It was a strong week for US-based FinTech companies, with 17 securing fresh capital this week.

Aside from the US dominating the week for deals, it proved to be quite diverse. In total, FinTech Global covered 36 FinTech investment deals. Four of these were based in the UK (Aveni, Primary Portal, iLex and FullCircl), three were from Canada (Propel Holdings, Layer2 Financial and Wisedocs), two were German companies (osapiens and Hawk) and another two were Israeli (Clutch Security and Zenity).

Other countries to see a FinTech close funds were Singapore (Aleta Planet), Belgium (Credo Ai), Mexico (Aviva), Australia (InvestorHub), Lithuania (Bourgeois Boheme), Slovenia (Leanpay), Egypt (Cartona) and the Philippines (Hive Health).

The 17 US companies were: Bilt Rewards, Cowbell, Gradient AI, Faye, Axiad, Lineaje, GeoWealth, Rillet, Roadzen, Endari, SafeGuard Privacy, Mintify, Axle Automation, PortfolioPilot, Lukka, Halcyon and Teamshares.

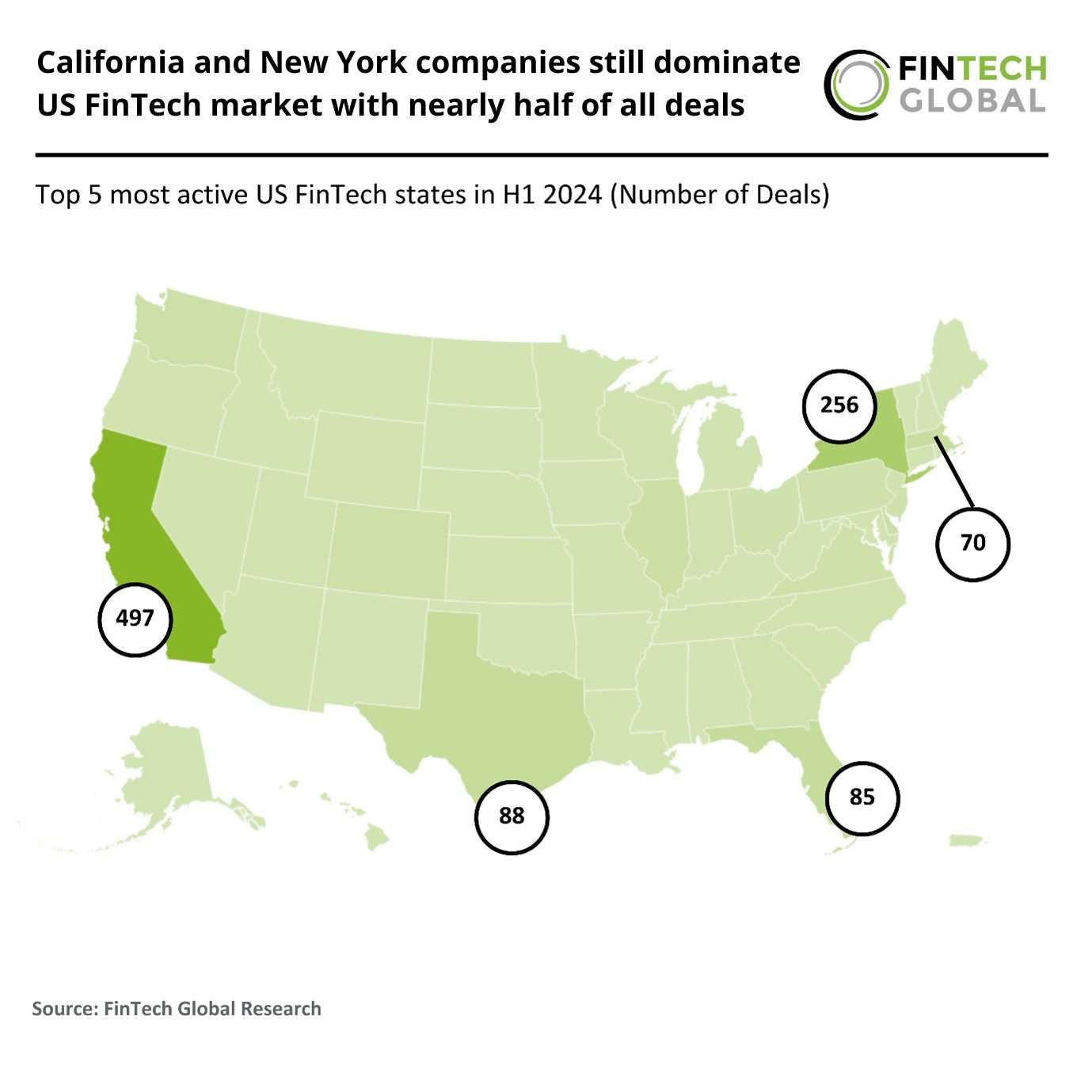

While on the topic of the US, recent research from FinTech Global found that California and New York are still dominating the country’s FinTech scene. During the first half of 2024, there were 1,584 deals in total, down from 3,658 in 2023 H1. California was home to 31% of all US-based FinTech deals, recording 497 in just the first six months of the year. However, this was a huge drop from H1 2023, when the state saw 1,105 deals.

New York noticed a similar drop in deals. While the state recorded 256 FinTech funding rounds, a 16% share of all US deals, the state had 616 deals close in H1 2023. Texas, Florida and Massachusetts were the other biggest FinTech hubs of H1 2024.

Across all 36 deals a total of $955.6m was raised, of which, $831.2m was secured by the ten biggest deals. As seen by the funding totals, it was a big week for smaller deals, with the average deal size being just $26.5m.

