A total of $679.3m was raised across 31 FinTech funding rounds this week, with CyberTech and PayTech companies leading the charge.

Funding activity picked up pace this week, following last week where just 17 deals were completed.

The CyberTech and PayTech sectors recorded the most activity, closing eight and seven deals, respectively.

While CyberTech dominated the deals this week, they were mostly small deals. Advanced AI security analytics platform Andesite was the largest CyberTech deal of the week, pulling in $15m to support its launch out of stealth mode. This deal was also the tenth biggest of the week.

The other CyberTech deals closed this week were StrikeReady, HUB Cyber Security, PVML, TrojAI, Knostic, Salvador Technologies and Upstream Security.

PayTech had a mixture of big and small deals this week. The largest in the sector was a €100m funding round raised by UK-based Hokodo. The company offers innovative payment solutions designed to streamline B2B transactions across the UK and the EU.

The other six PayTech companies to secure funds this week were Mimo, TransferGo, Smartpay, Bumper, Monkee and KredosAI.

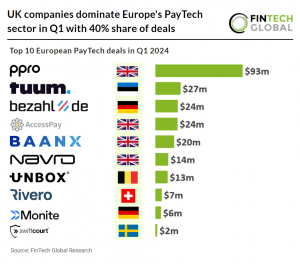

A recent report from FinTech Global found that the UK was home to the lion share of European PayTech deals in Q1 2024. European PayTech deal activity for the quarter reached 27 deals, a 55% drop from Q1 2023. There was also a reduction in the total capital raised, with the companies raising a combined $235m in Q1 2024, a 18% reduction YoY. The UK was home to the highest number of PayTech deals with 11 transactions, a 40% share of deals on the continent.

As for the other FinTech sectors, there were five infrastructure and enterprise software companies (FloQast, Tabs, goFlux, TaxDown and Juicer), three WealthTechs (Bunq, Pactio and Avenir), three InsurTechs (Honey Insurance, Novidea and Laka), three RegTechs (Alethea, Sprinto and Corlytics), and two LendTechs (Parafin and Gilion).

The biggest deal of the week was raised by LendTech Parafin, which raised a $125m warehouse facility aimed at enhancing its capacity to offer capital to SMEs. It was one of four FinTechs to raise over $100m this week. The other three to achieve this milestone were Honey Insurance, Hokodo and FloQast.

In terms of countries, the US recorded the most deals. The country accounted for ten of the deals, and was followed by the UK (6) and Israel (4).

The ten US companies were Parafin, FloQast, Novidea, Alethea, Sprinto, Andesite, StrikeReady, Tabs, Juicer and KredosAI. The UK-based companies were Hokodo, Mimo, Pactio, Bumper, Avenir and Laka), and the Israel-based companies were HUB Cyber Security, PVML, Salvador Technologies and Upstream Security.

It proved to be a very diverse week, with ten other countries each recording a FinTech deal. These were Canada (TrojAI), Brazil (goFlux), Netherlands (Bunq), Spain (TaxDown), Australia (Honey Insurance), Austria (Monkee), Sweden (Gilion), Taiwan (TransferGo), Ireland (Corlytics) and Japan (Smartpay).

Here are this week’s 31 FinTech funding rounds FinTech Global reported on this week.

Embedded FinTech Parafin boosts infrastructure with $125m warehouse facility

Parafin, a full-stack embedded financial services company, has successfully secured a $125m warehouse facility.

The funding comes from Silicon Valley Bank (SVB), a division of First Citizens Bank, and Trinity Capital, strengthening Parafin’s financial capabilities.

The $125m investment is aimed at enhancing Parafin’s capacity to provide capital to small and medium-sized businesses on major platforms like DoorDash and Amazon. SVB, through its national FinTech practice, along with Trinity, supports Parafin’s innovative machine learning-based underwriting model which evaluates sales performance to customize financing offers effectively.

Parafin’s operational model focuses on empowering companies, including marketplaces, vertical SaaS, and payment processors, to launch and manage embedded financial services.

By simplifying complex financial operations such as underwriting and compliance, Parafin allows its partners to provide timely and personalized financing solutions to their sellers, thereby facilitating business growth and scalability in a challenging economic landscape.

Australian FinTech startup, Honey Insurance, raises $108m to enhance smart home safety

Honey Insurance, an Australian home insurance startup, has just announced a significant boost in its journey to redefine the home insurance landscape.

The company, established in 2020, successfully raised $108m in a Series A funding round, prominently led by Gallatin Point Capital, according to a report from Coverager.

At its core, Honey Insurance is committed to providing more than just insurance; it’s about delivering peace of mind through advanced technology. The startup operates through an underwriting relationship with Australian insurer RACQ, offering comprehensive home, renters, and landlord insurance. What sets Honey apart is its unique approach to insurance – customers are equipped with three smart home sensors designed to monitor various home aspects, enabling proactive prevention against potential mishaps.

