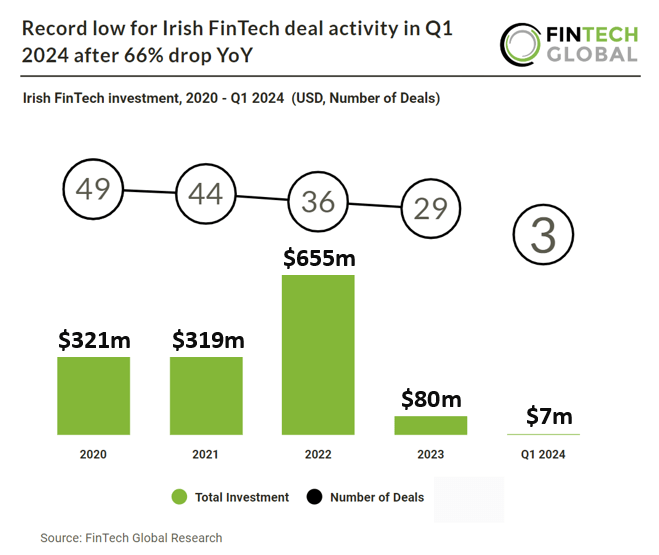

Key Irish FinTech investment stats in Q1 2024:

· Irish FinTech deal activity reached three deals in Q1 2024, a 66% reduction from Q1 2023

· Irish FinTech companies raised a combined $7m in the first quarter of 2024, a 77% drop from Q1 2023

· The three Irish FinTech deals in Q1 2024 belonged to the InsurTech, PayTech and WealthTech sector

In the first quarter of 2024, the Irish FinTech sector experienced a significant downturn in both deal activity and fundraising. There were only three deals made during this period, which represents a 66% decline compared to the first quarter of 2023. Additionally, the total capital raised by Irish FinTech companies amounted to $7m, marking a 77% reduction from the funds secured in the same quarter the previous year. This substantial decrease highlights a cooling in investment enthusiasm within the Irish FinTech landscape.

Quantmatix, a firm that assists professional investors in evaluating stock and asset selection, had the largest Irish FinTech deal in Q1 2024 after raising $2.9m in their seed round from Angel investors: Halo Business Angel Network (Hban) and Enterprise Ireland. Quantmatix has developed what cofounder Liam Boggan describes as “market GPS”, to help traders and investors to inform and time investment decisions, predicting prices and market performance across a range of asset classes that includes equities, fixed income, foreign exchange, crypto, and commodities. It does not offer investment advice, but supports regulated advisers to identify market trends. Quantmatix was founded in 2021 by Mr Boggan and Paul Chew, and currently employs around 10 people with plans to double that number before the end of the year. It has plans to expand its sales and marketing base in the US, Middle East and Asia, tech expertise in AI and big data analytics as it is poised to take on the lucrative US market.

The Bank of Ireland released their financial regulatory priorities for 2024 in January. Key focuses include updating the Consumer Protection Code to adapt to a more digitalized financial services sector and enhancing protections for consumers. Efforts will also intensify on addressing systemic risks within the non-bank sector and expanding the understanding of macroprudential risks. The Individual Accountability Framework will be implemented to ensure firm compliance and support stakeholders in meeting new standards. Preparations for the Digital Operational Resilience Act are underway, particularly relevant given Ireland’s substantial technology sector. Additionally, the implementation of the Markets in Crypto Asset Regulation and the Credit Unions (Amendment) Act 2023 will proceed, including necessary updates to the Credit Union Handbook and modifications to Central Bank Regulations. Policy development and supervisory expectations regarding the use of artificial intelligence in financial services are also on the agenda, in anticipation of the EU’s AI Act.