There were three deals to exceed $100m. The biggest deal of the week was a $330m credit facility secured by Canada’s Propel Holdings. The company is supporting financial access for underserved consumers in the US through its digital lending technology.

The other two deals to surpass $100m was the $150m fundraise from US-based loyalty program Bilt Rewards, and the $120m Series B of osapiens, a German ESG platform and provider of compliance and sustainability reporting solutions. Bilt’s fundraise brought its valuation to $3.1bn.

The sectors were also diverse this week. WealthTech led the charge with seven of the deals (GeoWealth, Primary Portal, Aviva, InvestorHub, Mintify, PortfolioPilot and Teamshares). However, CyberTech, PayTech, InsurTech and RegTech each recorded six deals.

The CyberTechs were Lineaje, Clutch Security, Endari, SafeGuard Privacy, Zenity and Halcyon. The PayTechs were Bilt Rewards, Layer2 Financial, Leanpay, Cartona, Bourgeois Boheme and Aleta Planet.

The InsurTech companies were Cowbell, Gradient AI, Faye, Hive Health, Wisedocs and Roadzen. The RegTech companies were Axiad, Credo AI, Aveni, Axle Automation, FullCircl and Hawk.

Rounding off the deals this week were two marketplace lending FinTechs (Propel Holdings and iLex), one infrastructure and enterprise software platform (Rillet), a blockchain startup (Lukka) and an ESG FinTech solution provider (osapiens).

Here are the 36 FinTech companies to raise funds last week.

Propel Holdings secures upsized $330m credit facility to boost consumer

Propel Holdings, known as a trailblazer in the FinTech sector, recently announced a significant expansion to its syndicated credit facility.

The facility, specifically designed for the CreditFresh line of business, has been upsized by $80m, bringing the total commitment to an impressive $330m.

The expansion was supported by existing partners Bastion Management and Hudson Cove Capital Management, LLC, along with affiliates of both, and welcomed new banks into the syndicate. This move underscores the robust growth and potential of Propel’s financial offerings.

Propel Holdings is redefining financial access for underserved consumers in the US through its innovative platform. The company operates notable brands like Fora Credit, CreditFresh, and MoneyKey, as well as a Lending-as-a-Service product line. Propel’s AI-driven technology allows for a more nuanced evaluation of customers beyond traditional credit scoring methods, facilitating broader and more effective credit distribution.

The additional funds from the upsized credit facility are earmarked to bolster the ongoing growth of the CreditFresh portfolio. This strategic funding is expected to further Propel’s mission to build financial opportunities for its customers and deliver sustained, profitable growth.

Bilt Rewards clinches $150m in fresh funding to enhance loyalty programs

Bilt Rewards , the largest loyalty program in the U.S. for home and neighborhood, has successfully secured an additional $150m in funding.

The round was spearheaded by Teachers’ Venture Growth (TVG), a division of the Ontario Teachers’ Pension Plan specializing in late-stage and growth investments. Alongside TVG, significant contributions came from Vanderbilt University Endowment and the University of Illinois Foundation, with continued support from previous investors.

Bilt Rewards operates as a pioneering loyalty platform that significantly impacts both the residential and local business sectors. By integrating loyalty systems with rental payments, Bilt has facilitated an environment where every rent payment enhances tenant credit scores while simultaneously accruing redeemable points that can be spent within the local community.

The fresh capital will be used to expand Bilt’s influential resident loyalty program and grow its neighborhood loyalty initiatives. These programs are essential for connecting property owners with local businesses, creating a vibrant community ecosystem. Bilt aims to extend these services to include single-family homes and is planning to incorporate mortgage payments into its platform by year-end.

Additional information reveals Bilt’s impressive trajectory of growth. Since their last funding round in January, which raised $200m and put the company’s valuation at $3.1bn, Bilt’s annual platform spend has surged to over $30bn. This represents a 50% increase, driven by the expansion of its loyalty programs to more apartment buildings and into the condominium and homeowner association (HOA) markets. Furthermore, the neighborhood program has expanded to include over 21,000 restaurants and 3,500 fitness studios.

osapiens raises $120m to propel ESG tech leadership

osapiens, an ESG platform and provider of compliance and sustainability reporting solutions, today announced the completion of a $120m Series B.

The company is set to use these funds to accele rate international expansion and further enhance its technology platform.

The $120m investment was led by Growth Equity at Goldman Sachs Alternatives, securing a minority stake in osapiens. This follows a significant $27m Series A led by Armira Growth in 2023, marking continued confidence in osapiens’ innovative approach to ESG technology.

osapiens has quickly established itself as a global leader in the ESG technology sector. Its primary product, the osapiens HUB, is an AI-powered cloud-based platform designed to streamline compliance with international ESG regulations.

This includes the Corporate Sustainability Reporting Directive (CSRD), the European Union Deforestation-free Regulation (EUDR), and the Corporate Sustainability Due Diligence Directive (CSDDD). The platform also helps companies identify and mitigate risks in their operations and supply chains, and reduce manual workloads through automation.

The funds from this round will be utilised to support the company’s plans for expanding its international reach and investing further in its technology. This is aimed at enhancing business compliance, resilience, and efficiency on a global scale.

osapiens is differentiated by its ability to leverage a common data model that integrates compliance, risk mitigation, and operational efficiency modules in a single platform. This unique feature fosters real impact and distinct market advantage, enhancing transparency and efficiency, and providing businesses with actionable insights that promote long-term sustainability and a positive environmental impact.

Cisco Investments backs CyberTech Halcyon

Halcyon, a pioneering anti-ransomware firm, has recently secured strategic funding from Cisco Investments.

