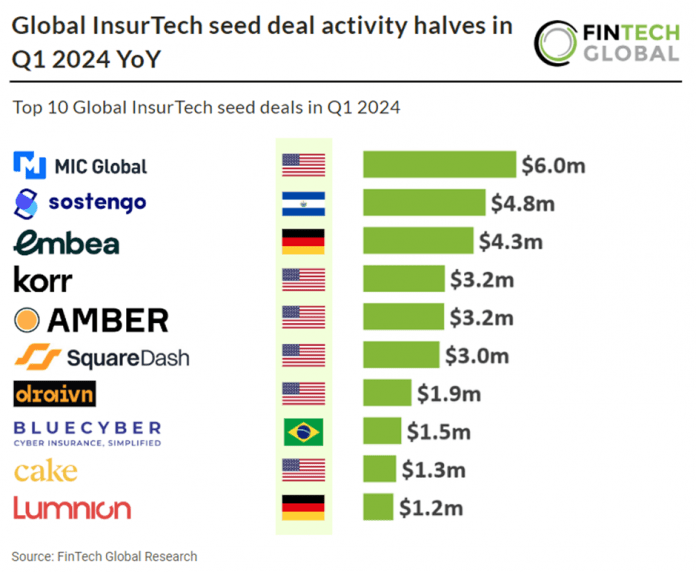

Key Global InsurTech seed deal investment stats in Q1 2024:

• InsurTech seed deal activity reached 25 deals in Q1 2024, a 52% reduction from Q1 2023

• InsurTech seed companies raised a combined $33.8m in the first three months of 2023, a 27% decrease YoY

• Only eight unique countries were home to seed deal funding rounds in Q1 2024

In the first quarter of 2024, the global InsurTech sector saw a notable decline in seed deal activity, with only 25 deals recorded, marking a 52% reduction compared to the same period in 2023. Additionally, InsurTech seed companies collectively raised $33.8m during the opening quarter of the year, reflecting a 27% decrease YoY.

MIC Global, an embedded micro insurance company, had the largest global InsurTech seed deal in Q1 2024, after raising $6m in their seed round, led by Launchpad Capital. The strategic investment will bolster the company’s capacity to drive innovation and extend its technology-driven insurance platform, broadening its reach to diverse audiences across developed and emerging markets. MIC Global specializes in delivering customized microinsurance solutions for underserved individuals and small to medium enterprises. With operations spanning approximately 17 countries, the company’s coverage encompasses protection against income loss, everyday risks, and identity theft, catering to the needs of marginalized communities and businesses. Jamie Crystal, co-founder and CEO of MIC Global, said “We are pleased to welcome Launchpad Capital, GreenlightRe, and Ironsides Partners as strategic investors and partners to help fuel MIC Global’s continued growth as the preeminent embedded micro insurance provider. MIC is reimagining how insurance is bought and sold, and the additional capital will support the company’s global growth strategy with a focus on expanding our technology-enabled insurance platform to provide protection to people in both developed and emerging countries through our banking, mobile phone, digital/technology, insurance, and InsurTech partners.”

Only eight unique countries recorded seed deals, globally in Q1 2024 and the US led the way with 16 deals, a 56% share of all funding rounds in Q1 2024. Germany was the second most active InsurTech seed country with three transactions, a 12% share of deals. The remaining had one deal each.