CyberTech and marketplace lending companies lead the way in this week’s FinTech deals. A total of 21 deals were completed by FinTechs this week, with five of these being CyberTechs and another five being marketplace lending businesses.

A combined total of $1.2bn was raised across all 21 FinTech deals this week, around double the total raised last week. While funding was up, the deal volume was down by by a third.

As for the biggest deal of the week, Canadian marketplace lending company Financeit took the podium with its CAD $500m ($364m) securitisation facility. The capital brings the company’s total financing capacity to $2bn and will enable Financeit to expand its consumer receivables portfolio.

There was another Canadian FinTech to raise funds this week, Chexy. The PayTech startup, which launched in early 2023, secured CAD $4.1m ($3m). Chexy stands out as Canada’s first platform to allow over 15 million renters nationwide to pay their rent with their preferred credit card.

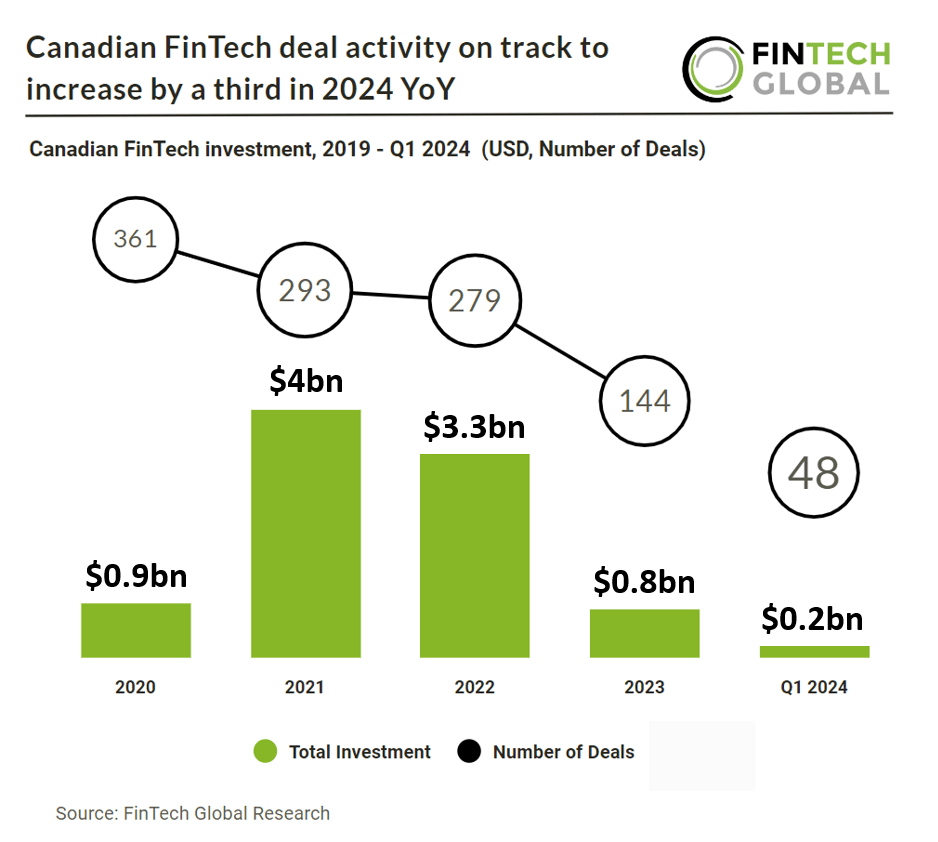

These two deals are positive signs for the Canadian FinTech sector, with deal activity on track to increase by a third YoY in 2024 . Research from FinTech Global found that Canadian FinTech deal activity is on track to reach 192 deals in 2024 based on Q1 results, a 33% increase from 2023. The most active FinTech sector in the country was PayTech, which recorded nine deals.

However, while deal activity is up, funding volume is going down. Canadian FinTech companies raised a combined $162m in Q1 2024, a 60% drop from Q1 2023.

The US remained the most active country for deals with eight. These were Huntress, Semperis, Kapitus, Finaloop, Amplify Life Insurance, Gynger, Trustwise and Numerated.

The UK was close behind with five deals: Zilch, Finbourne, PQShield, Entro Security and Prosper.

Other countries represented this week were France (Ramify), Indonesia (Amartha), Mexico (Clip), Singapore (Peak3), Uzbekistan (TBC) and Israel (Aim Security).

