it was a strong week for US-based CyberTech companies, accounting for eight of the total 26 FinTech deals covered this week.

In total, FinTech Global covered 26 FinTech funding rounds this week with the US accounting for the lion share of these. The country was home to 16 of the deals, followed by the UK, which recorded five.

Of the 16 US-based companies to raise funds this week, either of them were CyberTech companies. Interestingly, these were the only CyberTech companies to secure funds this week. The companies were: Strider Technologies, Aembit, Darkhive, P0 Security, Operant AI, Realm.Security, Arcjet and SplxAI.

The other US-based companies to secure funds this week were Finally, Thatch, Polly, Nirvana, Ledgebrook, Sigo Seguros, Datricks and Cashmere.

Unsurprisingly, the US-dominated the biggest deals of the week, accounting for six of them, including the biggest two deals. The biggest deal of the week was raised by Finally, which secured an impressive $200m for its Series B funding round. The AI-powered finance and HR platform raised the funds to expand the company’s team, further develop its product offerings, and enhance its market penetration strategies. The Series B was comprised of $50m in equity from PeakSpan Capital and a substantial $150m credit facility from Encina.

The second largest deal of the week was substantially smaller than Finally’s $200m. It was a $44m Series C secured by CyberTech Strider Technologies. The funding round was led by Pelion Venture Partners and also saw participation from other investors, including AXA Venture Partners, Valor Equity Partners, DataTribe, and Cyfr Capital.

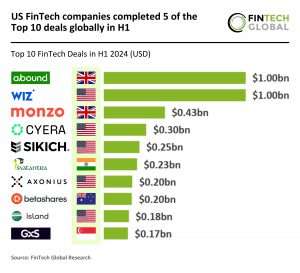

The US continues to dominate the FinTech sector and a recent research piece from FinTech Global gave greater credence to this. During the first half of 2024, there were a total of 2,754 deals in the Fintech sector. While this seems like a sizable amount, it was a 50% drop on H1 2023 and a 35% drop from H2 2023.

The amount of capital raised by companies also witnessed a decline. During H1 2024 a total of $53bn was invested into FinTech companies, a 46% decrease from the $98bn raised in H1 2023 and a 20% drop from the $66bn raised during H2 2023.

There were two companies to raise $1bn during the first half of the year, UK-based abound and US-based Wiz. Of the ten biggest deals, there were five countries represented. The US was home to five of the ten biggest deals.

The UK also secured two of the biggest deals, which were also two of the three biggest deals of the opening six months of the year.

For this week, the UK-based FinTech companies made their presence known. A total of five UK-based companies secured funds this week. These were Novatus Global, Twenty7tec, Form3, Optalitix and PropEco.

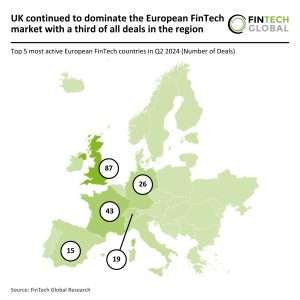

Another research piece from FinTech Global this week showed the UK’s FinTech dominance in Europe. During Q2 2024, the European FinTech sector recorded 270 deals, a seismic drop of 77% from Q2 2023. The UK led the market with a 32% share of the deals (87 deals). It was followed by France with 43 deals and Germany with 26 deals.

Going back to this week, the remaining countries represented these week were India (FlexiLoans), Singapore (Helicap), UAE (FlapKap), Egypt (Paymob) and Canada (NetNow).

In terms of sectors, CyberTech recorded the most deals. It was then followed by marketplace lending and InsurTech, which both recorded five deals. The five marketplace lending companies were FlexiLoans, FlapKap, Polly, Twenty7tec and NetNow. The five InsurTech companies were Thatch, Nirvana, Ledgebrook, Sigo Seguros and Optalitix.

Elsewhere, there were two WealthTech deals (Helicap and Cashmere), two RegTech deals (Datricks and Novatus Global), two PayTech funding rounds (Form3 and Paymob), one ESG FinTech round (PropEco) and one infrastructure and enterprise software deal (Finally).

