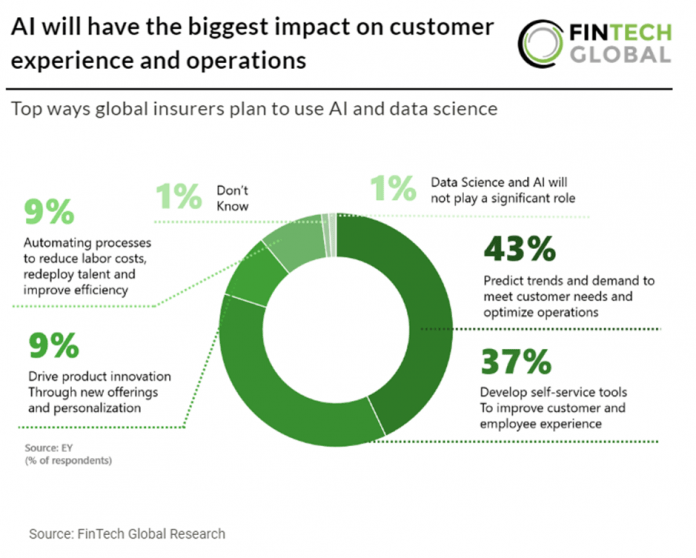

A recent report from EY looked at insurers’ focus on leveraging AI and data science in several key areas. Insurers know the potential benefits of AI are substantial as only 1% of respondents have said that data science and AI will not play a significant role. The main areas Insurers have identified data science and AI playing a significant role are operational efficiencies, cost reduction, improved customer experiences, and advanced predictive capabilities. The report also noted that it is crucial to recognize that the associated risks, whether financial or otherwise, are equally significant and interconnected. For instance, while AI like GenAI offers novel opportunities to personalize product offerings and customer communications, the heightened customization also amplifies the risks of privacy breaches, suitability issues, and discrimination violations.

The responses show insurers exercise caution when considering the adoption of AI for customer-facing operations, largely due to the lack of regulatory clarity in the field. Despite this hesitancy, the potential benefits of utilizing AI to enhance the value proposition and improve customer experiences, such as offering virtual “white-glove” services to high-net-worth individuals and key commercial customers, cannot be ignored.

Looking ahead, more ambitious applications of AI are expected to emerge, aiming to narrow the protection gap. For instance, leveraging data streams from satellites and sensors will enable the creation of detailed infrastructure models and digital twins, empowering communities to conduct ongoing simulations for more robust and precise protections.