Global CyberTech investment stats in H1 2024:

- CyberTech funding globally increased by 17% YoY

- Average deal value for CyberTech deals in the half increased to $27.7m as investors participated in larger investments

- Wiz secured the biggest CyberTech deal globally by raising $1bn in a Series E funding round

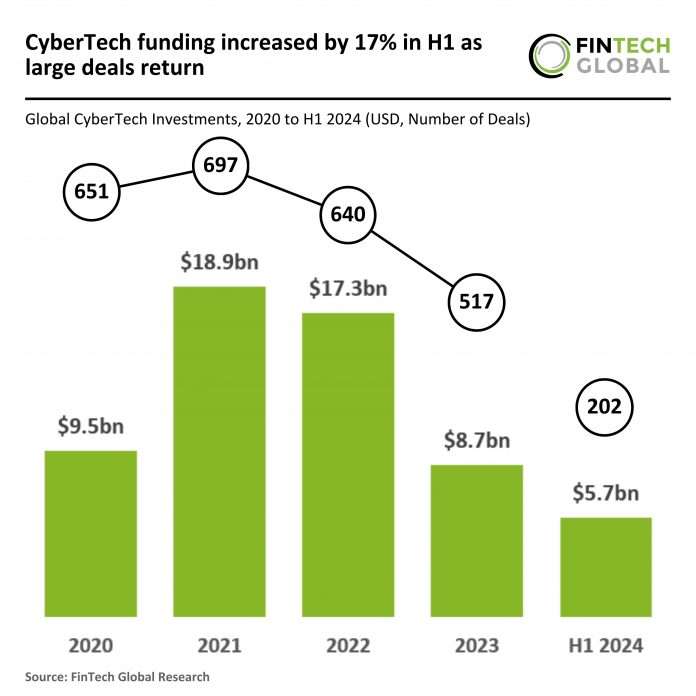

In H1 2024, the global CyberTech sector saw mixed results in terms of deal activity and funding. Only 202 deals were recorded in the first half of the year, representing a 27% decline compared to the 276 deals completed during the same period in H1 2023. However, despite the drop in deal numbers, CyberTech companies managed to raise $5.6bn in H1 2024, a 17% increase from the $4.8bn raised in H1 2023. If this trend continues, the projected total for deal activity in 2024 would be around 404 deals, a notable 23% decrease from the 517 deals completed in 2023.

The average deal value in H1 2024 stood at approximately $27.7m, a significant increase from $17.4m in H1 2023, indicating a 59% rise. This growth in average deal size suggests that although fewer deals are being closed, investors are concentrating on larger, more established CyberTech companies. This could reflect a strategic shift toward securing high-value investments in key players, as companies in the sector continue to tackle increasing cybersecurity threats globally.

Wiz, a cloud security company, secured the largest CyberTech deal of the half by securing $1bn in a Series E funding round, propelling its valuation to a staggering $12bn. This significant milestone reflects the growing demand for robust cloud security solutions and Wiz’s rapid market capture in just four years. The funding round, co-led by Andreessen Horowitz, Lightspeed Venture Partners, and Thrive Capital, positions Wiz as one of the most highly valued startups in cybersecurity today. The round, announced as the industry’s RSA Conference commenced in San Francisco, signals renewed investor interest in the cybersecurity space, following a strong funding quarter for cyber startups and the successful IPO of Microsoft-backed data security firm Rubrik. Additional participation in Wiz’s latest round came from Greylock, Wellington Management, and existing investors Cyberstarts, Greenoaks, Howard Schultz, Index Ventures, Salesforce Ventures, and Sequoia Capital.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global