Without further delay, here are the 26 FinTech deals we covered this week.

Finally secures $200m in Series B funding to enhance SMB financial services

Finally, the AI-powered finance and HR platform, has successfully secured a $200m Series B investment.

The latest funding round consists of $50m in equity from PeakSpan Capital and a substantial $150m credit facility from Encina. This strategic financial infusion builds on the firm’s previous $95m Series A in 2022 and an additional $10m capital received in February this year, bringing its total funds to an impressive $305m.

The company is dedicated to transforming the finance and HR capabilities of small and medium-sized businesses (SMBs). Finally offers a comprehensive suite of tools, including bookkeeping, payroll, bill pay, and expense management, tailored to streamline operations for SMBs, which constitute nearly half of the American workforce.

With its Series B funding, Finally plans to accelerate its growth trajectory. The capital will be used to expand the company’s team, further develop its product offerings, and enhance its market penetration strategies.

Since its last funding round, Finally has achieved a remarkable 300% annual revenue growth and has significantly increased its workforce by the same percentage. The company has also launched four innovative products over the past year: Corporate Charge Cards, Expense Management, Business Checking Accounts, and Payroll.

Strider Technologies secures $55m to expand AI-driven global intelligence platform

Strider Technologies, a leading provider of strategic intelligence solutions, has raised $55m in a Series C funding round.

The funding round was led by Pelion Venture Partners, marking the firm’s largest single investment to date. The round also saw participation from other investors, including AXA Venture Partners, Valor Equity Partners, DataTribe, and Cyfr Capital.

Strider Technologies is recognised for its innovative approach to global intelligence, leveraging AI and proprietary methodologies to transform public data into actionable insights. The company’s platform allows organisations to secure critical assets, make informed decisions, and compete more effectively in the global economy.

With the new funding, Strider plans to accelerate the development of its AI-driven platform and expand its reach into new geographies, particularly in Europe and Asia. Additionally, the company intends to broaden its operations in the public sector, addressing the increasing demand for strategic intelligence solutions.

Helicap secures $50m credit facility with XenCapital to boost southeast Asian businesses

Helicap, a Singapore-based FinTech firm, has successfully secured a $50m credit facility with XenCapital, the lending arm of the FinTech unicorn Xendit, which operates across Southeast Asia.

The funding is set to play a pivotal role in supporting underbanked businesses within the region. XenCapital, a key player with a history of disbursing over $700m in loans since 2021, joins forces with Helicap to further their shared goal of driving financial inclusion across Southeast Asia.

The new funds will be used to empower businesses and stimulate economic growth within Southeast Asia. This aligns perfectly with Helicap’s mission to ease access to capital for underbanked businesses, helping to fill a substantial $400bn financing gap left by traditional banking systems.

In addition to the credit facility, Helicap boasts a strong backing from notable investors including Malaysia’s Kenanga Investment Bank Berhad, Japanese firm Credit Saison, Temasek-backed Tikehau Capital, integrated Asian financial house PhillipCapital, and top VC firms such as East Ventures, Access Ventures, Voveo Capital, and leading Singapore property group Soilbuild Group Holdings.

Novatus Global bolsters RegTech prowess with $40m investment

Novatus Global, a London-based leader in regulatory technology, has announced a significant growth investment of $40m from Silversmith Capital Partners, a growth equity firm located in Boston.

Since its inception in 2019 by seasoned industry experts, Novatus has become a trusted ally to major global banks, asset managers, and financial institutions, a relationship cemented by a revenue increase of over threefold in the past year.

This funding is earmarked for further development of the cutting-edge SaaS platform, Novatus En:ACT, and for broadening the company’s geographical footprint, reinforcing its position as the preferred partner for its clients.

Novatus stands out in the RegTech landscape by enabling its clients to tackle their most demanding regulatory and compliance needs, whether imposed by governments or industry bodies. Its flagship offering, Novatus En:ACT, is a market leader, providing scalable, cloud-native solutions trusted globally to ensure accurate and timely transaction reporting across all G20 transaction reporting regimes.