Honey Insurance’s philosophy is simple yet profound: Australian homeowners deserve better, safer, and more intelligent insurance solutions. By integrating smart technology into its services, the company is not just insuring properties; it’s actively contributing to making homes safer every day. This commitment is underscored by a significant investment of $250 in safety for each customer from the outset, providing smart sensors that can preemptively alert homeowners to potential dangers such as fire, water damage, and theft.

Moreover, Honey Insurance prides itself on offering more than just savings; it’s about delivering value that grows over time. Customers who reduce their risk through the use of smart sensors enjoy lower premiums, with up to an 8% discount annually. This is part of Honey’s broader mission to make insurance a rewarding experience, not just a contractual necessity.

Hokodo secures €100m ($106m) to boost B2B digital payment solutions across Europe

Hokodo, described as Europe’s premier digital payment terms provider, has successfully secured a significant debt facility.

This London-based FinTech company, established in 2018, is at the forefront of offering innovative payment solutions designed to streamline B2B transactions across the UK and the EU.

The company announced a new €100m debt facility, sourced from Viola Credit, a global credit investment manager with a focus on the innovation economy. This strategic financial injection is poised to facilitate over €1.5bn worth of B2B transactions throughout Europe over the next two years. Viola Credit’s support underscores the potential and the pivotal role Hokodo plays in the B2B payment landscape.

At its core, Hokodo provides a vital service by enabling B2B buyers to access deferred payment options, such as paying 30, 60, or 90 days post-purchase or at the end of the following month. This flexibility is further enhanced by Hokodo’s recent introductions of ‘Pay in Instalments’ and ‘Pay Now’ features, offering B2B merchants a comprehensive suite of payment solutions tailored to their needs.

The funding will primarily support the further development and expansion of Hokodo’s Pay Later and Pay Now offerings. These services are crucial for B2B merchants and marketplaces, offering them a competitive edge by providing their customers with flexible payment options at the checkout. Such initiatives are not only aimed at easing cash flow challenges but also at fostering growth and development on both ends of the transaction.

FloQast clinches $100m in Series E funding to bolster accounting tech innovation

FloQast, a provider in the finance and accounting operations platform space, has successfully concluded its Series E funding round.

This latest financial injection amounts to $100m, significantly enhancing the company’s market valuation to a robust $1.6bn. The funding effort was spearheaded by ICONIQ Growth, with substantial contributions from new investors BDT & MSD Partners and WiL (World Innovation Lab). Notably, existing stakeholders like Meritech Capital and Sapphire Ventures reaffirmed their confidence in FloQast’s trajectory by participating once again.

FloQast specialises in refining and automating financial and accounting operations. The platform, designed by accountants for accountants, aims to streamline critical processes within these departments, thereby boosting overall efficiency and accuracy. By leveraging advanced technologies, FloQast provides invaluable insights that help inform and optimise business strategy.

The influx of capital from the Series E round will primarily fund research and development initiatives aimed at enhancing the existing technology stack and introducing innovative solutions to the market. Moreover, the investment will support FloQast’s strategic plans for scaling operations globally, ensuring that more organizations worldwide can benefit from its cutting-edge solutions.

Additional plans include leveraging recent advancements in artificial intelligence to both improve current offerings and develop new ones. This strategy is expected to solidify FloQast’s position as a pivotal entity in the transformation of finance and accounting operations on a global scale.

Bunq’s latest $31m capital raise to fuel U.S. and U.K. market penetration

European digital bank bunq, which recently declared a net profit of $57m in 2023, has reportedly raised $31m in new funding.

The fresh capital comes from the bank’s existing shareholders, according to a report from Finovate.

The $31m infusion is aimed at furthering bunq’s strategic development and ensuring compliance with the Dutch Central Bank’s capital requirements.

Primarily, bunq is in the business of revolutionising the banking experience with a strong emphasis on user-friendly digital interfaces and innovative financial services. The bank’s interest income has notably tripled in 2023, soaring from over €41m to more than €127m. This substantial growth in revenue underpins bunq’s profitable trajectory not just for the past year but also for its future prospects.

The newly acquired funds are designated for significant expansion initiatives. Specifically, bunq plans to enhance its market presence in the U.K. and to make a strategic entry into the U.S. market. The bank is preparing to reapply for a banking license in the U.S. through the Office of the Comptroller of the Currency (OCC), after a previous application was withdrawn due to regulatory challenges with Dutch and U.S. authorities.

Novidea secures $30m boost from HarbourVest to revolutionise InsurTech

Novidea has recently announced a significant development in its growth trajectory, securing an additional $30m in funding from HarbourVest Partners.

This injection of capital raises Novidea’s total Series C funding to $80m, with the overall funding reaching the $120m mark.

The recent funding is earmarked for several strategic initiatives aimed at bolstering Novidea’s position in the market. Primarily, the funds will be utilized for organic expansion into new territories to cater to the increasing demand for Novidea’s solutions. Additionally, the investment will facilitate accelerated product innovation and support Novidea’s inorganic growth strategy through strategic acquisitions.

