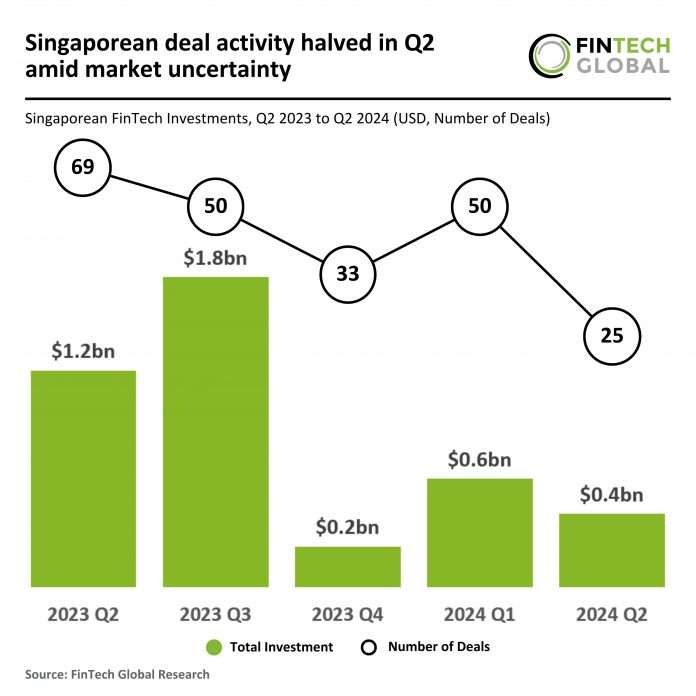

Key Singaporean FinTech investment stats in Q2 2024:

- FinTech deal activity in Singapore dropped by 50% in Q2 compared to the previous quarter as investors strategies change due to market uncertainties

- FinTech funding in the country dropped by 64% YoY

- GXS bank, a pioneering digital bank secured the largest deal of Q2 2024 in Singapore by completing a $169.1m funding round

In Q2 2024, the Singaporean FinTech sector experienced a downturn in both deal activity and funding. Only 25 funding rounds were completed in Q2 2024, marking a 64% decrease compared to the 69 in Q2 2023. Funding also saw a sharp decline, with FinTech companies raising just $419m in Q2 2024, a 65% drop from the $1.2bn raised during the same period last year. When compared to Q1 2024, which saw 50 deals and $618m in funding, Q2 2024 reflects a 50% drop-in deal activity and a 32% decline in funding.

The average deal value in Q2 2024 was $16.8m, a slight decrease from $17.2m in Q1 2024 and down from $17.4m in Q2 2023. This decline in average deal value for the Singaporean FinTech market could be attributed to a shift in investor sentiment, with a preference towards spreading capital across a larger number of smaller deals rather than concentrating on fewer, high-value investments. This approach may be a response to rising market uncertainty and tighter financial conditions, as investors look to diversify risk and avoid overcommitting to individual companies, especially in a volatile global economic environment.

GXS Bank, Singapore’s pioneering digital bank has secured the biggest deal in the region for Q2 with a $169.1m capital injection from backers Singtel and Grab, according to regulatory filings with the Accounting and Corporate Regulatory Authority of Singapore. Grab took up the majority of the 229.5m shares, being allotted 191.8m shares, while Singtel received 37.7m shares. The digital bank has disbursed more than 100k loans in the first year of its FlexiLoan product, which targets gig workers and traditionally underserved bank customers. GXS Bank has also seen traction with FlexiLoan among segments well-served by traditional banks. Deposits in both GXS and Malaysia GXBank rose to $479m at the end of Q1 2023 from $36m in Q1 2022, driven mainly by GXBank, with over 90% of its depositors being Grab users. This funding will further support GXS Bank’s mission to deliver innovative financial solutions and expand its services.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global