Additionally, Novatus offers bespoke advisory services that leverage its technological solutions and decades of industry expertise to assist clients of varying sizes and stages in navigating complex compliance, risk management, and transformational challenges.

The investment will primarily fuel innovation and support Novatus’s ongoing expansion into North America, building on a successful launch in Australia the previous year.

San Francisco-based Thatch raises $38m to revolutionise health insurance benefits

Thatch, a health benefits startup, has raised $38m in a Series A funding round led by Index Ventures and General Catalyst.

The $38m round saw participation from several prominent investors, including SemperVirens, The General Partnership, Andreessen Horowitz (a16z), and Avid Ventures, according to InsurTech Insights.

Founded in 2021, Thatch’s platform focuses on simplifying health benefits administration for businesses and employees.

The platform is designed to streamline the complexities of the Individual Coverage Health Reimbursement Arrangement (ICHRA) law, allowing employers to make tax-free contributions to health insurance plans.

Employees can then choose their own health insurance, offering more flexibility and control over their healthcare choices.

With the new funding, Thatch plans to scale its operations and expand its services, addressing growing demand from businesses and individuals.

The company aims to continue innovating in the health benefits space, providing more cost-effective and transparent solutions.

FlexiLoans bags $34.5m for empowering MSMEs in tier 2 and Tier 3 Indian cities

FlexiLoans, an innovator in India’s digital lending space, has announced a successful equity raise of $34.5m in its latest Series C funding round.

This significant investment was led by an ensemble of both global and domestic backers including Accion, Nuveen, Fundamentum, and existing investor Maj Invest, underscoring the confidence in FlexiLoans’ mission and strategy.

Founded in 2016 by Deepak Jain, Ritesh Jain, and Manish Lunia, FlexiLoans has become a cornerstone in the Indian MSME financing landscape. The company’s platform has revolutionised the way small businesses access financial services, particularly in less urban areas. By employing a fully digital model, FlexiLoans allows for rapid loan approvals, often within 48 hours, using alternative data sources for credit assessments.

With the new funds, FlexiLoans is poised to broaden its operational reach and refine its product offerings, with a strong focus on technological enhancements. This strategic capital injection will enable the company to continue its mission to fuel the growth of Micro, Small and Medium-sized Enterprises (MSMEs) across India, especially in tier 2 and tier 3 cities where traditional banking services are limited.

FlexiLoans has made significant strides in financial inclusion, having disbursed over ₹7,000 crores across more than 2,100 towns and cities in India.

The firm’s sophisticated proprietary credit underwriting engine, which incorporates advanced machine learning algorithms, plays a crucial role in assessing borrowers’ creditworthiness without traditional collateral requirements.

FlapKap raises $34m in pre-Series A funding to transform SME financing in MENA

FlapKap, the Abu Dhabi-based FinTech leader, announced today it has secured $34m in combined debt and equity during its latest pre-Series A funding round.

This significant financial boost was led by BECO Capital and included substantial contributions from new investor Pact VC, according to a report from FinTech Finance News.

Additional support also came from existing backers such as A15, Nclude, and QED Investors. The round was also bolstered by debt financing from Channel Capital, bringing FlapKap’s total funding to $37.6m.

The company is renowned for offering innovative revenue-based and embedded financing solutions tailored to the MENA region’s unique market demands.

This fresh capital infusion will enable FlapKap to further its reach across the UAE and GCC, allocating more resources to empower small and medium-sized enterprises (SMEs) and to maximize their growth potential. Additionally, the funds will enhance the company’s technological infrastructure to introduce new trade finance products specifically designed for B2B transactions.

Initially launched to aid e-commerce businesses, as well as industries such as retail and restaurants, FlapKap has expanded its services to support a broader spectrum of SMEs. The platform simplifies the funding process, allowing businesses to receive financing offers within just 48 hours of application by integrating seamlessly with e-commerce platforms and social media.

Polly secures $25m to enhance mortgage tech innovation and growth

Aembit secures $25m in Series A to enhance non-human identity security

Aembit, a pioneer in non-human identity and access management (IAM), has successfully raised $25m in its Series A funding round.