HarbourVest Partners, through its Managing Director, Corentin du Roy, expressed enthusiasm about the partnership with Novidea. Du Roy highlighted the operational efficiencies delivered by Novidea’s software solution for brokers, which aligns with HarbourVest’s long-standing investment focus on the insurance brokerage sector. This partnership is poised to aid Novidea in scaling its operations internationally.

The demand for digital transformation within the insurance sector cannot be overstated, with technology spending expected to surge by more than 25% by 2026. Novidea is at the forefront of addressing critical challenges faced by the industry, including enhancing data quality, improving digital customer experiences, and streamlining insurance workforce processes. An insightful report released by Novidea earlier this year revealed that 75% of global insurance businesses are planning to overhaul their core technology within the next two years, highlighting a significant opportunity for InsurTech innovations.

Novidea’s cloud-native software platform is designed to enhance operational efficiency and resilience for insurance agents, brokers, MGAs, wholesalers, and specialty insurers. The platform allows for the automation of repetitive processes and provides a superior customer experience. In recent years, Novidea has expanded its global presence, including launches in Southeast Asia and enhancements to its senior leadership team.

The platform’s open API architecture facilitates the modernization of the entire insurance distribution lifecycle, enabling insurers to manage the customer journey comprehensively. Novidea’s platform is celebrated for its operational efficiency and the seamless digital experience it offers to team members and customers alike. With its global reach extending to more than 100 customers across 22 countries, Novidea continues to be recognized for its technological innovation and contribution to the insurance industry.

Alethea secures $20m in Series B to combat digital disinformation threats

Alethea, a pioneer in the field of disinformation detection and mitigation, has successfully closed a $20m Series B funding round.

The round was prominently led by GV, with significant contributions from Ballistic Ventures, which also spearheaded Alethea’s Series A round in 2022, and Hakluyt Capital, known for investing in high-potential, internationally ambitious companies.

This latest infusion of capital underscores the confidence investors have in Alethea’s innovative technology and its potential to significantly impact the creation of a secure digital landscape. To date, Alethea has raised a total of $34m.

Alethea is at the forefront of developing cutting-edge solutions that detect and mitigate disinformation and misinformation. The company’s flagship product, Artemis, provides early warnings of security risks, including cyber attacks, disinformation campaigns, and foreign influence operations.

Utilising AI, Artemis scans a wide array of data points across numerous platforms and languages, alerting organisations to potential threats and enabling proactive management of vulnerabilities.

The funds from the Series B round will be employed to expand Alethea’s sales and marketing initiatives, aiming to extend the reach of Artemis to all organisations with an online presence. Furthermore, the investment will support the growth of Alethea’s team and the enhancement of Artemis’ features to better meet the evolving needs of their customers.

Additional information about the company highlights Alethea’s commitment to using AI for social good by addressing the increasingly complex challenges of disinformation in the digital age. Alethea’s approach not only protects organisations but also fortifies the integrity of digital democracies.

Sprinto secures $20m in Series B to enhance RegTech capabilities

Sprinto, a prominent player in the RegTech industry, has successfully closed a $20m Series B funding round. The investment was led by notable names including Accel, Elevation Capital, and Blume Ventures, positioning Sprinto for significant technological advancements.

The company specialises in intelligent automation and artificial intelligence (AI) to aid businesses in managing risk and compliance more efficiently. By implementing Sprinto’s solutions, companies can achieve higher transparency, control, and confidence, which are essential for maintaining trust and compliance in today’s complex business environments.

With the newly acquired funds, Sprinto plans to double down on their research and development efforts focused on AI and intelligent automation. The primary aim is to enhance their core risk and compliance modules, particularly in areas of third-party risk management and internal risk controls, transforming these elements into robust standalone products.

This strategic infusion of capital will also support Sprinto’s mission to empower businesses from startups to mature enterprises to implement and streamline complex compliance and trust-related processes. As businesses increasingly require rigorous validation of security and data privacy practices, Sprinto’s enhanced solutions are poised to significantly reduce business engagement friction and foster proactive risk management.

Mimo secures £15.5M (19.3m) to enhance financial management for SMBs

Mimo, the newly launched platform that simplifies global payments, cash flow, and financial management for SMBs and accountants, has successfully raised £15.5m.

This significant funding round was led by Northzone and included participation from Cocoa Ventures, Seedcamp, Upfin VC, and an asset-backed facility arranged by Fost. Additionally, various angel investors from leading companies such as Stripe, GoCardless, Wayflyer, and Anyfin have also contributed.

The company, which processes several million GBP in transactions monthly, is set to revolutionise how small and medium businesses (SMBs) manage their finances. Mimo provides a comprehensive suite of financial tools designed to consolidate various financial management functions into a single, user-friendly platform. This integration allows SMBs and finance professionals to seamlessly manage money flows, significantly simplifying B2B payments and improving cash flow management.

