Key European FinTech investment stats:

- European deal activity dropped by almost 75% in Q2 2024 in comparison to the same period last year

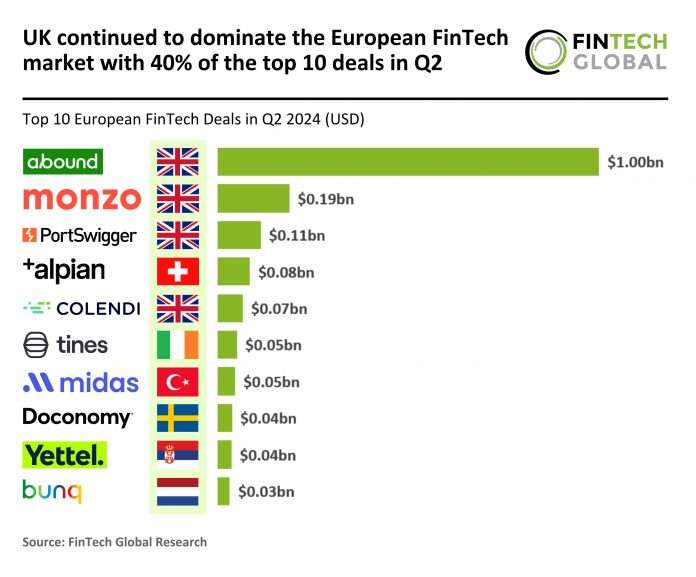

- UK was the only country to be featured in the top 10 deals for Q2 2023 and Q2 2024

- Alpian secured the largest FinTech deal in Europe outside the UK during the second quarter, with a Series C funding round of $84m

In Q2 2024, the European FinTech sector recorded 201 transactions, marking a sharp drop of nearly 75% from the 793 deals completed during the same quarter last year and a 55% drop from the 452 funding rounds in Q1 2024. The total FinTech funding raised in Q2 2024 amounted to $4.6bn, representing a decrease of 53% from the $9.8bn raised in Q2 2023.

The top 10 deals in Q2 2024 were spread across seven different countries, highlighting a broadening geographic distribution of FinTech activity in Europe. The UK continued to lead, securing four deals, while the Netherlands, Serbia, Sweden, Turkey, Ireland, and Switzerland each had one top deal each. This indicates a shift towards a more diverse landscape compared to Q2 2023, where the UK dominated with six deals, and Italy, Norway, Germany, and France each had one top deal each. Notably, the UK remains the only country represented in the top 10 deals for both Q2 2023 and Q2 2024.

A positive trend for the overall FinTech market in 2024 so far has been the growth of the average deal size. This trend was apparent in this market too, with the average deal value during the second quarter increasing to $22.9m from $12.4m during Q2 2023. This is an 85% increase in average deal value and an indicator of the investors’ growing appetite in the space.

Alpian, Switzerland’s pioneering digital banking platform has closed its $84m Series C funding round, marking it as the only non-UK company in the top five funding rounds for Q2 2024. The investment, which includes $44m contingent upon regulatory approvals, highlights the growing confidence in Alpian’s innovative approach to digital wealth management and banking services. The new capital will fuel further advancements in Alpian’s financial solutions as the company continues its rapid expansion. In 2024, Alpian doubled its client base to several thousand in the first four months alone, with total assets nearing $111m, driven by its advisory mandate that bridges managed and self-directed solutions. This mandate, offering access to curated investment opportunities and personalised recommendations, complements the ‘Managed by’ discretionary mandate, contributing to a remarkable net performance of 14.28% in managed assets since inception. Additionally, Alpian’s competitive banking features, including some of Switzerland’s highest deposit interest rates and significantly lower forex exchange fees compared to traditional banks, continue to attract a growing client base.