This investment boosts Aembit’s total capital to nearly $45m. The round was spearheaded by Acrew Capital, with contributions from previous backers including Ballistic Ventures, Ten Eleven Ventures, Okta Ventures, and the CrowdStrike Falcon Fund.

The company specialises in non-human identity (NHI) management, which includes the various applications, scripts, and bots used by enterprises to automate processes, as well as the credentials these NHIs use to interact with critical databases, applications, and infrastructure. Recent high-profile security breaches involving NHIs at major firms like Cloudflare, The New York Times, and Microsoft have highlighted the urgent need for robust NHI management solutions.

Aembit’s funding will primarily be directed towards enhancing their cutting-edge non-human IAM technology. This involves automating identity-driven, secretless, centrally enforced, and auditable access between distributed applications and SaaS services to cloud and on-premises resources. By innovating in this field, Aembit aims to reduce the attack surface associated with the growing and diverse landscape of non-human identities.

Additional context from the funding round includes insights from a recent survey conducted by Aembit. It revealed significant challenges in secure management of NHI credentials within the industry, with over 30% of organizations still storing credentials within code and 23% using less secure methods like email and chat for sharing credentials. More than 60% of respondents expressed a need for a comprehensive solution that spans their entire organization.

Aembit has been recognized as a leader in the non-human IAM sector, being named a Top 2 finalist at the 2024 RSA Innovation Sandbox competition and a finalist for the Best Identity Management Solution at the 2024 SC Awards. These accolades underscore the company’s commitment to advancing secure access management capabilities, including multi-factor authentication (MFA) strength conditional access, policy automation via infrastructure-as-code, and robust auditing for NHI access.

Nirvana secures $24.2m in Series A to enhance health insurance transparency

Nirvana, a pioneering health tech company, today announced a significant boost to its mission of bringing transparency to health insurance processes.

The firm has successfully secured $24.2 million in Series A funding led by Northzone, with contributions from Inspired Capital, Eniac Ventures, and Surface Ventures.

Specializing in eligibility and insurance verification, Nirvana harnesses artificial intelligence to illuminate the often opaque world of healthcare benefits. Their technology offers real-time insurance verification and precise cost estimates, empowering patients and providers alike. This breakthrough approach enables a more transparent healthcare experience, mitigating the risk of unexpected costs for patients and streamlining operations for providers.

The fresh capital will fuel Nirvana’s expansion into new healthcare specialties, enhancing their AI-driven platform to cater to a broader array of medical fields. The founders, Akshay Venkitasubramanian, Urvish Parikh, and Kelvin Chan, envision this funding as a key driver in scaling their operations and broadening the reach of their innovative solutions.

Their technology not only simplifies insurance verification but also integrates seamlessly with existing healthcare management systems through APIs, EHR/EMR integrations, or the universally accessible web/mobile application, OneVerify.

Paymob secures $22m to bolster digital payment infrastructure in MENA

Paymob, a trailblazer in the MENA financial services sector, has recently announced a substantial $22m extension to its Series B funding, culminating in a robust $72m total for the round.

According to Wamda, this investment surge was spearheaded by EBRD Venture Capital, with significant contributions from Endeavor Catalyst.

The funds come at a time when Paymob has demonstrated impressive financial health, particularly in its primary market of Egypt, where it has seen a sixfold increase in revenue since the initial Series B capital injection in Q2 2022. These financial reserves are set to bolster Paymob’s strategic initiatives across the MENA region.

Established in 2015, Paymob has been a pioneer in the regional FinTech space, having been the first to obtain the Central Bank of Egypt’s Payments Facilitator licence in 2018. The company has since expanded its footprint, launching operations in the UAE in 2022 and securing a Payments PTSP certification in Saudi Arabia in May 2023. December 2023 marked a significant milestone with Paymob receiving Oman’s PSP licence, becoming the first international FinTech entity to do so.

The fresh funds are earmarked for deepening Paymob’s market penetration in Egypt and scaling its operations across newly entered markets. This strategic expansion is supported by a $50m initial Series B round in 2022, which has enabled the introduction of its app this year and a 3.5-fold increase in its merchant base, now serving nearly 350,000 merchants.

