It proved to be a very diverse week in FinTech. There were a total of 15 FinTech funding rounds, of which, 11 different countries were represented.

The summer holiday period is in full swing. The number of deals was down from 20 last week, and 39 the week prior.

A total of $620m was raised by the 15 funding rounds, with the lion’s share of this coming from a $365m securitisation deal raised by Octane. The remaining 14 FinTech companies raised a combined total of $255m.

What was interesting this week was a lack of deals in the US. The country is almost always home to the most deals, often accounting for more than half of all weekly deals. However, the country only recorded two deals this week. These were PayTech company Octane and WealthTech business Canoe Intelligence.

Other countries to record two deals this week were the UK, Israel and Ireland. As for the UK, these were England-based Tracebit and Wales-based PureCyber. The Israeli companies were CyberTechs Cognyte and Cytactic, while the Irish FinTechs were PayTech Trustap and marketplace lending startup CreditLogic.

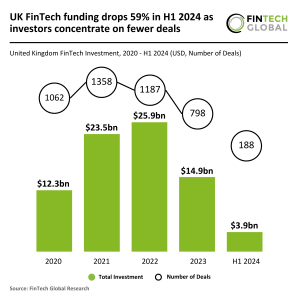

The UK’s FinTech sector has struggled a lot during 2024, research from FinTech Global found. Total deal activity dropped by 60% in H1, compared to the same period in 2023, with 188 and 457 deals recorded, respectively. Funding volume has also seen a significant decline, with $3.9bn raised in H1 2024 and $6.9bn in H1 2023. However, while activity is down, the size of deals is slightly up. The average deal value in H1 2024 was approximately $20.7m, reflecting an increase compared to the $15.1m in H1 2023.

This diverse week for funding also saw FinTech deals for companies based in Singapore (Partior), Kenya (NALA), India (Dezerv), Italy (Exein), Germany (Lemon.markets), Canada (Clutch Technology) and Paraguay (BucksApp).

The second biggest deal of the week was recorded by Sinapore’s Partior, which raised $60m. Partior enables banks and financial institutions to execute real-time, cross-border transactions in multiple currencies. It raised the funds to expand its offerings to include JPY, AED, BRL, and other currencies soon.

Kenya’s NALA was the third biggest deal of the week. The PayTech company secured $40m to expand its consumer business and to further develop its Rafiki platform, which is designed to enhance payment reliability, reduce costs for users, and streamline financial transactions.

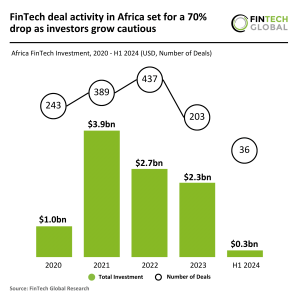

Research from FinTech Global recently found that FinTech deal activity in Africa is set for a 70% decline in 2024. There were just 36 funding rounds recorded in the first half of the year, which is down from 121 completed in H1 2023. A total of 203 deals were recorded in 2023, making Africa’s projected deal activity a 70% decline. Funding volume is also down significantly, with just $300m raised the the first half of the year. Interestingly, PayTech was the most active FinTech subsector during H1 2024, accounting for eight of all deals. It was followed by WealthTech, which recorded six deals.

PayTech companies led this week’s deals. Not only were there five deals in total, but the three biggest deals of the week were all PayTechs. The five PayTech companies (Octane, Partior, NALA, Clutch Technology and Trustap) raised a combined total of $475m.

There were also five CyberTech deals recorded this week. These were Exein, Cytactic, Cognyte, PureCyber and Tracebit.

As for the other sectors, there were three WealthTech deals (Canoe Intelligence, Dezerv and Lemon.markets), one marketplace lending fundraise (CreditLogic) and one Data & Analytics funding round (BucksApp).

Here are the 15 FinTech funding rounds covered on FinTech Global this week.

Octane strengthens market position with $365m asset-backed deal

Octane, a leader in the FinTech sector that streamlines major recreational purchases, has successfully concluded a $365m asset-backed securitization, known as OCTL 2024-2.

This financial maneuver was secured by fixed-rate installment powersports loans, offered through its dedicated lending arm, Roadrunner Financial.

The securitization introduced six distinct classes of fixed-rate notes, ranging from Class A-1 to Class E, which have been assessed and rated by esteemed agencies such as Standard & Poor’s and Kroll Bond Rating Agency. This marks Octane’s initial asset-backed securitization for the year 2024, following a series of successful issuances in the previous year.

