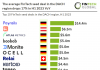

Combined Brazilian banking app downloads reached a total of 860m since January 2017 with incumbent banks having a slight edge over challengers with 441m installs, a 51% share. Neo banks saw a total of 418m, a 49% share over the same period. Incumbent banks saw a 16% increase in downloads from March 2023 – March 2024 whilst neo banks saw a 26% increase over the same period. Based on this it is likely that neobanks will outpace incumbent banks’ total downloads mid-way through 2025. Overall total app downloads in March 2023 – March 2024 reached 146m downloads, a 22% decrease from the previous year.

Nubank, the largest FinTech bank in Latin America, has the most combined downloads of any bank in Brazil. Nubank currently has 136m downloads and is on track to reach 165m by April 2025. The company added 19.3 million new customers, bringing its total to nearly 94m across Brazil, Mexico, and Colombia. This increase, representing a 50% year-over-year growth, has notably boosted its Brazilian customer count to 87.m, covering over half of the country’s adult population and ranking it as Brazil’s fourth-largest financial institution in terms of customers. Financially, Nubank’s revenue surged by 57% in the fourth quarter of 2023, totalling $2.4bn. For the entire year, the company reported $8bn in revenue. This robust performance allowed Nubank to achieve a net profit of $1bn and an adjusted net profit of $1.2bn for 2023, a dramatic improvement from a $9.1m net loss in 2022. These results align with CEO David Vélez’s previous statements about the company’s profit goals.