With the newly acquired £15.5m, Mimo plans to expand its B2B payments solution tailored for SMBs and increase its workforce. The funding will also support the further development of their financial management tools, which are crucial for businesses that deal with extensive invoicing and operate across multiple currencies.

Andesite AI secures $15.25m to bolster cybersecurity with advanced AI analytics

Andesite AI, a McLean, VA-based firm, emerged from stealth mode with a substantial $15.25m in initial funding.

According to FINSMES, the company is dedicated to enhancing the capabilities of cybersecurity teams overwhelmed by sophisticated threats.

The funding round was co-led by Red Cell Partners and General Catalyst, marking a robust start for Andesite AI under the aegis of CEO Brian Carbaugh. The capital infusion underscores the confidence investors have in Andesite’s innovative approach to cybersecurity.

Andesite AI has developed an advanced AI security analytics platform that serves both private and public sector cyber analysts. This platform leverages artificial intelligence to analyze decentralized data sets extensively. The objective is to aid cyber defenders in swiftly identifying threats and vulnerabilities, thus enhancing their ability to prioritize, allocate resources, and respond to threats effectively. The platform is designed to improve overall security posture while also aiming to reduce operational costs.

The newly acquired funds will be used to further develop their AI-driven analytics capabilities and expand their reach within the cybersecurity industry. This strategic investment will support Andesite’s mission to empower cybersecurity professionals with better tools to tackle advanced persistent threats (APTs).

FinTech startup Pactio raises $14m from EQT Ventures to enhance private capital workflows

Pactio, a next-generation FinTech platform, has successfully completed a $14m Series A funding round.

The round was spearheaded by EQT Ventures, with substantial contributions from high-profile private equity insiders and technology angels.

The investors participating in this oversubscribed round include notable figures such as former Stripe Europe CEO Matt Henderson and Volt founder Tom Greenwood. They join a prestigious group of early backers, among whom are Monzo co-founder Tom Blomfield and GoCardless co-founder Matt Robinson, enhancing Pactio’s robust support system.

Pactio is carving out a niche in the expansive private capital market, which is projected to grow to $29tn in assets under management (AUM) by 2040. The company’s mission is to build the critical infrastructure missing in today’s fragmented market landscape, focusing on the early stages of deal creation. Their platform integrates advanced technology, including artificial intelligence (AI), to streamline the entire investment lifecycle, from deal sourcing to exit.

The newly acquired funds will be utilised to broaden the capabilities of Pactio’s digital architecture. The focus will be on extending its ‘single source of truth’ functionality across the investment lifecycle and enhancing its AI features. This strategic expansion aims to address the increasing complexity and diversification of investment strategies, from private credit to secondaries.

StrikeReady secures $12m in Series A for AI-driven cyber Innovation

StrikeReady, an innovative early-stage startup based in Palo Alto, California, has successfully raised $12m in a Series A funding round.

According to Security Week, founded with the vision to modernize cybersecurity command centers, the company is pioneering the integration of artificial intelligence (AI) to enhance security operations centers (SOCs). The funding was led by 33N Ventures, with significant contributions from Hitachi Ventures, Monta Vista Capital, and several influential cybersecurity executives.

At its core, StrikeReady is committed to redefining how SOCs operate. By leveraging AI technologies, the company aims to simplify the complexities prevalent in SOC environments. This includes streamlining and automating routine tasks, which are often time-consuming and prone to error. StrikeReady’s approach involves moving beyond traditional AI and large language model (LLM) applications. Instead, it has developed a proprietary large action model (LAM) that proactively takes actions across the technology stack based on user prompts, marking a significant leap in the field of cybersecurity.

The company plans to utilize the new funding to further its mission of transforming cloud-based security operations. StrikeReady’s innovative security operations and management platform is designed to assist security teams by integrating and operationalizing a variety of security products. This unified approach not only enhances the defense against threats but also ensures a swift response to incidents. By combining AI, data, and automation, StrikeReady addresses some of the most pressing challenges in modernizing security operations: understanding the capabilities of diverse cybersecurity products, mitigating the cybersecurity talent shortage, and improving collaboration among teams.

Swedish FinTech Gilion bags €10m ($10.6m) to revolutionise growth-stage financing

Gilion, the Swedish FinTech firm formerly known as Ark Capital, has successfully closed a €10m equity funding round.

According to Tech EU, the recent funding round drew a mix of veteran and new investors, including notable figures such as Annika Falkengren, former CEO at SEB and Managing Partner at Lombard Odier. New investors in this round included Oscar Werner, the newly appointed CEO of Gilion, along with Göran and Henrik Garvner of SignUp Software, and Andrew Konopelski, a former head at EQT Credit.

Gilion specialises in providing innovative financial solutions to growth-stage companies throughout Europe. Utilising an advanced analytics platform, the company offers customised deal terms for Growth Loans. These terms are uniquely tailored using comprehensive data analysis and machine learning predictions, enabling terms like two-year interest-only periods and a six-year repayment window.

