Key Latin American FinTech investment stats in Q1 2024:

• Latin American FinTech deal activity reached 46 transactions in Q1 2024, a 48% reduction YoY

• Latin American FinTech companies raised a combined $257m in Q1 2024, a 52% increase from Q1 2023

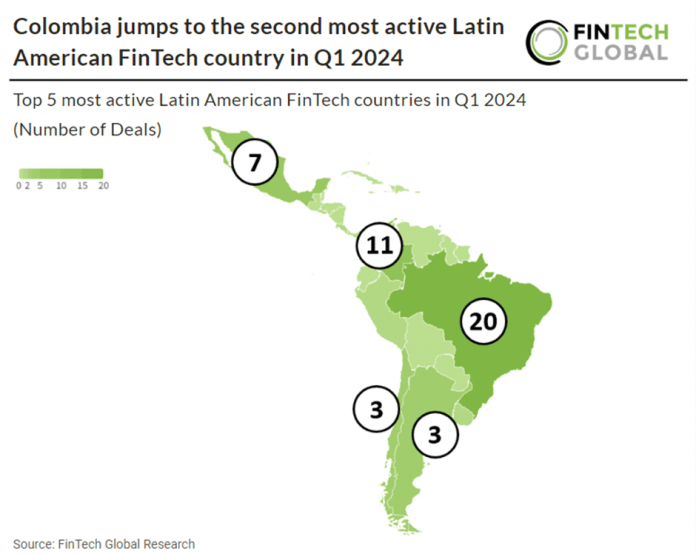

• Brazil was the most active Latin American FinTech country with 20 funding rounds, a 43% share of deals.

In the first quarter of 2024, Latin American FinTech companies experienced a significant shift in their financial landscape. Deal activity in the region saw a total of 46 transactions, marking a 48% reduction compared to the same period in the previous year. Despite the decrease in deal numbers, these companies raised a combined total of $257m, representing a substantial 52% increase in funding from the first quarter of 2023.

Simetrek, a solution that automates financial and accounting control, had the largest Latin American FinTech deal in Q1 2024 after raising $55m in its latest Series B funding round, led by Goldman Sachs Asset Management. Simetrik has developed intuitive solutions to simplify and automate key financial tasks like record centralization, reconciliations, controls, reporting, and accounting. Its products are based on Simetrik Building Blocks (SBBs), a scalable, adaptable, and intuitive concept based on no-code development and generative AI technologies. Tailored to the dynamic needs of CFOs and their teams, these SBBs are set to further evolve with the Series B funding, enhancing their AI capabilities and reinforcing Simetrik’s dedication to advancing these solutions. Simetrik clients base includes large companies such as PayU, Mercado Libre, Rappi, PagSeguro, Falabella, Oxxo, Itaú, and Nubank, and partnerships with leading firms like Deloitte. The company’s global footprint spans over 35 countries, monitoring over 200 million records daily, including in key Asian markets such as India and Singapore. Simetrik intends to use funds from this Series B to help expand its international reach, targeting major payment companies and consumer marketplaces worldwide.

Brazil was the most active Latin American FinTech country with 20 funding rounds, a 43% share of deals. Colombia was the second most active country with 11 deals, a 24% share of deals. Mexico was third with seven deals, a 15% share of deals. Notably Colombia was the only Latin American FinTech country to see a rise in deal activity from Q1 2023 to Q1 2024, increasing 38%.

PayTech was the most active Latin American FinTech subsector in Q1 2024 with 10 deals, representing a 21.7% share of total deals. The total transaction value in the Latin American PayTech market is projected to reach $306 billion in 2024. This surpasses that of a comparable market such as Southeast Asia, which is projected to reach $287 billion in 2024. The Latin American market is expected to show an annual growth rate (CAGR 2024-2028) of 9.76%, resulting in a projected total amount of $445 billion by 2028.