction of these securities were found to be fulfilling their intended purpose of initiating new credit operations, prompting the government to anticipate a reduction in issuance volume. Real estate-linked securities like LCI and LIG amount to 460 billion reais ($93.57 billion), while LCAs, tied to agribusiness, also represent the same value. The changes entail stricter rules for eligible underlying assets in new issuances and aim to improve the effectiveness of public policy in supporting these sectors, according to a joint statement by the finance ministry and the central bank.