The size of the investment was not disclosed, but Halcyon noted it has raised a total of $90m, to date.

This funding is part of a broader mission to reduce ransomware risks to zero, reinforcing Halcyon’s essential role in the cybersecurity landscape.

Halcyon’s platform is uniquely designed to thwart ransomware from the outset. It employs advanced artificial intelligence and machine learning technologies focused exclusively on ransomware threats. This strategic investment will enable Halcyon to enhance its platform, ensuring robust protection against ransomware attacks that often bypass traditional security measures.

The new funds will be instrumental in scaling the deployment of Halcyon’s anti-ransomware solutions. These funds are intended to drive broader adoption and further development of technologies that can preemptively identify ransomware strains and recover hijacked data instantaneously.

Apart from the recent funding, the announcement included critical insights into the ongoing challenges posed by ransomware. According to Halcyon’s research, a significant number of organizations have been repeatedly victimized by ransomware attacks, leading to substantial business disruptions and data losses. This underscores the growing need for effective solutions like those Halcyon provides.

Cyber insurance leader Cowbell secures $60m Series C investment from Zurich

Cowbell, a leading provider of cyber insurance for small and medium-sized enterprises (SMEs), has announced the closure of a $60m Series C equity investment round.

With the fresh capital, Cowbell aims to scale its operations to meet the growing demand for cyber insurance.

The company plans to extend its presence in key international markets, enhance its cyber resilience services, launch innovative products, and strengthen strategic partnerships.

The firm is set to leverage advancements in AI and GenerativeAI to expand its technological infrastructure, driving efficiency and supporting expedited decision-making for policyholders and brokers through traditional, digital, and API-driven channels.

The round was led by Zurich Insurance Group, a prominent global multi-line insurer.

Zurich’s investment highlights its commitment to providing businesses with top-notch cyber protection and resilience solutions, particularly for the SME and middle market segments.

This partnership aligns with Zurich’s goal to utilise best-in-class technology to address the evolving complexities of cyber risk management.

Cybercrime costs are projected to reach $24tn globally by 2027, with ransomware attacks alone costing small businesses an average of $1.7m per incident.

Cowbell’s broker-first approach and its user-friendly platform have gained worldwide traction and trust, with licensed producer growth nearly tripling over the last two years. By reinvesting in AI and GenAI advancements, Cowbell aims to bring greater transparency to cyber risk, facilitating smarter decision-making and raising cyber resilience standards for brokers and businesses globally.

Gradient AI secures $56m Series C to enhance AI-driven InsurTech solutions

Gradient AI, a foremost provider of AI solutions in the InsurTech sector, has successfully raised $56.1m in a Series C funding round.

This financial infusion was spearheaded by Centana Growth Partners, accompanied by contributions from MassMutual Ventures, Sandbox InsurTech Ventures, and Forte Ventures.

Operating at the intersection of artificial intelligence and insurance, Gradient AI is dedicated to refining the industry’s operational efficiencies through automation. Their solutions are designed to aid insurers in enhancing their risk assessments and operational efficiencies, which in turn boosts profitability.

The freshly secured capital is earmarked for several strategic initiatives. These include the enhancement of existing product features and functionalities, the launch of new products to broaden the suite of solutions available to property and casualty (P&C) and health insurers, and increased investment in research and development. This R&D focus is intended to propel further AI innovations within the insurance market, solidifying Gradient AI’s position as a technological leader.

In addition to funding product development, this capital will bolster customer success and sales functions, ensuring that Gradient AI continues to deliver significant value to its clients.

Faye secures $31m in Series B funding to elevate travel insurance technology

Faye, the trailblazing travel platform, has successfully secured $31m in Series B funding, escalating its total capital to $49m.

This latest financial injection was led by Portage Ventures, alongside contributions from Lumir Ventures. The funding round also saw continued support from existing backers such as F2 Venture Capital, Viola Ventures, and Munich Re Ventures.

Faye operates at the intersection of travel and FinTech, offering a suite of services that transform how travelers experience insurance and assistance. Their comprehensive coverage includes everything from proactive trip monitoring to swift claims processing, all powered by their cutting-edge technology.

The platform has introduced several new features since its last funding round, such as pre-trip essential information, access to over 20K telemedicine doctors, and app recommendations for local travel insights. These enhancements build upon Faye’s initial offerings, which allowed users to secure their trips in seconds and manage claims effortlessly via their app.

Looking ahead, Faye plans to utilize this investment to propel growth, innovate new products, and expand operations, including scaling up their U.S. headquarters in Virginia and their offices in New York, Florida, and California.

Credo AI raises €19.4m ($21.2m) for advancing AI safety and compliance

Credo AI, a pioneering firm in AI governance software, has successfully secured a €19.4m investment.

According to EU Startups, this financial infusion comes from a mix of new and existing investors, including CrimsoNox Capital, Mozilla Ventures, FPV Ventures, Sands Capital, Decibel VC, Booz Allen Hamilton, and AI Fund.

The Brussels-based company has now amassed a total of $41.3m in funding. Credo AI specialises in creating solutions that align the rapid evolution of artificial intelligence with the essential frameworks of responsible governance. The recent capital will support its strategic goal of becoming the central hub for AI governance, facilitating seamless integration with leading MLops and LLMops tools.

The investment will enable Credo AI to broaden its market approach and intensify its product innovation, particularly in governance intelligence. The aim is to ensure that organisations worldwide can adopt AI technologies responsibly, fostering innovation while maintaining operational efficiency amidst stringent industry standards and regulatory frameworks.

