European FinTech investment stats in Q2 2024:

- FinTech deal activity in Europe dropped by 77% YoY

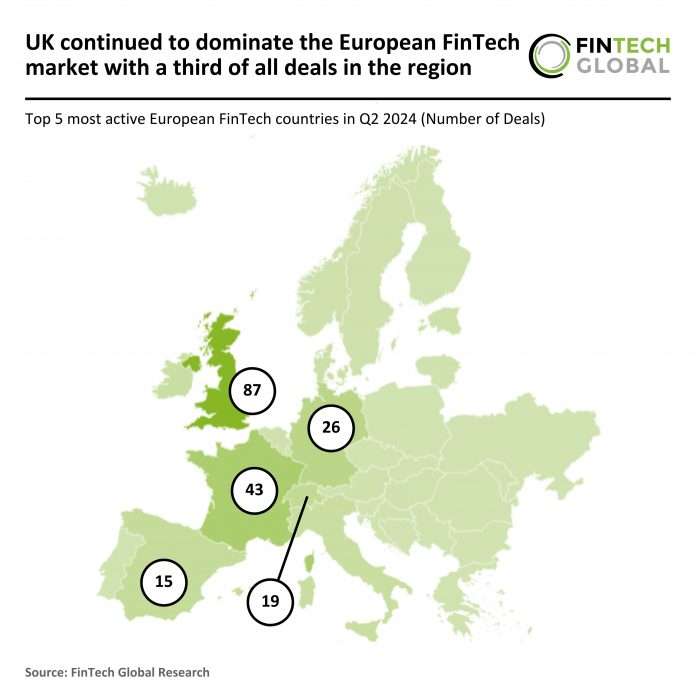

- UK continued its domination of the European FinTech market with a third of all deals in the region completed in Q2 2024

- Finmid secured the largest deal in Germany for the second quarter, with a Series A funding round of $25m

In Q2 2024, the European FinTech sector recorded 270 deals, a drastic drop of 77% from the 1,188 transactions completed during the same period in 2023. The UK led the market with 87 deals (32% share), maintaining its position as the most active country but with a reduced number compared to its 341 deals (29% share) in Q2 2023. France followed with 43 deals (16% share), down from 139 deals (12% share) in the same period last year. Germany completed 26 deals (10% share), a significant drop from the 131 deals (11% share) recorded in Q2 2023.

While the UK, France, and Germany remained the top three countries, all saw a considerable reduction in deal numbers. The UK’s dominance grew slightly in terms of share, despite the lower deal count, reflecting a contraction across the continent. France and Germany also maintained their positions, but with substantial declines in both deal numbers and market share, underscoring the broader challenges in the European FinTech sector.

Finmid, a Berlin-based embedded FinTech solution provider, secured the largest deal for a German FinTech in Q2 2024 with a $25m Series A funding round, valuing the company at $107m post-money. Specializing in offering payment and financing options for marketplaces, Finmid targets two-sided businesses looking to improve their margins by integrating financial services. With growing demand among European SMBs for alternative financing sources beyond traditional banks, Finmid’s solution allows marketplaces to leverage customer data to deliver personalised financing options. This new funding will support product development and expansion into new markets, positioning Finmid to capture more of the European embedded finance space.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global