In today’s fast-paced and highly regulated financial landscape, securing full UK FCA authorisation is more than just a regulatory milestone—it’s a strategic imperative that can profoundly impact a firm’s trajectory.

According to ACA Group, whether launching a new venture, breaking away from a larger institution, or seeking autonomy as an Appointed Representative, the journey towards FCA authorisation offers a multitude of advantages beyond mere compliance.

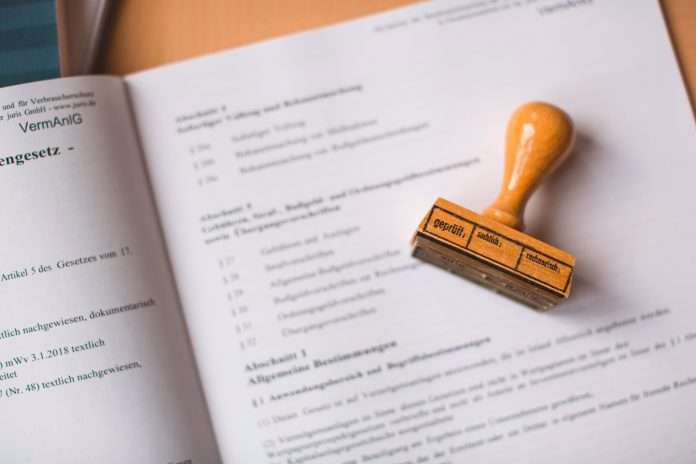

Gaining FCA authorisation acts as a hallmark of credibility in the financial industry, instilling trust among clients, investors, and counterparties. This stamp of approval signals adherence to rigorous regulatory standards and a commitment to ethical conduct, attracting institutional investors, wealth managers, and other stakeholders seeking to engage with authorised entities.

Beyond credibility, FCA authorisation fulfills a crucial legal requirement for conducting various financial activities in the UK. Failure to obtain proper approvals can result in significant penalties and legal ramifications, making compliance an indispensable prerequisite for businesses operating in the financial realm.

Achieving FCA authorisation opens doors to broader market access, as many institutions and investors prefer to collaborate exclusively with independently authorised entities. This expanded reach can lead to enhanced business opportunities, strategic partnerships, and increased client acquisition, bolstering the firm’s growth potential.

Independently owned and regulated firms hold a distinct advantage in the mergers and acquisitions landscape. Their autonomy and compliance standards showcase stability, rendering them attractive targets for potential buyers or merger partners, thereby enhancing their value proposition and appeal to growth-oriented investors.

While Brexit has reshaped market dynamics, FCA authorisation still offers avenues for accessing EU markets under specific conditions. Through partnerships with European management companies, UK firms can extend their reach and provide cross-border services, fostering expansion and diversification opportunities even in the post-Brexit era.

FCA authorisation ensures alignment with stringent compliance standards, mitigating legal and operational risks as the business expands. By operating within a regulated framework, firms can safeguard their reputation, maintain stakeholder trust, and navigate challenges with greater resilience.

Presenting a long-term proposition to investors, FCA-authorised firms demonstrate independence and financial stability, gaining a competitive edge in the marketplace. Moreover, pursuing FCA authorisation underscores a commitment to robust prudential standards, further enhancing the firm’s resilience and preparedness for unforeseen circumstances.

Obtaining FCA authorisation signifies a firm’s dedication to long-term sustainability and professionalism in the financial markets. By investing in regulatory compliance and governance, firms lay a solid foundation for growth, resilience, and enduring success in a dynamic industry.

In conclusion, FCA authorisation transcends mere regulatory compliance, offering a strategic roadmap for firms to build credibility, access markets, mitigate risks, and pursue sustainable growth in the ever-evolving landscape of financial services.

Read the full post here.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global