The capital from this latest funding round will be utilised to expand Gilion’s loan offerings and further develop its technology platform. This expansion is part of Gilion’s broader strategy to provide more diverse and flexible financing options to technology companies, especially in the current European venture capital ‘drought’.

This significant investment comes after Gilion reported a 400% increase in revenue year-over-year and an 800% rise in client engagements. Such growth highlights the increasing demand for alternative financing models in the technology sector, which Gilion is well-positioned to meet.

Taiwania Capital invests $10m in TransferGo to fuel Asia-Pacific growth

TransferGo, a FinTech leader known for empowering worldwide mobility, has secured a $10m funding boost from Taiwania Capital.

This strategic investment, supported by both the public and private sectors of Taiwan, is poised to accelerate TransferGo’s presence in the Asia-Pacific market.

The company secured the $10m investment from Taiwania Capital, a prominent venture capital firm in Taiwan. This new capital injection marks a pivotal moment for TransferGo, following a valuation that has doubled since September 2021, underpinned by a 50% revenue surge and recent profitability achievements in 2023.

TransferGo operates as a transformative force in the FinTech sector, providing rapid, around-the-clock transaction services across 160 countries. With a commitment to instant delivery for nearly 90% of its transactions and maintaining an 80% market-leading gross margin, TransferGo ensures superior service accessibility and reliability. The company’s dedication to customer satisfaction is also reflected in its high TrustPilot score of 4.7 out of 5.

The newly acquired funds are earmarked for several ambitious projects. Primarily, the investment will expedite TransferGo’s growth initiatives in the Asia-Pacific region and facilitate the rollout of innovative product offerings. These enhancements will aim to provide fairer, more inclusive financial services globally, broadening the company’s product development and customer value propositions.

Additional insights into the company’s strategy reveal an expansion of its workforce by over 30% and a reinforcement of its leadership team with top-tier global talent, despite challenging market conditions in the previous year. This strategic bolstering of resources underscores TransferGo’s resilience and commitment to scaling operations internationally.

HUB Cyber Security nabs $8m in strategic financing to propel growth

HUB Cyber Security, known simply as HUB, has recently announced the successful acquisition of $8m in financing.

The funding, acquired through a straight debt arrangement, marks a significant milestone in the company’s journey. HUB’s leadership has carefully selected this financing route to enhance working capital, meet creditor obligations, and support the company’s ambitious growth plans.

HUB Cyber Security, established in 2017 by veterans of the Israeli Defense Forces’ elite intelligence units, is at the forefront of the cybersecurity industry. The company offers cutting-edge confidential computing cybersecurity solutions and services. With a focus on protecting sensitive commercial and government information, HUB has introduced advanced encrypted computing solutions designed to prevent hostile hardware-level intrusions. Additionally, the company has developed a range of innovative data theft prevention solutions. Operating in over 30 countries, HUB provides a wide array of cybersecurity computing appliances and services worldwide.

The newly acquired funds will be strategically utilised to fuel HUB’s growth trajectory, enhance working capital, and ensure the company’s commitments to its creditors are met seamlessly. This financing is part of HUB’s ongoing efforts to maintain a robust financial foundation while aggressively pursuing expansion opportunities.

PVML raises $8m to boost secure AI-powered enterprise data access

Smartpay leads the way in Japanese FinTech with a $7m pre-Series A

Smartpay, a trailblazer in the Japanese FinTech sector, has successfully completed a $7m Pre-Series A funding round, led by SMBCVC and Angel Bridge VC, drawing significant attention from both Japanese and international investors.

The company is at the forefront of digital embedded finance in Japan, being the first in the country to offer no interest, no late fees, and free of charge installments at the point of purchase. It’s revolutionising the way Japanese consumers shop online, offering a seamless checkout process that completes in under 10 seconds without the need for physical store visits for installment payments.

With the introduction of “Smartpay Bank Direct,” Smartpay has filled a significant gap in the Japanese market, catering to the 70% of consumers who prefer bank account payments over credit cards. This service, a first of its kind in Japan, enables direct bank account payments for online purchases, providing a convenient and secure alternative to credit card payments.

The funds from this latest investment round will be channeled into further innovation and expansion of Smartpay’s services. This includes the launch of fully digital in-store payments with free automated installments, aimed at simplifying the payment process for consumers and reducing fraud risk for merchants. The initiative will make Smartpay accessible to an even larger audience, with the goal of reaching 2 million consumers and 30,000 merchants within the next few years.

Smartpay is not just enhancing the consumer payment experience but also supporting Japanese merchants in growing their ecommerce revenue. Merchants integrating Smartpay have seen a significant increase in average order values and a reduction in cart abandonment rates. The company’s efforts in simplifying the checkout process and providing free digital finance options at the point of purchase have addressed critical pain points for both consumers and merchants.

Tabs secures $7m seed funding to enhance AI-driven accounts receivable platform

Tabs, an AI-powered accounts receivable platform for B2B businesses, has successfully closed a $7m seed funding round.