In addition to these financial strategies, Credo AI has enriched its leadership, appointing new roles in People, Go-to-Market (GTM), and Engineering. These strategic additions underscore the company’s commitment to scaling operations to meet the growing global demand for safe and responsible AI usage.

From its inception in 2020, Credo AI has focused on ensuring that AI serves humanity, advocating for human-centric approaches where AI algorithms are deployed. The company’s influence in AI governance continues to grow as it triples its revenue this year and expands its team, including leadership roles in revenue generation and product engineering.

Axiad secures $25m investment to enhance identity security innovations

Axiad, an identity-first security provider, announced today that it has secured a $25m investment from Invictus Growth Partners.

This funding will primarily support product innovation, recruitment of top talent, and advancement of the FedRAMP certification process.

The investment will be channeled into enhancing Axiad’s product offerings, particularly in phishing-resistant multifactor authentication (MFA) and other advanced authentication solutions. These innovations aim to fortify identity security for enterprises and government entities, responding to the rising challenges of identity-based attacks which, according to an IDSA survey, have affected 91% of organizations in 2024.

Axiad intends to use the new funds to boost its sales and marketing efforts, and accelerate its journey towards achieving a Federal Risk and Authorization Management Program (FedRAMP) Authority to Operate (ATO). The company also plans to expand its team by hiring additional skilled professionals across various functions.

Additional developments at Axiad include a recent agreement with a federal agency to sponsor Axiad Cloud through the final stages of the FedRAMP process. Axiad Cloud, the company’s flagship product, offers a comprehensive suite of authentication tools that integrate seamlessly with existing IT systems, thereby reducing costs and enhancing security without disrupting user experience.

Lineaje secures $20m to boost software supply chain security

Lineaje, a software supply chain management firm, has secured a $20 million investment to elevate its artificial intelligence functionalities and bolster security.

According to Silicon Angle, the company is rapidly advancing the security management of software supply chains critical to numerous industries.

The Series A round was spearheaded by Prosperity7 Ventures, Neotribe Ventures, and Hitachi Ltd. Additional contributions came from a variety of investors including Tenable Ventures Inc., Carahsoft Technology Corp., Wipro Ventures, SecureOctane, Alumni Ventures Group, and executives from notable technology firms such as ZScaler Inc., CrowdStrike Holdings Inc., and Trellix Inc.

Lineaje’s core business revolves around offering robust security management solutions for software supply chains. Its technology provides a detailed mapping of software components, exposing each element’s dependencies and authenticating the entire chain to prevent compromises. This is becoming increasingly important as the industry faces mounting risks from sophisticated cyber threats.

The newly acquired funds are earmarked for several strategic initiatives. Key among them is the advancement of Lineaje’s AI capabilities, which are central to its strategy to reduce costs associated with maintaining enterprise software while increasing security. This move is expected to significantly enhance the transparency and security of open-source software components across the board.

GeoWealth secures $18m in growth investment with BlackRock leading the charge

GeoWealth, a Chicago-based turnkey asset management platform (TAMP) and FinTech innovator, has successfully closed an $18m funding round.

The $18m growth investment was spearheaded by BlackRock, the renowned global investment management. This funding initiative also saw participation from Kayne Anderson Growth Capital, a prominent growth capital investor from GeoWealth’s Series B round in 2021, and J.P. Morgan Asset Management, a strategic backer since 2018.

GeoWealth operates as a proprietary technology platform designed to support a broad spectrum of investment use cases for Registered Investment Advisors (RIAs). The platform is celebrated for its integrated technology that simplifies access to a diverse array of asset types through unified accounts. This capability allows RIAs to efficiently meet their clients’ demands for comprehensive asset management solutions.

The freshly secured capital is earmarked for the continued enhancement of GeoWealth’s offerings. According to the company, these funds will be instrumental in developing new features that provide RIAs with more flexible, customizable, and user-friendly tools.

Specific growth initiatives will be led by Brendan Falls, Executive Vice President and Chief Growth Officer, alongside new product developments under the guidance of Cliff Schoeman, Executive Vice President and Chief Product Officer. Planned enhancements include advancing unified managed account (UMA) functionalities and augmenting features that support alternative investments, reporting, and tax management.

Aveni secures £11m ($14.1m) to pioneer tailored AI solutions in UK financial services

Aveni has secured a Series A investment of £11m, marking it as one of the most substantial early-stage funding rounds for a Scottish firm in 2024.

The round was led by Puma Private Equity and saw participation from Par Equity, Lloyds Banking Group, Nationwide, and other leaders in the financial services industry.

The investment underlines a growing confidence in Aveni’s unique approach, which merges its globally recognised AI expertise with deep financial services experience to develop specialised large language models (LLMs) and AI products. These innovations are specifically tailored for the financial services sector.

This fresh infusion of capital will enable Aveni to enhance its existing product suite, Aveni Detect and Aveni Assist, which have already seen significant adoption among the UK’s top financial firms. The funding will also support the development of FinLLM, an industry-aligned large language model that promises to redefine the application of generative AI within UK financial services, focusing on transparency, trust, and precision.

FinLLM is set to be a benchmark project for the ethical and responsible integration of AI in financial services, co-developed with new investors such as Lloyds Banking Group and Nationwide. The initiative will be led by a dedicated team at the state-of-the-art Edinburgh Futures Institute.

The round also features continued support from existing stakeholders including Scottish Enterprise, highlighting sustained investor confidence in Aveni’s vision and strategic direction.

Rillet secures $13.5m to revolutionize accounting with modern ERP solutions

Leanpay clinches €10m ($10.9m) in Series B to expand BNPL services in Central Europe

Leanpay, a trailblazer in the Buy Now Pay Later (BNPL) and Point-of-Sale (POS) lending sector, has announced the completion of a €10m Series B funding round.