Interestingly, five FinTech companies raised over $100m this week. Aside from Financeit, the others were Huntress, Zilch, Semperis and Clip. Following the close of the funding rounds, Huntress more than doubled its valuation beyond $1.5bn, while Clip also retained its unicorn status.

As mentioned, CyberTech recorded five deals this week. These were Huntress, Semperis, PQShield, Aim Security and Entro Security. While the five marketplace lending companies were Financeit, Kapitus, Gynger, Amartha and Numerated.

Elsewhere, the PayTech and WealthTech sectors both recorded three deals. The PayTechs were Zilch, Clip and Chexy, while the WealthTechs were Ramify, TBC and Prosper. There were two InsurTechs to raise funds this week, Peak3 and Amplify Life Insurance, as well as one Infrastructure and enterprise software provider, Finaloop. Rounding off the week were data and analytics business Finbourne and RegTech startup Trustwise.

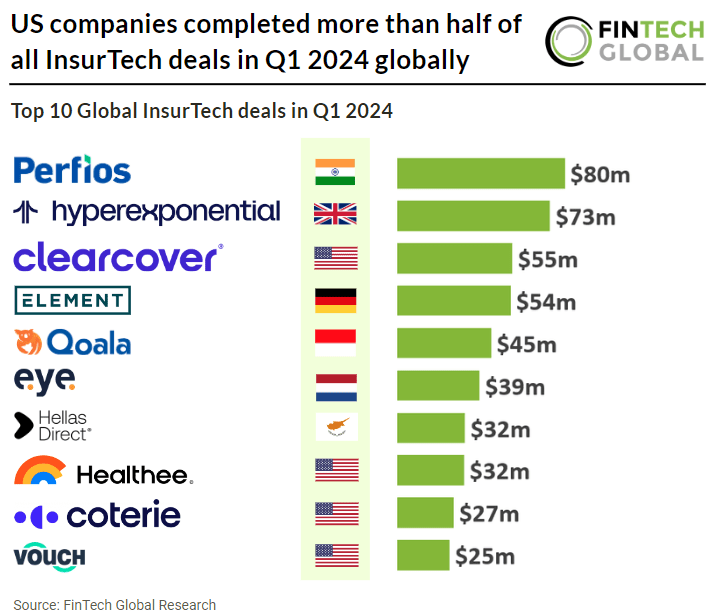

A report from FinTech Global this week found that the US dominated the InsurTech sector in Q1 2024. The USA had a 55% share of global InsurTech deals during the quarter, including four of the biggest funding rounds. In total there were 140 InsurTech deals closed during Q1, a 38% reduction from Q1 2023. The amount raised experienced an even greater decline, with InsurTech companies having raised a combined $872m in Q1 2024, a 66% decrease YoY

Without further delay, here are the 21 FinTech funding rounds we covered this week:

Financeit boosts securitization facility to C$500m ($364m), total capacity reaches C$2bn

FinanceIt Canada, a prominent player in the Canadian point-of-sale financing market for home improvement, recreational vehicles, and retail sectors, has successfully increased its securitization facility to C$500m.

Initially established in September 2023 with CIBC, the facility has now welcomed additional backing through an increase in committed capital from CIBC and the inclusion of Concentra Bank, a wholly owned subsidiary of Equitable Bank, as a new lender.

The enhanced facility, which now totals over C$2bn in financing capacity, is designed to support Financeit’s burgeoning consumer receivables portfolio. This expansion is pivotal in addressing the growing demand for home improvement loans among Canadian consumers, marking a significant step in Financeit’s growth trajectory.

FinanceIt stands as a leading provider of innovative financial solutions, facilitating point-of-sale financing options across various sectors. Since its inception in 2011, Financeit has been pivotal in enabling enterprise businesses, big box retailers, OEMs, and dealer networks to offer flexible payment plans. These plans not only aid in increasing transaction sizes but also improve close rates, leveraging Financeit’s advanced cloud-based technology to ensure a smooth and transparent loan application process for merchants across Canada.

Cybersecurity firm Huntress secures $150m funding led by Kleiner Perkins

Huntress, a pioneering force in cybersecurity for small businesses to small enterprises and the service providers that support them, has announced a significant milestone with the closure of a $150m Series D funding round.

The round was led by Kleiner Perkins, Meritech Capital, and existing investor Sapphire Ventures.