Twenty7tec enhances UK FinTech sector with £16.5m ($21.69m) fundraise

Based in Bournemouth, UK and established in 2014, Twenty7tec has become a significant player in the UK’s mortgage technology scene, increasingly popular among wealth advisers.

The company has secured a substantial £16.5m investment from BGF, a prominent investor in the UK and Ireland, aimed at fuelling growth and expansion across the region.

Twenty7tec provides an integrated platform that simplifies the mortgage process from product search and sourcing to application and completion. Utilised daily by over 16,000 mortgage, protection, and wealth advisers, the platform is renowned for its efficiency and accuracy, helping advisers deliver top-notch customer service while adhering to complex regulatory requirements.

The new funds will be used to accelerate Twenty7tec’s product development, enhance its technological infrastructure, and explore new market opportunities. Additionally, the investment will support the expansion of the company’s team, ensuring continued delivery of exceptional service and innovation.

Moreover, the investment has facilitated Angela Williams joining the board as Non-Executive Chair, after being introduced by BGF’s Talent Network. Angela’s extensive experience in tech-focused businesses will be crucial in refining and driving Twenty7tec’s growth strategy.

Darkhive raises $21m in Series A for advanced UAS security solutions

Darkhive, a trailblazer in defense technology, has announced the close of a $21m Series A funding round spearheaded by Ten Eleven Ventures.

Known for its innovative approach to unmanned aircraft systems (UAS), Darkhive is making significant strides in enhancing situational awareness for military and public safety teams globally.

This substantial investment round included key contributions from Ten Eleven Ventures, emphasizing their commitment to cybersecurity and national security technologies. Additional financial backing came from notable firms such as Crosslink Capital, RTX Ventures, and Stellar Ventures, each aligning with Darkhive’s mission to revolutionize the defense sector.

Darkhive specializes in developing advanced, lightweight drones designed for short to mid-range reconnaissance missions. These drones are supported by a proprietary software platform that ensures secure, continuous delivery of Department of Defense (DoD) accredited software. This platform not only facilitates regular updates but also manages comprehensive fleet and device operations in the field.

With the fresh capital infusion, Darkhive plans to expand its product line and increase resources to secure and support DoD contracts more effectively. The funding will also help the company extend its life-saving technology to more field teams, ensuring they have the necessary tools to execute their missions successfully.

John Goodson, CEO of Darkhive, emphasized the urgent need for secure and efficient UAS solutions that cater to the US and its allies. He highlighted the challenges posed by foreign UAS technologies, which, despite being cost-effective, fail to meet security standards, leaving critical operations vulnerable.

In addition to the Series A funding, Darkhive has a robust track record of securing capital and contracts that underscore its potential and commitment to security. The company previously raised $4m in a Seed round and has been actively involved in multiple government projects, including a Phase III SBIR IDIQ with AFWERX Autonomy Prime and various other defense-related contracts.

Ledgebrook’s innovative push in InsurTech garners $17m Series B funding

Ledgebrook, the rapidly growing InsurTech firm, has successfully closed a $17m Series B funding round.

Leading the round were the esteemed Duquesne Family Office and The Stephens Group, with additional support from long-term partners Brand Foundry Ventures and American Family Ventures. This funding milestone highlights the industry’s strong support for Ledgebrook’s mission.

The capital will be primarily used to accelerate the expansion of Ledgebrook’s current operations and initiate innovative projects that promise to redefine the insurance experience through cutting-edge technology and exceptional customer service.

With a vision set on long-term innovation, Ledgebrook is keen on surpassing traditional insurance service benchmarks.

AI compliance leader Datricks lands $15m funding from SAP and Team8

Datricks, an AI-powered financial integrity and compliance software startup, has successfully secured $15m in its latest Series A funding round.

According to Venture Beat, this substantial financial boost was spearheaded by the venture capital firm Team8, accompanied by significant contributions from SAP, a leader in global enterprise software, and the existing investor Jerusalem Venture Partners (JVP).