The round was spearheaded by BlackPeak Capital, a prominent growth equity firm in Southeast Europe. Other notable participants included Catalyst Romania Fund II, joining new investors alongside South Central Ventures and Lead Ventures, who had previously invested in Leanpay.

Originating in Slovenia, Leanpay has expanded its operations across Romania and Hungary, servicing over 120 thousand satisfied customers. To date, the company has issued more than €200m in consumer loans and collaborates with over 1,500 merchant partners. This allows consumers to conveniently pay in installments for diverse purchases. The past year has seen Leanpay’s revenue surge by 2.5 times, and since its Series A funding, revenue growth has quadrupled.

Leanpay is celebrated for its seamless user experience, which markedly contrasts with traditional financing methods. The platform offers a fully digital journey, eliminating the need for physical bank visits or cumbersome paperwork. Shoppers can ascertain their credit limits before purchases and select their installment plans online, enhancing convenience and user-friendliness.

Layer2 Financial secures $10.7m for global payments innovation

Layer2 Financial, a regulated payments infrastructure company, is making headlines with its latest funding achievement.

The firm has successfully raised $10.7m in a Series A round led by Galaxy Ventures, accompanied by significant support from Accomplice. This capital injection is poised to further propel the company’s ambitious plans to revolutionise global money movement.

Layer2 Financial specialises in transforming the landscape of cross-border payments. By leveraging both fiat and digital currencies, the company facilitates secure and massive fund transfers across the globe.

Their innovative system has already proven successful, as evidenced by a consistent monthly increase of over 20% in transaction processing volumes. This growth reflects the increasing demand from various businesses, including non-bank financial institutions, traditional banks, and neobanks, for efficient and compliant payment solutions.

The new funds will be channelled towards product development, market expansion, enhancing tech infrastructure, and recruiting top-tier talent. These initiatives are critical for Layer2 Financial to maintain and accelerate its growth trajectory in the competitive payments industry.

Moreover, Layer2 Financial stands out in the market with its comprehensive service offering. The company supports a plethora of payment-related use cases through a vast network of partners, including financial institutions and payment processors. Their services include handling multiple currencies, high-capacity transactions, and advanced features like configurable virtual account names, third-party payments, and tokenized transactions.

Primary Portal secures £7.5m ($9m) to revolutionise equity markets with digital solutions

Primary Portal, a platform that aggregates and digitises equity capital market processes, has successfully completed the first stage of its £7.5m Series A.

The round was spearheaded by the venture capital arm of Deutsche Börse Group, DB1 Ventures, and also saw additional contributions from existing shareholders Dutch Founders Fund (DFF) and Flow Traders.

This substantial injection of capital underscores the growing confidence in Primary Portal’s mission to transform the traditionally cumbersome and error-prone equity capital markets. By fostering greater interoperability within capital markets systems, Primary Portal is setting new standards for efficiency and connectivity.

The company intends to use the new funds to expand its offerings significantly. This expansion includes enhancing the connectivity between asset managers’ order management systems and banks, which will enable straight-through processing of capital markets transactions for the first time. Furthermore, Primary Portal is set to advance its analytical data solutions, providing state-of-the-art, AI-driven analytics tools to its clients.

In addition to these technological advancements, the funding will help bolster the company’s market position and accelerate its growth in the digital space. Primary Portal has already garnered a robust user base, with over 90 banks and 400 institutional investors currently leveraging its innovative platform to streamline equity issuances.

Cybersecurity innovator Clutch Security nets $8.5m in funding led by Lightspeed

Egypt’s leading B2B platform Cartona raises $8.1m for market expansion

Cartona, Egypt’s pioneering B2B platform, has announced a significant milestone in its journey to transform the traditional trade market in Egypt.

The company, which serves a diverse array of stakeholders including mom-and-pop stores, hotels, and FMCG companies, recently secured an $8.1m in its Series A extension round of funding.

This recent financial influx was led by Algebra Ventures, a prominent Egyptian tech venture capital firm. The funding round also saw participation from existing investors Silicon Badia and the SANAD Fund for MSME. Notably, this round was completed while Cartona maintained a robust cash position from a previous $12m Series A funding, indicating a strong financial health.

Cartona is dedicated to digitizing the supply chain for small and medium-sized enterprises (SMEs) across Egypt. The platform streamlines the distribution process, enabling efficient direct connections between retailers and key suppliers in the FMCG and HORECA sectors. By leveraging technology, Cartona facilitates improved inventory and working capital management for retailers, enhancing profitability and operational efficiency.

The newly acquired funds are earmarked for several strategic initiatives. A total of $5.6m in equity capital will be used to accelerate growth across Cartona’s various business verticals, expand its market presence in the MENA region, and explore potential B2B2C opportunities. Additionally, $2.5m in debt capital, sourced from leading providers such as Camel Ventures and GlobalCorp, will support the working capital needs of local retailers, enhancing financial access and sustainability.

BoBo’s €6.5m ($7.1m) seed round to enhance high-value transaction security

Bourgeois Boheme (BoBo), a trailblazing FinTech firm based in Vilnius, has successfully closed a seed funding round of €6.5m, according to a report from EU Startups.

The investment round was spearheaded by Graphit Lifestyle, marking a significant milestone for the company.

BoBo is redefining financial management for a new generation of wealthy entrepreneurs by digitizing family cash flow management. The company has introduced innovative security systems enhanced with AI database analysis to enable seamless, high-value transactions securely.