The $150m raised in this latest round more than doubles Huntress’ valuation beyond $1.5bn. This substantial investment will be used to power cutting-edge endpoint, identity, cloud, and SaaS security research, alongside strategic acquisitions, reinforcing Huntress’ commitment to fortify the critical businesses that comprise the backbone of the global economy.

Huntress specialises in providing advanced cybersecurity solutions to small businesses and the service providers that support them. Their highly demanded Huntress Managed Security Platform is continuously evolving with fully autonomous capabilities. This platform combines endpoint detection and response, identity threat detection and response, security awareness training, and a soon-to-be-released SIEM, all supported by a world-class Security Operations Center (SOC).

With the new funding, Huntress aims to build and acquire disruptive new products, further strengthen its mission to protect the most vulnerable companies, and fuel its go-to-market engine to reach this underserved and under-protected market before cybercriminals do.

The new investment follows years of meteoric growth for Huntress, which has seen over 70% year-over-year revenue growth for the past two years. The company has also been voted the industry leader in endpoint detection and response for the 8th consecutive season and the industry leader in managed detection and response by customers in G2 rankings earlier this year. These achievements highlight Huntress’ impressive trajectory as it approaches $100m in annual recurring revenue and protects nearly 3.5 million endpoints and identities.

FinTech firm Zilch secures £100m funding from Deutsche Bank

Zilch, the world’s first ad-subsidised payments network (ASPN), has announced a significant £100m securitised debt financing deal arranged by Deutsche Bank.

This new funding is set to propel Zilch’s business expansion and enhance its capability to introduce new products for a wider customer base.

The financing, led by Deutsche Bank, is expected to enable Zilch to triple its sales volume and achieve notable capital efficiencies.

Zilch, which offers a reward-earning debit and zero-interest instalment service, has experienced impressive growth, reaching over 4 million customers and processing more than 10 million monthly payments. The platform has facilitated over £2.5bn in commerce and saved customers more than £450m in fees and interest through its innovative ad-subsidisation model.

Zilch plans to use the new funding to scale its business further and expedite the rollout of its feature roadmap, aiming to broaden its wallet and market share. The company is adding over 100,000 new customers every month and doubling its revenue year over year. This latest financing will support Zilch’s momentum as it continues to drive billions in commerce and significant savings for its customer base.

CEO and Co-Founder Philip Belamant said, “With this new securitisation, we’re poised to triple sales volumes and achieve significant capital efficiencies as we continue to drive billions in commerce to our retail network and, in turn, hundreds of millions in savings and subsidies to our customer base.

“This partnership not only provides an excellent opportunity for debt investors to join in Zilch’s success, but it also enables us to accelerate the rollout of our feature roadmap which will broaden wallet and market share.”

Semperis raises $125m to enhance identity system defense platform

Semperis, a pioneer in identity-driven cyber resilience, has announced it secured $125m in growth financing from J. P. Morgan and Hercules Capital.

Following a $200m Series C round in 2022 led by KKR, the new funding will allow Semperis to further invest in product innovation and support its rapidly expanding global customer base.

Semperis provides the industry’s most comprehensive identity system defense platform, trusted by the largest enterprises and government agencies worldwide, to significantly reduce the success rate of ransomware and other destructive attacks. The company’s focus on cyber resilience has earned it a spot on Deloitte’s Technology Fast 500 list for four consecutive years.

The new funding will be used to enhance Semperis’ product innovation and expand its global footprint. The company aims to continue disrupting cyberattacks with advanced machine-learning-based attack prevention, detection, and response capabilities.

In addition to the growth financing, Semperis has added three new executives to its C-suite. Jeff Bray, Chief Financial Officer, brings extensive experience from Rapid7, Imprivata, and Invicti Security. Mike DeGaetano, Chief Revenue Officer, has a strong background in sales leadership from Symantec, RSA, Zscaler, Forcepoint, and Broadcom. Annabel Lewis, Chief Legal Officer and Corporate Secretary, has 20 years of cybersecurity and tech industry experience, including roles at Trustwave, Singtel, and Onapsis.

Mexican FinTech unicorn Clip secures $100m investment round

Mexican FinTech unicorn, Clip, has announced it has secured an investment round of $100m.

The funding comes from investment funds managed by Morgan Stanley Tactical Value (MSTV) and a prominent West-Coast mutual fund manager.