The investment was led by Lightspeed Venture Partners, with additional contributions from previous investor Primary Ventures. This recent financial injection has increased the total capital raised by Tabs to $12m.

Located in New York, Tabs leverages artificial intelligence to transform the accounts receivable (AR) processes for companies. By automating the extraction and management of contract-related data, Tabs helps businesses streamline invoicing and payment collections. This automation is particularly crucial in today’s economic environment where efficient cash flow management is a significant challenge for many companies.

The funds from this round will be utilised to further develop Tabs’ proprietary technology and expand its market reach. The goal is to mitigate the risks associated with B2B financial operations and enhance the efficiency of cash flow systems, which is increasingly important as businesses seek flexibility and speed in their billing processes.

In addition to the funding news, Tabs has demonstrated substantial impact on its clients’ operational efficiencies. Companies using Tabs, such as Findigs, Pinata, and Inspiren, have reported a 40% reduction in time required to collect payments. This efficiency gain is attributed to the reduction of manual tasks in the billing process and the utilisation of dynamic billing capabilities that adjust to real-time market changes and customer usage.

goFlux raises $6m to expand digital freight services across the Americas

goFlux, a leader in the digital and financial integration of agricultural freight in Brazil, has successfully completed a Series A funding round, raising $6m.

This latest investment round, pivotal in scaling the company’s operations, was spearheaded by Capria Ventures, known for its focus on Generative AI applications in the Global South. The round also welcomed contributions from a mix of follow-on and new international investors including SP Ventures, The Yield Lab Latam, Blue Impact Global, Reflect Ventures, Arrebol Capital, and other notable names from the United States and Switzerland.

With a robust platform that integrates financial services into freight logistics, goFlux has set a benchmark in the sector. Their services range from a dynamic contracting platform to innovative financial products such as the goFlux NaConta for receivables anticipation.

With the fresh capital infusion, goFlux is poised to enhance its platform’s functionalities, ramp up its sales force, and improve overall security and compliance frameworks. A significant portion of the funding will also be funnelled into artificial intelligence capabilities, particularly for freight prediction, which will refine strategic planning and decision-making processes for their clients.

Furthermore, goFlux plans to extend its geographical footprint from Brazil to other key markets including Argentina, Paraguay, Uruguay, Mexico, and the United States. This expansion is aligned with their strategy to address the broader needs of the logistics sector across the Americas, especially in industries like food, pulp and paper, civil construction, and steel.

The funding will also facilitate the launch of goFlux View, an advanced predictive intelligence solution that offers a futuristic outlook on freight trends. This tool is expected to leverage Generative AI to provide comprehensive, easy-to-interpret analytics for complex data sets, thereby enhancing operational efficiencies for users.

TrojAI’s $5.75m raise to bolster enterprise AI protection

TrojAI, an enterprise AI security firm, has unveiled a significant boost to its operations with a fresh injection of $5.75m in seed funding.

The company, known for its innovative solutions in safeguarding artificial intelligence (AI) applications across businesses, is marking a new chapter in its journey with this financial milestone.

The recent capital infusion was led by the existing investor, Flying Fish, alongside continued support from Build Ventures and Techstars. Notably, the round also saw the entrance of new investors such as Alteryx Ventures and Flybridge Capital Partners. This diverse group of backers underscores the industry’s recognition of TrojAI’s vital role in the burgeoning AI security space.

Delving into what TrojAI does, it’s clear that the company is not just another player in the tech field. It has carved a niche for itself by offering a comprehensive AI security platform tailored for businesses. This platform is designed to assess and mitigate risks associated with AI models before their deployment and ensure their safety once operational. The advent of AI in the enterprise sector brings with it a plethora of opportunities but also significant risks, making TrojAI’s solutions more critical than ever.

The proceeds from this funding round are earmarked for several strategic areas. Primarily, the focus will be on further product development, bolstering sales and marketing efforts, and enhancing customer support. Additionally, TrojAI plans to broaden its geographical footprint by setting up a new office in Boston, Massachusetts, signifying its commitment to tapping into the global demand for secure AI solutions.

In a strategic move to strengthen its leadership team, TrojAI has appointed Lee Weiner as the company’s new CEO. Weiner, with his impressive 25-year tenure in the B2B software industry and a robust background in cybersecurity, is poised to drive the company’s growth and expansion. His experience is expected to be invaluable as TrojAI embarks on this next phase of scaling and innovation.

TaxDown secures €5m ($5.32m) investment to innovate tax filing in Spain and Latin America

TaxDown, a Madrid-based startup, has recently concluded a significant funding round, securing €5m to propel its growth.

The investment round was led by prominent funds including Base10 and JME Ventures, both known for their strategic investments across the United States and Latin America, according to a report from EU Startups. This round also welcomed participation from Abac Nest and the debut involvement of 4Founders Capital, a firm led by notable industry veterans including Javier Pérez Tenessa, the former CEO of eDreams.