Distinctively, BoBo specializes in facilitating unlimited wire transfers and card transactions up to €1m, managing assets across various geographical locations. This capability is particularly crucial as an estimated 65% of young high-net-worth individuals are expected to increase their wealth in 2024, highlighting a shift towards tech-savvy stakeholders in the wealth accumulation sector.

The funds from this round will be utilized to expand BoBo’s platform capabilities, including the development of an administrative panel for third-party transaction management and the expansion of services to the MENA region. This expansion aims to accommodate the increasing demand for sophisticated transactional solutions among younger, affluent individuals.

BoBo also offers a secondary-account management system that allows authorized parties to handle transactions, manage invoices, and reconcile family expenses efficiently. Another innovative feature is the integration of payment chips into personal accessories, enabling transactions through devices like watch straps, car gloves, or jewelry, tailored to the lifestyle of the ultra-wealthy.

Philippines’ Hive Health boosts SME health access with $6.5m funding

Hive Health, a pioneering digital health insurer based in the Philippines, has completed a $6.5m Pre-Series A funding round, supported by an impressive consortium of global and local investors.

This strategic investment was led by the Sy family-backed Gentree Fund and global venture capital firm BEENEXT, with additional participation from Y Combinator, The Graduate Syndicate, Amasia, and Oak Drive Ventures. Several angel investors also joined the round, including David Wells, Lee Kheng Nam, Natasha Reyes, and Dr. Edwin Mercado.

Hive Health is dedicated to enhancing healthcare access for small and medium enterprises (SMEs) in the Philippines. The company leverages advanced technology and a comprehensive network to deliver quality healthcare solutions that are both affordable and accessible. By integrating FinTech and data analytics into their services, Hive Health aims to address the significant gaps in healthcare coverage that many Filipinos face.

The newly acquired funds are earmarked for several ambitious goals. Hive Health plans to expand its mission-driven team, extend its network of healthcare providers nationwide, and further develop its innovative technology platform. These efforts are expected to improve the overall healthcare experience for both employers and employees, making it more cost-effective and efficient.

In addition to financial growth, Hive Health has been instrumental in breaking new ground in the healthcare insurance market. Prior to this funding, the company made history by acquiring Health Plan Philippines, Inc. (HPPI), which included a full insurance license and a longstanding provider network spanning 38 years.

Mexican FinTech Aviva clinches $5.5m to boost services for micro businesses

Aviva, a pioneering FinTech company from Mexico, has successfully secured a substantial $5.5m in seed funding.

According to Finextra Research, the investment saw participation from an impressive consortium of investors including Krealo, Ignia Partners, Carao Ventures, Rainforest Capital, DCG, Wollef, Newtopia, 500 Global, and Magna VC.

Founded just last year, Aviva has innovatively merged physical and digital banking solutions to serve over 70 million people in Mexico, especially targeting those in smaller cities with populations under 500,000. This demographic, largely involved in informal employment and reliant on cash transactions, presents a significant opportunity for FinTech services, with potential lending assets valued over $150bn.

The core offering of Aviva includes a unique, 100% conversation-based loan application process utilising advances in natural language processing and computer vision technologies. Customers can visit micro-sized bank branches where they are guided through a quick, seven-minute loan approval process via a video call handled by a bot.

Currently operational in 26 cities, Aviva caters predominantly to clients working within the informal sector, with over 50,000 individuals already experiencing its hybrid, or “phygital,” onboarding process. This strategy addresses a critical gap in the financial services sector, targeting those traditionally excluded from formal financial systems.

The freshly acquired funds are earmarked for further development of Aviva’s product offerings, enhancing its partnership distribution model, and expanding its network of kiosks across medium and small-sized cities. By year’s end, Aviva aims to extend its reach to over 50 cities.

Wisedocs bags $4.5m from CIBC to streamline insurance claim reviews with AI

Wisedocs, an innovative leader in the InsurTech sector, recently received a significant financial boost. CIBC Innovation Banking has extended $4.5m CAD in growth capital financing.

This move is designed to support Wisedocs in broadening its client base and enhancing its product offerings.

The company, renowned for its artificial intelligence (AI) software platform, offers streamlined solutions for summarizing claim files. Specifically, it serves the insurance industry by enabling rapid and cost-effective medical record reviews.

With the new funds, Wisedocs plans to continue its trajectory as a market leader. The focus will be on further developing its intelligent technology platform to manage claims more efficiently. This strategic enhancement aims to leverage advanced generative AI to revolutionise how medical records are processed.

CIBC’s funding follows Wisedocs’ successful $12.7m oversubscribed Series A financing round in January 2024. This indicates strong confidence in Wisedocs’ ongoing expansion and its role within the InsurTech industry.

AI-driven insurance firm Roadzen secures $4m funding from Mizuho Securities

Roadzen Inc., a global leader in AI at the convergence of insurance and mobility, has secured an extension of its loan maturity date and an additional $4m in capital from Mizuho Securities.

The amended facility increases the loan from $7.5m to $11.5m in 15% senior secured notes and extends the maturity date to December 31, 2024.

Roadzen Inc. is transforming auto insurance using advanced AI technology. Thousands of clients, including some of the world’s leading insurers, carmakers, and fleets, use Roadzen’s innovative solutions to develop new products, sell insurance, process claims, and enhance road safety.

The company is renowned for its pioneering work in telematics, generative AI, and computer vision, earning recognition from notable publications like Forbes, Fortune, and Financial Express.

The additional funding from Mizuho Securities will support the firm’s efforts to simplify its balance sheet and address inherited costs from going public.

