An efficient ongoing monitoring system is a linchpin in the relentless battle against financial crime and the imperative to comply with AML regulations.

According to Qkvin, regulatory bodies mandate stringent AML ongoing monitoring requirements to ensure financial institutions maintain robust systems capable of identifying and reporting potential money laundering activities. Such requirements encompass regular reviews of customer information, transaction patterns, risk assessments, and enhanced due diligence measures.

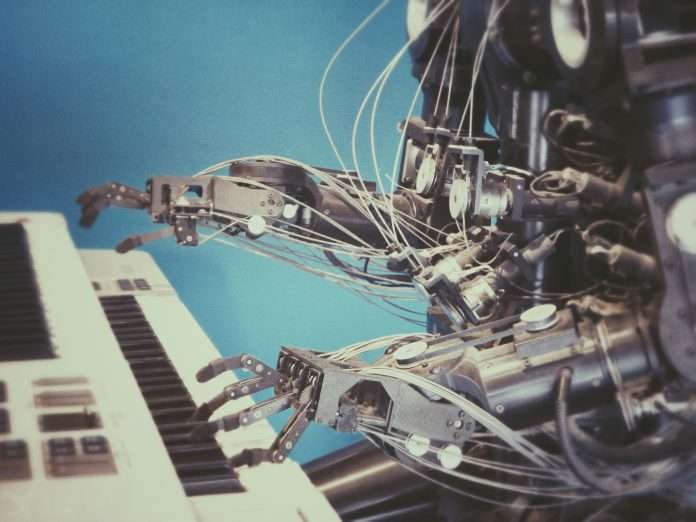

Financial institutions must embrace automation-driven monitoring bolstered by advanced technologies like machine learning algorithms, data analytics tools, and automated alerts to effectively meet these requirements. These technological innovations streamline monitoring processes, enhance detection rates, reduce false positives, and improve efficiency in combating money laundering. Moreover, they enable organisations to proactively identify and mitigate potential security threats and compliance issues pivotal to modern AML and fraud detection strategies.

What are some of the key measures to prevent financial crime? In the view of Qkvin, one of the first ones is regular controls of updates.

Continuous scrutiny and updates to databases tracking individuals and entities under economic sanctions or subject to various restrictions are crucial. These meticulous updates maintain the efficacy of monitoring systems, ensuring they remain up-to-date and capable of identifying potential risks and compliance issues promptly.

PEP databases are also key. Maintaining up-to-date information on Politically Exposed Persons (PEP) is vital. These databases vigilantly monitor individuals holding prominent public positions or connections to such figures, ensuring transparency in financial dealings and mitigating risks of money laundering and terrorist financing.

Next is watchlist management. Global watchlists for PEPs and sanctions play a pivotal role in tracking individuals or entities of concern. Regular checks and updates to these databases should be part of the financial institution’s ongoing screening to promptly identify and trigger alerts for any entities or individuals engaged in suspicious activities.

Another one is automated data collection. Central to ongoing monitoring is the process of automated data collection, which gathers data from various digital sources such as system logs, network traffic, and application behaviour. This data is then analysed in real-time using advanced algorithms and machine learning techniques to detect anomalies or patterns indicative of security threats or non-compliance with regulatory requirements.

Then comes real-time analysis, which is essential for promptly identifying deviations from established norms or predefined behavioural patterns. Algorithms used in this stage pinpoint even the slightest deviations that may signify a security breach or non-compliance, ensuring organizations remain vigilant and proactive in addressing emerging threats.

The final one is automated reporting. After data analysis and issue identification, automated reporting swiftly relays relevant information to stakeholders. This expedites response processes, ensuring timely actions are taken to mitigate potential risks.

As the risk and compliance landscape evolves, ongoing monitoring systems must adapt to emerging trends. Criminals are increasingly leveraging technology to commit FinCrime; therefore, financial institutions will need to modernise to stay ahead of these advancements. Future trends will likely be influenced by regulatory changes, emerging technologies, and evolving industry best practices.

Regulatory shifts may include increased transparency, stricter data protection regulations, and enhanced reporting requirements, driving organizations to implement monitoring systems that align with these changes. Moreover, technological advancements like artificial intelligence, machine learning, and predictive analytics will play pivotal roles in enhancing monitoring systems’ effectiveness and efficiency. Additionally, industry best practices will focus on standardized frameworks, benchmarking metrics, and integration with other risk management functions to ensure a holistic approach to risk mitigation.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global