In this latest financial initiative, Octane saw significant contributions from Atlas SP Securities, which led the transaction as the structuring agent and lead book-running manager. Additional support was provided by J.P. Morgan Securities, Mizuho Americas, and Truist Securities, acting as joint bookrunners, helping to widen Octane’s investor base while retaining the backing of its longstanding institutional investors.

Octane’s Chief Financial Officer, Steven Fernald, expressed enthusiasm about the company’s continued success, stating, “We’re thrilled to close our second transaction of the year and are grateful to see such strong recurring participation by our existing institutional investors.

Partior secures $60m in Series B to enhance global financial infrastructure

Partior, a FinTech innovator specializing in blockchain-based clearing and settlement, has recently announced a significant milestone in their funding journey.

The company successfully closed the first part of their Series B funding round, raising over $60 million. This round was led by Peak XV Partners, with additional backing from new investors Valor Capital Group and Jump Trading Group. Existing stakeholders such as J.P. Morgan, Standard Chartered, and Temasek also participated, reaffirming their ongoing support.

Partior is at the forefront of revolutionizing financial market infrastructures with its unified ledger technology. The platform enables banks and financial institutions to execute real-time, cross-border transactions in multiple currencies. Currently operational with USD, EUR, and SGD, Partior plans to expand its offerings to include JPY, AED, BRL, and other currencies soon.

The newly acquired funds are earmarked for several ambitious projects. Partior intends to develop capabilities for intraday FX swaps, cross-currency repos, and programmable enterprise liquidity management, among others. These advancements aim to enhance the efficiency of global payment systems and foster just-in-time multi-bank payments.

Partior’s initiative is also recognized as a potential game-changer for the industry. According to the Bank for International Settlements, modernizing correspondent banking through blockchain could significantly improve pre-screening and settlement processes, enhancing customer verification and anti-money laundering measures.

NALA secures $40m to pioneer payment solutions for Africa’s booming population

NALA, an emerging leader in the global payment scene, has recently announced a significant funding boost of $40m.

The company, known for its innovative approach to payments, aims to revolutionize the way money moves across borders, especially targeting the needs of the burgeoning African continent and other emerging markets.

The investment was led by a group of visionary investors who believe in NALA’s potential to scale its operations beyond Africa. The company’s recent funding round is pivotal in advancing its mission to cater to the global migrant diaspora and establish a robust B2B payments platform named Rafiki. Rafiki is designed to enhance payment reliability, reduce costs for users, and streamline financial transactions, mirroring the successes of companies like dLocal in Latin America and AirWallex in Asia.

At its core, NALA strives to address the significant challenges of payment systems in Africa, which are often plagued by inefficiencies and high costs. The company’s solutions focus on providing a seamless and cost-effective way for individuals and businesses to transact across borders.

The new funds will be strategically used to expand NALA’s consumer business and to further develop Rafiki. This expansion is not just about broadening the service offerings but is a critical step towards laying down the payment rails for what NALA believes will be the next billion users in the global financial system.

Canoe Intelligence secures $36m in Series C funding led by Goldman Sachs for AI expansion

Canoe Intelligence, a prominent player in the financial technology sector, has successfully completed a $36m Series C funding round.

This round was spearheaded by Growth Equity at Goldman Sachs Alternatives, with contributions from existing stakeholders F-Prime Capital and Eight Roads. This funding milestone has notably tripled Canoe’s company valuation compared to its Series B in 2023.

Canoe Intelligence is at the forefront of developing AI and machine learning technologies aimed at enhancing alternative investment management. The firm’s innovative platform is designed to optimize data accuracy and accessibility, improving efficiency across financial back and front offices.

The newly acquired funds are earmarked for several strategic initiatives. Primarily, Canoe plans to further its development of cutting-edge AI technologies that promise to revolutionize the management of alternative investments.

Dezerv raises INR 265 Crores to enhance tech-driven wealth management services

Dezerv, an innovative WealthTech firm from India, today announced a significant funding achievement, securing INR 265 Crores ($31.7m).

This substantial financial boost was led by Premji Invest, accompanied by participation from existing backers Elevation Capital, Matrix Partners India (also known as Z47), and Accel.

Founded by seasoned veterans Sahil Contractor, Sandeep Jethwani, and Vaibhav Porwal, Dezerv has quickly risen as a leading wealth management platform, managing assets worth over INR 7000 Crores. The platform is dedicated to optimising portfolio performance for India’s burgeoning class of wealth creators, who now have more than INR 1 Crore in investable wealth.