InvestorHub bags $4m in fresh capital to disrupt capital markets

Direct-to-investor marketing platform InvestorHub, has secured $4m in an extension funding round spearheaded by EVP.

InvestorHub, originally known as Fresh Equities, embarked on this second funding venture less than two years after a strategic rebranding. Following an impressive tripling of their revenue over 13 months, the company attracted heightened investor interest, leading to an oversubscribed round.

The round includes a provision for an extra $1m post-raise, inviting further strategic investors and bringing the total capital to $5m atop the initial $4m.

InvestorHub operates as a pivotal platform where 4% of ASX companies, like Retail Food Group, engage with investors. The platform has identified the UK — accounting for about 10% of its clientele — as a crucial market for potential growth.

The newly acquired funds are earmarked for broadening InvestorHub’s market share both in Australia and internationally. The company aims to use this capital to double its year-over-year revenue. Plans include the introduction of advanced artificial intelligence and machine learning capabilities to enhance product efficiency, bolster prediction modelling, and expedite insightful deliverables for businesses and investors.

InvestorHub co-founder and co-CEO Ben Williamson highlighted the transformative potential of the recent capital influx. “Historically, markets have always leaned in favour of intermediaries, resulting in a disconnect between companies and investors, unfair (and even weakened equity) markets and a general disregard for retail investors.

However, technology is granting access to new types of investors who are having a measurable impact on liquidity, share price movement, and capital raise outcomes,” Williamson explained.

He further detailed the underappreciated power of ‘long tail’ investors, who represent a significant portion of trading volume and can dramatically enhance their shareholding value when effectively engaged.

Cybersecurity startup Endari secures $4m seed funding

SafeGuard Privacy secures $3.6m boost to enhance privacy compliance

SafeGuard Privacy, a prominent SaaS-based compliance platform, has successfully closed a $3.6m funding round.

Leading the investment were TechOperators, Dynamism Capital, Sidekick Partners, and two additional existing investors.

Founded in 2019, SafeGuard Privacy specializes in helping various stakeholders—from publishers to tech platforms—navigate the complex landscape of global privacy regulations.

The company has attracted $3.6m in fresh capital from notable firms including TechOperators and Dynamism Capital. Sidekick Partners, along with two other veteran backers, also contributed, underscoring the industry’s confidence in SafeGuard Privacy’s solutions.

SafeGuard Privacy is renowned for its effective platform that automates the compliance processes required by privacy laws worldwide. By standardizing privacy compliance, SafeGuard Privacy has become integral to many leading companies and trade associations like BBB National Programs and OneTrust.

The new funds will be used to develop SafeGuard Privacy’s innovative legal AI and the next generation of Data Protection Impact Assessments (DPIAs). Additionally, the investment will support the expansion of universal risk-based assessments and the enhancement of direct brand and organizational partnerships.

Significant growth in customer adoption highlights the platform’s value, with users reporting efficiency improvements of over 80%. These gains have been critical in attracting further investments.

Mintify’s latest $3.4m investment boosts its NFT infrastructure

Mintify, a burgeoning platform in the FinTech sector, has successfully raised $3.4m in a recent funding round.

The investment was supported by a coalition of entities including ARCA, Cumberland, GM Capital, Psalion, Master Ventures, Zeneca, Spencer VC, and an impressive lineup of over fifty angel investors.

Mintify operates as a dynamic interface and execution engine specifically for NFT trading. The platform is recognised for facilitating rapid transactions and maintaining a robust engagement rate, with over 140K active wallets and more than 300K transactions executed in less than a year. Mintify has already been integrated into major blockchain ecosystems like ETH, Base, and Blast, and plans are set to expand to Ordinals and additional chains by year-end.

The funds from this investment round are earmarked for significant enhancements to Mintify’s product lines and network supports, coinciding with the launch of Mintify’s own token later this year. Mintify is pushing the boundaries into new realms such as gaming, digital art, and more, indicating a strategic diversification of its service offerings.

Mintify’s infrastructure and trading terminal are designed to seamlessly integrate into the burgeoning sectors of digital assets, including games, music, art, real world assets (RWAs), and fashion.

iLex raises $7m to expand next-gen loan distribution solutions

iLex, a trailblazing FinTech, headquartered in London, has announced a significant boost to its funding with an additional $2.5m added to its pre-Series A round, culminating in a total of $7m for this phase.

This funding increment has propelled the total capital raised by the company to $11m since its inception.

The investment round saw contributions from QBN Capital, Eileses Capital, and MI8, supplemented by investments from notable capital market entrepreneurs such as Jean Maynier, Matthieu Delamaire, and Jean-Philippe Malé.

iLex is redefining the syndicated loan market by developing a next-generation distribution platform. The company’s mission is to digitalize and streamline both primary and secondary loan markets through a comprehensive suite that includes deal workspaces, investor and market analytics, portfolio management, and private marketplaces.

The fresh influx of funds will be directed towards advancing iLex’s product roadmap. Key developments include the launch of a new primary syndication solution aimed at accelerating platform adoption across the EMEA and APAC regions. This strategic expansion aims to enhance the platform’s global outreach and operational capabilities.

Since its founding in 2020, iLex has successfully deployed its platform to 30 of the top 50 leading bookrunners worldwide, expanding its network to encompass over 500 active loan desks globally. The company’s rapid growth and adoption underline its critical role in transforming how loans are syndicated in the global financial landscape.

Axle Automation secures $2.5m in seed funding to revolutionize AML compliance

Axle Automation, a trailblazing provider of AI-powered solutions for compliance teams, has successfully closed a significant seed funding round.

The company, led by CEO and co-founder Ioannis Giannaros, has secured $2.5m to expand its team and enhance its innovative compliance solutions.