Since its inception in 2019, TaxDown has rapidly emerged as the leading platform for tax filing in Spain, boasting the highest number of tax returns processed annually. The company has successfully managed over €750m in taxes for its two million users, saving them in excess of €100m. TaxDown’s platform is designed to simplify and streamline tax procedures, making it the go-to solution for taxpayers seeking reliable and efficient tax filing services.

The newly acquired funds are earmarked for further development and expansion of TaxDown’s capabilities, particularly to enhance its technological offering and expand its market reach in both Spain and Mexico. The focus is on continuing to leverage advanced technology to improve user experience and expand its customer base, aiming to increase its users to three million.

Juicer sizzles with $5.3m seed funding to revolutionise restaurant pricing

Juicer, a San Fransicsco-based firm that offers restaurant revenue management and pricing solutions, has successfully raised $5.3m in seed funding.

According to FinSMES, The investment round saw leadership from York IE, alongside contributions from Augment Ventures and Mudita Venture Partners. A noteworthy cohort of operators and investors also backed Juicer, including personalities such as Athletic Greens President Kat Cole, Kayak co-founder Paul English, and 16 Handles founder Solomon Choi, among others. York IE’s Vice President of Investments & Strategy, Marshall Everson, will also be taking a seat on Juicer’s board following this funding round.

The company is at the forefront of introducing innovative solutions for data-driven restaurant revenue management and competitive intelligence. Leveraging the latest in AI and machine learning algorithms, Juicer empowers restaurants to optimise their pricing strategies. This enables consumers to enjoy transparent, predictable pricing, particularly benefiting from lower prices during off-peak hours.

Juicer has earmarked the freshly secured funds for accelerating the development of its sophisticated tools and data resources for restaurant operators. This initiative aims to significantly enhance operational efficiencies and consumer experiences across the restaurant sector.

Beyond its immediate offerings, Juicer is committed to further innovating its technology stack. JUICER Pricing and JUICER Compete stand out as flagship solutions. The former is an algorithmic price optimisation engine, while the latter provides AI-driven competitive intelligence, enabling national brands and their franchisees to benchmark their menu prices against local competitors and assess the value of bundles and meals in varying markets.

Knostic secures $3.3m to enhance GenAI access control frameworks

Knostic, a trailblazer in generative AI (GenAI) security, announced today that it has successfully closed a $3.3m pre-seed funding round.

This significant financial injection marks a robust entry for the company as it emerges from stealth mode and positions itself as a leader in need-to-know access controls for GenAI applications.

The funding round saw contributions from a diverse group of venture capital firms and angel investors including Shield Capital, Pitango First, DNX Ventures, and Seedcamp. Prominent industry figures such as Kevin Mahaffey of Lookout, David Cross of Rain Capital, and several others also backed the venture, underscoring the market’s confidence in Knostic’s innovative approach.

Knostic is setting new standards in data security by providing targeted access controls that align with organizational policies. This approach is crucial for businesses utilising large language models (LLMs) like Microsoft Copilot and Glean, which integrate institutional knowledge to generate ChatGPT-like interactions without compromising sensitive information such as sales data or M&A details.

The newly acquired funds will be instrumental in advancing Knostic’s technology which focuses on mitigating risks associated with GenAI tools. By refining their proprietary access control mechanisms, Knostic aims to equip enterprises with the necessary tools to safely harness the power of LLMs while protecting their most critical data.

In addition to enhancing their technology, Knostic plans to expand their reach within the enterprise sector, particularly focusing on organizations at the early stages of GenAI adoption. Their solutions help identify and rectify potential need-to-know violations, facilitating a safer and more compliant use of GenAI applications across various industries.

Automotive FinTech Bumper accelerates with £2m ($2.49m) investment

Avenir secures $530k to revolutionise WealthTech with cutting-edge personalisation

Avenir, a UK-based WealthTech firm, has successfully secured $530,000 in pre-seed funding.

This notable achievement comes just three months after the company graduated from the ABN AMRO + Techstars Future of Finance accelerator program, marking a significant milestone in its journey.

The funding round was led by an impressive roster of investors, including SFC Capital, Techstars, and several prominent angel investors. These angels bring a wealth of experience from leading financial institutions such as FNZ, JP Morgan, and Morgan Stanley, highlighting the industry’s strong belief in Avenir’s potential and strategic direction.

At its core, Avenir is pioneering the WealthTech sector by providing wealth managers and financial advisors with an advanced suite of tools. Utilising cutting-edge technology and artificial intelligence (AI), Avenir offers personalised wealth management solutions at scale. This approach not only revolutionises traditional practices but also ensures greater efficiency, personalisation, and impact within the wealth management landscape.