Clip, founded in 2012, is Mexico’s leading digital payments and commerce enablement platform, catering primarily to small and mid-sized businesses (SMBs). The company provides a comprehensive range of software and hardware solutions, facilitating digital payments, online sales, credit access, and operational simplification for SMBs.

The new funds will be used by Clip to accelerate product development initiatives, furthering its mission to drive financial inclusion in Mexico through innovative technology solutions.

Clip founder and CEO Adolfo Babatz said, “The investment from these two globally renowned investors is a testament to Clip’s opportunity to continue to lead the digital transformation of Mexico’s commerce ecosystem, and more broadly, provides even further validation of our mission to open access to digital payments, financial services and technology solutions to all SMBs in the country.

“We are excited to leverage this financing round to continue to expand and strengthen our offerings to empower more stakeholders across Mexico’s economy.”

London-based Finbourne raises £55m ($69m) for investment data management expansion

Finbourne Technology, a prominent London-based investment data management firm, has successfully secured £55m in a Series B raise.

According to UKTN, the investment was spearheaded by Highland Europe and AVP, marking a significant milestone for the company.

Founded in 2016, Finbourne Technology specialises in providing robust data management solutions to asset owners and managers. The company’s platform is designed to facilitate efficient tracking of investment performances and streamline compliance processes. Among its notable clients are Northern Trust and the Pension Insurance Corporation, underscoring its pivotal role in the investment management sector.

The infusion of £55m will primarily be used to enhance Finbourne’s go-to-market strategies. According to the company, these funds will be directed towards significant investments in marketing initiatives tailored to key segments within the global investment management, banking, and capital markets spheres. The aim is to broaden the reach and utility of Finbourne’s services, enabling a more comprehensive and trusted consolidation of financial data across various operational fronts.

Additional details revealed by the company include the engagement of Santander Corporate and Investment Banking as the financial advisor for the transaction. This partnership highlights the strategic measures Finbourne is adopting to ensure the effective utilisation of the newly acquired funds.

Small business lender Kapitus secures $45m in corporate note financing

Kapitus, a leading provider of financing for small and medium-sized businesses, has announced the closing of a $45m investment-grade corporate note financing.

This latest financing round increases the company’s total debt facilities to $585m. The investors involved in this financing were not disclosed.

Kapitus specialises in offering diverse financing solutions to small and medium-sized enterprises (SMEs). With the new funds, the company aims to expand its portfolio of financing products and enhance its funding platform, making it more accessible and efficient for small businesses to secure essential growth capital.

Proceeds from this financing will be directed towards further technological investments in Kapitus’ funding platform. This enhancement is expected to streamline the process, allowing more small businesses to obtain critical growth capital quickly and efficiently.

To date, Kapitus has provided over $6bn in growth capital to nearly 55,000 small businesses across the U.S.

Addition leads $37m Series B investment in cybersecurity firm PQShield

PQShield, a cyber company that specialises in quantum-resistant cryptographic solutions, has completed a $37m Series B funding round.

The round was led by Addition and saw contributions from new investors Chevron Technology Ventures, Legal & General, and Braavos Capital, alongside existing backers Oxford Science Enterprises.

The investment will be used to bolster PQShield’s commercial operations as it addresses the increasing global demand for its post-quantum cryptography (PQC) solutions. These solutions are designed for hardware, software, and communications systems, and include the company’s research intellectual property.

PQShield is at the forefront of the global transition to quantum security, a shift underscored by imminent ratifications of post-quantum cryptography standards by the National Institute of Standards & Technology (NIST). These standards are also expected to be adopted by the International Organization for Standardisation (ISO). With governments and organisations being urged to migrate to PQC systems to protect sensitive data, the importance of companies like PQShield in the cybersecurity landscape is increasingly critical.

The company has a robust product suite that includes secure boot and update of devices, Hardware Security Modules (HSMs) that secure financial transactions, and military-grade communications systems. PQShield’s customer base includes high-profile names like AMD, Microchip Technologies, and Collins Aerospace, among others.

Furthermore, PQShield is deeply involved in advising governments, industry bodies, and cybersecurity agencies on transitioning to quantum security. They play a crucial role in the NIST PQC standardisation project and offer guidance to entities such as the White House and the UK National Cyber Security Council.