Established in 2019 by CEO Haim Halpern and chief technology officer (CTO) Roy Rozenblum, Datricks originally emerged from a consulting business boasting about 500 consultants. The company has transitioned into a software entity, focusing on “risk mining” – a novel, AI-driven technique that autonomously scrutinizes financial workflows across business systems including SAP, Oracle, and Salesforce. “We were a consulting company for many years, managing large projects. At some point, we decided to transition to a software company to achieve scale,” Rozenblum commented during a video call interview with VentureBeat earlier this week.

The newly acquired funds are earmarked for scaling Datricks’ operations and further enhancing its flagship product, the Datricks Financial Integrity Platform. This platform plays a crucial role in unveiling financial discrepancies, patterns of fraud, and compliance breaches, thus enabling companies to garner real-time insights and avert potential financial and reputational damages.

Datricks addresses a critical gap in financial risk management where traditional compliance and audit methods frequently miss marking potential risks. This inadequacy leaves enterprises prone to schemes that could entail losses amounting to millions. According to the Association of Certified Fraud Examiners, organizations globally lose roughly 5% of their annual revenue to fraud, tallying up to $4.7 trillion in losses.

P0 Security secures $15m investment for pioneering cloud governance solution

P0 Security, a pioneer in cloud identity security, has recently secured $15m in a Series A funding round.

The round was led by SYN Ventures and saw participation from cloud security leader Zscaler, along with existing investor Lightspeed Venture Partners. The company has also welcomed SYN Ventures Operating Partner, Ryan Permeh, to its Board of Directors.

Since its inception, P0 Security has raised a total of $20m. The company stands out in the cloud-native landscape, which is increasingly characterized by an explosion of resources, data locations, and identities that extend far beyond traditional network boundaries. This complexity has rendered legacy identity and access management solutions inadequate for today’s distributed digital infrastructures.

P0 Security introduces a groundbreaking approach to access governance and identity security. The company offers a unified Identity Governance and Administration (IGA) and Privileged Access Management (PAM) platform that is specifically designed for cloud environments.

Its agentless architecture enables rapid deployment, granting security teams unprecedented visibility and control over both human and non-human identities accessing cloud resources. The platform is engineered to support seamless integration and management of access rights, streamlining the access lifecycle for developers and automated identities through user-friendly workflows.

He further explained that traditional tools fail to address the complexities introduced by the cloud, especially the involvement of non-human identities. P0 Security’s platform is designed to answer the pressing question of who or what can access organizational cloud resources, thereby restoring control to organizations.

The new capital will empower P0 Security to expand its go-to-market and engineering teams significantly, aiming to cater to its growing customer base that includes major players in technology and financial services sectors.

Form3 announces £10m ($13.1m) Series C extension funding led by British Patient Capital

Form3, a prominent British payment technology firm, has recently secured a £10m investment.

This funding, contributed by British Patient Capital, forms part of Form3’s Series C extension round. Other notable investors participating in this round include Visa and Molten, among others.

As a leading entity in the payment technology landscape, Form3 offers a robust solution that allows major banks and financial institutions to expedite their digital transformation journeys. By connecting to multiple payment schemes through a single, scalable platform, Form3 replaces outdated legacy systems with advanced, cloud-native infrastructure tailored for real-time payments.

The fresh injection of capital will fuel Form3’s ongoing efforts to scale operations, develop new products and services, and extend its reach into new territories.

Sigo Seguros bags $10.5m to expand car insurance offerings

Sigo Seguros, a car insurance startup focused on underserved communities, has raised $10.5m in a Series A funding round.

The round was led by Varco Capital and Listen, with additional support from Angeles Ventures, Flintlock Capital, Zeal Capital, Rise of the Rest, and Fiat Ventures, according to the Coverager.

Founded in 2018 and based in Austin, Texas, Sigo Seguros primarily targets immigrants and working-class communities with its unique “Spanish-first approach”.

The company currently offers car insurance coverage in Texas through a partnership with Old American Insurance and plans to expand its services to Florida and California.

The fresh funding will be used to fuel this geographical expansion and enhance its product offerings. Additionally, the company aims to continue its focus on providing accessible, inclusive car insurance to underserved groups across more states.

