Key Australian FinTech investment stats in Q2 2024:

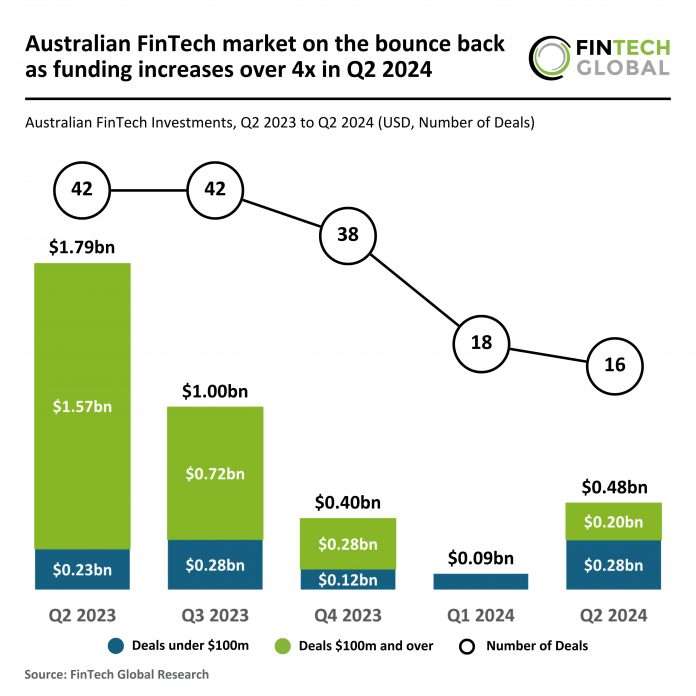

- Australian FinTech funding in the second quarter increased by 4x compared to the opening quarter of the year

- However, average deal size dropped from $42.7m in Q2 2023 to $29.7m in the second quarter of this year as investors grew cautious

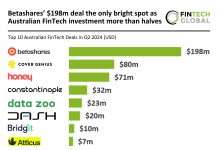

- Sydney based Betashares, secured the largest deal in Australia for Q2 2024 with a funding round of $198m

In Q2 2024, the Australian FinTech market saw a notable decline in both deal activity and funding compared to the previous year, but also a strong recovery from the previous quarter. The number of deals dropped by 61.9%, from 42 in Q2 2023 to 16 in Q2 2024. This continued the trend from Q1 2024, which recorded 18 deals. However, total funding in Q2 2024 surged to $475m, marking a 4x increase from the $88m raised in Q1 2024, although still 73.5% lower than the $1.79bn raised in Q2 2023.

The breakdown between deals under and over $100m is telling. In Q2 2024, deals under $100m reached $277m, almost unchanged from $279m in Q1 2024, and a 22% increase compared to the $227m in Q2 2023. However, deals over $100m dropped significantly, from $1.565bn in Q2 2023 to just $198m in Q2 2024, an 87.3% decrease. Notably, Q1 2024 had no deals exceeding $100m, making the return of larger deals in Q2 2024 a positive sign.

The average deal value in Q2 2024 was $29.7m down from $42.6m in Q2 2023 and much higher than the $4.9m average in Q1 2024. This rebound in funding from Q1 suggests that while large-scale investments have declined, mid-sized deals are attracting more attention, possibly due to cautious investor sentiment in response to economic uncertainty, higher interest rates, and tighter financing conditions. The sharp increase in funding from Q1 to Q2 2024 signals a renewed, albeit selective, confidence in the Australian FinTech sector.

Betashares, a leading Australian financial services company known for its investing platform Betashares Direct and range of exchange-traded funds (ETFs), has secured the largest deal for an Australian FinTech in Q2 2024 with a $198m investment from Temasek, a global investment firm headquartered in Singapore. This capital injection follows a period of rapid expansion for Betashares, which has managed over $25bn on behalf of more than a million investors, financial advisers, and institutions. The investment from Temasek, which will see the firm become a minority shareholder alongside TA Associates and Betashares’ staff, underscores Betashares’ long-term ambition to become a premier independent financial services provider. The company continues to innovate with initiatives like Betashares Direct, a retail investment platform designed to assist self-directed investors in building long-term wealth. Betashares remains committed to transparency, cost-effectiveness, and simplicity as it expands its market presence and offerings, aiming to create long-term value for customers, partners, and shareholders alike.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global