InsurTech provider Peak3 secures $35m in Series A led by EQT

InsurTech provider Peak3, formerly known as ZA Tech, has raised $35m in a Series A funding round led by EQT, with participation from Alpha JWC Ventures.

The $35m investment will support Peak3’s expansion in the EMEA region and its investments in data and AI solutions. This fundraising effort saw contributions from EQT, a major global technology investor, and Alpha JWC Ventures, a leading venture firm in Southeast Asia.

Peak3, founded in 2018, is a next-generation insurance core system SaaS provider. The company has developed a cloud-native, modular insurance core and distribution system catering to life, health, and property and casualty (P&C) insurance. It has become a trusted technology partner to global insurers such as AIA, Generali, Prudential, and Zurich, as well as digital platforms like Carro, Grab, Klook, and PayPay.

With the new funding, Peak3 aims to advance its analytics and AI capabilities towards an intelligent core insurance solution. The company plans to grow its EMEA operations and establish new system integrator partnerships. Peak3 targets double-digit ARR growth this year and is on the path to reach cashflow breakeven over the coming quarters.

Additionally, Peak3 has recently achieved several key milestones, including launching its first multi-country, multi-tenant core modernisation in Europe, rolling out an integrated customer data and big data platform for scaling analytics and AI capabilities, and establishing its first technology centre in Europe. The rebranding to Peak3 coincides with the issuance of over a billion insurance policies on its systems, including the first policies issued to North American and African customers.

Real-time accounting innovator Finaloop raises $35m from top investors

Finaloop, a real-time e-commerce accounting platform, has successfully completed a $35m Series A funding round.

This round was led by Lightspeed Venture Partners and saw contributions from Vesey Ventures, Commerce Ventures, and previous backers Accel and Aleph.

The company, which was established in 2020 and operates out of New York and Tel Aviv, offers an innovative solution in accounting for the e-commerce sector. Its services cater specifically to the needs of retail brands operating in dynamic online markets, enhancing financial transparency and efficiency.

With the fresh injection of capital, Finaloop plans to further develop its AI-driven software for e-commerce accounting automation and inventory cost management. Additionally, the funds will support expanding market operations and partnerships with accounting firms and data-driven marketing agencies, enhancing their reach and service capability.

Finaloop is pioneering in providing instantaneous, AI-driven accounting services tailored specifically for direct-to-consumer brands on major online platforms like Shopify, Amazon, and Walmart, as well as for wholesale and multi-channel enterprises.

Their system enables complete financial data access, empowering stakeholders to make better, more informed decisions that drive profitability and growth.

Since its inception, Finaloop has demonstrated significant growth, increasing its customer base by 400% over the past year. It now serves thousands of brands and manages over $13bn in gross merchandise value across its platform.

Central to Finaloop’s technological advancement is Rico©, a pioneering AI-driven reconciliation engine that has successfully automated the categorization and reconciliation of more than 94% of 70 million transactions. This efficiency underscores Finaloop’s commitment to modernising financial management within the e-commerce sector.

Amplify Life Insurance’s $20m Series B investment

Amplify Life Insurance, a budding InsurTech firm, recently announced a successful closure of its Series B funding round, amassing a significant $20m.

This financial injection was co-led by Crosslink Capital and Anthemis, with additional contributions from Munich Re Ventures, Moneta Ventures, Evolution Ventures, and Greycroft, according to a report from Coverager.

Established in 2019 and based in San Francisco, Amplify Life Insurance is a comprehensive life insurance platform that provides term, permanent and cash value life insurance. One of its products is the variable universal life policy, which gives customers the chance to grow tax-efficient wealth along with life insurance protection.

With the fresh capital, Amplify Life plans to bolster its workforce, aiming to increase its headcount from 100 to approximately 125.

Embedded financing pioneer Gynger raises $20m in Series A round

Gynger, the first embedded financing platform for technology purchases, announced today it has raised $20m in Series A funding.

This funding round was led by PayPal Ventures, with participation from Gradient Ventures, Velvet Sea Ventures, BAG Ventures, and Deciens Capital.

The New York-based company, founded in 2021, aims to revolutionise the technology purchasing landscape. Gynger facilitates businesses in financing their software and technology needs by providing a seamless and automated embedded financing platform.

With the new funding, Gynger plans to scale its team and operations, furthering its vision of transforming its embedded financing platform into a comprehensive payments solution for technology transactions.

