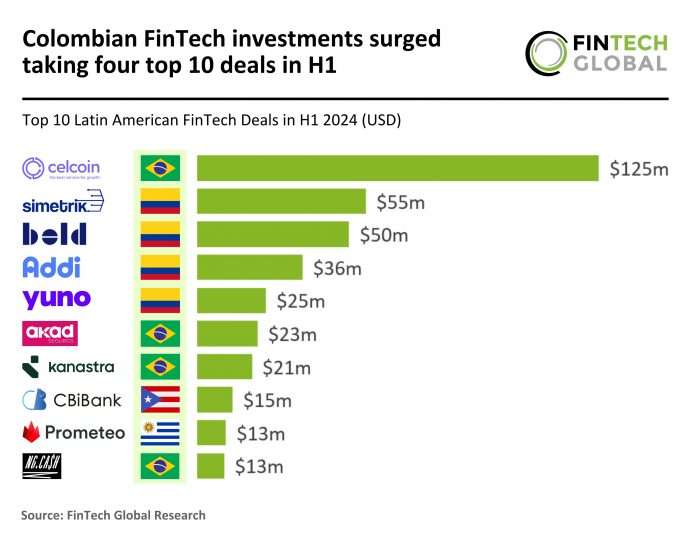

Key Latin American FinTech investment stats in H1 2024:

- Colombia FinTech investments experienced an uptick and secured four of the top 10 deals in the first half of the year

- Latin America FinTech funding grew by 20% in YoY comparison as investors focus on larger funding rounds

- Simetrik secured the biggest FinTech deal in Latin America with a Series B funding round of $55m

In H1 2024, the Latin American FinTech sector recorded 79 transactions, reflecting a sharp decline of nearly 58% from the 189 deals completed during the same period in 2023 and a 40% drop from the 131 funding rounds in H2 2023. Despite the reduced number of funding rounds, total FinTech funding in H1 2024 amounted to $1.2bn, representing a 20% increase from the $1.0bn raised in H1 2023 but a 29% decrease from the $1.7bn raised in H2 2023. This suggests a contraction in the number of deals, but with a focus on larger rounds.

The top 10 deals in H1 2024 were distributed across four countries, with Brazil and Colombia each securing four deals, while Puerto Rico and Uruguay contributed with one top deal each. A notable shift was the increased prominence of Colombia, which matched Brazil with four top deals, compared to just the one in H1 2023. Brazil remains a dominant player, continuing its strong performance from the previous year, while Puerto Rico maintained a presence in the top 10 across both periods. However, Mexico, which had a top deal in H1 2023, was absent from the list in H1 2024, replaced by Uruguay. This change indicates a growing diversification in the Latin American FinTech landscape, with new countries emerging as significant players.

Simetrik, a solution that automates financial and accounting control, had the largest FinTech deal in Colombia for H1 2024 after raising $55m in its latest Series B funding round, led by Goldman Sachs Asset Management. Simetrik has developed intuitive solutions to simplify and automate key financial tasks like record centralization, reconciliations, controls, reporting, and accounting. Its products are based on Simetrik Building Blocks (SBBs), a scalable, adaptable, and intuitive concept based on no-code development and generative AI technologies. Tailored to the dynamic needs of CFOs and their teams, these SBBs are set to further evolve with the Series B funding, enhancing their AI capabilities and reinforcing Simetrik’s dedication to advancing these solutions. Simetrik clients base includes large companies such as PayU, Mercado Libre, Rappi, PagSeguro, Falabella, Oxxo, Itaú, and Nubank, and partnerships with leading firms like Deloitte. The company’s global footprint spans over 35 countries, monitoring over 200m records daily, including in key Asian markets such as India and Singapore. Simetrik intends to use funds from this Series B to help expand its international reach, targeting major payment companies and consumer marketplaces worldwide.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global