The funding round, amounting to $2.5m, was led by Diagram Ventures, with additional participation from Mistral Ventures, Uphonest Capital, StreamingFast, and several strategic angel investors.

Axle Automation specializes in leveraging generative artificial intelligence to automate and enhance AML compliance processes. The company focuses on streamlining operations such as Enhanced Due Diligence, thereby allowing financial institutions to scale their compliance efforts efficiently. By automating these traditionally manual and inefficient processes, Axle aims to reduce fraud, compliance risks, and operational costs while simultaneously increasing revenue.

The newly acquired funds will be utilized to further Axle’s mission of empowering financial institutions with state-of-the-art AML solutions.

AI-driven financial advisor PortfolioPilot.com secures $2m

PortfolioPilot.com, a groundbreaking AI-driven financial advisory platform, has successfully closed a $2m seed funding round.

This capital boost was supported by Morado Ventures, NEA Angel Fund, Unpopular Ventures, and several esteemed Silicon Valley angel investors.

The platform is pioneering a new era in financial advising, termed as the “next generation financial advisor.” PortfolioPilot.com empowers individuals to manage their finances with confidence, leveraging artificial intelligence and hedge fund-inspired models. It currently boasts over 22,000 users and manages more than $20bn in assets.

The fresh injection of funds is earmarked for enhancing the platform’s capabilities and expanding its reach. This initiative aligns with the company’s strategy to democratise sophisticated financial advice, making it accessible to a wider audience.

PortfolioPilot.com promotes an array of features that stand out in the crowded FinTech landscape. These include low-cost personalized financial advice, a strong fiduciary duty to act in the clients’ best interests, and tailored advice that caters to individual financial situations and goals. Furthermore, the platform offers a free net worth portfolio tracker and a five-minute “report card” assessment, providing users with valuable second opinions on their financial health.

In recent developments, PortfolioPilot.com launched a paid subscription model in August 2023, offering personalized recommendations for a flat fee of $29 per month. This approach has opened the doors to hedge fund-inspired investment insights for the masses. Additionally, Global Predictions, the parent company of PortfolioPilot.com, was recognised as a winner in the prestigious M6 international forecasting competition, showcasing the efficacy of its complex predictive models.

FullCircl secures major growth debt from Salica Investments amid record Q2 performance

Hawk bags investment from Macquarie to boost AI anti-financial crime tech

Hawk, an AI-powered technology for fraud prevention and AML firm, has announced an expansion of its Series B financing round.

Macquarie Capital joins a robust group of investors including Rabobank, BlackFin Capital Partners, Sands Capital, DN, Picus, and Coalition in this funding initiative.

The investment sum, which increases the total Series B to $144m, will primarily fuel Hawk’s international expansion. This strategic move comes amid a spike in demand for AI-driven solutions aimed at combating financial crimes globally.

Hawk’s core business revolves around the deployment of advanced, explainable AI technologies that significantly bolster the capabilities of financial institutions in detecting and preventing financial crime. Their systems are designed to ensure strict adherence to AML and CFT regulations while offering a unified solution for AML, sanctions screening, and fraud prevention.

The new funds are earmarked for further technological advancement and market expansion. Hawk aims to leverage Macquarie Capital’s expertise and network to extend their reach, particularly in the Asia-Pacific and US markets, enhancing their client base and further establishing their presence in these regions.

Founded in 2018 by veterans of the finance industry, Hawk has seen rapid growth and now monitors or screens billions of transactions globally. Their innovative approach to using explainable AI has set new standards in the industry, reducing false positives and uncovering new types of criminal activity more effectively than traditional systems.

MPower Partners fuels Teamshares’ expansion into Japan

MPower Partners Fund, Japan’s first ESG-focused global venture capital fund, has recently extended its investment portfolio by funding Teamshares, an innovative employee ownership platform targeting small businesses.

This investment marks another significant step in Teamshares’ financial journey, following earlier investments from MUFG Innovation Partners (MUIP) in February and Nomura in March.

Teamshares announced it successfully raised growth equity from MPower Partners. This strategic move supports Teamshares’ expansion plans, particularly its recent extension into the Japanese market, which anticipates inaugurating its first employee-owned business in Japan this year.

At its core, Teamshares aims to revolutionise small business ownership. Founded in 2019, the company is dedicated to fostering a network of 10,000 employee-owned companies, aiming to create $10 billion in stock wealth for employees. By purchasing businesses from retiring owners, Teamshares transitions them to 80% employee ownership within 20 years, ensuring these companies remain financially durable and permanently employee-owned.

The company has already acquired over 90 U.S. small businesses, spanning 31 states and 42 industries, integrating more than 2,600 new employee owners into its model.

MPower Partners Fund’s investment aligns with its commitment to integrate ESG principles into its investment strategy, supporting businesses that positively impact small business owners, their employees, and broader communities. This partnership embodies the ‘Sanpo Yoshi’ philosophy — beneficial for all parties involved.

Zenity secures strategic investment from M12 to bolster enterprise copilot security

Aleta Planet secures strategic investment to boost Middle East operations

Aleta Planet, a Singapore-based payments solutions provider, has secured a new investment from the United Arab Emirates’ strategic management company National Pulse, according to a report from Zawya.

The financial details of the investment were not disclosed, but will support the growth of Aleta Planet’s presence in the UAE, Middle East, and Africa.

The company, founded in 2014, specializes in facilitating global payments, including those via China’s popular UnionPay platform. Aleta Planet is known for handling approximately $2bn worth of cross-border payments annually.

Lukka enhances enterprise data solutions with investment from Animoca Capital

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global