Sigo Seguros reports that it has already provided coverage to over 60,000 individuals. In 2023, its partner, Old American, disclosed that the startup was responsible for generating $13.8m in written premiums.

Operant AI attracts $10m investment to boost cloud and AI security solutions

Operant AI, an emerging player in the FinTech sector based in San Francisco, has successfully raised $10m in venture capital.

According to Security Week, the Series A funding round saw contributions from SineWave Ventures, Felicis, Alumni Ventures, Massive, Calm Ventures, and Gaingels. Since its public inception in April 2023, Operant AI’s total capital stands at $13.5m.

Operant AI is spearheaded by veteran software engineers Vrajesh Bhavsar and Priyanka Tembey. The company’s core offering is a runtime application platform designed to shield every layer of live applications from malicious attackers. This platform represents a shift away from traditional security measures that only scrutinize code prior to deployment.

The need for dynamic protection tools is growing, as these provide real-time visibility and defense across various layers of cloud applications, including APIs, services, and AI components. Operant AI’s innovative solution is engineered to block over 80% of prevalent runtime attacks, including those identified in the OWASP Top 10, with minimal changes required to existing code structures.

Alongside the funding announcement, Patricia Muoio, a partner at SineWave Ventures with a storied background in NSA/DoD operations, alongside Nancy Wang, a Venture Partner at Felicis with prior experience as AWS Data Protection Director, will take seats on Operant AI’s Board of Directors. Their extensive backgrounds are expected to provide valuable insights into the company’s strategic direction.

Realm.Security secures $5m in seed funding to streamline cybersecurity data management

Realm.Security, a startup tailored for cybersecurity, has stepped out of stealth mode and announced a $5m seed investment spearheaded by Accomplice and Glasswing Ventures.

Founded by cybersecurity experts Peter Martin, Jeff Kraemer, and Sanket Choksey, who have been pivotal in shaping influential companies within the industry, Realm.Security is transforming massive amounts of sprawling security data into a streamlined, intelligent framework.

This transformation enables security teams to manage their resources more efficiently and break free from vendor dependency.

Realm’s initiative is to tame the overwhelming flow of security data by integrating and managing disparate data types through cutting-edge AI and data processing technologies.

By centralizing the data management process, Realm’s platform allows security teams to normalize, suppress, route, and enrich data from various sources, aiming for a multi-destination strategy. This approach promises to liberate customers from vendor lock-in and mitigate escalating costs associated with usage-based licensing models.

Cashmere raises $3.6m in seed funding to enhance wealth management client acquisition

Revolutionizing developer security: Arcjet secures $3.6m led by Andreessen Horowitz

Arcjet, a trailblazer in developer security solutions, has successfully closed a seed funding round of $3.6m.

The investment was spearheaded by Zane Lackey of Andreessen Horowitz, a notable figure in the technology investment sphere. Other participants in this round included Seedcamp and an impressive lineup of angel investors, highlighting the broad industry support for Arcjet’s innovative approach.

At its core, Arcjet provides cutting-edge security tools specifically designed for developers working with modern web platforms like Next.js, Node.js, and SvelteKit, among others. Their products are tailored for seamless integration into various development environments, ensuring that security measures enhance rather than hinder the development process.

The new capital injection will be strategically used to expand Arcjet’s range of developer-focused security solutions. Plans are in place to enhance middleware capabilities that operate on every request, allowing for more granular security adjustments directly within the application’s workflow.

Arcjet’s method represents a significant shift from traditional security measures, which often rely on network-level filtering. By embedding security more deeply into the application layer, Arcjet allows developers to address security challenges with unprecedented precision and flexibility. This includes the ability to respond to various threats dynamically, from automated bots to unauthorized data access, ensuring that each aspect of application security is robust and adaptable.

Optalitix secures $3m funding to drive insurance software innovation

Optalitix, a specialist in insurance and finance software, has raised $3m in a follow-on fundraising round led by its existing investor, Calculus Capital.

The round also saw participation from 24 Haymarket and other investors, bringing the company’s total funding to $8m, according to FF News.