The new funds are earmarked for several exciting advancements. Dezerv plans to develop fresh investment strategies, enhance its technological infrastructure to ensure superior client service, and expand its team by hiring additional investment specialists. These initiatives are aimed at propelling the company into its next phase of growth amid an expanding market of affluent and high net worth individuals in India.

Exein secures €15m ($16.3m) in funding to lead global embedded cybersecurity standards

Exein, an IoT cybersecurity specialist headquartered in Rome, has successfully secured a €15m Series B funding round.

This substantial financial boost was led by 33N, a firm that focuses on investing in cybersecurity and infrastructure software, with participation from Partech. The funding round also saw re-investment from existing stakeholders including United Ventures, eCAPITAL, and Future Industry Ventures, a Redstone/SBI fund.

The company, which safeguards over 80 million IoT devices daily across the industrial, automotive, and aerospace sectors, is set for a bold expansion. Plans include broadening its footprint across Europe, the US, and Asia, with a new office set to open in Taipei to spearhead growth in the region. Furthermore, Exein is expected to double its headcount within the next year, illustrating a robust growth trajectory.

Exein is revolutionizing IoT security by embedding advanced security directly into devices at the manufacturing level. This method offers a unique digital immune system for each device, independent of network security measures. Such endpoint security ensures that device manufacturers can integrate state-of-the-art security features seamlessly, protecting against cyber threats and complying with emerging global cybersecurity regulations.

Evolution Equity Partners backs Cytactic with $16m to enhance cybersecurity readiness

Cytactic, a pioneering SaaS platform, has recently secured a $16m seed funding round.

The investment, led by the prominent cybersecurity venture capital fund Evolution Equity Partners, positions Cytactic at the forefront of cyber crisis readiness and management.

The funding underscores the growing urgency among businesses to enhance their defenses against cyber threats. In an era marked by frequent and complex cyber incidents, Cytactic offers a holistic, intuitive platform that serves as a comprehensive command center for all stakeholders involved in cyber-crisis readiness, response, and recovery.

Cytactic’s innovative approach integrates cyber crisis preparation, response management, and recovery into a unified platform. This user-friendly system is designed to accommodate various business profiles and risk landscapes, helping organizations navigate the challenges of cyber threats with a streamlined, orchestrated process.

The platform is a direct response to the need for better synchronization among stakeholders during a cyber crisis. By facilitating coordinated management and swift recovery, Cytactic helps mitigate the impact of cyber incidents and potentially avert threats before they escalate.

Lemon.markets secures €12m ($13m) boost to expand brokerage infrastructure

Lemon.markets, a burgeoning FinTech enterprise, has announced a significant funding boost of €12m.

This investment round was led by CommerzVentures, with notable contributions from Heliad AG and an array of previous backers including Creandum, Lakestar, Lightspeed, and System.One.

Lemon.markets is dedicated to providing robust infrastructure aimed at supporting the next 100 million brokerage accounts. This ambitious goal underscores their commitment to making capital markets accessible to a wider audience, leveraging technology to simplify and enhance the investment experience.

The infusion of funds is earmarked for several strategic initiatives. Key among these is the acceleration of new partnerships and the continued growth and scaling of their platform. This includes the introduction of mutual funds and further expansion into the banking sector, highlighted by their recent collaboration with Tomorrow. These developments are part of a broader strategy to diversify and enhance their offerings, making investing more accessible to the general public.

Cognyte receives $10m order, reinforcing its role in combating global security threats

Cognyte Software, a global leader in investigative analytics, has successfully secured a $10m follow-on order from a longstanding partner, a national security agency in the EMEA (Europe-Middle East-Africa) region.

The $10m order will allow the agency to enhance its capabilities in extracting and analyzing large volumes of data. Cognyte’s state-of-the-art software plays a crucial role in addressing various threats, including terrorism, drug trafficking, and weapons smuggling.

Cognyte Software Ltd. is at the forefront of investigative analytics, providing software that empowers government bodies and other organizations with actionable intelligence. The company’s innovative solutions accelerate and refine the effectiveness of investigations and decision-making processes.