The newly acquired funds are earmarked for further innovation and disruption within the WealthTech industry. Avenir’s CEO and Co-founder, Jeremy Bensoussan, expressed the company’s ambition to transform the £1.2 trillion assets under management in the UK’s wealth management sector. By continuing to innovate and provide exceptional value to financial professionals and their clients, Avenir aims to redefine the standards of wealth management

Austrian FinTech start-up Monkee secures seven-figure investment

Austrian FinTech start-up, Monkee, has recently secured a significant seven-figure investment, marking a new milestone in its journey to revolutionise personal finance management, according to a report from tech.eu.

Monkee is at the forefront of offering a “Save Now, Buy Later” model, aiming to provide a responsible alternative to the widely used “Buy Now, Pay Later” systems.

This recent funding round was supported by both new and existing investors. With a user base already exceeding 150,000 account holders, thanks to a partnership with Vereinigte Volksbank Raiffeisenbank eG (VVRB), Monkee is set on a rapid expansion path.

At its core, Monkee is dedicated to changing how people think about and manage their finances. The app encourages users to save with purpose, offering a gamified experience that makes saving money both fun and rewarding. Collaborating with over 500 commerce partners, Monkee offers attractive cashback opportunities, helping users achieve their financial goals more quickly. With more than 300,000 app downloads and savings goals surpassing €250m, it’s clear that Monkee is addressing a vital need for a shift in personal finance paradigms.

The new infusion of capital will be used to fuel further growth and expansion. This includes bolstering Monkee’s product offerings, particularly in the realm of long-term savings, and enhancing customer trust through the partnership with a reputable banking partner like VVRB.

Corlytics secures investment from Verdane to spearhead RegTech innovation

Corlytics has recently announced a major investment from Verdane, a specialist growth investor known for creating category leaders.

Verdane, boasting €6.9bn in committed capital, has taken a majority equity stake in Corlytics, marking a strategic move to bolster the RegTech company’s growth trajectory.

The investment has been facilitated through Verdane’s €1.1bn Edda III Fund, designating Corlytics as a pivotal player in the RegTech industry and a significant consolidator within the sector. This collaboration aims to harness Verdane’s two decades of experience in partnering with European software companies and its deep RegTech expertise to propel Corlytics’ expansion.

Corlytics operates at the forefront of regulatory technology, providing an integrated solution for financial services firms to navigate the complex landscape of regulatory demands. The company’s unique platform offers comprehensive coverage from regulatory horizon scanning and policy management to attestation, enhanced by generative AI technologies and direct links to international regulators. Corlytics stands out as the sole provider of a complete end-to-end compliance solution that anticipates and meets evolving regulatory requirements.

The company plans to utilise this new round of funding to continue its significant investment in innovation, particularly in the development of next-generation AI and machine learning technologies. These advancements aim to revolutionise how firms manage regulatory content, moving beyond traditional approaches to a more intelligent and integrated strategy.

Corlytics has witnessed remarkable growth since 2020, driven by its core regulatory compliance products, and has doubled its customer base during this period. The company’s aggressive growth strategy includes the acquisition of ING SparQ and Clausematch in 2023, further solidifying its position as a comprehensive platform for managing regulatory risk globally.

John Byrne, founder and CEO of Corlytics, expressed enthusiasm about the partnership with Verdane, highlighting the potential for accelerated growth and further sector consolidation. Nils Vold, Partner at Verdane, echoed this sentiment, underscoring the strategic nature of the investment and Verdane’s commitment to supporting Corlytics’ global leadership in the RegTech field.

In conjunction with this investment, Corlytics is pleased to announce an expansion of its board of directors, welcoming Simon Russell as Chair to bring nearly three decades of software advisory expertise to the company’s strategic planning and growth.

Salvador Technologies garners financial backing from Deutsche Telekom

KredosAI secures new investment to revolutionize payment outcomes with AI

Cisco Investments backs Upstream Security, enhancing IoT and vehicle cybersecurity solutions

Embedded InsurTech Laka gains significant funding from Achmea Innovation Fund

Achmea Innovation Fund has recently placed a significant investment in Laka, a pioneering InsurTech startup based in London.

Founded in 2017, Laka is distinguished for its innovative insurance solutions specifically tailored to e-bike riders and cyclists across multiple European nations including the Netherlands.

The investment amount, though undisclosed, marks a strategic enhancement to Achmea’s portfolio in smart and sustainable mobility. It aligns seamlessly with the company’s ongoing pursuits in innovative mobility solutions.

Laka, which presently insures over €140m in bicycles and e-bikes, is set to leverage this financial injection to deepen its market penetration and enhance its product offerings.

Laka operates on a unique collective-driven insurance model. This model pools cyclists who share the risk of insuring their bicycles, with premiums adjusted monthly based on the actual claims made, ensuring costs are kept fair and proportional to the risks incurred. This approach not only promotes a community among cyclists but also aligns costs directly with the benefits they receive.

The funds from this investment will be utilised to expand Laka’s footprint across Europe, focusing on enhancing their embedded insurance products. This includes partnerships with major retailers and brands like Gazelle, Urban Arrow, Decathlon, and Riese & Müller, integrating insurance directly at the point of sale, which simplifies the process for consumers.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global