Additionally, Gynger secured a debt facility of up to $100m from Community Investment Management (CIM). This facility will support Gynger in meeting the increasing demand for technology financing solutions by scaling its financing capabilities.

Gynger CEO and Founder Mark Ghermezian said, “Over the last year, we have experienced tremendous growth and demand.

“We are revolutionizing how companies buy and sell technology by providing a payments solution that addresses the needs of both vendors and their customers. We are building the future of flexible financing for all technology. We are thrilled to welcome PayPal Ventures as an investor to help push our growth to a whole new level.”

The company’s unique approach enables businesses to purchase software and services using non-dilutive capital, optimising cash flow through flexible payment terms. Gynger’s platform has already facilitated payments for numerous leading technology vendors, including Snowflake, Salesforce, AWS, Cisco, ZoomInfo, and Datadog.

Gynger’s financing solutions are designed to benefit both buyers and sellers of technology. For technology vendors, the platform offers alternative purchasing methods for their customers, accelerating sales and improving cash flow. Vendors can shorten Day Sales Outstanding (DSOs) and secure long-term commitments while receiving upfront payments through Gynger’s platform.

Gynger leverages advanced AI and data analytics to underwrite and approve credit for customers swiftly. The platform automatically detects technology spend, recommending the best financing opportunities for both buyers and sellers. This end-to-end solution simplifies the purchasing process for businesses across all industry verticals.

$18m funding boost for Aim Security to enhance GenAI enterprise security

Aim Security, a cyber firm specialising in the protection of GenAI within enterprises, has successfully raised $18m in a Series A.

The round was led by Canaan Partners, with additional contributions from seed investor YL Ventures.

The company, founded by cybersecurity veterans and former members of the IDF’s elite intelligence Unit 8200, Matan Getz and Adir Gruss, has rapidly positioned itself as a leader in the niche of GenAI security. With this latest funding, Aim Security’s total capital raised now stands at $28m.

Aim Security is dedicated to ensuring the safe adoption and operation of AI across various enterprise applications. Its services range from securing chatbots and virtual assistants to safeguarding sophisticated AI-driven tools like Microsoft 365 and GitHub Copilot. The company addresses the unique security challenges posed by AI, such as sensitive data exposure and the new wave of AI-specific cyber threats.

The newly acquired funds are earmarked for further development of Aim’s comprehensive security platform, which is tailored to the specific threats posed by AI technologies. Aim’s solutions are designed to support industries that are highly regulated and have stringent data security requirements, such as banking, insurance, healthcare, manufacturing, and defence.

Additional information highlights the company’s proactive approach to AI security. Aim’s platform is engineered to govern and secure all forms of AI utilisation across enterprise environments, effectively enabling businesses to leverage AI for growth and efficiency without compromising on security.

Manchester-based Entro Security raises $18m to tackle non-human identities

Entro Security, a trailblazer in Non-Human Identity (NHI) security, announced today its successful closing of an $18m Series A investment round.

The funding, spearheaded by Dell Technologies Capital, also saw participation from previous seed investors Hyperwise Ventures and StageOne Ventures, along with notable angel investors Rakesh Loonkar and Mickey Boodaei.

This new influx of capital aims to enhance Entro’s global operations and address the growing market demand for its innovative NHI and Secrets Management platform.

Since its emergence from stealth in May 2023, Entro Security has raised a total of $24m. The company specializes in securing enterprise-scale systems against the rising threats associated with machine-to-machine interactions.

The rapid expansion of cloud and Software as a Service (SaaS) technologies has exacerbated the proliferation of unmanaged NHIs and secrets, such as API keys and service accounts, which now outnumber human employees by 45 times. This imbalance has led to significant vulnerabilities, evidenced by incidents like the recent Dropbox breach.

By focusing on the lifecycle management of NHIs and the security of secrets, Entro aims to provide strategic security solutions that are becoming increasingly essential for businesses.

The platform developed by Entro offers comprehensive capabilities for managing and securing NHIs and secrets. It facilitates complete visibility, contextual understanding, and robust governance, enabling businesses to secure, monitor, and manage NHIs and secrets effectively from inception through to rotation.

Indonesian microfinance company Amartha secures $17.5m

Indonesian microfinance technology company, Amartha, has received a $17.5m equity investment from the Accion Digital Transformation Fund.