The additional funds will be employed to further develop Cognyte’s technological offerings, ensuring that their solutions remain cutting-edge and continue to meet the evolving challenges of global security.

iA Financial Group invests $10m in Clutch Technology’s pre-owned car sales platform

iA Financial Group, one of Canada’s largest insurance and wealth management organisations, has announced a $10m investment in Clutch Technology, a firm specialising in the online sales of pre-owned vehicles.

This strategic move aims to integrate iA Financial Group’s insurance products into Clutch’s digital car-buying platform, according to InsurTech Insights.

This partnership will enable iA Financial Group to leverage its expertise in digital product distribution, ensuring Clutch customers have an all-in-one transaction for vehicle purchases and insurance coverage.

Founded in 2017 and headquartered in Toronto, Clutch has become one of Canada’s largest used vehicle retailers. In 2023, Clutch reported selling over 8,000 vehicles through its online platform.

The company offers a seamless and transparent car-buying experience, currently providing extended warranty and guaranteed asset protection products from iA Financial Group.

The new funding will be used to enhance Clutch’s digital platform, expand its product offerings, and improve the overall customer experience.

By integrating iA Financial Group’s insurance products into their platform, Clutch aims to provide a comprehensive service that covers both vehicle purchases and insurance needs.

PureCyber, a rapid-growth cybersecurity firm, bags £5m ($6.5m) from BGF

PureCyber, a trailblazing cybersecurity firm based in Wales, has just announced a significant financial boost, securing a £5m investment from BGF.

This investment comes as a strategic move to propel PureCyber further into the cybersecurity market. Founded in 2016 by CEO Damon Rands, the company has carved a niche for itself by offering an array of cybersecurity solutions, including brand protection, incident response, global penetration testing, and fully managed Security Operations Center (SOC) services.

Specializing in a unique subscription model, PureCyber has made advanced cybersecurity accessible to a diverse range of sectors including professional and financial services, manufacturing, education, and sports. Its client list boasts prestigious global institutions and premier league football clubs.

With the fresh capital infusion from BGF, PureCyber aims to expand its services further into the SME market and enhance its footprint in the global enterprise arena.

Irish FinTech startup Trustap raises $5.5m to revolutionize marketplace payments

Trustap, a secure payment gateway, has successfully secured $5.5m in Series A funding, bringing its total capital raised to over $9m.

This latest investment round was led by TX Ventures, with participation from SeedX, Partners Resolute, Aperture, and existing shareholders MiddleGame Ventures, ACT VC, Atlantic Bridge, and FurthrVC, according to a report from Tech.eu.

Trustap is designed to streamline marketplace transactions by acting as the merchant of record. This enables it to handle payments, logistics, and customer support, thereby boosting margins and overall revenues for marketplaces. Its escrow-style payment system is crucial for building trust between buyers and sellers, facilitating transactions of both low and high-value items—from electronics and tickets to vehicles and luxury goods.

Cybersecurity innovator Tracebit lands $5m to enhance cloud security deception

CreditLogic secures €3.5m ($3.8m) to boost European expansion

CreditLogic, the Dublin-headquartered FinTech company specialising in lending-as-a-service, has successfully raised €3.5m to propel its expansion across Europe.

This fresh capital infusion comes with contributions from Riverside Acceleration Capital (RAC), part of the global investment entity The Riverside Company, and several individual tech investors, according to a report from Silicon Republlc.

The company, founded in 2018 by former banking executives Eddie Dillon and CTO Gavin Bennett, has carved a niche in the banking sector by drastically reducing the costs associated with acquiring and onboarding customers, as well as issuing new mortgages.

With the new funds, CreditLogic aims to significantly enhance its operational capabilities and broaden its reach throughout Europe. Plans are underway to augment the company’s workforce by adding 15 new full-time positions in Ireland, spanning AI, data science, engineering, and sales, over the next 12 to 18 months.

BucksApp clinches $1m investment to enhance data-driven solutions in LatAm

BucksApp, a B2B FinTech startup founded in Paraguay and Bolivia, has recently secured $1m in a pre-seed funding round.

The funding was led by iThink VC and BuenTrip Ventures, with additional contributions from Escalatec and several angel investors, according to a report from Contxto.

BucksApp is transforming raw, often incomplete data into valuable insights for a broad range of clients, including banks, digital wallets, and retail entities like supermarkets and pharmacies. Through meticulous analysis, BucksApp helps its clients maximize revenue by optimizing transactional data to enhance sales strategies.

The fresh capital will be directed towards technological advancements and expanding the team, with a particular focus on markets in Paraguay, Bolivia, Peru, and Ecuador.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global