The latest funding round will support Optalitix’s ongoing efforts to drive product innovation and accelerate its expansion plans.

With the global insurance industry increasingly prioritising digital transformation, Optalitix is poised to benefit from a forecasted 25% growth in technology spending by 2026, as insurers seek competitive advantages in pricing and underwriting solutions.

Optalitix’s key offerings include Optalitix Models, a cloud-hosted solution that converts Excel models into code, and Optalitix Quote, a digital pricing and underwriting workbench.

The new funds will be used to enhance these products and expand Optalitix’s reach to a broader user base.

SplxAI secures $2m to enhance AI chatbot security

SplxAI, an emerging player in the field of AI security, has successfully raised $2m in a pre-seed venture capital round.

According to Security Week, the funding initiative was spearheaded by Inovo.vc, complemented by contributions from Runtime Ventures, South Central Ventures, and a cohort of angel investors.

Established in 2023, SplxAI is dedicated to advancing a security platform specifically designed to pinpoint vulnerabilities within AI chatbots and conversational systems. This initiative is set against a backdrop where the adoption of AI technologies is rapidly escalating across various industries.

The company’s ambitious project involves the creation of an end-to-end platform for what they term “offensive AI security.” This innovative platform is intended to enable enterprises to adopt and utilize generative AI securely. By 2030, the market for generative AI is projected to soar to $40bn, marking a significant growth trajectory that SplxAI aims to tap into.

SplxAI plans to channel the fresh capital into accelerating its product development. The funds will also support the hiring of new talent and scaling operations, primarily focusing on the U.S. market. Their solution boasts the capability to automate complex attack scenarios, such as hallucinations, prompt injections, and steering conversations off-topic, which are critical in aiding AI security teams to preemptively identify and mitigate potential threats.

Moreover, the solution is designed to align the risk surface with compliance frameworks, monitor threat activity in real-time, and support multi-modal pentesting scenarios across various types of attachments. This comprehensive approach ensures a robust security posture for organizations employing AI technologies.

Ripple Ventures leads $1.8m pre-seed investment in trade credit startup NetNow

NetNow, a pioneering trade credit automation platform, has successfully secured $1.8m in pre-seed funding.

The investment round was spearheaded by Ripple Ventures, with contributions from Centre Street Partners, Antler, Motivate Venture Capital, and Day One Ventures. Additionally, NetNow has earned a grant from Intuit after being named The Most Customer Obsessed company.

NetNow specializes in automating the credit and collections process specifically for wholesalers and distributors. This modern platform is designed to bring much-needed innovation to B2B Credit Management, particularly within industries that have traditionally relied on outdated, cumbersome processes. By leveraging cutting-edge technology, NetNow introduces automation, integration, and flexibility into a sector ripe for disruption.

The newly acquired funds are earmarked for accelerating the development of AI-driven features within NetNow’s platform. These advancements are set to simplify documentation processes, enhance data analysis, and generate sophisticated risk scores and metrics.

For industries like building materials—ranging from lumber yards to steel mills and HVAC supply houses—NetNow offers a critical solution that improves credit management for both new and existing contractors and construction projects.

PropEco raises £275k to revolutionize property risk management with climate focus

PropEco, a Glasgow-based tech company, recently secured a seed investment of £275,000. The company is known for its advanced technology platform that evaluates the long-term value and viability of properties with an innovative approach.

The £275k investment was led by Symvan Capital, a London-based venture capital firm specializing in early-stage, high-growth technology companies, with additional participation from the University of Strathclyde’s Inspire Entrepreneurs Fund.

PropEco operates at the intersection of property technology and climate risk assessment. The company’s AI-powered platform taps into a wealth of data from thousands of sources, including proprietary ones, to offer detailed evaluations on factors like flood risks, air quality, and potential for green retrofits. This data fuels a variety of tools and services, from APIs to comprehensive property reports.

The infusion of capital will boost PropEco’s efforts to empower property professionals, lenders, and insurers with data and tools necessary to manage the effects of social and environmental trends, including climate change. Plans include team expansion and accelerated product development to set the stage for global reach within the next year.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global