The investment aims to enhance Amartha’s platform, which provides financial products and services to underserved women-led small businesses in rural areas across Indonesia, leveraging data and AI.

Amartha, known for its digital financial infrastructure, connects microbusinesses in Tier 2 and 3 cities outside Java Island. By offering an embedded lending and funding model for both institutional and retail investors, Amartha delivers personalised financial solutions. The company also provides payment services and a proprietary credit scoring system, making it a comprehensive microfinance technology option for digitising Indonesia’s grassroots communities. So far, Amartha has disbursed over 25 trillion Indonesian rupiah ($1.6bn) in working capital to more than 2.5 million women-led businesses across Java, Sumatra, Nusa Tenggara, Sulawesi, and Kalimantan.

The new funding will help Amartha expand its product offerings, strengthen its audience analytics system, and drive the adoption of its digital services, thus connecting more people and small businesses to responsible financial services. In addition to financial capital, the Accion Digital Transformation Fund will provide strategic support to enhance customer engagement, operational efficiency, and product innovation through digital technologies.

Ramify clinches €11m (11.7m) from top investors to redefine wealth management in France

Ramify, a French WealthTech company, has announced a financial milestone with the completion of an €11 million Series A funding round.

According to FinTech Finance, the round was spearheaded by 13books Capital, alongside contributions from Fidelity International Strategic Ventures and existing backers including Newfund, AG2R, Crédit Agricole, and several business angels.

This fresh injection of capital is set to further propel Ramify’s mission to become the preferred investment platform for France’s affluent investors.

Since its inception in 2021 by Olivier Herbout and Samy Ouardini, Ramify has quickly made a name for itself in the WealthTech sector. The platform caters to the evolving needs of wealthy investors by offering a seamless, high-quality investment experience. Over the past 18 months, the company has seen a twentyfold increase in assets under management, solidifying its position in the market with an extensive array of products and services.

At its core, Ramify is designed as an all-encompassing investment platform, merging digital tools with expert advisory services to offer reduced fees. The company primarily serves French individuals possessing financial assets ranging from €100,000 to €5 million. It provides a diverse portfolio of investment opportunities, including stocks, bonds, real estate, and more exotic assets like private equity and art investments. The platform’s standout features include Lombard lending and Luxembourg life insurance, catering to its most distinguished clients.

Looking forward, Ramify is poised to leverage significant generational wealth transfers expected across Europe, amounting to over €10 trillion in the next fifteen years. With over 70% of these inheriting individuals seeking new financial advisors, Ramify’s innovative blend of digital efficiency and personalised service positions it uniquely within the marketplace. Unlike traditional financial institutions that struggle with adaptability, or purely digital platforms that fail to meet the demands of premium clients, Ramify offers a tailored solution that marries technology with human expertise.

The team at Ramify, comprising quantitative finance experts, seasoned developers, and financial professionals, has created a robust platform that integrates advanced back-office automation and artificial intelligence. This technology-driven approach allows for the delivery of customised investment strategies and optimized tax solutions. Personalised client service remains a cornerstone of their offering, ensuring that individual investor needs are comprehensively met.

Uzbek mobile bank TBC gains $10m credit to promote financial inclusion

Uzbek mobile bank TBC, a subsidiary of the TBC Group, has secured a $10m credit facility from impact investment firm responsAbility.

According to Finextra Research, this marks a significant step forward for TBC Bank as it continues to expand its operations in Central Asia’s most populous country, Uzbekistan.

The investment was made by responsAbility Investments AG through its Green Climate Partnership Fund (GCPF). This credit facility is aimed at expanding TBC Bank’s microlending business, which operates through both physical branches in Georgia and a digital-only presence in Uzbekistan.

TBC Bank not only offers conventional banking services but has also recently increased its stake in digital payment solutions by acquiring 51% of LLC Inspired, which trades under the Payme brand in Uzbekistan. Payme serves as a digital payments application catering to individuals and small businesses, alongside offering credit facilities like Payme Nasiya (Payme Instalments), which focuses on instalment credit business.

The new funding is part of TBC Bank’s broader strategy to enhance financial inclusion and support economic growth through innovative financial solutions. It aims to extend more support to individuals and micro enterprises, helping them thrive and contribute to the broader economic fabric of Uzbekistan.

This isn’t the first time TBC Bank has partnered with responsAbility. Earlier in 2024, another $10m credit line was provided to support environmentally sustainable projects in the region. Furthermore, TBC Bank Group is recognised for its strong ESG performance, holding an MSCI ESG rating of ‘AA’ and has been awarded the EBRD’s Annual Sustainability Silver Award in 2023. Fitch Ratings also assigns TBC Bank Uzbekistan a Long-Term Issuer Default Rating (IDR) of BB-, reflecting the bank’s robust financial health and operational stability

Trustwise secures $4m from Hitachi Ventures to boost generative AI safety

Trustwise has officially launched, unveiling its innovative product, Optimize, alongside announcing a significant $4m seed funding.

The investment round, spearheaded by Hitachi Ventures and supported by Firestreak Ventures and Grit Ventures, marks a pivotal moment for the startup.

The funding will be instrumental for Trustwise as it accelerates the development of generative AI prototypes that are both cost and risk optimized. These efforts are targeted across various industries, aiming to enhance the company’s market presence through an aggressive go-to-market and partnership strategy while also advancing its research initiatives.

Trustwise is at the forefront of generative AI application performance and risk management. Its flagship product, Optimize, is a unique solution designed to mitigate risks and manage the escalating costs associated with deploying large language models in high-stakes environments. The company employs rigorous red teaming techniques, coupled with advanced APIs and datasets, to optimize generative AI workloads. Its solutions are aligned with major standards and regulations, such as the European Union AI Act and the NIST AI RMF 1.0.

Trustwise’s approach to generative AI goes beyond traditional models by focusing on API-based solutions that significantly reduce operational costs and carbon footprint, while enhancing safety and alignment with regulatory standards. The Optimize product has already shown promising results in current customer deployments, achieving substantial reductions in LLM and compute costs, and improving safety and alignment detection capabilities.

Canadian FinTech startup Chexy raises $4.1m ($3m) to expand renter rewards platform

Chexy, Canada’s pioneering rent rewards and payments platform, today announced a seed round raise of $4.1m CAD.

The funding round was led by Venrex, accompanied by contributions from Crossbeam Ventures, Groundbreak Ventures, Antler Global, and strategic angels in the realms of real estate, FinTech, and banking.

Launched in early 2023, Chexy stands out as Canada’s first platform to allow over 15 million renters nationwide to pay their rent with their preferred credit card. This innovative service not only accrues points and cashback for users but also supports their financial health by enabling automatic reporting of payments to Equifax, aiding in credit score improvement.

With the Government of Canada’s recent advocacy for accessible rent reporting in its budget announcement, Chexy is at the forefront of empowering renters. The company plans to use the new funding to make its rent reporting feature free for all active users, further aligning with national policies aimed at benefiting renters.

The funding will also enable Chexy to extend its services beyond rent payments to include Chexy Home Services. This new venture will offer tenants a variety of household services such as tenant insurance, WiFi, phone services, and more, all integrated into the Chexy home system for a more streamlined household management experience.

WealthTech Prosper successfully secures £800,000 ($1m) from Crowdcube investors

Prosper, a WealthTech startup, has successfully reached its £800,000 funding goal on Crowdcube, even before opening up to public investment.

According to Finextra Research, founded by alumni from Tandem and Nutmeg, along with Nutmeg’s COO Phil Bungey, Prosper is quickly gaining traction within the WealthTech community.

The company has garnered a substantial £3.2m in pre-seed investments from a notable group of FinTech founders. These investors include Tom Blomfield of Monzo and Matt Cooper from Capital One. This funding round adds to a previous £1m raised through Crowdcube in December of the previous year.

Prosper operates with a business model that echoes the disruptive strategy of companies like Wise, aiming to reduce fees traditionally charged by wealth managers while offering competitive, high-interest returns on various investment accounts. These accounts include SIPP, ISA, and general investment accounts, which have been available to founding members for several months.

The funds from this recent round will be used to further develop Prosper’s suite of savings products. Newly launched alongside this funding news are the Prosper Savings Accounts, which offer competitive interest rates as high as 5.78% — reportedly the highest in the UK for a 365-day notice account. These new savings accounts include a broad range of options such as easy access, fixed rate, and notice accounts from various banks.

In addition to these developments, Prosper emphasises its commitment to making personal finance management both accessible and cost-effective. The company offers free account opening and management, instead earning through nominal fees charged to banking partners.

Numerated receives investment from Citi to propel AI-driven commercial lending tech

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global